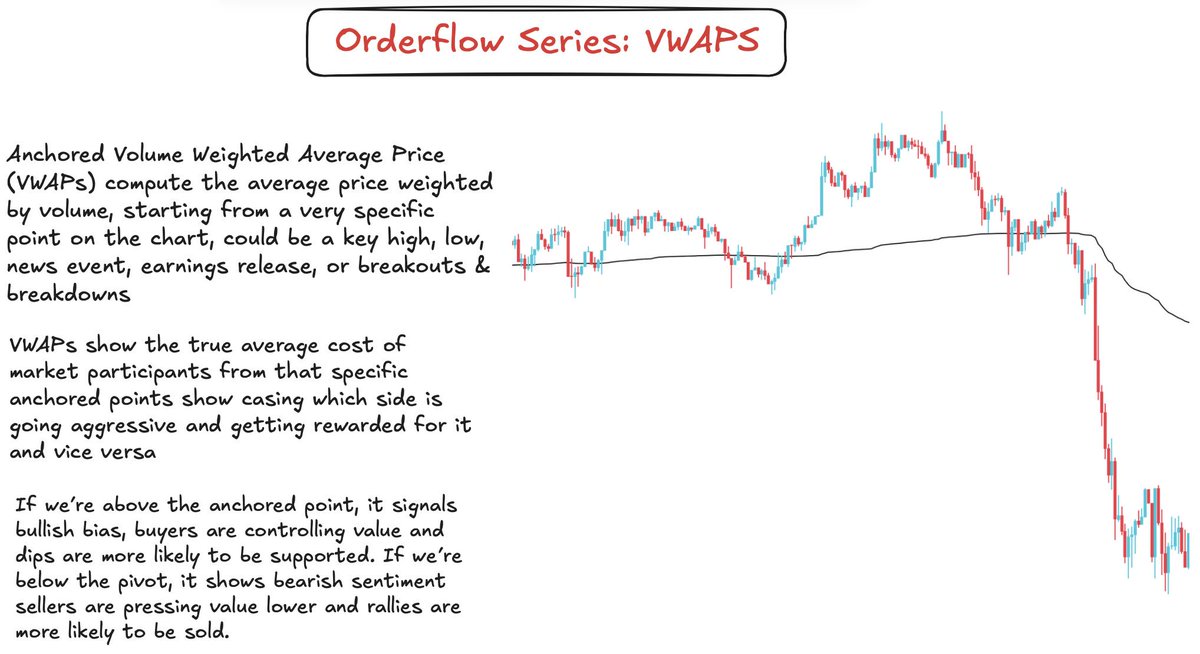

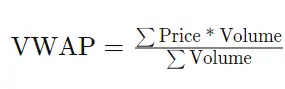

VWAP is basically made by multiplying each trade's price by its volume, adding all this together, and then dividing by the total number of coins traded.

Traders use VWAP to see if a coin is trending up or down.

Below VWAP -> Cheap

Above VWAP ->Expensive

On LTF.

Traders use VWAP to see if a coin is trending up or down.

Below VWAP -> Cheap

Above VWAP ->Expensive

On LTF.

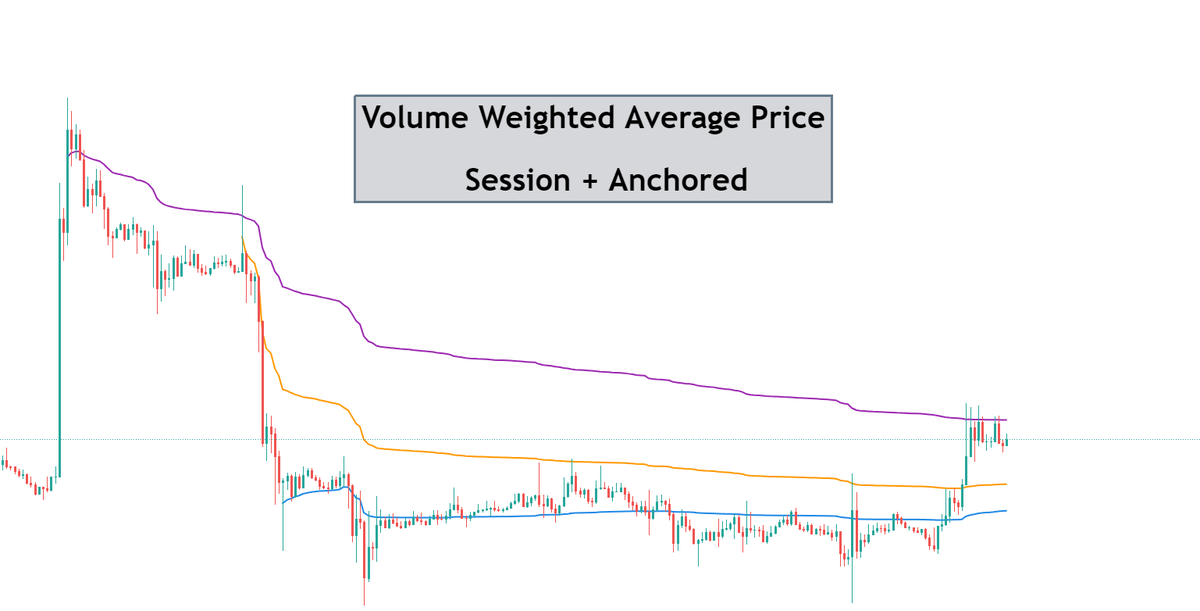

I will show both session VWAP and Anchored VWAP (AVWAP).

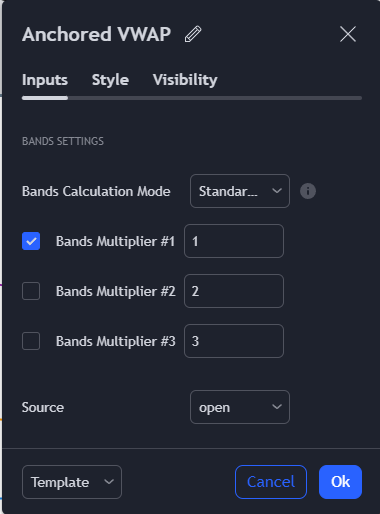

but we use the latter the most often and these are my default settings:

When anchoring to a high, use 'high'. When anchoring to a low, use 'low'.

but we use the latter the most often and these are my default settings:

When anchoring to a high, use 'high'. When anchoring to a low, use 'low'.

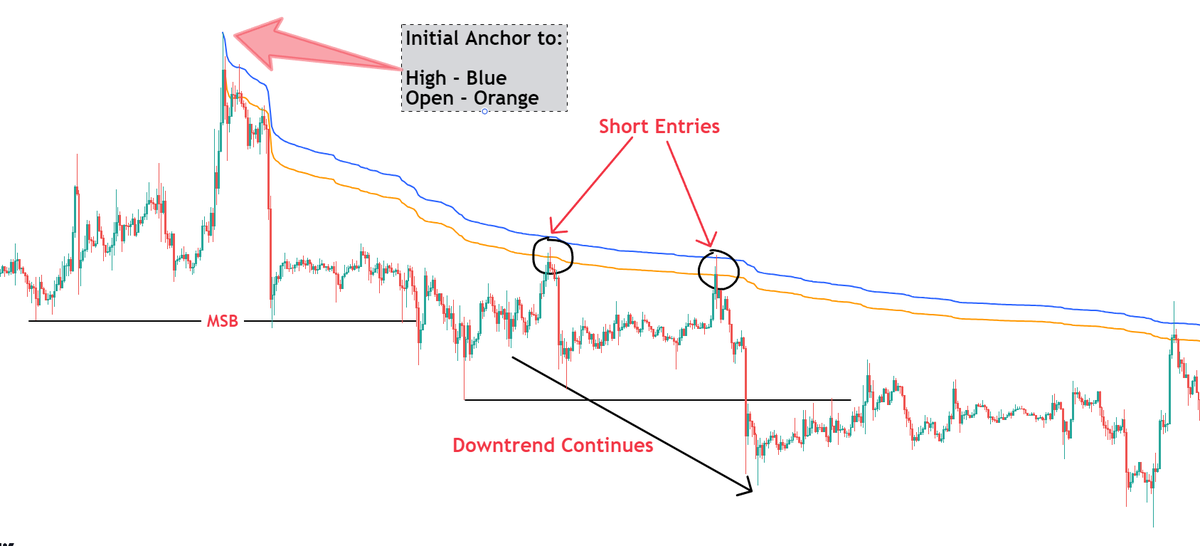

Here is a recent Bitcoin chart showing how you can anchor AVWAP to the high/low as well as open simultaneously. Read it well Chads.

You can consider entering somewhere between the 2 VWAPs.

I use it as an entry tool.

You can consider entering somewhere between the 2 VWAPs.

I use it as an entry tool.

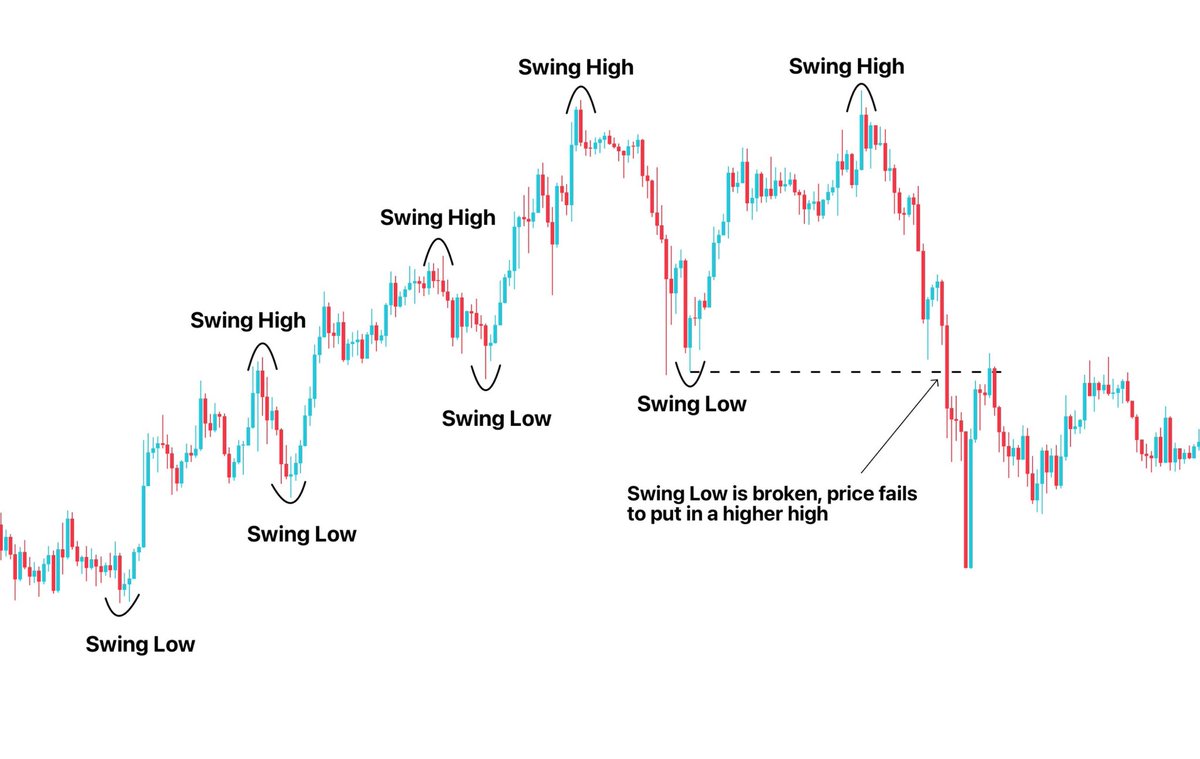

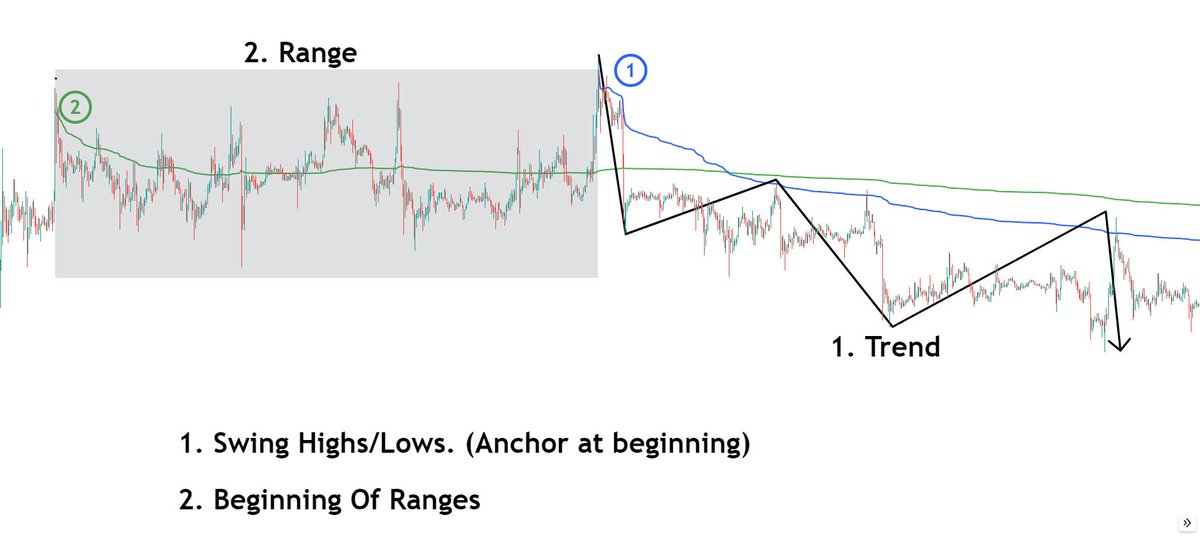

There are two places where I anchor the VWAP:

1. Swing Highs/Lows. (Anchor at beginning)

2. Beginning Of Ranges

1. Swing Highs/Lows. (Anchor at beginning)

2. Beginning Of Ranges

Now let's jump into how I take trades in both scenarios:

1. Trend Following Trade

NOTE: The more immediate and violent the reaction, the better.

1. Trend Following Trade

NOTE: The more immediate and violent the reaction, the better.

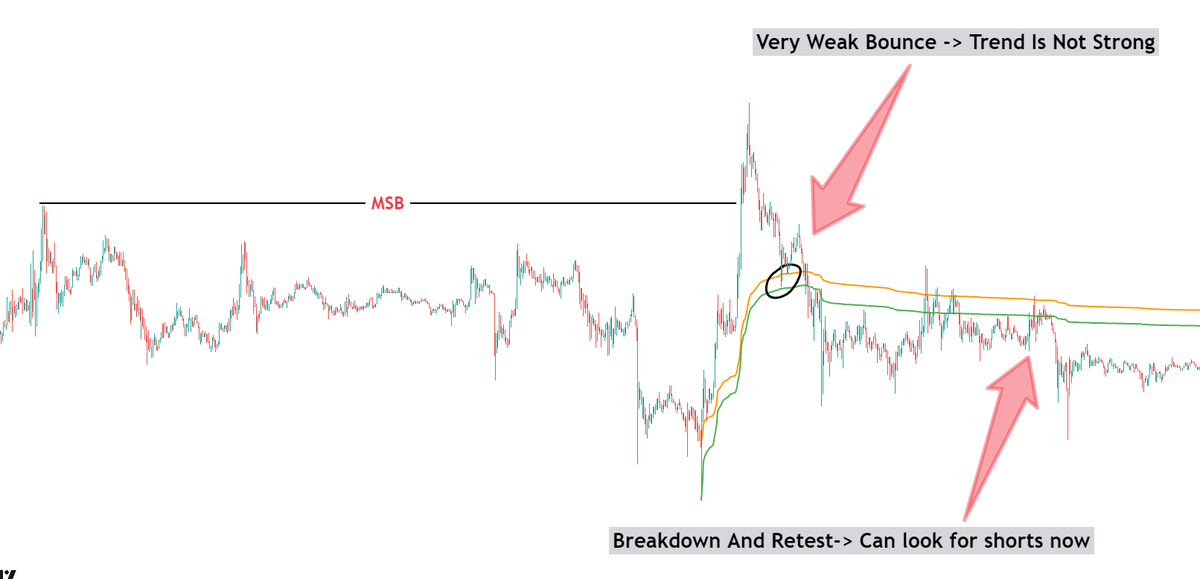

2. Trend Failure

This is a more nuanced setup where more confluence is needed. I mostly scalp trade the range on 1m TF when this happens

NOTE: If price immediately tests VWAP after first high/low, that is a bad sign.

This is a more nuanced setup where more confluence is needed. I mostly scalp trade the range on 1m TF when this happens

NOTE: If price immediately tests VWAP after first high/low, that is a bad sign.

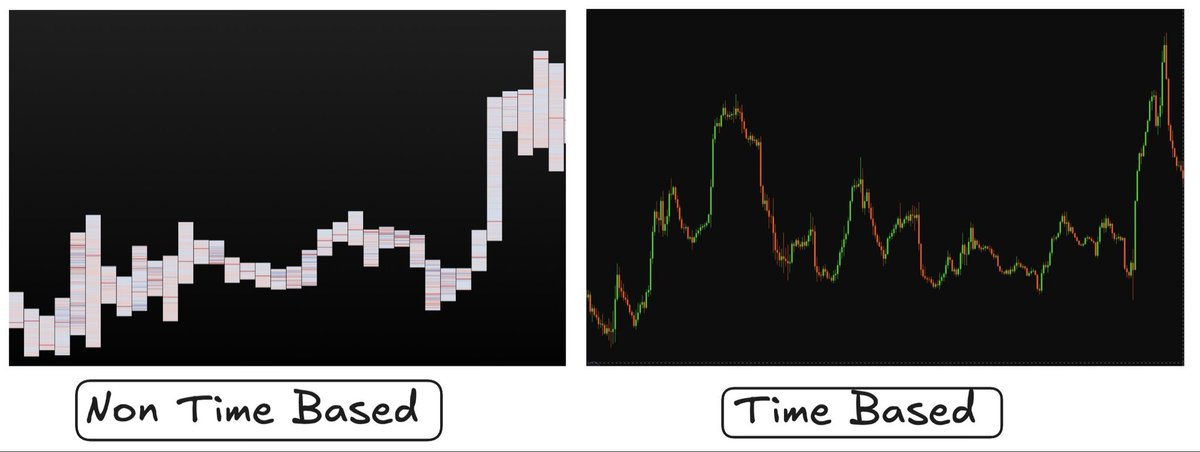

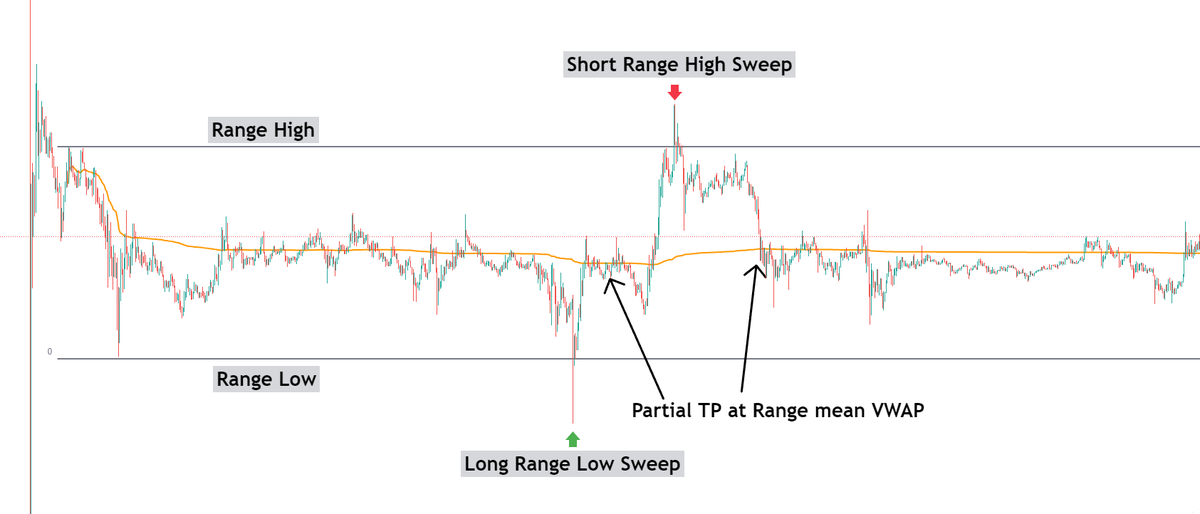

3. VWAP as range mean.

Here we mostly use it on "open" setting.

It is a point of interest in terms of target, also for entries (sometimes)

NOTE: Not the best way to use VWAP.

Here we mostly use it on "open" setting.

It is a point of interest in terms of target, also for entries (sometimes)

NOTE: Not the best way to use VWAP.

So this ia the trick I use for VWAP to make intraday trades. You can use it Chads and tell me how it works for you.

Follow me @BullyDCrypto for more tricks each day.

Follow me @BullyDCrypto for more tricks each day.

• • •

Missing some Tweet in this thread? You can try to

force a refresh