The most controversial term in accounting:

Stock-Based Compensation

How does it work? Why is it controversial?

Here’s a complete overview (in plain English):

Stock-Based Compensation

How does it work? Why is it controversial?

Here’s a complete overview (in plain English):

How can shareholders incentivize executives & employees to think & act like owners?

Stock-based compensation (SBC) has become the standard answer.

SBC pays executives and employees with stock instead of cash.

Stock-based compensation (SBC) has become the standard answer.

SBC pays executives and employees with stock instead of cash.

In theory, SBC aligns employee + owner incentives.

Employees make more money when the stock goes up and less (or nothing) when the stock goes down.

This makes employees care about the direction of the stock.

Employees make more money when the stock goes up and less (or nothing) when the stock goes down.

This makes employees care about the direction of the stock.

There are a few main types of SBC:

▪️Restricted Stock Units (RSUs)

▪️Stock Options

▪️Performance Shares

Here’s a quick summary of each:

▪️Restricted Stock Units (RSUs)

▪️Stock Options

▪️Performance Shares

Here’s a quick summary of each:

Paying SBC has a few big advantages:

▪️Does not consume cash (it's a non-cash expense)

▪️Tax benefits

▪️It incentives employee retention through a vesting period (they don't get all the stock unless they stay for 3-4 years)

▪️Does not consume cash (it's a non-cash expense)

▪️Tax benefits

▪️It incentives employee retention through a vesting period (they don't get all the stock unless they stay for 3-4 years)

That “Non-cash expense” part tends to be the most confusing.

Under GAAP accounting, SBC is expensed in 2 places on the income statement.

COGS + Operating Expenses:

Under GAAP accounting, SBC is expensed in 2 places on the income statement.

COGS + Operating Expenses:

Since SBC increases GAAP expenses, it impacts the rest of the income statement.

Some good (lower tax bill), some bad (lower net income & EPS / higher shares outstanding)

Some good (lower tax bill), some bad (lower net income & EPS / higher shares outstanding)

Most executives don’t like that SBC lowers net income / EPS.

Many choose to report their earnings, excluding the effect of SCB.

They do so by reporting “Non-GAAP” results, which allows them to remove SBC from the income statement, making profits look better.

Many choose to report their earnings, excluding the effect of SCB.

They do so by reporting “Non-GAAP” results, which allows them to remove SBC from the income statement, making profits look better.

SBC also impacts the Statement of Cash Flows

SBC doesn’t consume cash, but it was expensed on the income statement.

The cash flow statement ADDS BACK the expense since cash never left the company’s bank account.

This POSITIVELY impacts operating cash flow (and Free Cash Flow)

SBC doesn’t consume cash, but it was expensed on the income statement.

The cash flow statement ADDS BACK the expense since cash never left the company’s bank account.

This POSITIVELY impacts operating cash flow (and Free Cash Flow)

So, if SBC doesn’t “cost” cash, why is it controversial?

The #1 reason: Dilution.

SBC INCREASES the number of shares outstanding, which REDUCES each existing shareholder’s claim on earnings.

The #1 reason: Dilution.

SBC INCREASES the number of shares outstanding, which REDUCES each existing shareholder’s claim on earnings.

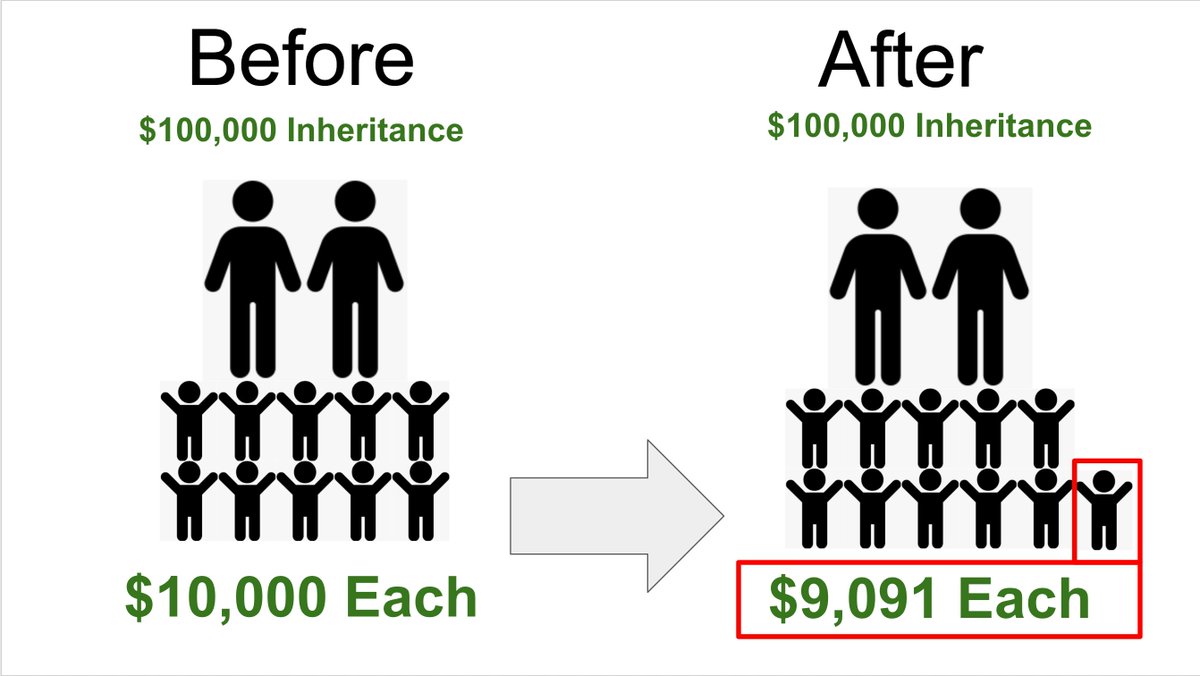

Here's why dilution is bad:

A family has 10 kids and a $100k net worth. Each kid will inherit $10k.

If the parents have 1 more kid, each EXISTING kid’s inheritance goes down (is DILUTED)

SBC is like a family having more kids. It's not good news for existing shareholders.

A family has 10 kids and a $100k net worth. Each kid will inherit $10k.

If the parents have 1 more kid, each EXISTING kid’s inheritance goes down (is DILUTED)

SBC is like a family having more kids. It's not good news for existing shareholders.

SBC policy varies wildly from company to company.

One of the worst offenders today is $PLTR

SBC "cost" investors $114 million in q2 2023 alone

Investors have been diluted by 10.9% over the past year (that's A LOT)

One of the worst offenders today is $PLTR

SBC "cost" investors $114 million in q2 2023 alone

Investors have been diluted by 10.9% over the past year (that's A LOT)

Why is SBC controversial?

Well, should SBC be expensed since it doesn’t consume cash and the share count goes up anyway?

Some say no.

Buffett says yes, and it’s hard to argue with his logic:

Well, should SBC be expensed since it doesn’t consume cash and the share count goes up anyway?

Some say no.

Buffett says yes, and it’s hard to argue with his logic:

Some investors, boards, and executives have WILDLY different opinions about SBC.

Some view SBC as "free money" (it's not) and issue it like crazy.

Others view it as a huge cost and prefer that all compensation is paid in cash, bonuses, and profit-sharing plans, NOT stock.

Some view SBC as "free money" (it's not) and issue it like crazy.

Others view it as a huge cost and prefer that all compensation is paid in cash, bonuses, and profit-sharing plans, NOT stock.

SBC is a real cost for investors.

Some investors recommend subtracting SBC from free cash flow to get a company's 'real' FCF

This Morgan Standly table shows how that can hugely impact valuations

h/t @QCompounding

Some investors recommend subtracting SBC from free cash flow to get a company's 'real' FCF

This Morgan Standly table shows how that can hugely impact valuations

h/t @QCompounding

I hate being diluted due to SBC, but I accept it’s a modern cost of doing business.

My rule of thumb for dilution/year:

<1% = great

1% - 3% = acceptable

3% - 5% = too much

>5% = AWFUL

But, like everything in investing, there’s TONS of nuance

My rule of thumb for dilution/year:

<1% = great

1% - 3% = acceptable

3% - 5% = too much

>5% = AWFUL

But, like everything in investing, there’s TONS of nuance

If you invest, you MUST understand how to find, read, & interpret financial statements.

@Brian_Stoffel_ and I are hosting a free Webinar on 9/14 to discuss Warren Buffett's rules of thumb

RSVP here (its free):

lu.ma/BuffettRules

@Brian_Stoffel_ and I are hosting a free Webinar on 9/14 to discuss Warren Buffett's rules of thumb

RSVP here (its free):

lu.ma/BuffettRules

@Brian_Stoffel_ Did you learn something?

Follow me @BrianFeroldi for more content like this.

I demystify finance with 1-2 threads each week.

Want to share? Retweet the first tweet below:

Follow me @BrianFeroldi for more content like this.

I demystify finance with 1-2 threads each week.

Want to share? Retweet the first tweet below:

https://twitter.com/61558281/status/1696881770350747945

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter