CA, CFA qualified ||

Amateur Investor, interest in #Specialsituation investing, love screening exchange filings|

Not an RIA, tweets are 4 educational purposes|

3 subscribers

How to get URL link on X (Twitter) App

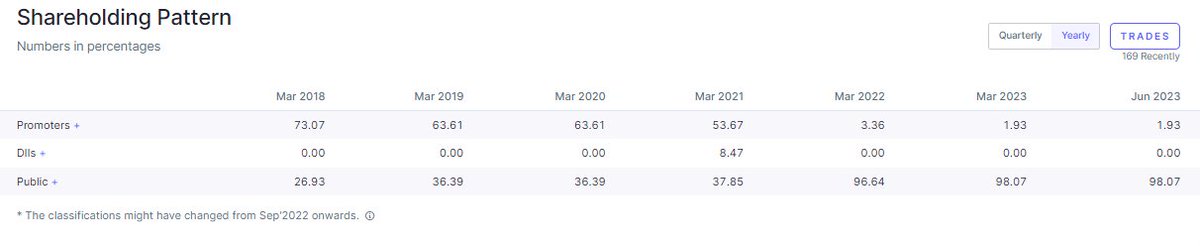

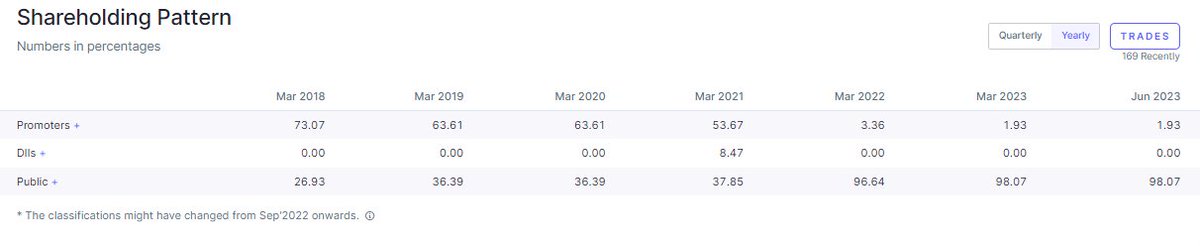

And while they were selling their stake, the stock was taking new highs. In fact the Mar2022 quarter when they reduced stake from 43% to 3%, the stock was over Rs40 which though have saw a sharp fall from the top.

And while they were selling their stake, the stock was taking new highs. In fact the Mar2022 quarter when they reduced stake from 43% to 3%, the stock was over Rs40 which though have saw a sharp fall from the top.