G G Engineering Ltd

It is case study how promoters listing on SME platform loot investors.

The co brought its IPO at Rs20 each in 2017 and got listed on #BSE SME.

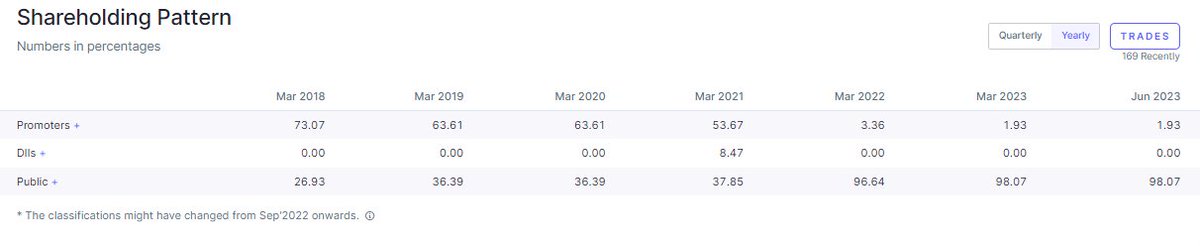

As on Mar2018, the promoter held 73% shares, and from there they kept selling. As on date they have less than 2%

1/n

It is case study how promoters listing on SME platform loot investors.

The co brought its IPO at Rs20 each in 2017 and got listed on #BSE SME.

As on Mar2018, the promoter held 73% shares, and from there they kept selling. As on date they have less than 2%

1/n

And while they were selling their stake, the stock was taking new highs. In fact the Mar2022 quarter when they reduced stake from 43% to 3%, the stock was over Rs40 which though have saw a sharp fall from the top.

Meanwhile they were engaging investors with #bonus and #split 2/n

Meanwhile they were engaging investors with #bonus and #split 2/n

They did not stop there, they brought two #rightissue; one in Aug 2022 (raised ~Rs55cr)and one in July 2023 (raised Rs65cr). In total, post IPO the company has raised ~Rs120cr.

Promoter has cashed out

Now look at sales,which suddenly jumped from 23cr in FY22 to 104cr in FY23

3/n

Promoter has cashed out

Now look at sales,which suddenly jumped from 23cr in FY22 to 104cr in FY23

3/n

Look at the B/S, so all the fixed assets have been sold over the years and as on FY23 it has zero fixed asset. And you see 85cr of Trade Receivable in FY23 vs FY23 sales of Rs104cr.

You can follow the sequence and guess what happened here.

4/n

You can follow the sequence and guess what happened here.

4/n

Now look at the recent filing. The co is raising upto Rs100cr through #preferential issue. And promoter also is investing Rs3 cr. Note that he cashed out over Rs100cr by selling entire stake on top and by raising fund through right issue and taking out.5/n

bseindia.com/xml-data/corpf…

bseindia.com/xml-data/corpf…

One may also guess who are these investors are what are they planning. It is high time @SEBI_India and @MCA21India tighten the regulations and penalize the defaulters. With these kind of robbery in daylight; investors will lose faith in the financial market.

##jagoinvestors

6/n

##jagoinvestors

6/n

Disclosure - NIL. While I keep looking for #specialsituation of rightissue or preferential issue, one need to be very careful what risk someone is taking.

7/7

7/7

Just missed adding. So the promoter - Kamal Beriwal who was holding the KMP position, resigned citing personal reasons and appointed these two guys as CEO and CFO. Look at the profile of the new KMPs.

Basically, the promoter has well planned the exit by appointing scapegoats.

Basically, the promoter has well planned the exit by appointing scapegoats.

Further, update.

I was going through the purpose of the rightissue which was brought by the company in FY22-23, where the company raised ~Rs50cr.

The fund was raised for working capital and general corporate purposes.

continued.. bseindia.com/downloads/ipo/…

I was going through the purpose of the rightissue which was brought by the company in FY22-23, where the company raised ~Rs50cr.

The fund was raised for working capital and general corporate purposes.

continued.. bseindia.com/downloads/ipo/…

I find that in December 22 quarter, GG Engineering acquired ~25% stake (~90lac shares) in GI Engineering. Average price of GI Engineering was ~Rs6 each, so the company invested ~Rs5cr in GI Engineering out of the right proceeds.

It further invested ~Rs20cr in GI in rightissue

It further invested ~Rs20cr in GI in rightissue

Further, GG Engineering took 1.46% stake in #Advik Capital, and 4.59% in #Integra Essentia in Dec22 quarter.

Basically, GG raised fund through right issue saying it is for business purposes and invested the money in other these three companies. It does not stop here.

continued..

Basically, GG raised fund through right issue saying it is for business purposes and invested the money in other these three companies. It does not stop here.

continued..

Both Advik and Integra have brought rightissue recently, in fact another record date of right issue of Advik is in 2 days.

One may recall that GG brought another right issue in July 2023. Again purpose of the issue wasworking capital and general purpose

bseindia.com/downloads/ipo/…

One may recall that GG brought another right issue in July 2023. Again purpose of the issue wasworking capital and general purpose

bseindia.com/downloads/ipo/…

So, GG is raising fund through rights, investing in other company in the secondary market and their right issues. It is not illegal.

The point is the purpose of right issue was not invest the money in other companies.

The point is the purpose of right issue was not invest the money in other companies.

Further, the co files utilization details of the right issue and says everything was complied with.

It is beyond me to go further, but if @SEBI_India or @MCA21India conduct investigation, they may find that these transactions are meant to rob investors.bseindia.com/xml-data/corpf…

It is beyond me to go further, but if @SEBI_India or @MCA21India conduct investigation, they may find that these transactions are meant to rob investors.bseindia.com/xml-data/corpf…

• • •

Missing some Tweet in this thread? You can try to

force a refresh