⚡ Turn volatility into opportunity

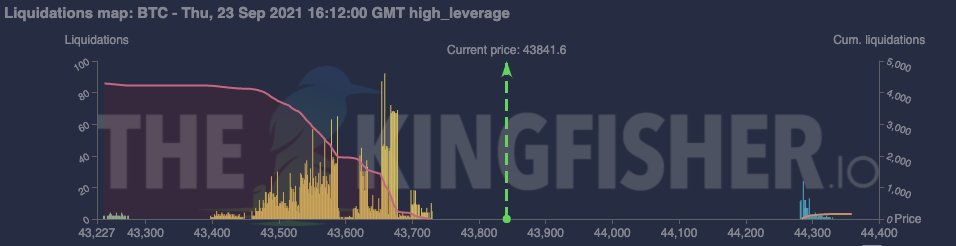

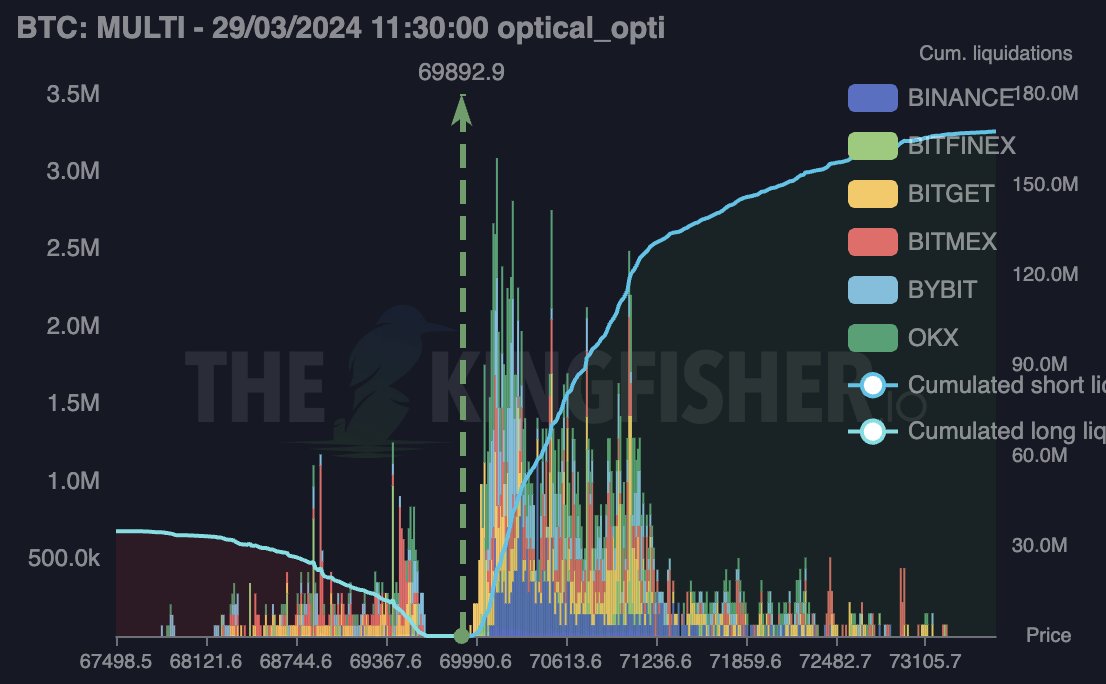

🛡️ Pioneer of the Liquidation Map

🌐 Trusted by 150K+ Traders | https://t.co/D0Npc8C2vy

🚨 #InLiqWeTrust | We sweep the liq

How to get URL link on X (Twitter) App

https://twitter.com/kingfisher_btc/status/1873070222879670650Some context first.

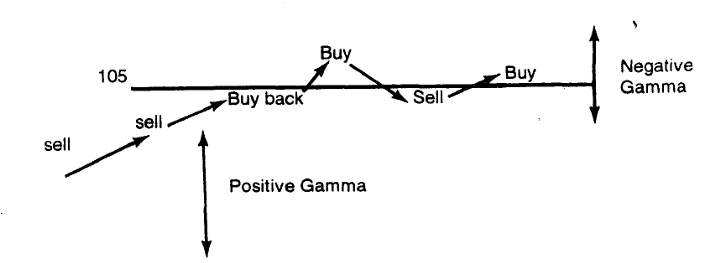

First, meet the "Market Makers."

First, meet the "Market Makers."

https://x.com/kingfisher_btc/status/1773660867856314814

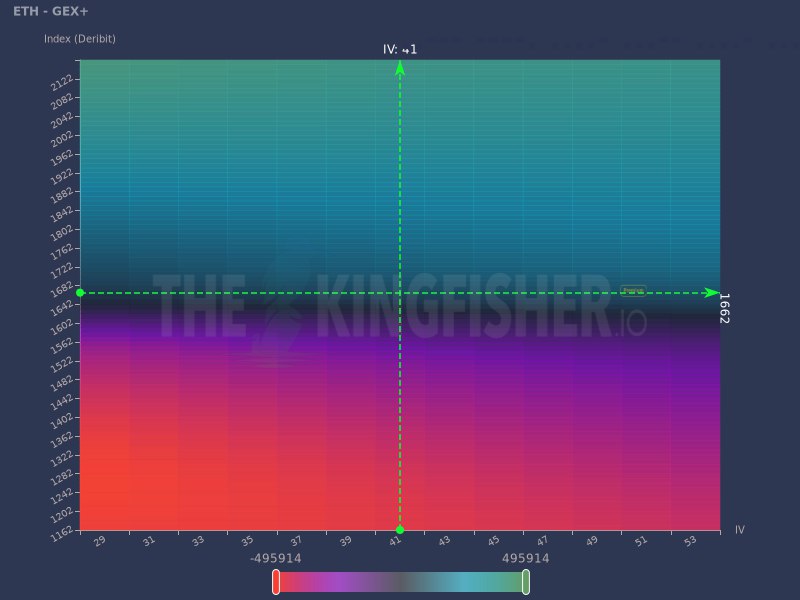

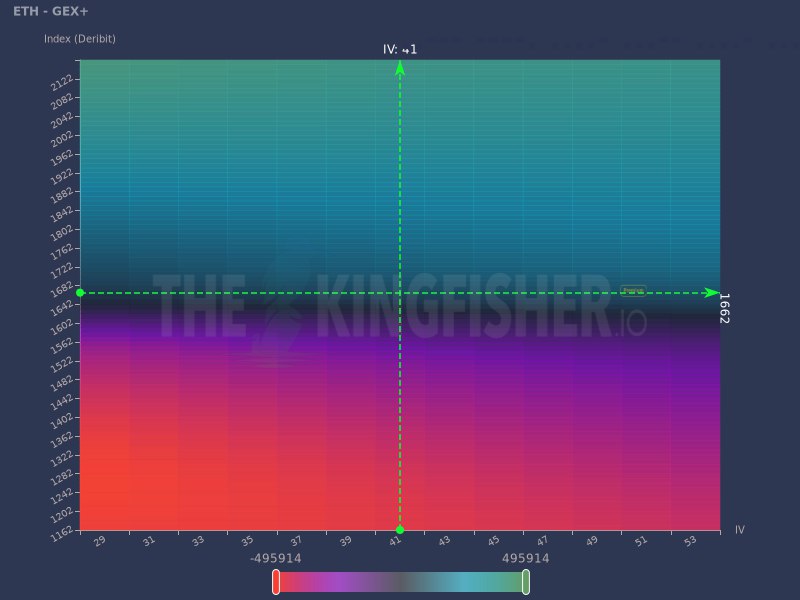

How to read the GEX+ ?

How to read the GEX+ ?

https://twitter.com/HsakaTrades/status/1370358214101925893

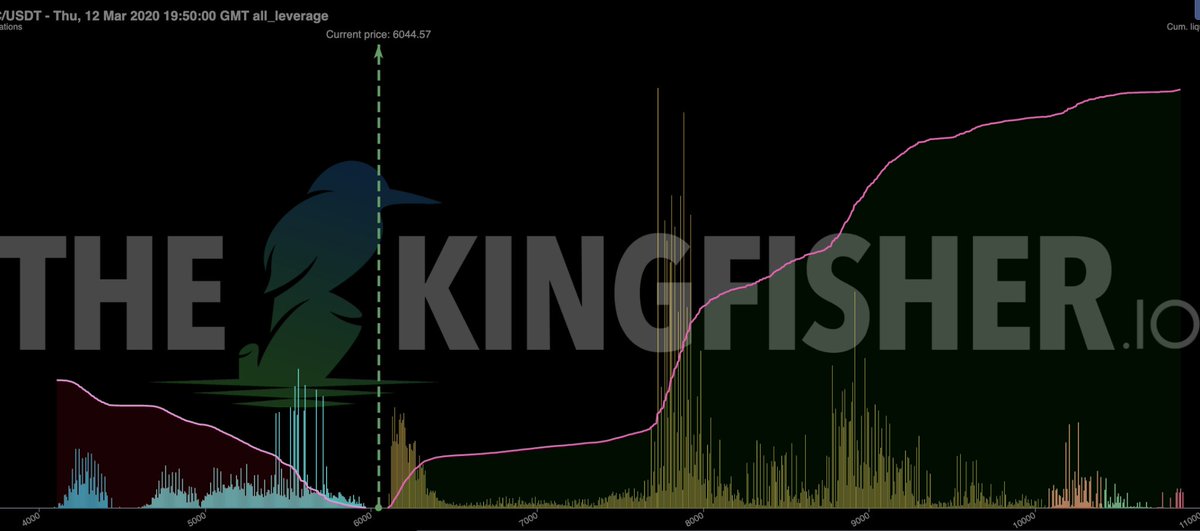

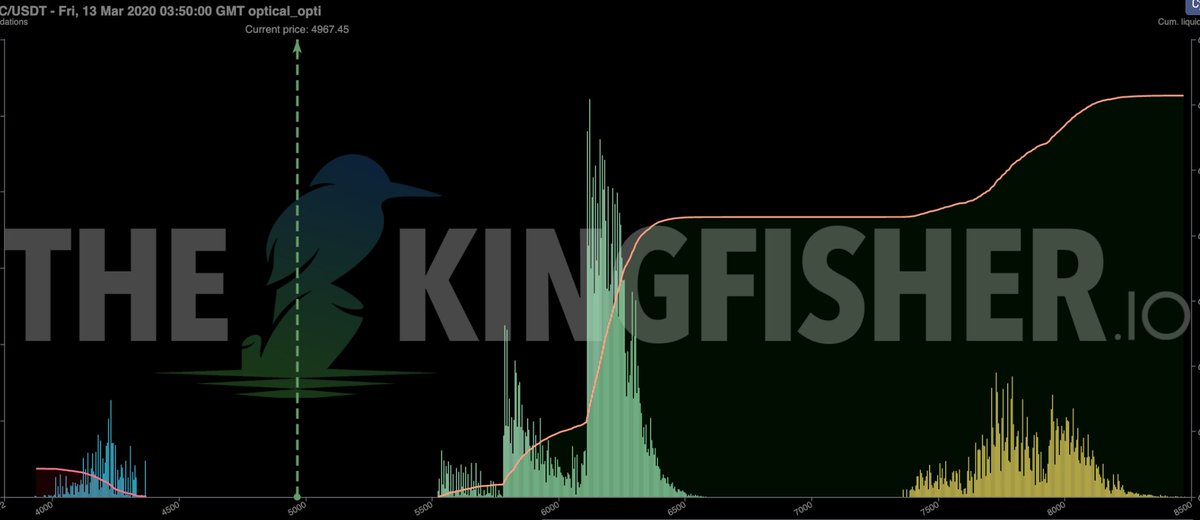

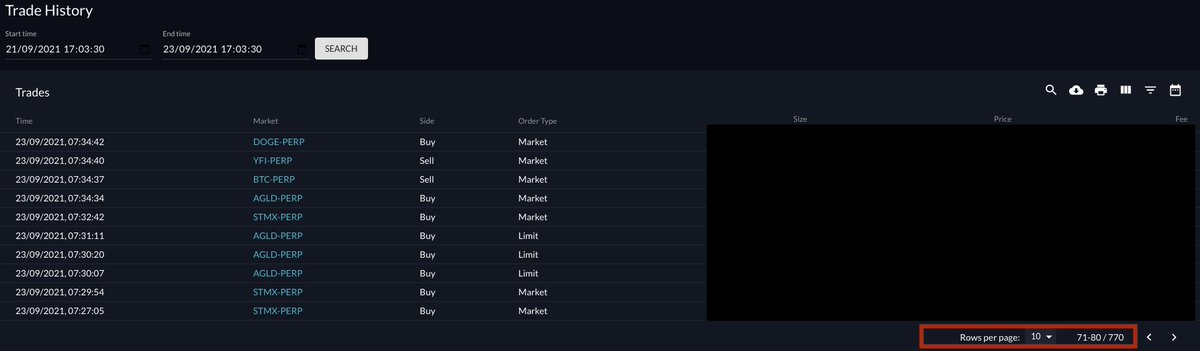

The main reason of this cascading liquidations was

The main reason of this cascading liquidations was

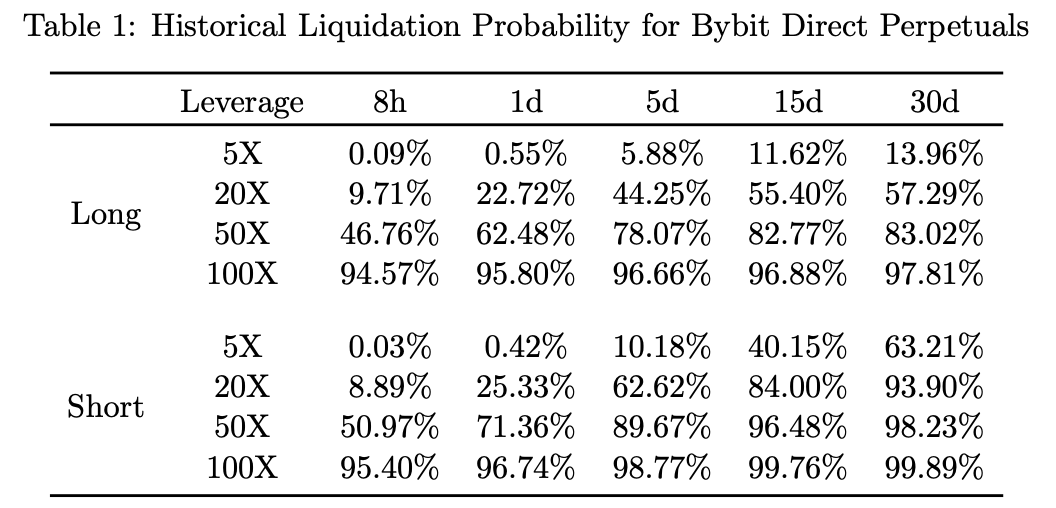

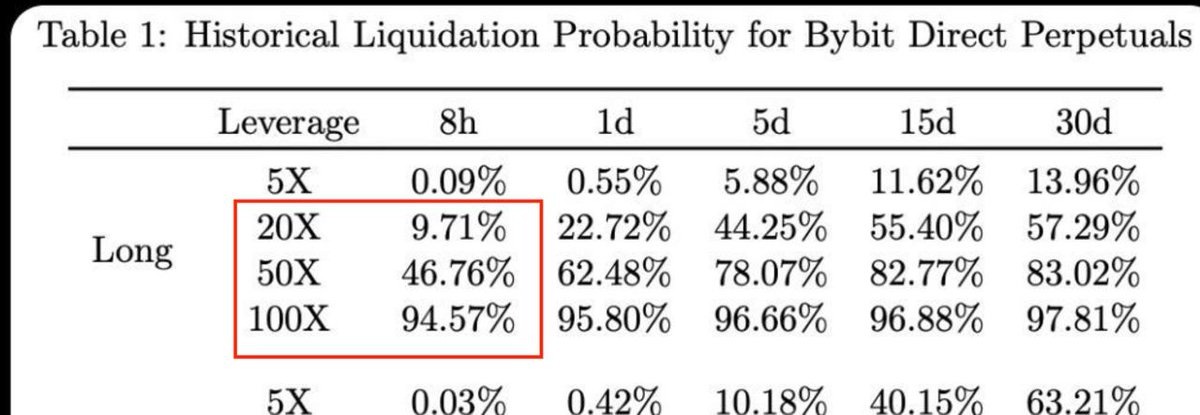

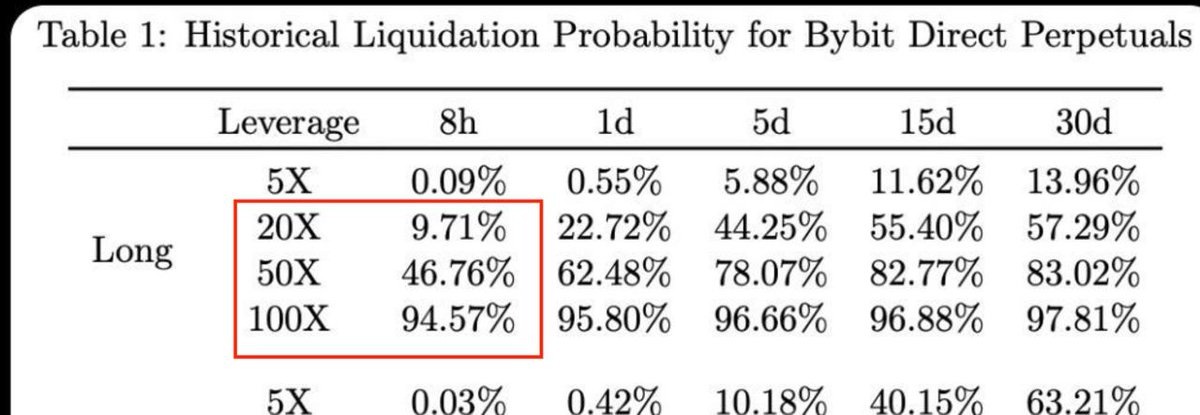

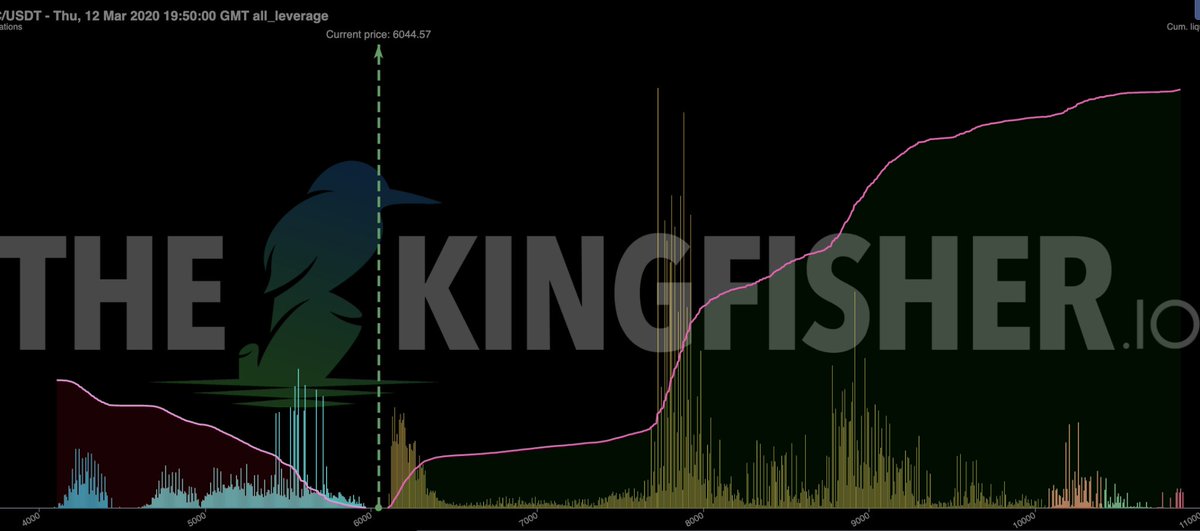

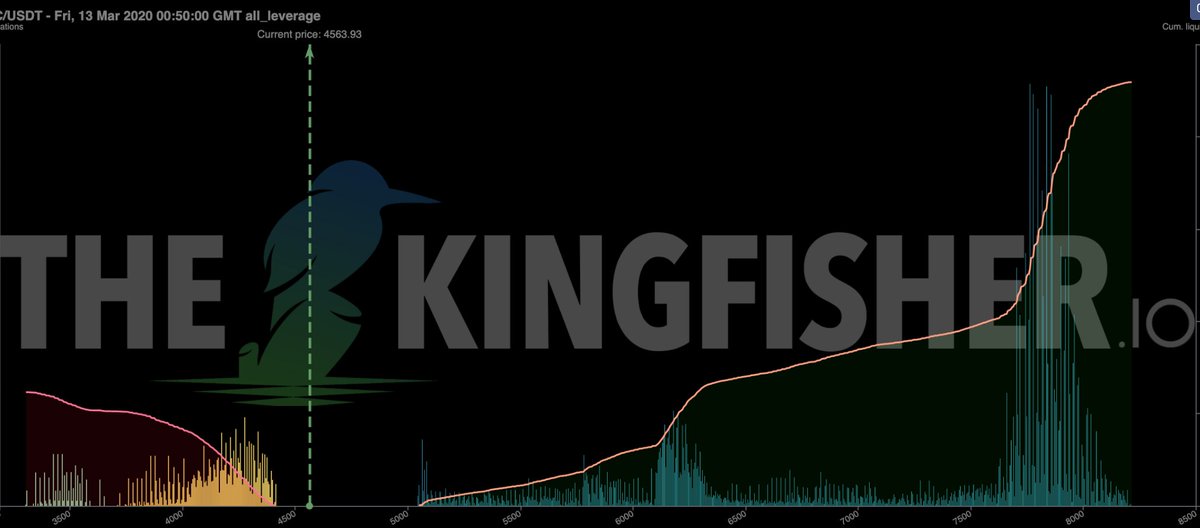

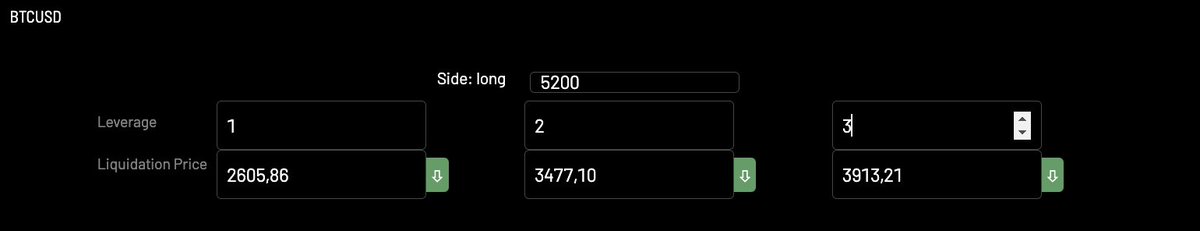

Have a look at the survival probability of $BTC traders.

Have a look at the survival probability of $BTC traders.