Full time Bitcoin trader. Part time Shit poster.

Free TG - https://t.co/92VKYXYOn1

Youtube: https://t.co/993E63YH8W

8 subscribers

How to get URL link on X (Twitter) App

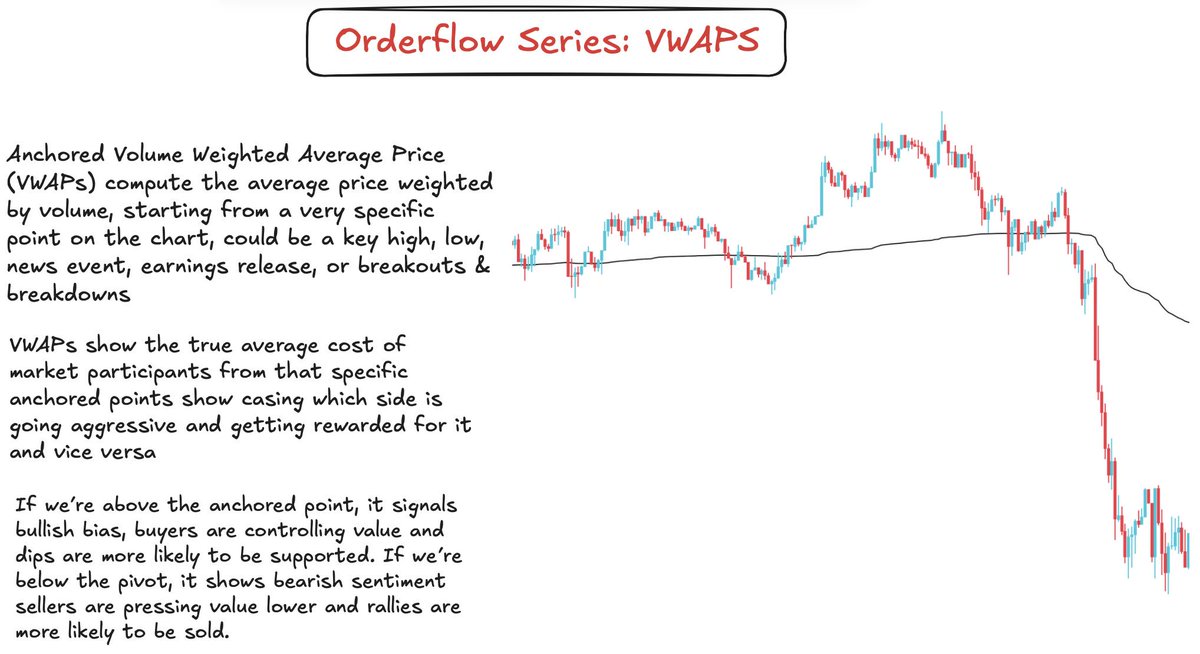

1) Intraday VWAPs

1) Intraday VWAPs https://x.com/BullyDCrypto/status/1950615153675993473

Normal trend-based bias forming:

Normal trend-based bias forming:

https://twitter.com/bullydcrypto/status/1926105718702112980

How to Read OI

How to Read OI

Evolving R refers to the dynamic nature of the risk to reward ratio (R) as a trade progresses. Initially, traders set a fixed R based on their entry, stop loss, and target levels

Evolving R refers to the dynamic nature of the risk to reward ratio (R) as a trade progresses. Initially, traders set a fixed R based on their entry, stop loss, and target levels

You can view the market from two different lens:

You can view the market from two different lens:

$MAVIA

$MAVIA

1. Risk Management

1. Risk Management

Exploiting Naked Points of Control (NPOCs), areas where liquidity is left unfilled. By identifying these levels, you can capitalize on price’s natural tendency to revisit them. This strategy offers precise entries, targeting areas where the market is most likely to react, providing a powerful edge for intraday trading setups.

Exploiting Naked Points of Control (NPOCs), areas where liquidity is left unfilled. By identifying these levels, you can capitalize on price’s natural tendency to revisit them. This strategy offers precise entries, targeting areas where the market is most likely to react, providing a powerful edge for intraday trading setups.

Understanding Context Of Market Environment:

Understanding Context Of Market Environment:

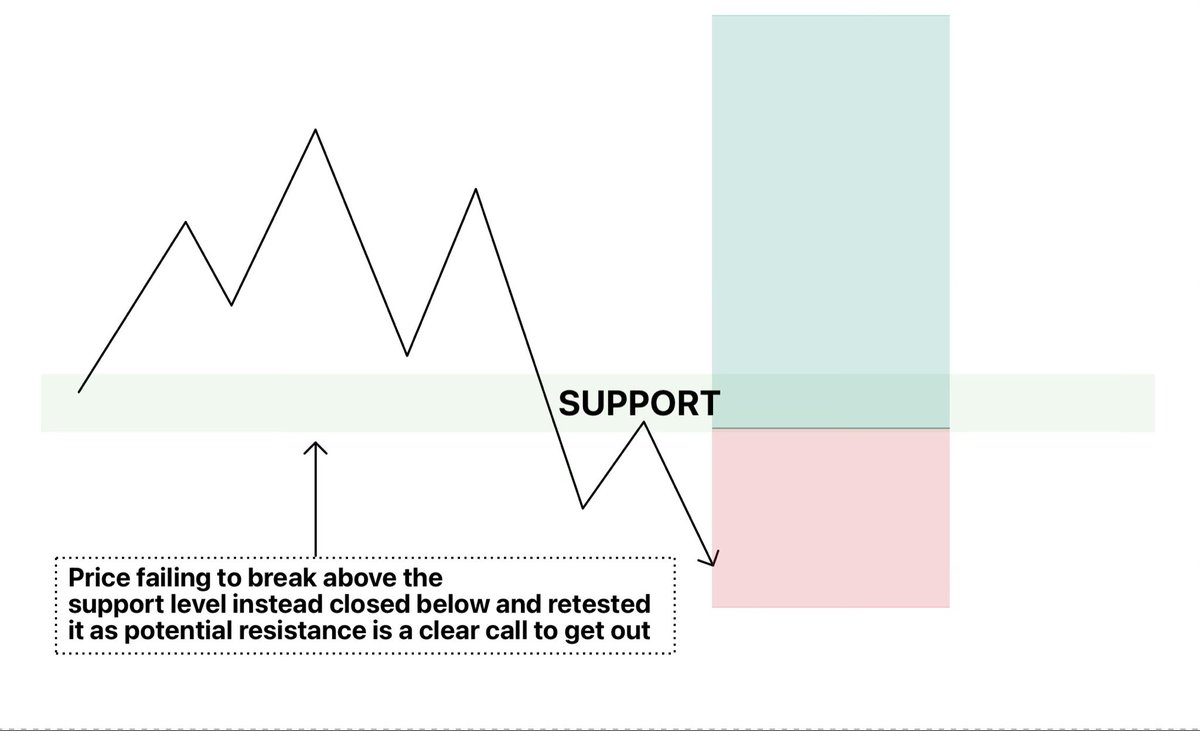

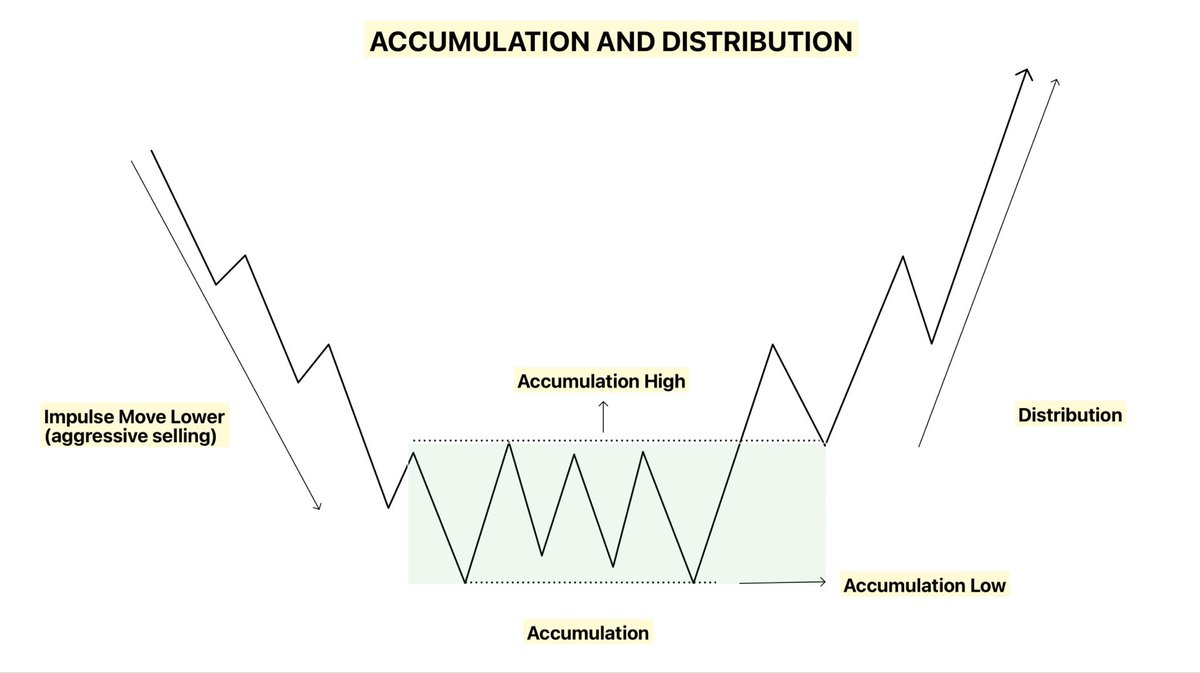

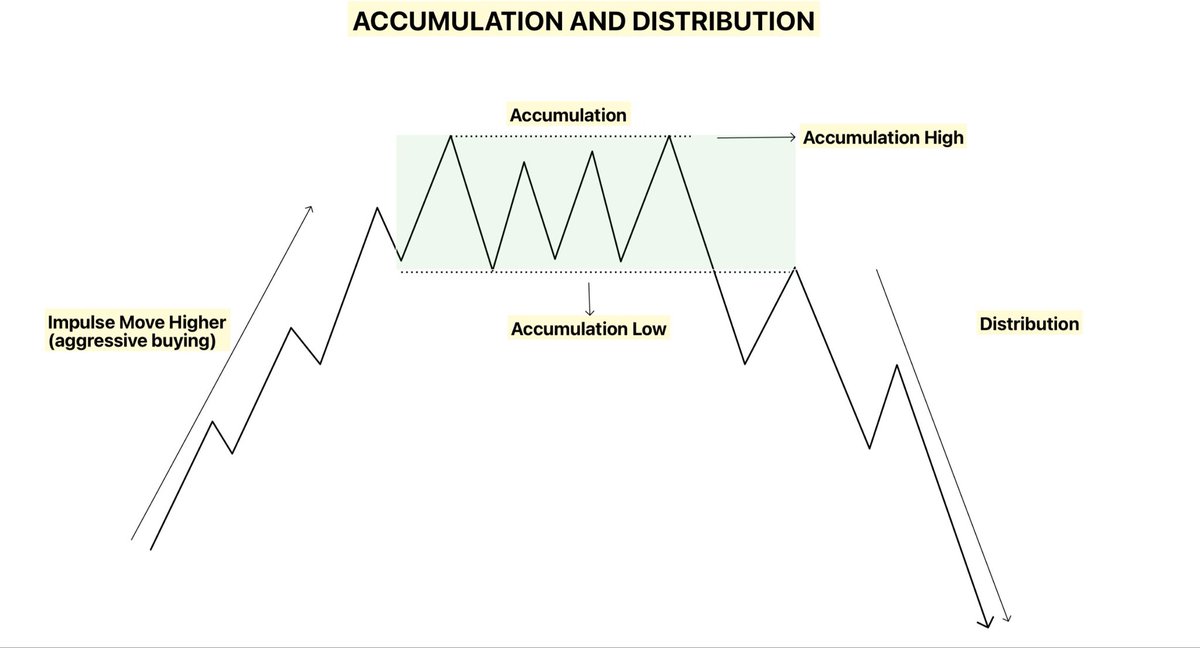

Why does Accumulation & Distribution Work in Trading

Why does Accumulation & Distribution Work in Trading

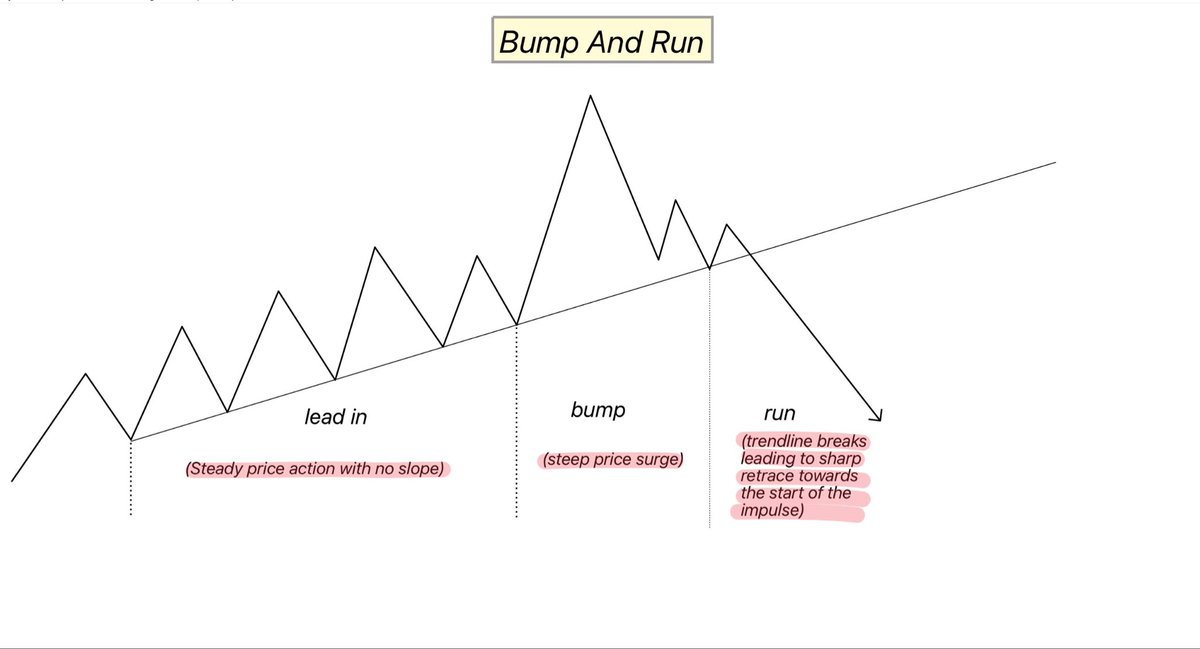

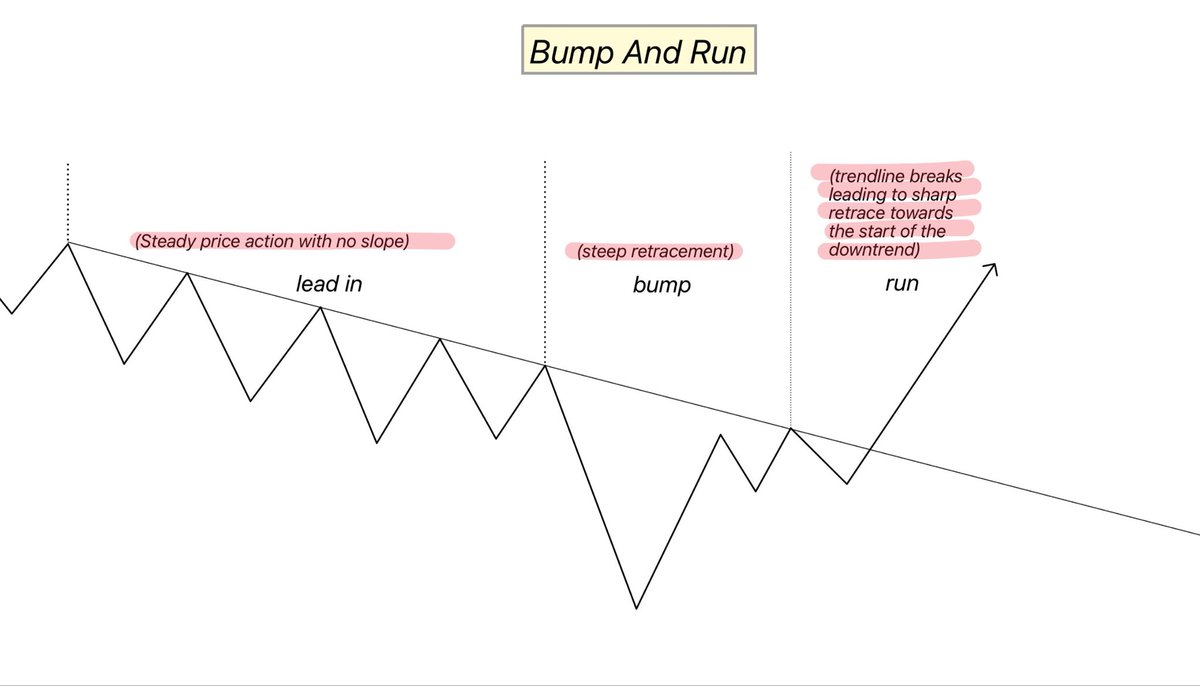

One of my favourite indicator that signals a potential trend reversal. It typically occurs after a sharp price increase or decrease, often driven by excessive momentum, followed by a steep uptrend/decline.

One of my favourite indicator that signals a potential trend reversal. It typically occurs after a sharp price increase or decrease, often driven by excessive momentum, followed by a steep uptrend/decline.

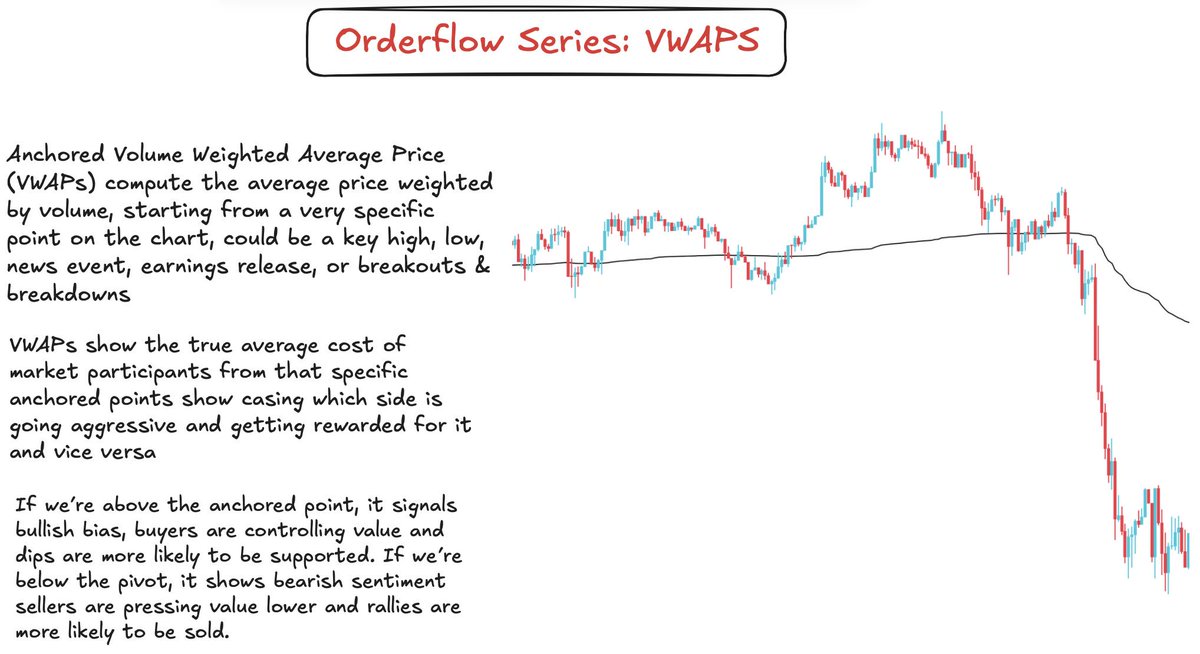

1) Understanding Support And Resistance

1) Understanding Support And Resistance

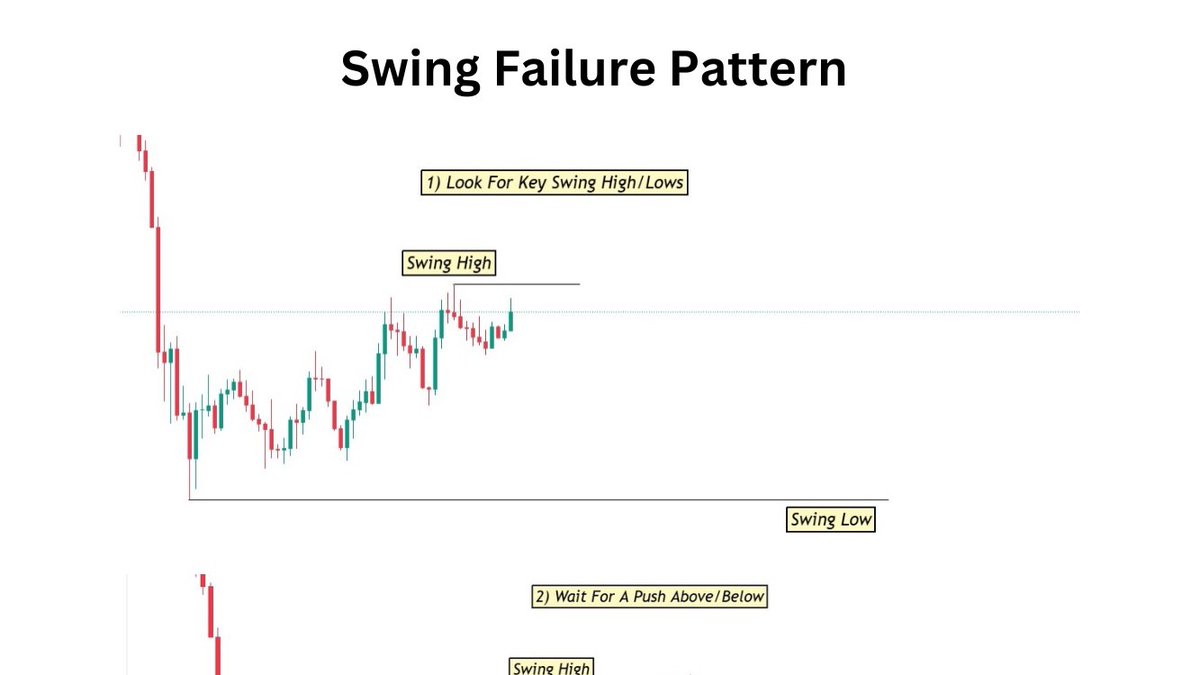

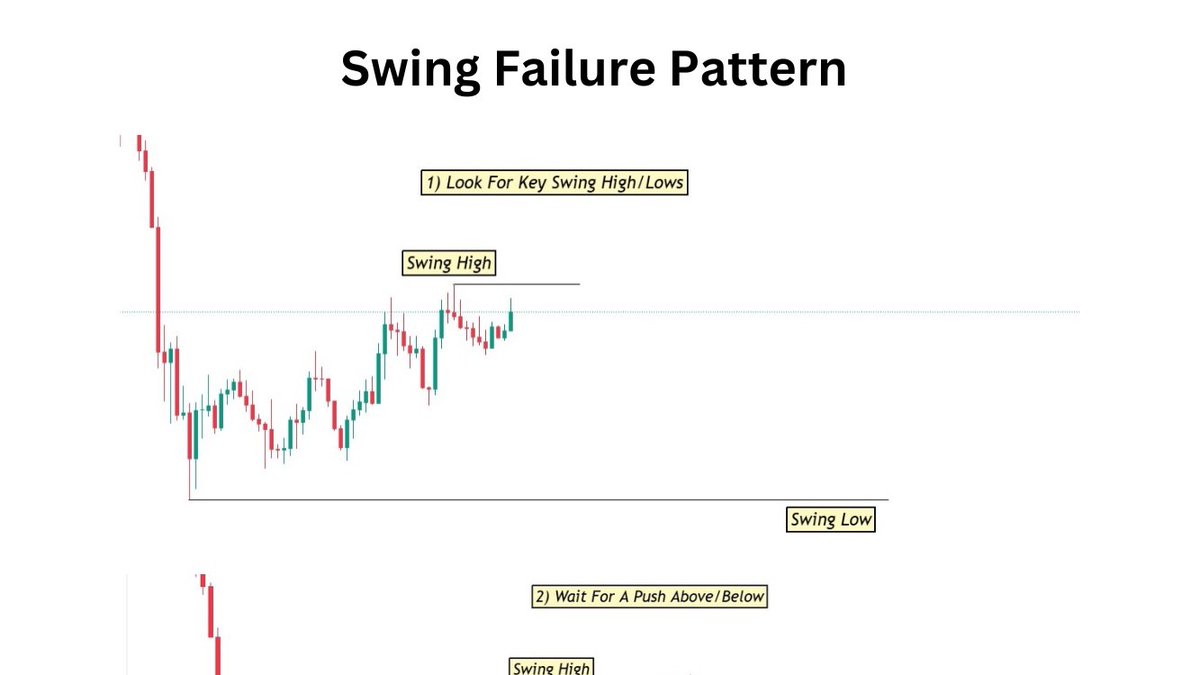

How to find swing points?

How to find swing points?

- ETH often shows strength during illiquid periods, attracting traders before a sudden liquidation event where it drops 20-30% as market makers pull bids

- ETH often shows strength during illiquid periods, attracting traders before a sudden liquidation event where it drops 20-30% as market makers pull bids

Now the immediate playbook:

Now the immediate playbook:

What is A swing failure pattern (SFP)?

What is A swing failure pattern (SFP)?

How to preserve profits and increase your account size

How to preserve profits and increase your account size

$ETH

$ETH

https://twitter.com/BullyDCrypto/status/1871608627263574211

What's next?

What's next?

The Three Drive Pattern

The Three Drive Pattern