The latest Sovereign Gold Bond (SGB) issue is here.

You can get 1 gram (or 1 unit) of SGB at Rs 5,873.

Typically, you get old SGBs (traded on stock exchanges) cheaper than the new issue.

But this time, the fresh issue looks like a better deal.

A thread 🧵

You can get 1 gram (or 1 unit) of SGB at Rs 5,873.

Typically, you get old SGBs (traded on stock exchanges) cheaper than the new issue.

But this time, the fresh issue looks like a better deal.

A thread 🧵

First, some basics.

SGBs mature in 8 years.

On redemption, you get the prevailing market price of gold.

You also earn an interest of 2.5% every year on the issue price.

There are two ways to buy SGB units:

- New issues (through banks)

- Old issues (on exchanges)

SGBs mature in 8 years.

On redemption, you get the prevailing market price of gold.

You also earn an interest of 2.5% every year on the issue price.

There are two ways to buy SGB units:

- New issues (through banks)

- Old issues (on exchanges)

All new issues are open for subscription for a short period.

The current issue is open between Sep 11 & Sep 15.

Post that, SGB units get listed on stock exchanges.

This allows you to buy old SGB issues from exchanges.

And gives you an option to sell before maturity.

The current issue is open between Sep 11 & Sep 15.

Post that, SGB units get listed on stock exchanges.

This allows you to buy old SGB issues from exchanges.

And gives you an option to sell before maturity.

Let’s now understand why the new SGB issue looks more attractive.

SGBs were first introduced by the govt in 2015.

To date, the RBI has issued more than 60 SGBs.

However, most old SGB units are available at a higher price than the latest SGB’s issue price.

SGBs were first introduced by the govt in 2015.

To date, the RBI has issued more than 60 SGBs.

However, most old SGB units are available at a higher price than the latest SGB’s issue price.

If you buy online, the latest SGB’s issue price is Rs 5,873.

Meanwhile, most old SGB issues are trading at a premium (higher than Rs 5,873) on exchanges.

A few old issues are available at a discount, but the difference isn’t meaningful. So, you can ignore them.

Meanwhile, most old SGB issues are trading at a premium (higher than Rs 5,873) on exchanges.

A few old issues are available at a discount, but the difference isn’t meaningful. So, you can ignore them.

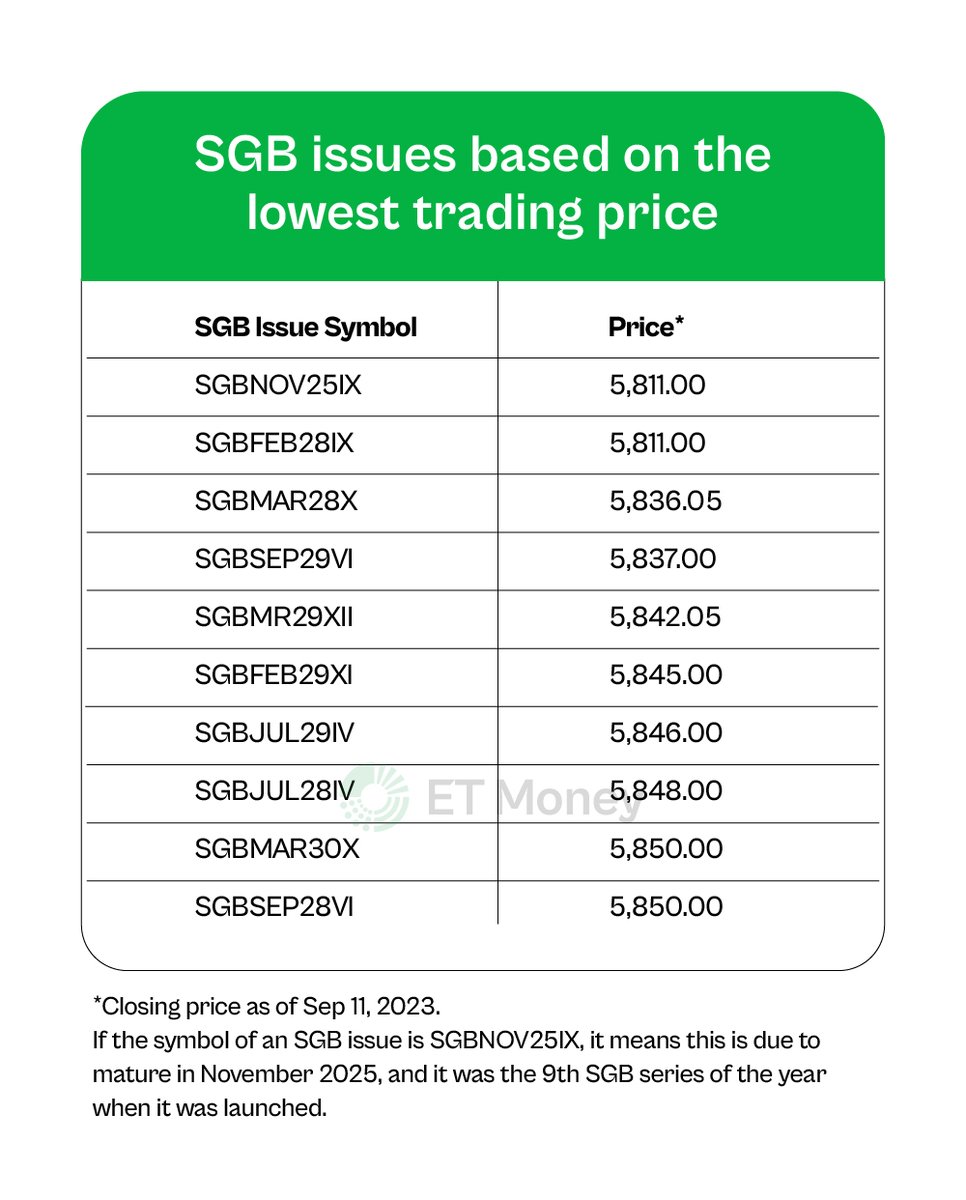

Take, for example, the top 2 tranches with the maximum discount: SGBNOV25IX and SGBFEB28IX

You get only a discount of ~Rs 60, hardly a discount of 1%.

If you consider the SGB’s yields (explained in the next tweet) and broking charges, there would be hardly any difference.

You get only a discount of ~Rs 60, hardly a discount of 1%.

If you consider the SGB’s yields (explained in the next tweet) and broking charges, there would be hardly any difference.

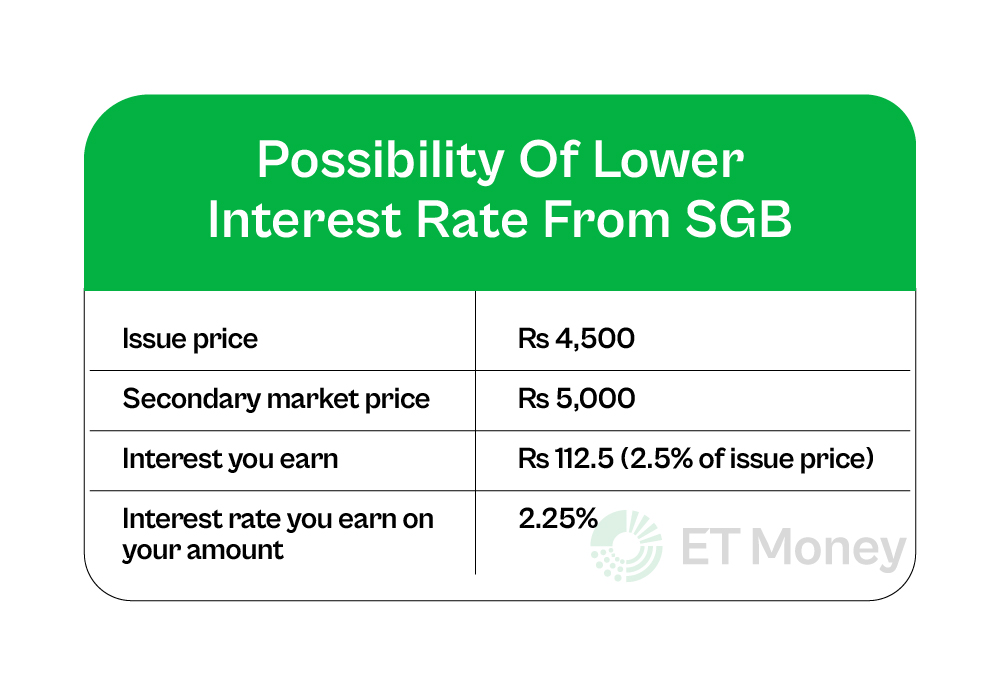

The 2.5% annual interest you receive is based on the issue price of each SGB.

If you pay more for an old SGB than its issue price, you will lose out on some interest.

Let’s look at an example.👇

If you pay more for an old SGB than its issue price, you will lose out on some interest.

Let’s look at an example.👇

Say, issue price of an old SGB was Rs 4,500.

You buy it at Rs 5,000 on an exchange.

The 2.5% interest will be on Rs 4,500, which is equal to Rs 112.5.

The interest you earn every year will be Rs 112.5 (2.25% of Rs 5,000)

So, you are missing out on some interest.

You buy it at Rs 5,000 on an exchange.

The 2.5% interest will be on Rs 4,500, which is equal to Rs 112.5.

The interest you earn every year will be Rs 112.5 (2.25% of Rs 5,000)

So, you are missing out on some interest.

Now, even if you get a good deal, you may not be able to buy old SGBs as there are not enough sellers. (See table)

And investing a sizable amount will be challenging.

So, if you are looking to invest in SGBs, opting for the new issue makes more sense.

And investing a sizable amount will be challenging.

So, if you are looking to invest in SGBs, opting for the new issue makes more sense.

We put a lot of effort into creating such informative threads.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter