Hot CPI numbers as expected - inflation accelerated again in Aug; here’s a plain-English, deep dive thread explaining the real-life impact of inflation 🧵...

First the headlines: 3.7% increase in CPI and 4.3% increase in core CPI, over twice the 2% target; monthly CPI rose 0.6%, hottest monthly reading in 14 months, an annualized rate of 7.8% - at that pace, prices double every 9.2 years:

And those monthly numbers show we haven’t been trending to 2% but 3%+ while cumulative inflation under Biden is about 17%, an annualized rate of 6.1%, meaning prices double in less than 12 years:

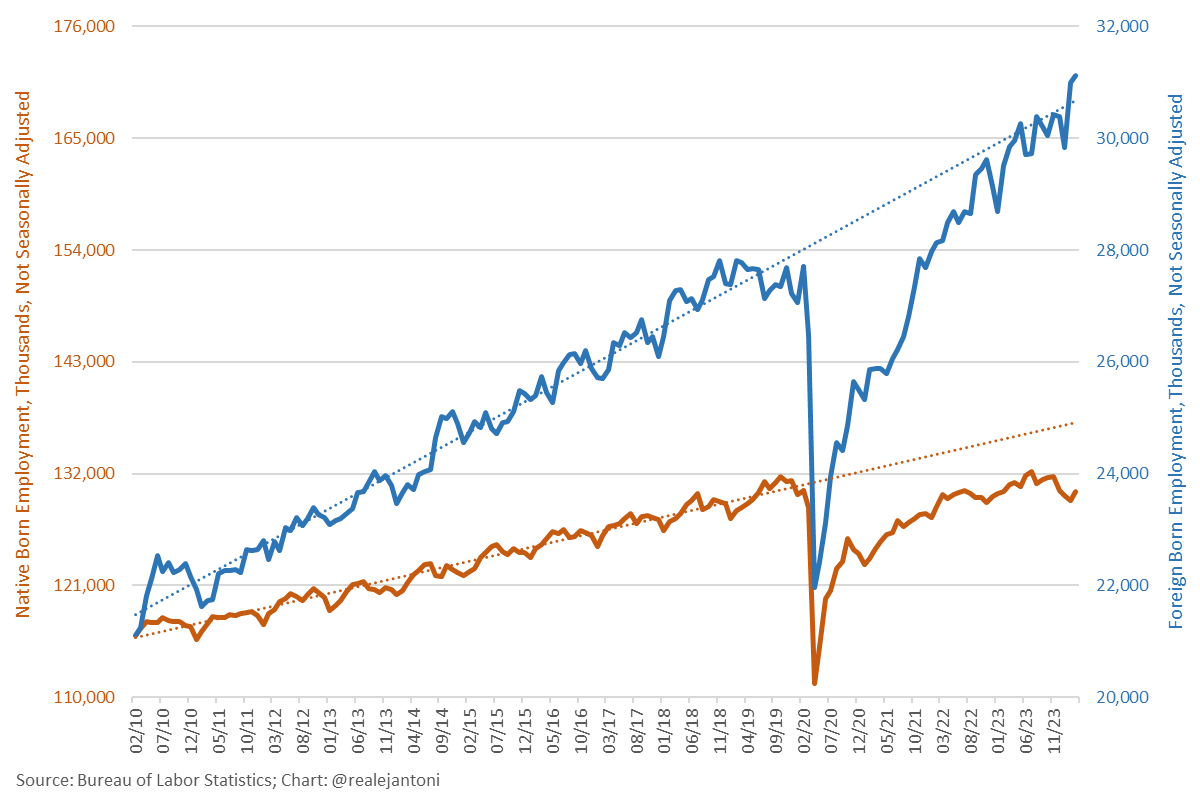

Despite wages being up 13%, prices have risen so much faster that real (inflation-adjusted) hourly earnings are way down; average worker now paying more in inflation tax than federal income tax on his or her hourly earnings:

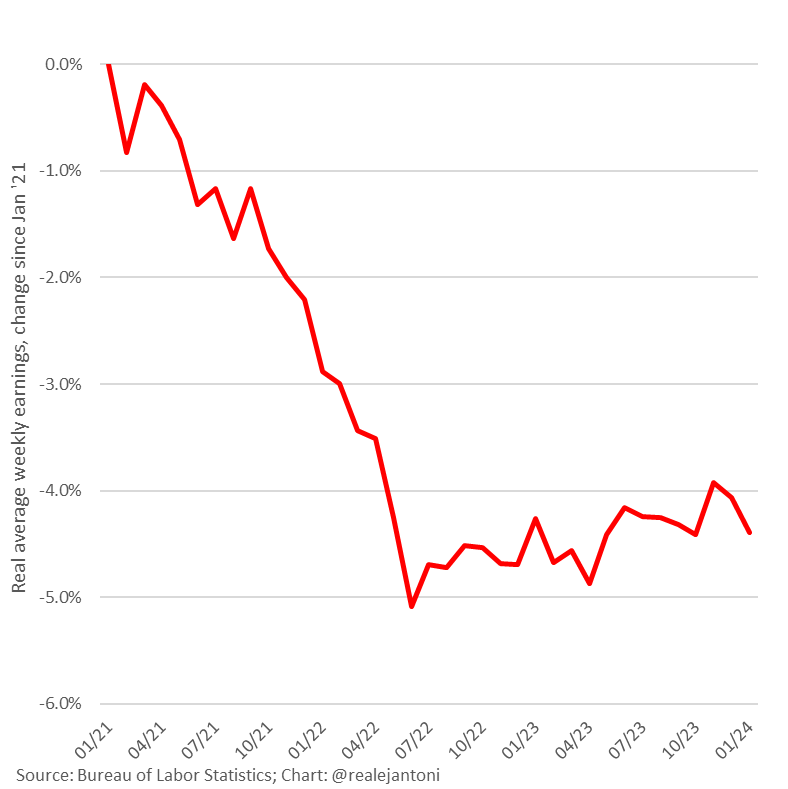

But hours have also been getting cut as business slows, so that real weekly earnings are down even more; typical American family’s weekly paycheck is about $230 bigger, but buys about $100 less:

For the typical American family, this means real annual earnings are down more than $5,100 while financing costs are up about $1,800; the equivalent of a $7,000 annual pay cut:

But that's just an average - if you're one of the poor suckers trying to buy a home today, it'll cost an extra $13,000 per year b/c the monthly mortgage payment on a median price home has doubled under Biden:

As we head into autumn and winter, things are poised to get worse for many families b/c the cost to heat a home is up 25.2% under Biden:

The massive drains to the strategic petroleum reserve were one of the few things (albeit unsustainable) that were keeping down inflation, but now we're right back on the roller coaster:

And there’s no end in sight to inflation b/c the spending just keeps going and the Fed isn’t drawing down the balance sheet fast enough – the inflation outlook sounds like a Clubber Lang fight prediction: “Pain.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh