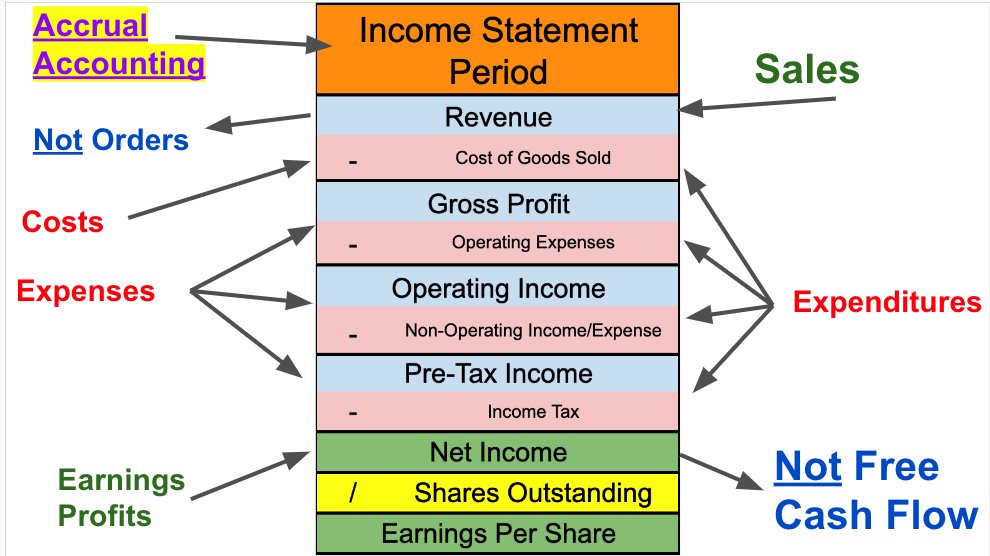

Revenue and Income are NOT the same things.

Costs and Expenses are NOT the same things.

Net Income and Free Cash Flow are NOT the same things.

Confused? Here's a 2-minute breakdown:

Costs and Expenses are NOT the same things.

Net Income and Free Cash Flow are NOT the same things.

Confused? Here's a 2-minute breakdown:

Sales and revenue mean the same things.

Both are the money that comes in from customer payments.

They both refer to the “top line” of the income statement.

Both are the money that comes in from customer payments.

They both refer to the “top line” of the income statement.

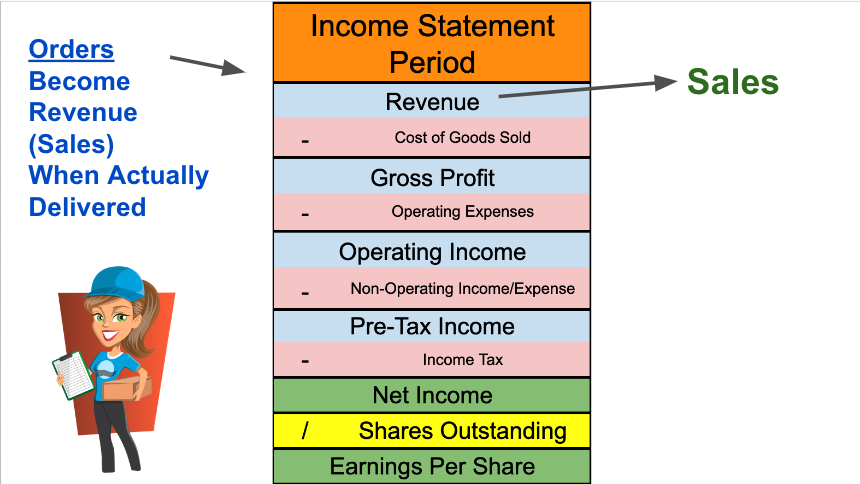

Orders and sales are NOT the same things.

Orders are when a customer places a request for the future delivery of a product or service.

Orders become sales when the product is actually shipped, or the service is performed.

Orders are when a customer places a request for the future delivery of a product or service.

Orders become sales when the product is actually shipped, or the service is performed.

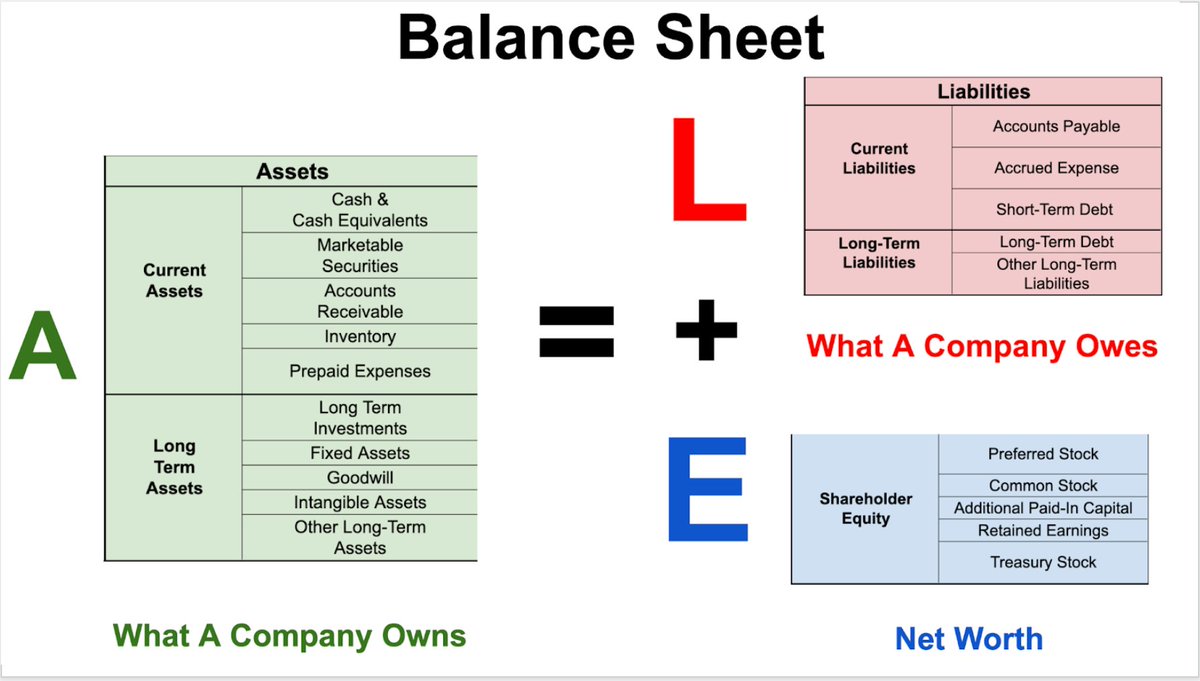

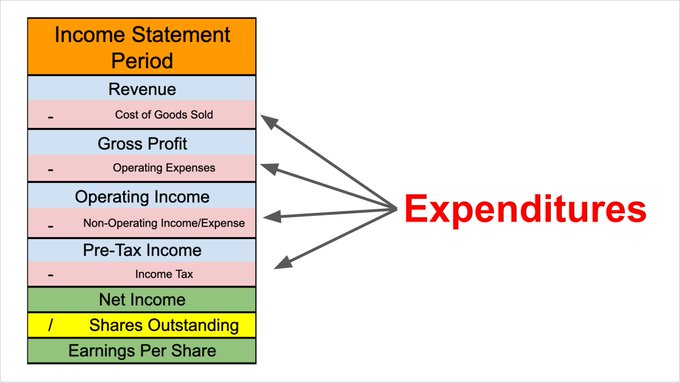

Costs are different from expenses.

Costs are money spent on making a product or delivering a service (hence "cost of goods sold")

Expenses are money spent on developing, selling, accounting for, and managing the product or service.

Costs are money spent on making a product or delivering a service (hence "cost of goods sold")

Expenses are money spent on developing, selling, accounting for, and managing the product or service.

Costs and expenses both become expenditures when money is actually sent to the vendors to pay the bills

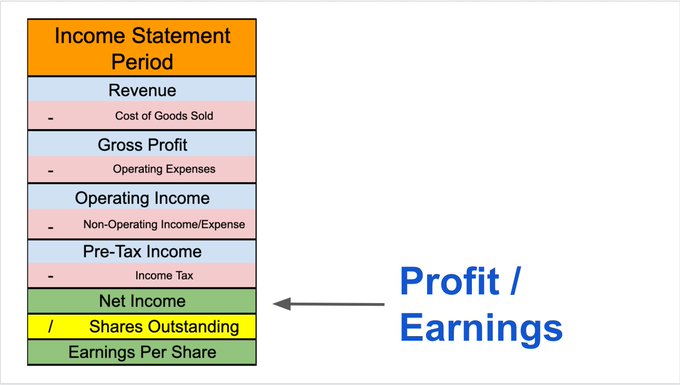

Profits, earnings, and net income all mean the same thing.

They are the “bottom line” of the income statement

They all represent what is left over after all of the costs & expenses are subtracted from the revenue

They are the “bottom line” of the income statement

They all represent what is left over after all of the costs & expenses are subtracted from the revenue

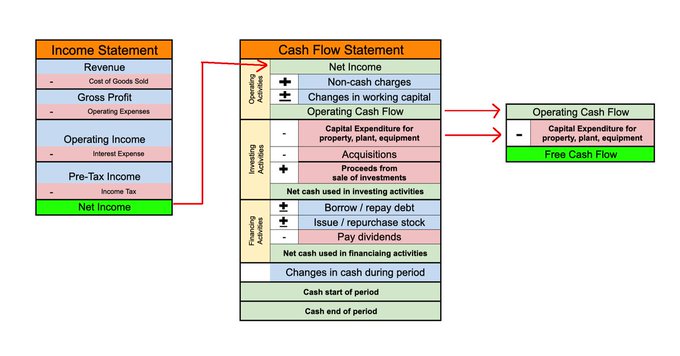

Net income and free cash flow are NOT the same things!

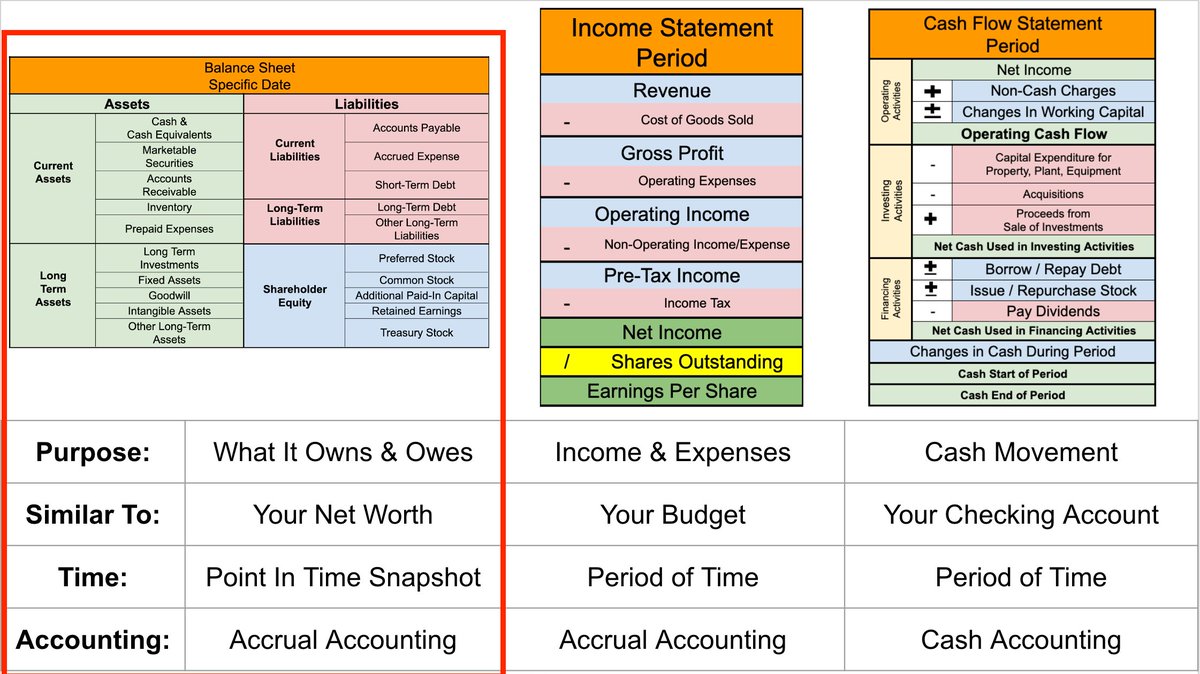

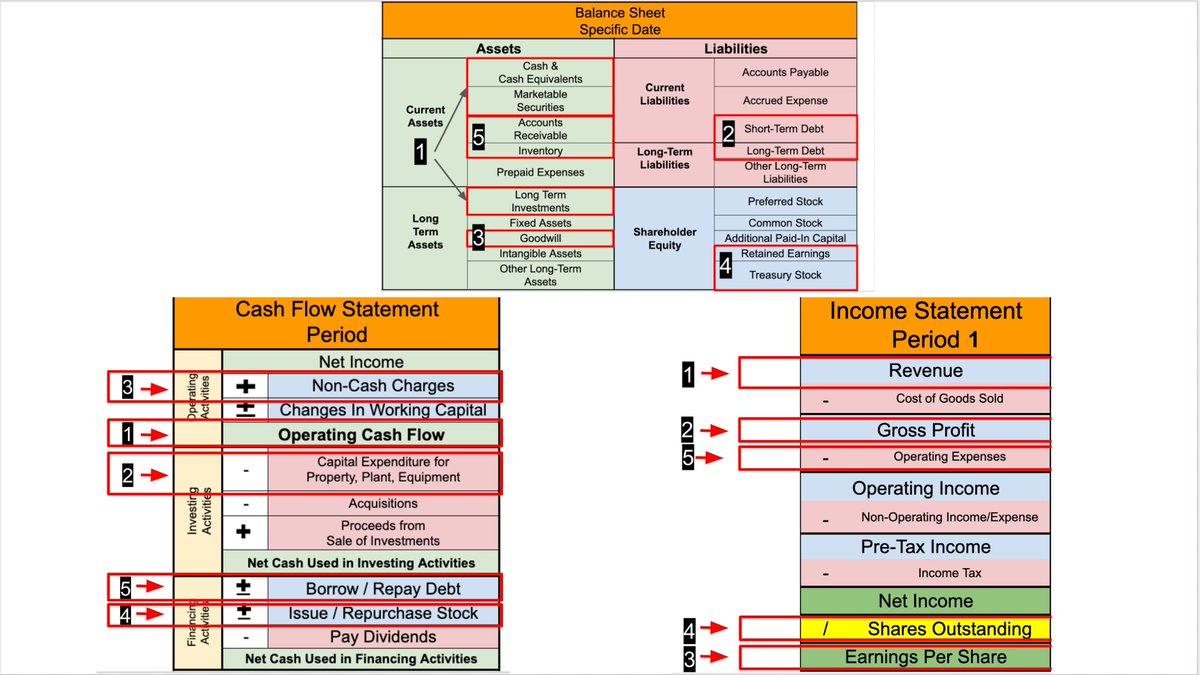

Net income measures profitability on the income statement using accrual accounting.

Free cash flow measures cash flow that is available to shareholders on the cash flow statement using cash accounting.

Net income measures profitability on the income statement using accrual accounting.

Free cash flow measures cash flow that is available to shareholders on the cash flow statement using cash accounting.

Accrual accounting and cash accounting are not the same things

Accrual accounting: revenue or expenses are recorded when they occur, not when payment is received or made

Cash accounting: transactions are recorded only when money goes in or out of an account

Accrual accounting: revenue or expenses are recorded when they occur, not when payment is received or made

Cash accounting: transactions are recorded only when money goes in or out of an account

Accounting is a great business skill to master, but it can be confusing.

Want to level up your skills?

Join 1,400+ investors at a FREE webinar on Thursday, Sept 14th at 12:00 PM EST

Can't make it live? All RSVPs will be emailed a replay:

RSVP here: lu.ma/BuffettRules

Want to level up your skills?

Join 1,400+ investors at a FREE webinar on Thursday, Sept 14th at 12:00 PM EST

Can't make it live? All RSVPs will be emailed a replay:

RSVP here: lu.ma/BuffettRules

Summary:

1: Revenue & Sales = Same

2: Costs = Making Product/Service

3: Expenses = Running the business

4: Profits, Earnings, Net Income = Same

5: Net Income = Accrual Accounting

6: Free Cash Flow = Cash Accounting

7: Accrual Accounting = 💳 ⌛️

8: Cash Accounting = 💵 ↔️

1: Revenue & Sales = Same

2: Costs = Making Product/Service

3: Expenses = Running the business

4: Profits, Earnings, Net Income = Same

5: Net Income = Accrual Accounting

6: Free Cash Flow = Cash Accounting

7: Accrual Accounting = 💳 ⌛️

8: Cash Accounting = 💵 ↔️

Enjoy this thread?

Follow me @BrianFeroldi for more content like this.

I demystify finance with 1-2 threads each week.

Want to share with your audience? Retweet the first tweet below:

Follow me @BrianFeroldi for more content like this.

I demystify finance with 1-2 threads each week.

Want to share with your audience? Retweet the first tweet below:

https://twitter.com/61558281/status/1700842498120146998

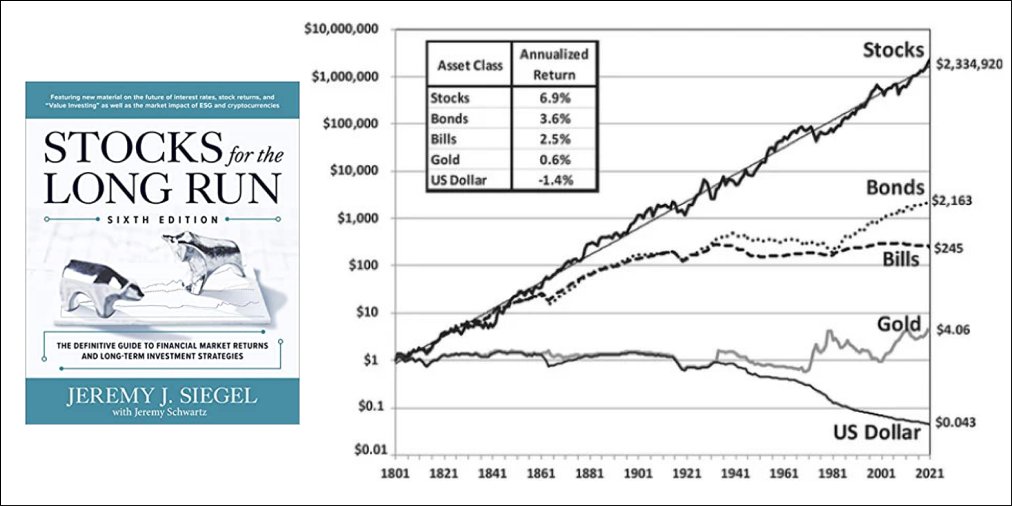

If you liked this post, you'll love my free ebook.

I organized 50 of the most powerful investing images I've ever seen.

Want a free copy? Get it here:

brianferoldi.com/50visuals

I organized 50 of the most powerful investing images I've ever seen.

Want a free copy? Get it here:

brianferoldi.com/50visuals

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter