in this thread I will cover the following:

- the routine I go through to find my levels of interest each day

- explaining those levels of interest

- prioritising each level of interest

- the routine I go through to find my levels of interest each day

- explaining those levels of interest

- prioritising each level of interest

htf levels

UNTAPPED daily, weekly, monthly pivots

below is an example of the daily, but I mark these out on the weekly, monthly also.

Bonus - I also look at this exact same method on my custom session candles, this works best for intra-day trades and im monitoring those daily

UNTAPPED daily, weekly, monthly pivots

below is an example of the daily, but I mark these out on the weekly, monthly also.

Bonus - I also look at this exact same method on my custom session candles, this works best for intra-day trades and im monitoring those daily

nPOCs (naked point of control)

checked on also the daily, weekly, monthly & session time frames.

preferred tick sizes for BTC/USDT

daily - 170*

weekly - 250*

monthly - 450*

note - I personally trade on BTC/USD (inverse) the above are just my recommendations if I traded linear

checked on also the daily, weekly, monthly & session time frames.

preferred tick sizes for BTC/USDT

daily - 170*

weekly - 250*

monthly - 450*

note - I personally trade on BTC/USD (inverse) the above are just my recommendations if I traded linear

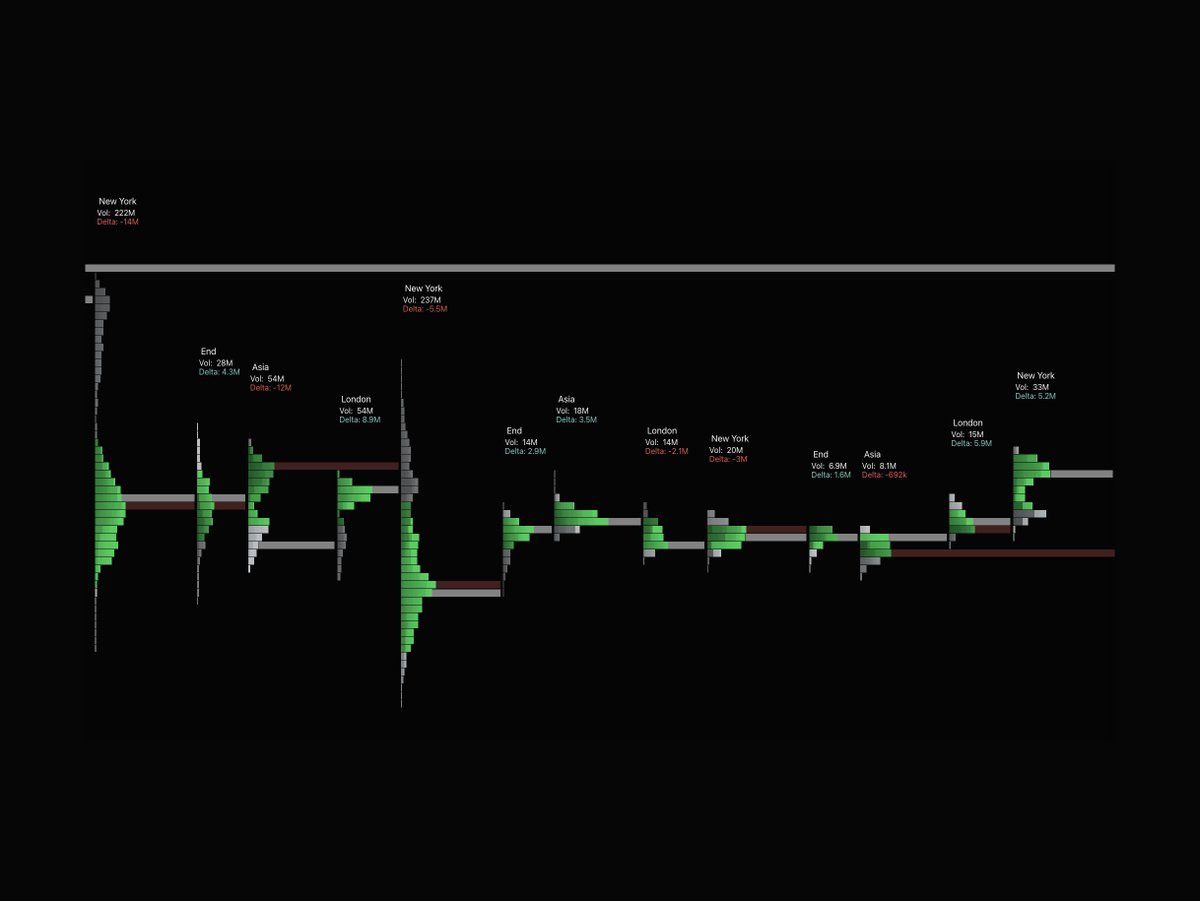

session POCs

preferred tick size (BTC/USDT) - 120*

note - these are all dependent based on the current volatility

the preferred values I'm giving are on average what I would end up using the most

mark these out intra day as the day progresses (on my tv chart)-

preferred tick size (BTC/USDT) - 120*

note - these are all dependent based on the current volatility

the preferred values I'm giving are on average what I would end up using the most

mark these out intra day as the day progresses (on my tv chart)-

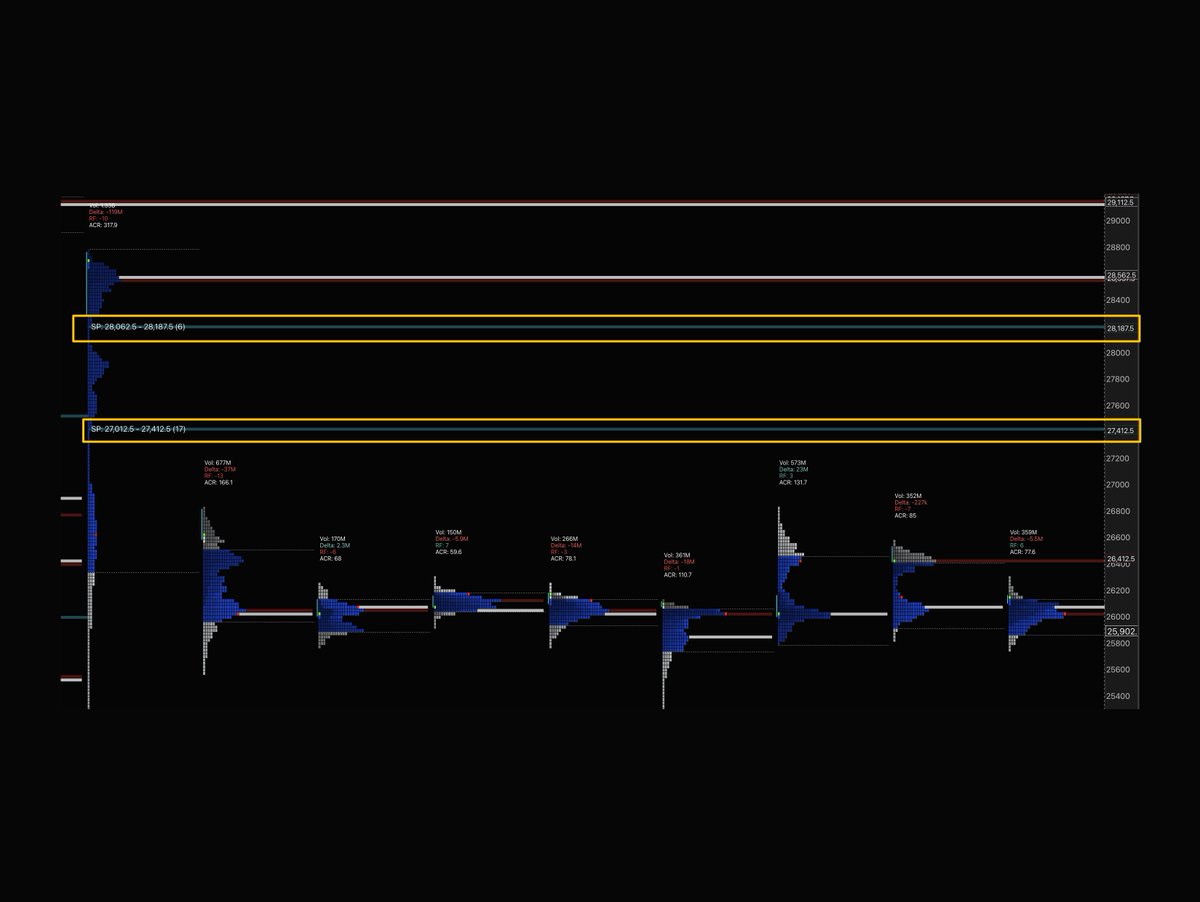

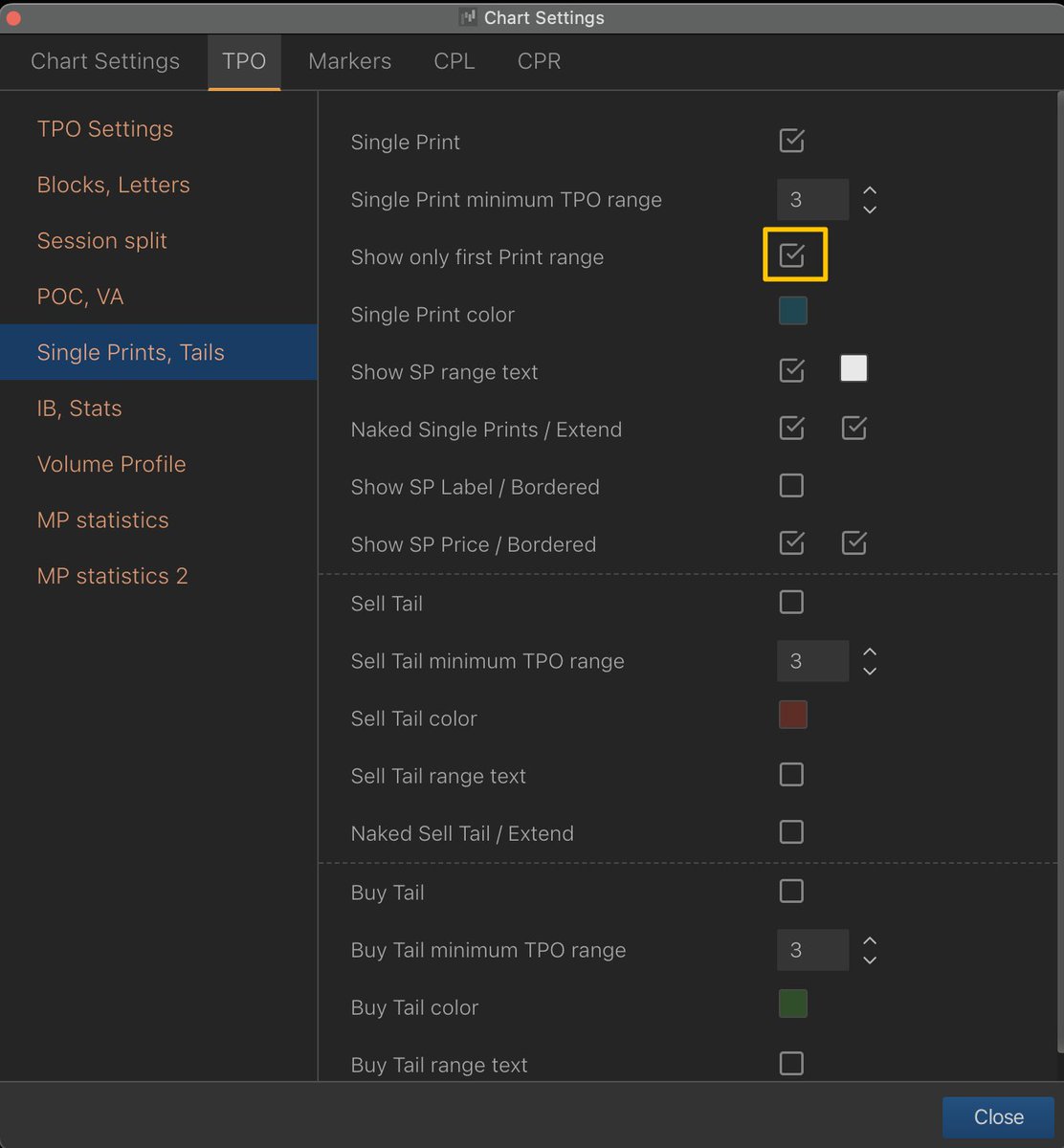

single prints

I only mark out the level which is once the entire single print has been filled

examples of this below ↓ & the setting used to enable this

I only mark out the level which is once the entire single print has been filled

examples of this below ↓ & the setting used to enable this

poor highs/lows

heres a link to a complete thread on this topic

heres a link to a complete thread on this topic

https://twitter.com/Luckshuryy/status/1660609762931662849

Liquidity

you are more than likely aware of how I tend to look for my favoured liquidity, the majority of it is in this thread

some further notes on session liquidity is in the next post of this thread

you are more than likely aware of how I tend to look for my favoured liquidity, the majority of it is in this thread

some further notes on session liquidity is in the next post of this thread

https://twitter.com/Luckshuryy/status/1687448176163229696

session highs/lows

quick fire notes:

- London session high/low being taken within NY session

- Asia & London session (create series of higher lows or lower highs) then swept by NY session (liquidity play)

quick fire notes:

- London session high/low being taken within NY session

- Asia & London session (create series of higher lows or lower highs) then swept by NY session (liquidity play)

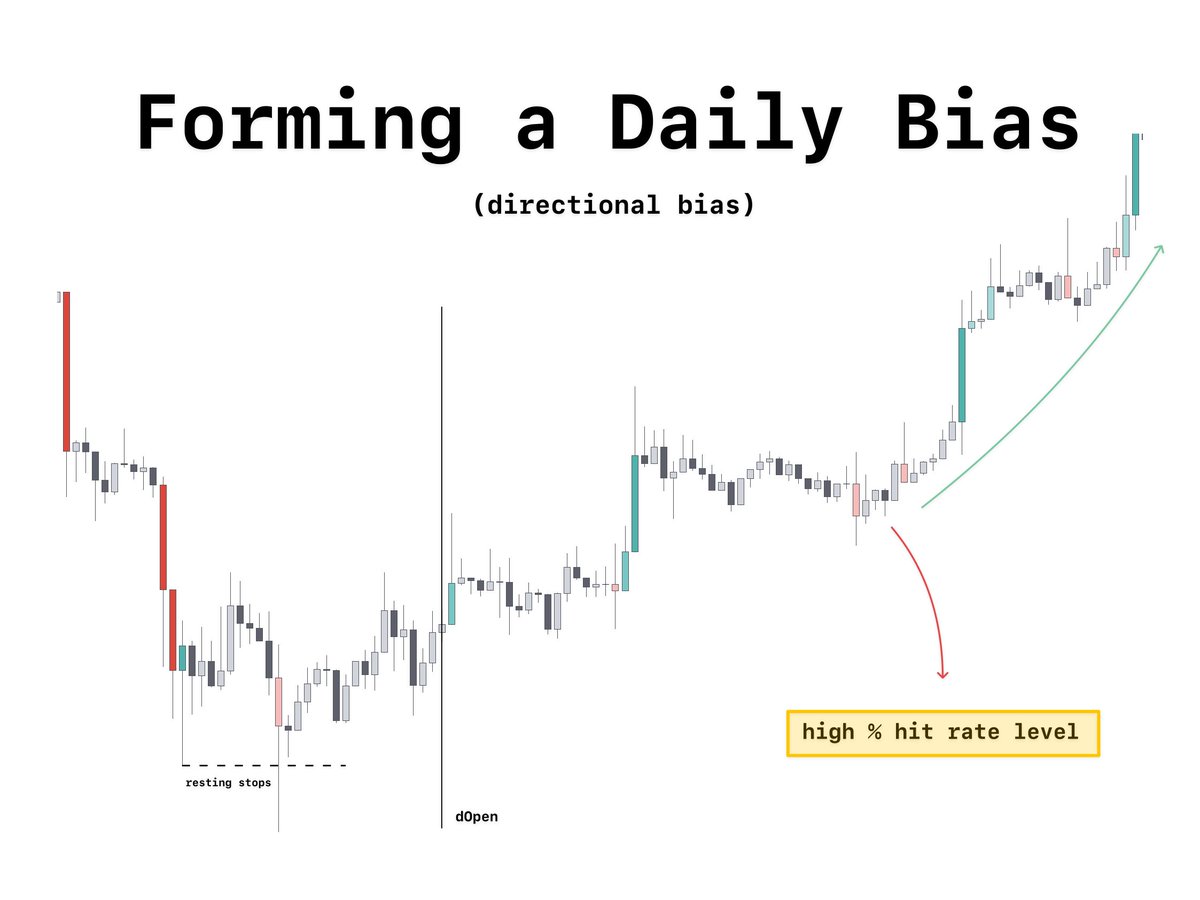

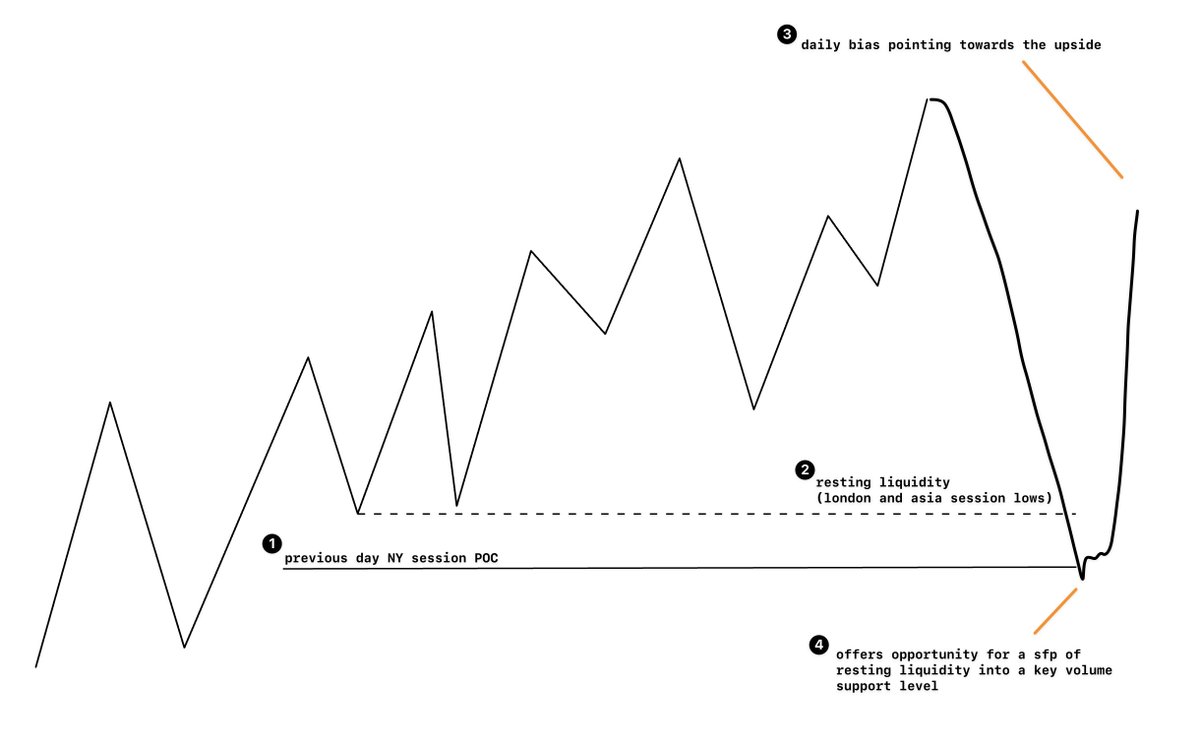

putting this all together

a typical day

- go through checklist

- form daily bias through resting liquidity and such

- set alerts

the other POI's discussed in this thread come into play when they come into confluence with liquidity levels and my daily bias regions.

example 👇

a typical day

- go through checklist

- form daily bias through resting liquidity and such

- set alerts

the other POI's discussed in this thread come into play when they come into confluence with liquidity levels and my daily bias regions.

example 👇

in the above example I used a previous day NY session POC as confluence

however, this can be any of the levels really discussed in this thread

it can even be multiple of them (better case scenario)

however, this can be any of the levels really discussed in this thread

it can even be multiple of them (better case scenario)

ps. if you want a good read next,

go give this thread a read on how I form my daily bias (most of it)

it should help piece together this thread a bit better for you

go give this thread a read on how I form my daily bias (most of it)

it should help piece together this thread a bit better for you

https://twitter.com/Luckshuryy/status/1688523580231823360

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter