1/16 I looked at Manchester United's financial statements to try understand why fans hate the Glazers so much.

Now I understand. The #Glazers have suffocated Man Utd by underinvestment and it is likely to continue.

Full analysis🧵 + V11s 👇🏾

#ManchesterUnited #ManUtd #Arsenal

Now I understand. The #Glazers have suffocated Man Utd by underinvestment and it is likely to continue.

Full analysis🧵 + V11s 👇🏾

#ManchesterUnited #ManUtd #Arsenal

2/16 Man Utd has historically been the biggest club in the world & still has a phenomenal brand but recently growth has slowed. Compared to 2018, 2022 revenue was down 1%.

One could say the revenue was impacted by COVID but Man City's revenue increased 22% over the same period.

One could say the revenue was impacted by COVID but Man City's revenue increased 22% over the same period.

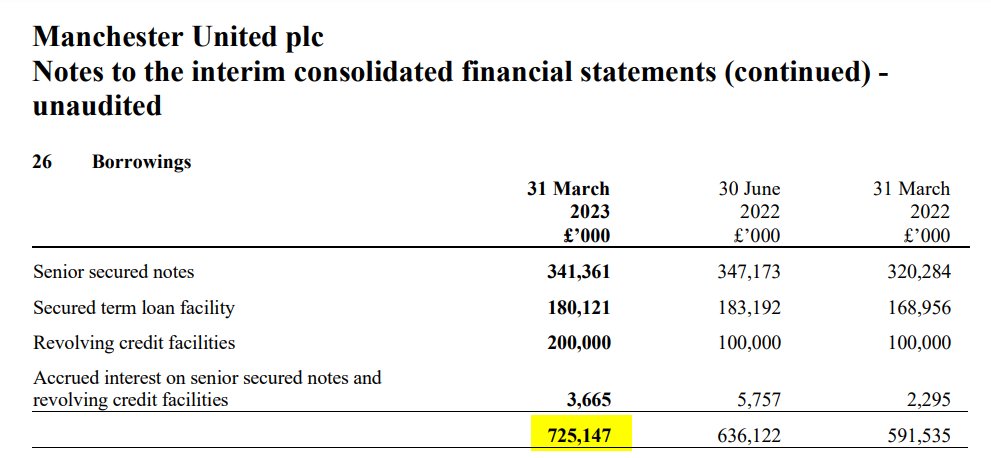

3/16 The biggest issue, however, is the level of debt which stands at £725m. Before the #Glazers, #ManUtd had £0m debt.

To add to that Man Utd has also spent +£700m on interest payments and +£150m in dividends.

That's more than the current valuation of Man City's starting 11.

To add to that Man Utd has also spent +£700m on interest payments and +£150m in dividends.

That's more than the current valuation of Man City's starting 11.

4/16 The Glazer's purchased Man Utd in 2005 via a £790m Leveraged Buy Out (LBO). I like the hyper simplified definition of LBO shown below.

It makes one thing clear - the goal is to manage the business to pay back debt, extract value & make money...nothing about trophies.

It makes one thing clear - the goal is to manage the business to pay back debt, extract value & make money...nothing about trophies.

5/16 The concerns about the way the Glazers have financially extracted returns from Man Utd have been so widespread that even when Chelsea was sold there were "anti-Glazer clauses" related to debt and dividends.

6/16 The Glazers' argument on dividends is that compared to other companies their policy is fine as stated by the Man Utd CEO.

This perhaps is the heart of the issue.

Man Utd is now run as a COMPANY to generate returns and not as FOOTBALL CLUB to win trophies.

This perhaps is the heart of the issue.

Man Utd is now run as a COMPANY to generate returns and not as FOOTBALL CLUB to win trophies.

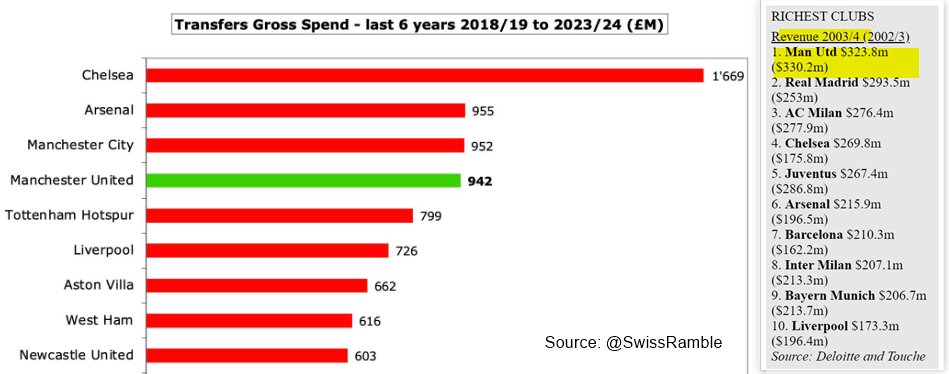

7/16 Man Utd has still been able to spend the 4th most 💰 in the last 6 years.

But considering that before the Glazers took over, Man Utd was debt-free & the richest club in the world, they should be in a position to outspend everyone (besides the insanity of Chelsea).

But considering that before the Glazers took over, Man Utd was debt-free & the richest club in the world, they should be in a position to outspend everyone (besides the insanity of Chelsea).

8/16 This transfer window Man Utd wasn't as ambitious as its peers, who chased £100m players.

Maybe it was financial prudence but perhaps the Glazers' potential sale played a part.

After all who buys new tires for a car they plan to sell next week.

Maybe it was financial prudence but perhaps the Glazers' potential sale played a part.

After all who buys new tires for a car they plan to sell next week.

9/16 It seems some signings this season have been optimized for cost and not potential e.g. signing 35 yr old Johnny Evans from recently relegated Leicester.

On the other had Man City already had a stacked defense but still had £78m to spend on highly rated Gvardiol.

On the other had Man City already had a stacked defense but still had £78m to spend on highly rated Gvardiol.

10/16 Unfortunately for fans, the Glazers look like they are not going away soon.

Despite a protracted bidding process that saw a record £5bn bid for the club, it now looks like the Glazer's may not sell preferring to hold out for a much bigger pay day.

Despite a protracted bidding process that saw a record £5bn bid for the club, it now looks like the Glazer's may not sell preferring to hold out for a much bigger pay day.

11/16 Perhaps there too many mouths to feed 😅 . When I talked about the Glazers in the past I didn't realize how many there were. There a are 6 Glazers on the board 🤯.

For comparison, Brighton & Arsenal have 2 family members on the board although Arsenal's board is smaller.

For comparison, Brighton & Arsenal have 2 family members on the board although Arsenal's board is smaller.

12/16 I empathize with ManU fans.

Fans want owners that want to win trophies more than make money.

However, is that a realistic expectation?

And if an owner is not making profit but uses the club for e.g sports washing is that an issue?

🤷🏽♂️ "I prefer not to speak"

Fans want owners that want to win trophies more than make money.

However, is that a realistic expectation?

And if an owner is not making profit but uses the club for e.g sports washing is that an issue?

🤷🏽♂️ "I prefer not to speak"

13/16 With the Glazers maintaining control it not certain the investment in Man Utd will increase soon.

I wouldn't write off Man Utd yet - it is still an amazing club and may just have to survive this era of Glazers as owners and Maguire and Evans in defense.

I wouldn't write off Man Utd yet - it is still an amazing club and may just have to survive this era of Glazers as owners and Maguire and Evans in defense.

14/16 What do you think? Are the Glazers to blame or its just business?

If you found this thread insightful, please Comment/Like/Retweet the 1st tweet below and follow @tmukogo for more.

I write on the finance & strategy impacting Africa and the rest of the World.

If you found this thread insightful, please Comment/Like/Retweet the 1st tweet below and follow @tmukogo for more.

I write on the finance & strategy impacting Africa and the rest of the World.

https://twitter.com/tmukogo/status/1698719310942973957

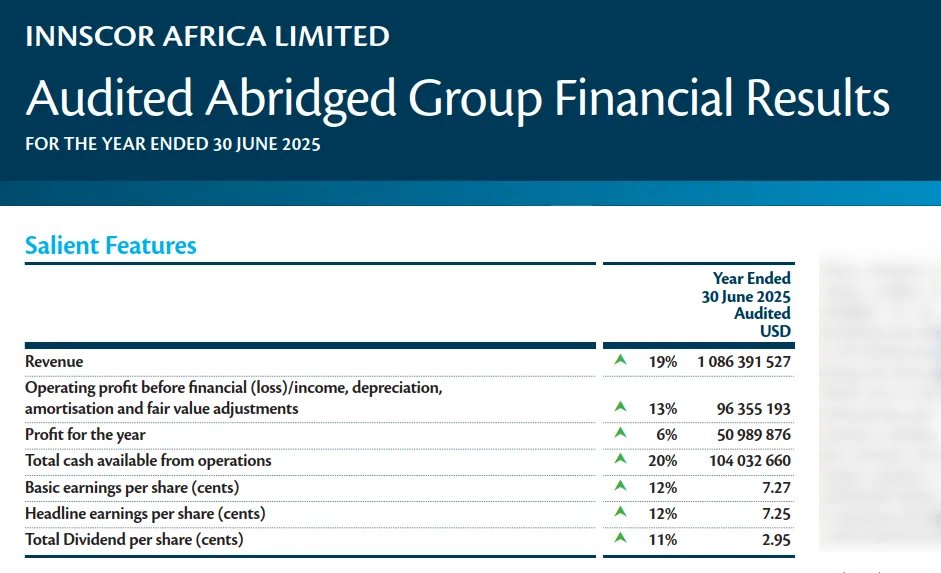

15/16 If you found this thread interesting you you will probably find the below threads also about football and finance worthwhile reading.

Recommendation 1/2

Recommendation 1/2

https://twitter.com/tmukogo/status/1683846344929312772

16/16 Below is another thread you may find interesting.

Recommendation 2/2

Recommendation 2/2

https://twitter.com/tmukogo/status/1665098467566395392

• • •

Missing some Tweet in this thread? You can try to

force a refresh