$TTOO +$519,777

Good multiday setup.

It wasn't as good as $NKLA or similar from earlier this year though.

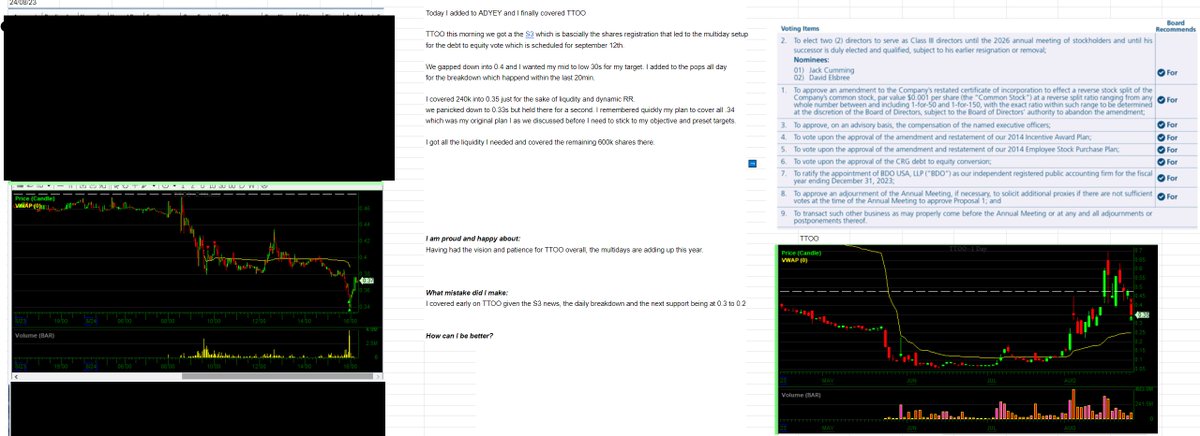

Clear dilution setup with a vote coming up on September 12th.

I am still wondering why it would even run into it(why people would buy)

Good multiday setup.

It wasn't as good as $NKLA or similar from earlier this year though.

Clear dilution setup with a vote coming up on September 12th.

I am still wondering why it would even run into it(why people would buy)

1/ The initial day +$177,520

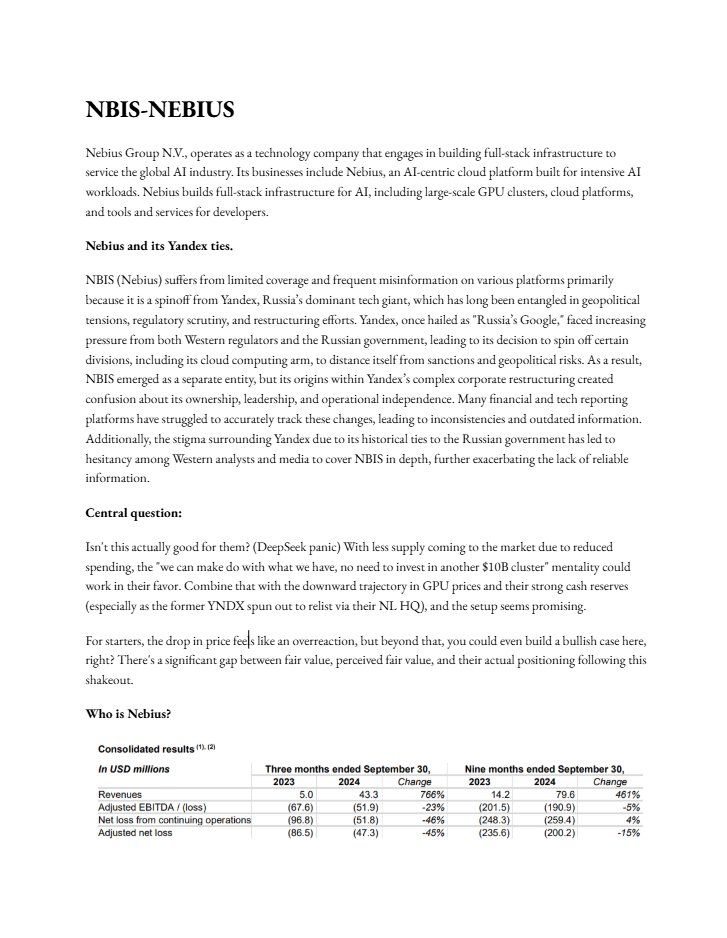

I thought I would include a review and my thought process straight from my 'trade recap' sheet.

Clear setup and prepared from prior multidays.

Easy trade.

Through the cushion, now I can focus on the daily swing trade.

I added back and swung 660k.

I thought I would include a review and my thought process straight from my 'trade recap' sheet.

Clear setup and prepared from prior multidays.

Easy trade.

Through the cushion, now I can focus on the daily swing trade.

I added back and swung 660k.

2/

The next day I used the prior lows and a premarket panic to cover 250k.

I proceeded to add back to a total of 600k, making sure to take advantage of the range and add back into the pop for the daily swing.

The next day I used the prior lows and a premarket panic to cover 250k.

I proceeded to add back to a total of 600k, making sure to take advantage of the range and add back into the pop for the daily swing.

3/

The next day we bounced higher than I expected.

I did a good job only adding very small before the red/green and especially towards my real area of interest into the 50s.

0.45750000.1646

0.52100000 0.2536

0.55300000.0804

Average for adds: 0.4987804878

Swung 700k.

The next day we bounced higher than I expected.

I did a good job only adding very small before the red/green and especially towards my real area of interest into the 50s.

0.45750000.1646

0.52100000 0.2536

0.55300000.0804

Average for adds: 0.4987804878

Swung 700k.

4/

The size down allowed me to get aggressive and I added to 1mil shares at open.

I covered a bunch into the late day wash and swung the rest for a lower low on the daily and to finish the daily swing.

The size down allowed me to get aggressive and I added to 1mil shares at open.

I covered a bunch into the late day wash and swung the rest for a lower low on the daily and to finish the daily swing.

5/

The daily sequence is working and I keep adding, now moving my stop to that lower high on the daily.

Pyramiding is the name of the game.

Covering before the full potential = losing money that is yours.

The daily sequence is working and I keep adding, now moving my stop to that lower high on the daily.

Pyramiding is the name of the game.

Covering before the full potential = losing money that is yours.

6/

S3 comes out leading to what I felt like would be panic that day.

Added throughout the day towards almost 1mil shares and I covered it all into the panic at a .3425 average.

I have done my job and have maximized the best I could.

I covered early in my opinion upon review.

S3 comes out leading to what I felt like would be panic that day.

Added throughout the day towards almost 1mil shares and I covered it all into the panic at a .3425 average.

I have done my job and have maximized the best I could.

I covered early in my opinion upon review.

CenterPoint is the only broker I trade with.

Not only are they the best in my view, but they offer you free access to all these platforms which I used to trade $TTOO:

@TradeIdeasLLC

@tradersync

@DilutionTracker

@TrendSpider

@Benzinga

Learn more: bit.ly/3QUtr5w

Not only are they the best in my view, but they offer you free access to all these platforms which I used to trade $TTOO:

@TradeIdeasLLC

@tradersync

@DilutionTracker

@TrendSpider

@Benzinga

Learn more: bit.ly/3QUtr5w

• • •

Missing some Tweet in this thread? You can try to

force a refresh