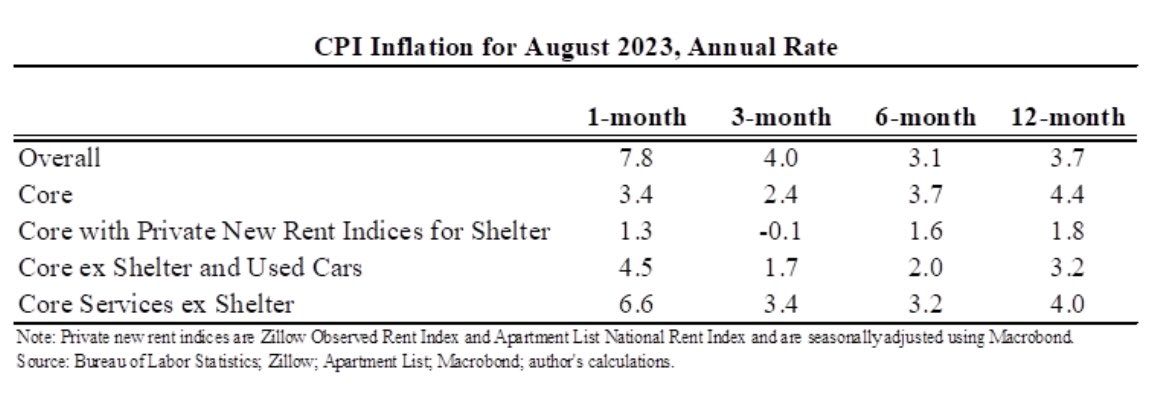

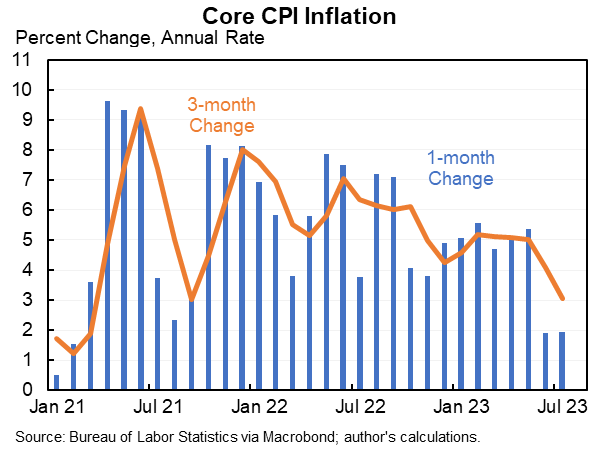

We had 2 consecutive unqualifiedly good CPI reports. I was hoping for a 3rd but this one is only qualifiedly good. Not a huge concern but some.

I'm focused on core CPI which grew at a 3.4% annual rate after 2 months <2%.

I'm focused on core CPI which grew at a 3.4% annual rate after 2 months <2%.

Note, I'm not worried about headline inflation. It was very high in August and the 12-month rate rose from 3.2% to 3.7%.

IS a good measure of how August was a difficult month for households with an 11% (sa) increase in gasoline.

But IS NOT a good predictor of future inflation.

IS a good measure of how August was a difficult month for households with an 11% (sa) increase in gasoline.

But IS NOT a good predictor of future inflation.

Back to core. When you see a number like this you like to look for special factor "excuses". The go-to has been shelter which is lagged but was the slowest growth in 2 years. Yes can slow more but probably not a lot more.

Also core goods prices fell again in August. Maybe they could fall more but this was, if anything, possibly unusually low. (New car prices increased a decent amount.)

If you exclude shelter & used cars what some people call "supercore" jumped up a lot in August--about as bad as anything earlier this year.

Is because we had a transitory? fall in used cars in August.

Will be further upward pressure in Oct when medical services resets.

Is because we had a transitory? fall in used cars in August.

Will be further upward pressure in Oct when medical services resets.

And core services ex shelter, which the Fed has says it tracks (but I'm ambivalent about because such a small %age of the basket) was way up in August.

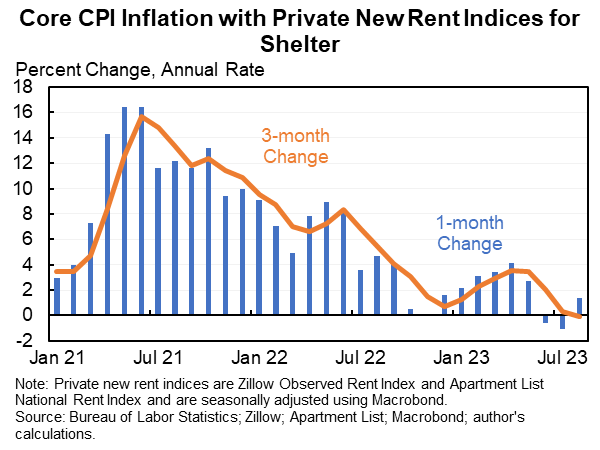

And here is swapping new rents instead of all rents for core. The most reassuring of the bunch because new rents are actually falling. Is a useful gut check but I would not actually assume that we're going to see substantial falls in all rents anytime soon.

BTW here are average hourly earnings (overall private and production and non-supervisory which excludes managers) relative to their immediate pre-pandemic trend (the pace they were on in 2018 and 2019).

Almost everything in my write-up above is about inflation within the month of August. That is one month of data. One month is noisy so would not read too much into it.

BUT a lot of the previous reassurance was based on just two months of data. Which is also noisy.

BUT a lot of the previous reassurance was based on just two months of data. Which is also noisy.

Overall I still feel better than I did a few months ago about the possibility of a soft landing. But I feel a bit worse than I did yesterday.

And if you over-updated based on the noisy June and July data you should probably be over-updating back again based on the August data.

And if you over-updated based on the noisy June and July data you should probably be over-updating back again based on the August data.

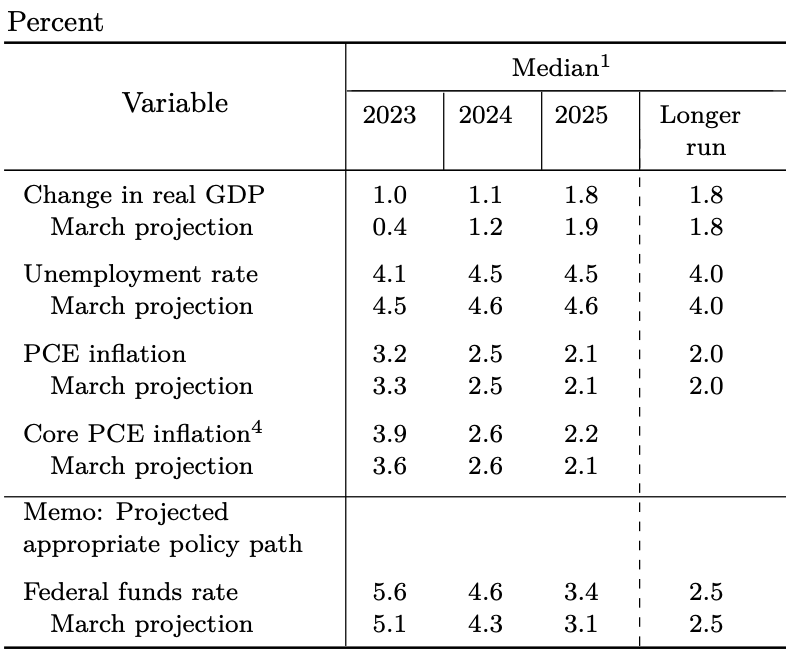

P.S. One month of data will not and should not change what the Fed does next week. But if we get two more months like this then I would hope they hike again at the December meeting.

P.P.P.S. There were some volatile things that boosted core this month that will go away that I didn’t note above like the 4.9% increase in airfares. But overall stand by the view that not much more shelter slowdown left and some volatile good news in August that will go away.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter