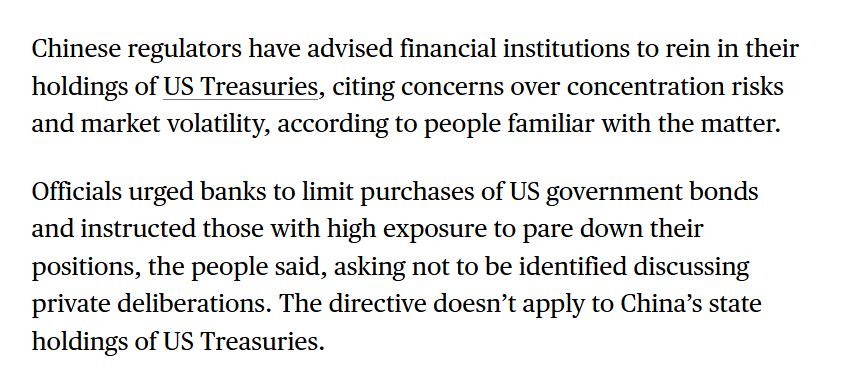

Perhaps the most boring chart in the world

The shares of the major currencies in global reserves, as reported to the IMF.

1/

The shares of the major currencies in global reserves, as reported to the IMF.

1/

The dollar's weight in global reserves is roughly 3 times the United States weight in the global economy (maybe a bit less0; the euro's weight is close to its weight in the global economy -- and China still punches way below its weight, for obvious reasons!

2/

2/

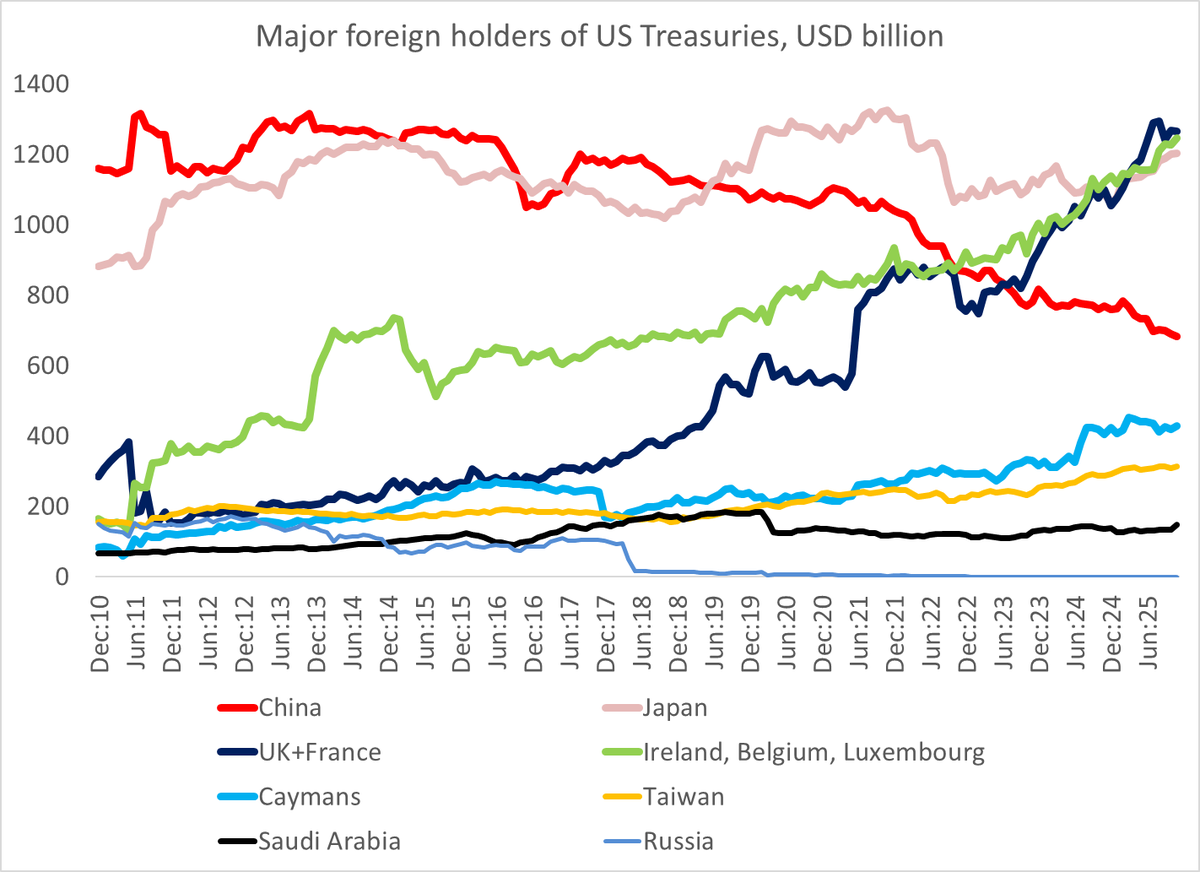

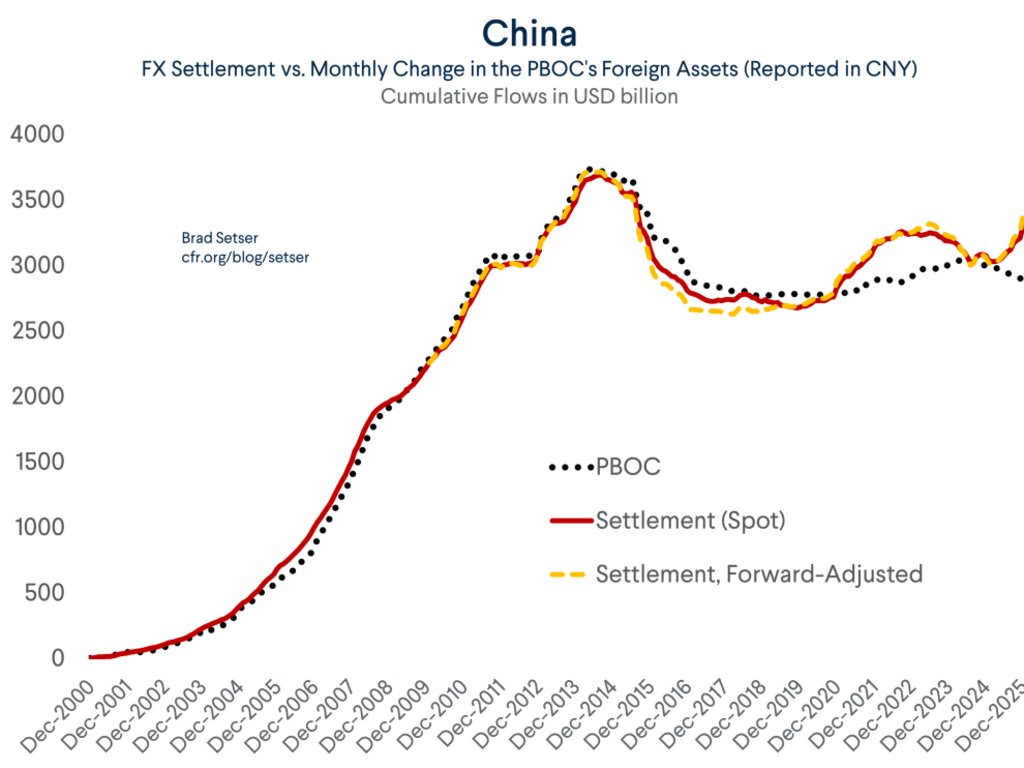

A far more interesting chart showing global reserves --

The big, interesting important story isn't shifts in share ... but the huge increase in reserve holdings from 02 to 14, and the subsequent reduction in the pace of accumulation.

3/

The big, interesting important story isn't shifts in share ... but the huge increase in reserve holdings from 02 to 14, and the subsequent reduction in the pace of accumulation.

3/

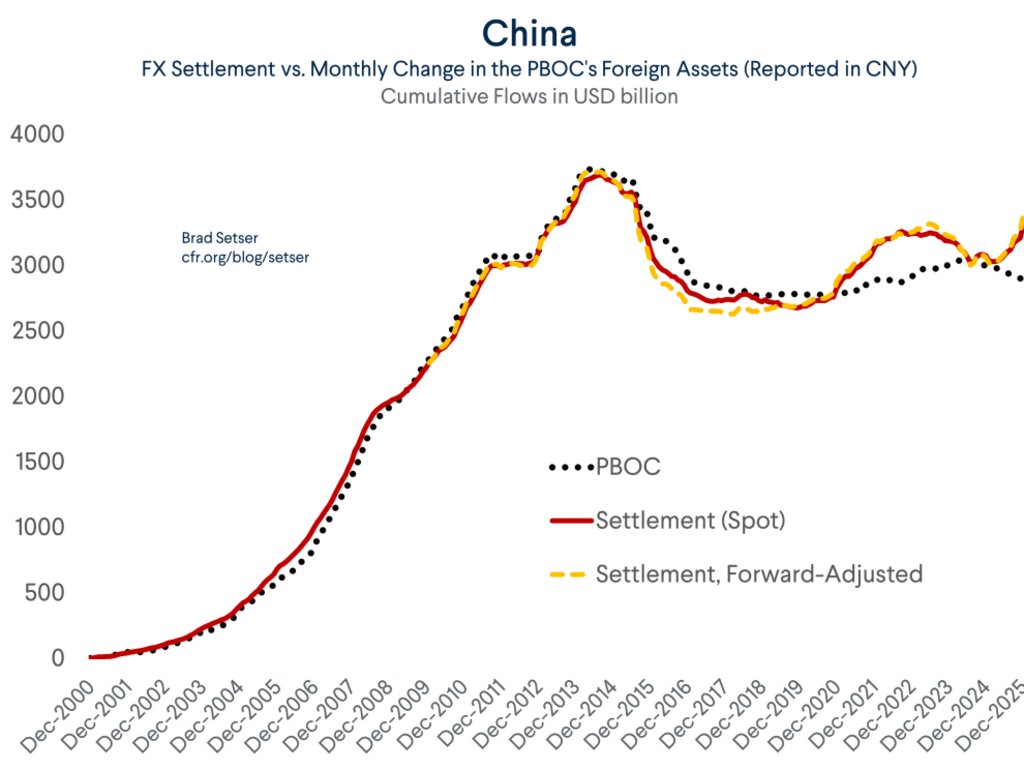

A technically demanding global reserves chart -- one showing actual flows (purchases + retained interest income) by currency.

The bond market adjustment complicates everything; I don't yet have a good bond market adjustment for the euro.

4/

The bond market adjustment complicates everything; I don't yet have a good bond market adjustment for the euro.

4/

China's reserve sales in 15-16 obviously figure heavily in that chart ...

and there was a quite large pickup in reserve accumulation in 2020-21 that we now tend to forget.

5/

and there was a quite large pickup in reserve accumulation in 2020-21 that we now tend to forget.

5/

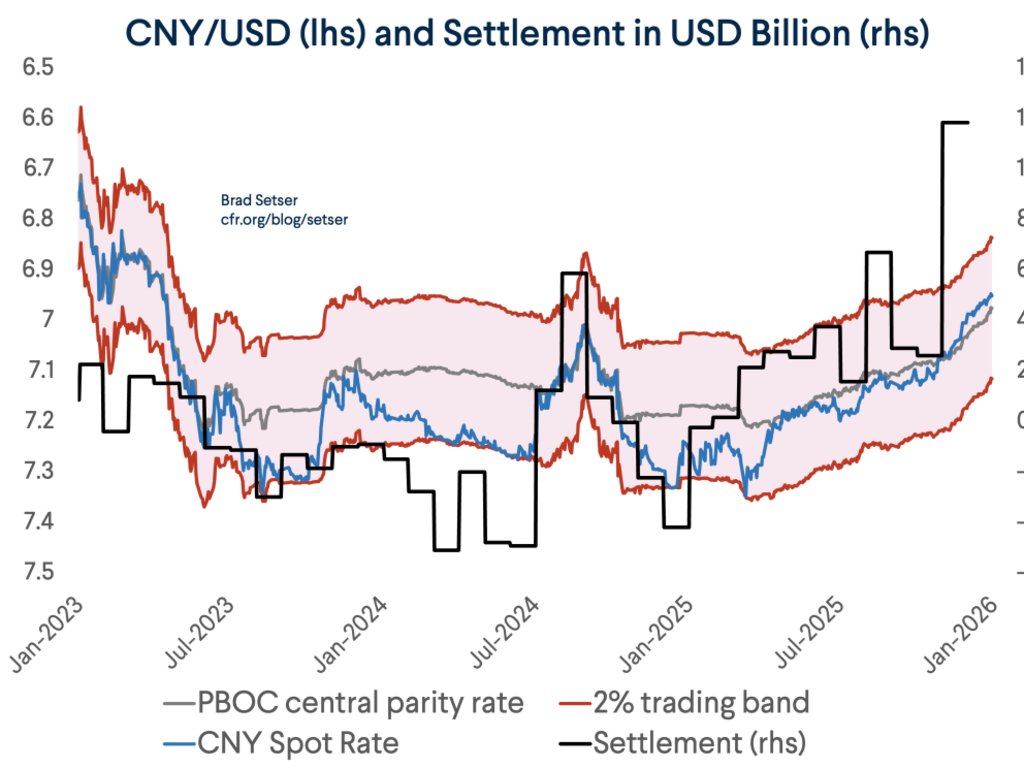

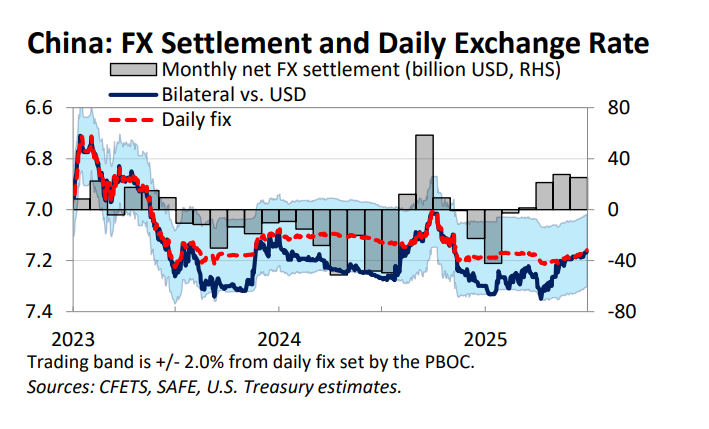

And some of the most interesting stories told by the reserves data have nothing to do with China --

For example, EM Asia sold a lot of reserves last summer and fall, in what I think was a successful defense against an overshot of their currencies when oil was high!

6/

For example, EM Asia sold a lot of reserves last summer and fall, in what I think was a successful defense against an overshot of their currencies when oil was high!

6/

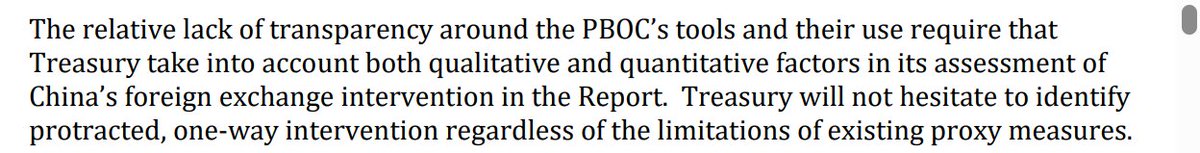

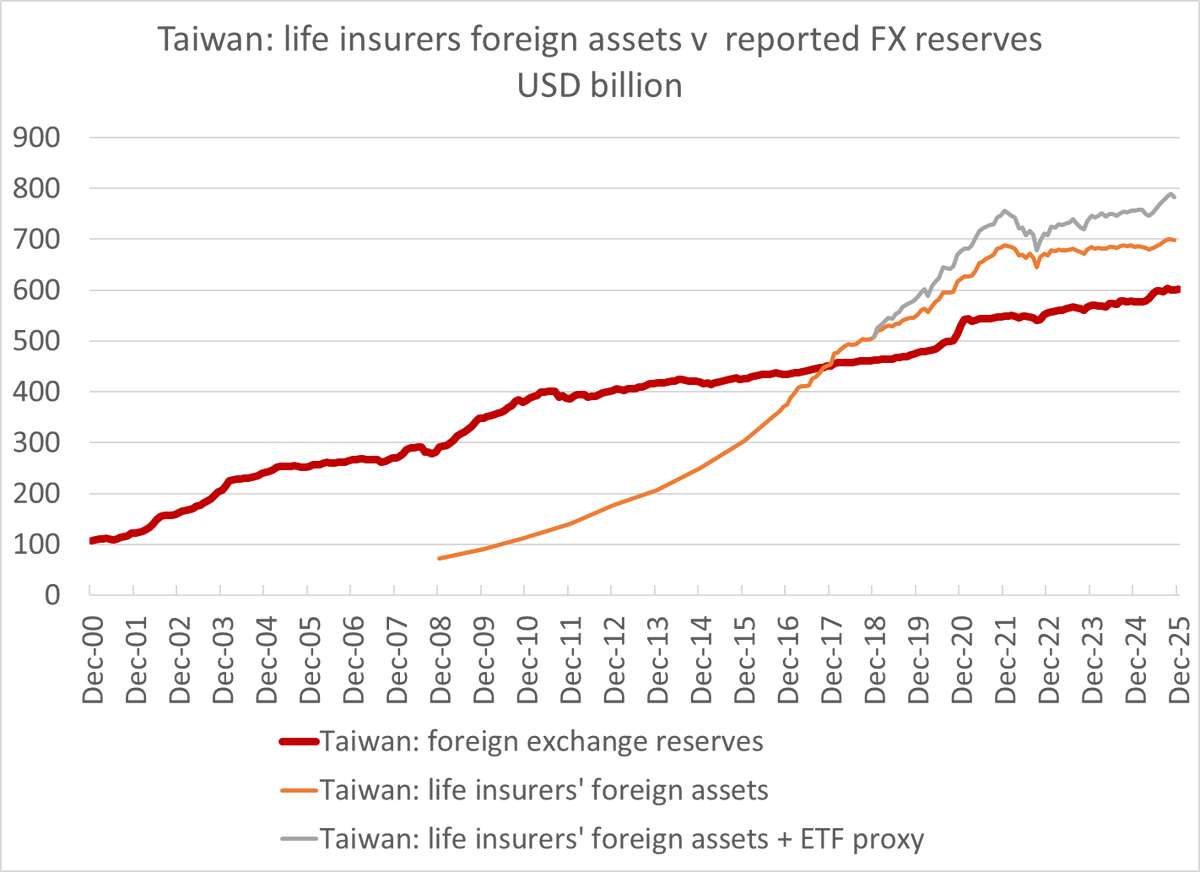

And, as I have noted many times and in many different ways, looking only at formal reserves misses much of the picture these days -- China has as much money in state banks, its policy banks and state investment funds as it holds in its formal reserves ...

7/7

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh