Economist for @VinceCoglianese, @Heritage, @Comm4Prosperity, @Richzeoli, and @RichValdes; VAMO

Podcast https://t.co/hjrm5YY440 w/ @cmt_anthony

10 subscribers

How to get URL link on X (Twitter) App

The headline numbers once again look good w/ over 300k payrolls added and the employment number from the household survey rising even faster, but what kinds of jobs are being created? Turns out they're all part-time:

The headline numbers once again look good w/ over 300k payrolls added and the employment number from the household survey rising even faster, but what kinds of jobs are being created? Turns out they're all part-time:

First, the headlines:

First, the headlines:

First the headlines:

First the headlines:https://x.com/RealEJAntoni/status/1753416226812948683?s=20

First, the headlines:

First, the headlines:

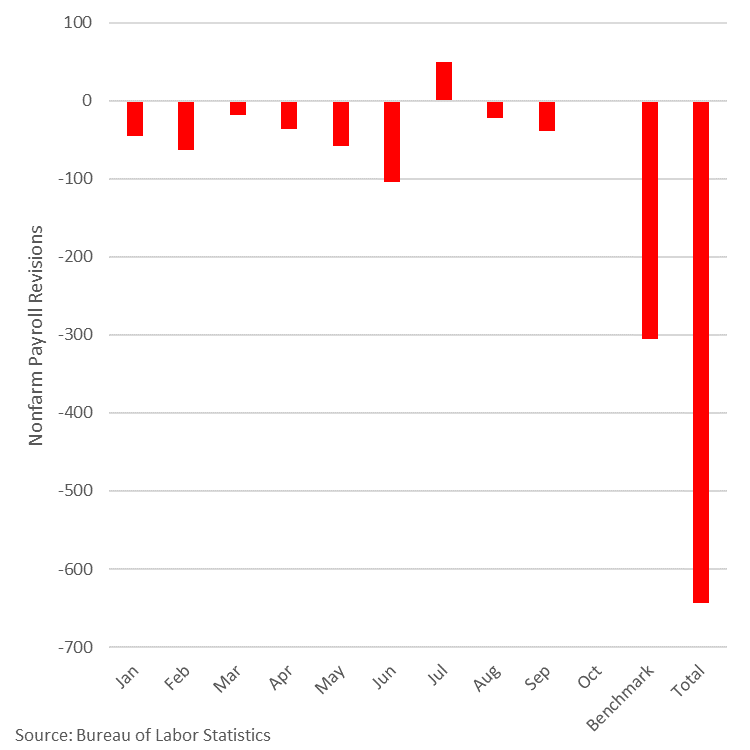

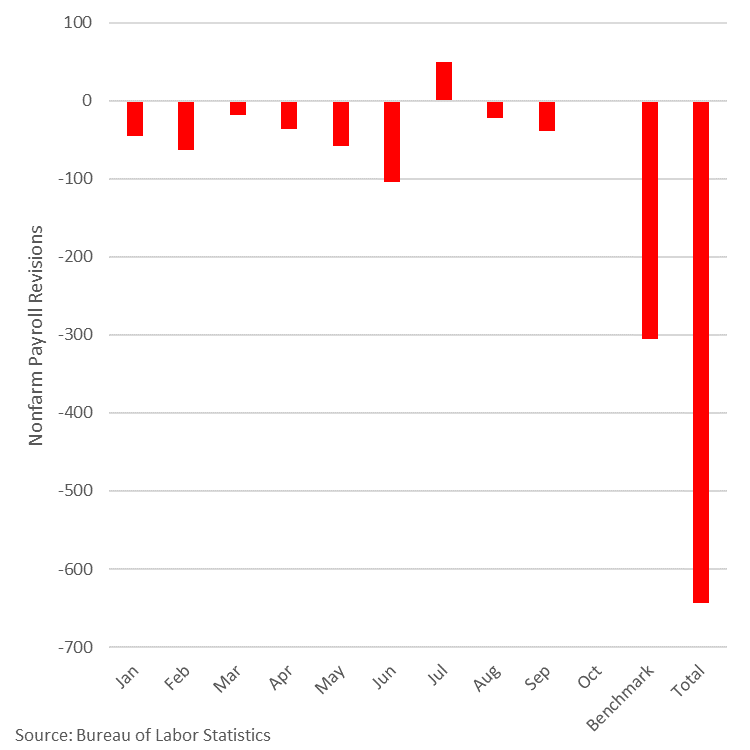

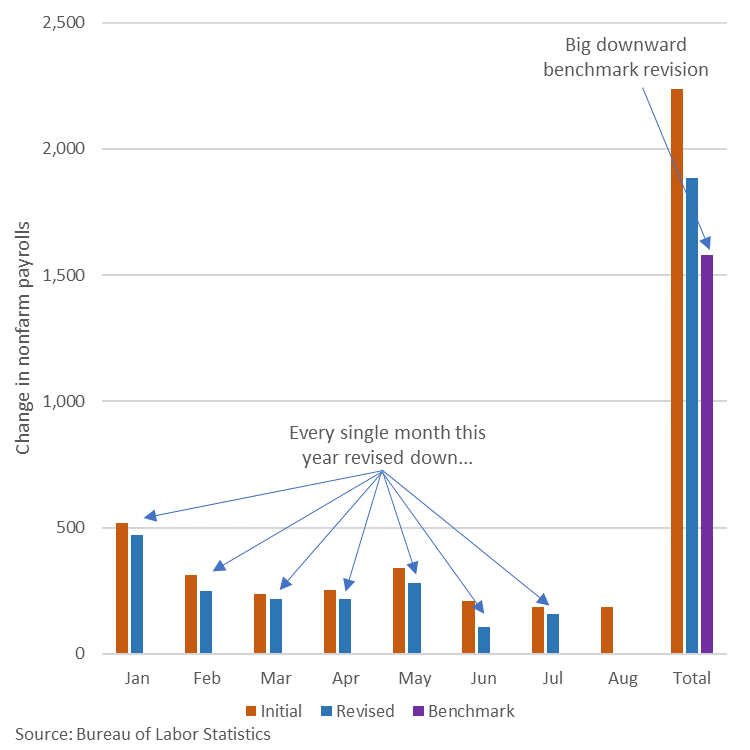

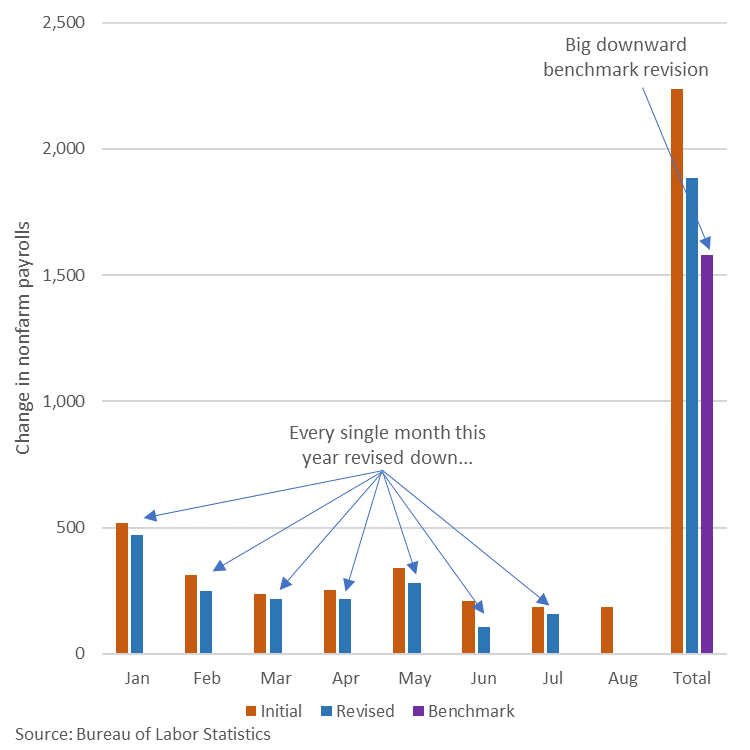

First, the headlines: nonfarm payrolls rose 216k on the backs of big downward revisions to previous months and unemployment rate remained unchanged at 3.7% - let's delve into why that rate is so low (hint: 676k people left the labor force in Dec)...

First, the headlines: nonfarm payrolls rose 216k on the backs of big downward revisions to previous months and unemployment rate remained unchanged at 3.7% - let's delve into why that rate is so low (hint: 676k people left the labor force in Dec)...

First, headlines: nonfarm payrolls up 199k, as jobs "increased in manufacturing, reflecting

First, headlines: nonfarm payrolls up 199k, as jobs "increased in manufacturing, reflecting https://twitter.com/RealEJAntoni/status/1732960769384263965

Looking at the weekly figures shows that M2 has moved sideways since mid Apr '23 and is down just 6.0% from all-time record in Apr '22; it's still 35.2% above pre-pandemic level; we have a long way to go in this inflationary cycle:

Looking at the weekly figures shows that M2 has moved sideways since mid Apr '23 and is down just 6.0% from all-time record in Apr '22; it's still 35.2% above pre-pandemic level; we have a long way to go in this inflationary cycle:

First, the headlines:

First, the headlines:

Real GDP jumped 4.9% in the third quarter, but what's fueling the rise vs. what's not growing speaks volumes about the economy's trajectory - the key driver of economy growth, real private fixed investment, is flat since Q1 '22:

Real GDP jumped 4.9% in the third quarter, but what's fueling the rise vs. what's not growing speaks volumes about the economy's trajectory - the key driver of economy growth, real private fixed investment, is flat since Q1 '22:

https://twitter.com/RealEJAntoni/status/1712094316712104180

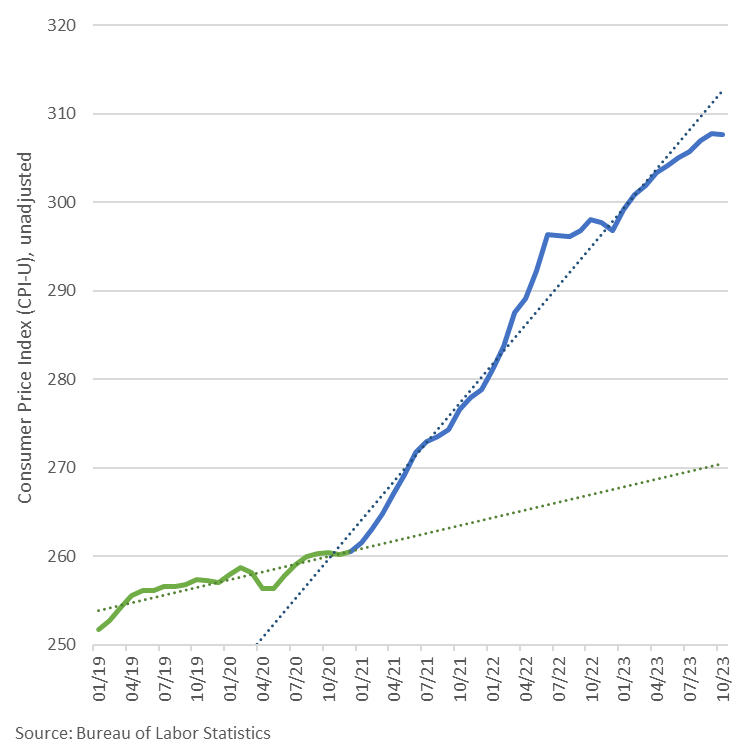

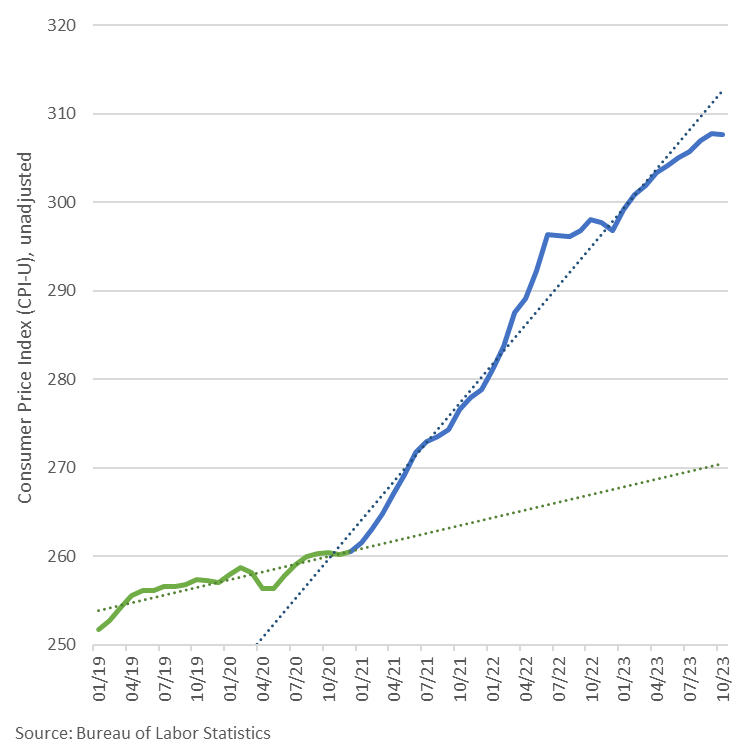

Since Jan '21, prices are up 17.1% on average, w/ many consumer staples up much more - energy prices are devastating consumers, prices up 23%-77%...

Since Jan '21, prices are up 17.1% on average, w/ many consumer staples up much more - energy prices are devastating consumers, prices up 23%-77%...

First the headlines:

First the headlines:

Here's what those losses look like: over $100 billion and counting; they managed to lose money despite having a money printer...

Here's what those losses look like: over $100 billion and counting; they managed to lose money despite having a money printer...

First the headlines: 3.7% increase in CPI and 4.3% increase in core CPI, over twice the 2% target; monthly CPI rose 0.6%, hottest monthly reading in 14 months, an annualized rate of 7.8% - at that pace, prices double every 9.2 years:

First the headlines: 3.7% increase in CPI and 4.3% increase in core CPI, over twice the 2% target; monthly CPI rose 0.6%, hottest monthly reading in 14 months, an annualized rate of 7.8% - at that pace, prices double every 9.2 years:

Job openings (proxy for labor demand) have plummeted and previous levels revised down, level now below pre-pandemic trend for 1st time since Mar '21; job opening rate also below pre-pandemic trend too; lower demand means lower price (wages), implying slower wage growth:

Job openings (proxy for labor demand) have plummeted and previous levels revised down, level now below pre-pandemic trend for 1st time since Mar '21; job opening rate also below pre-pandemic trend too; lower demand means lower price (wages), implying slower wage growth:

First, the headlines: 187k nonfarm payrolls added as unemployment rate climbs to 3.8%

First, the headlines: 187k nonfarm payrolls added as unemployment rate climbs to 3.8%

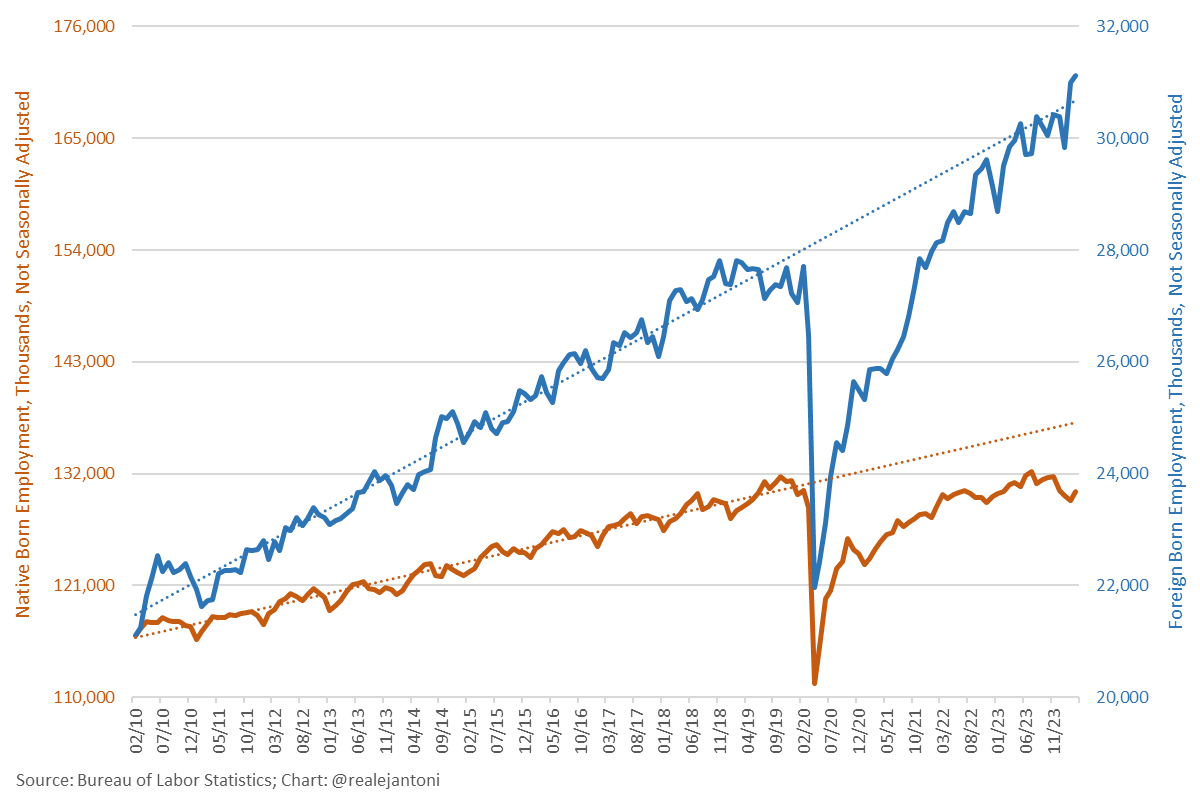

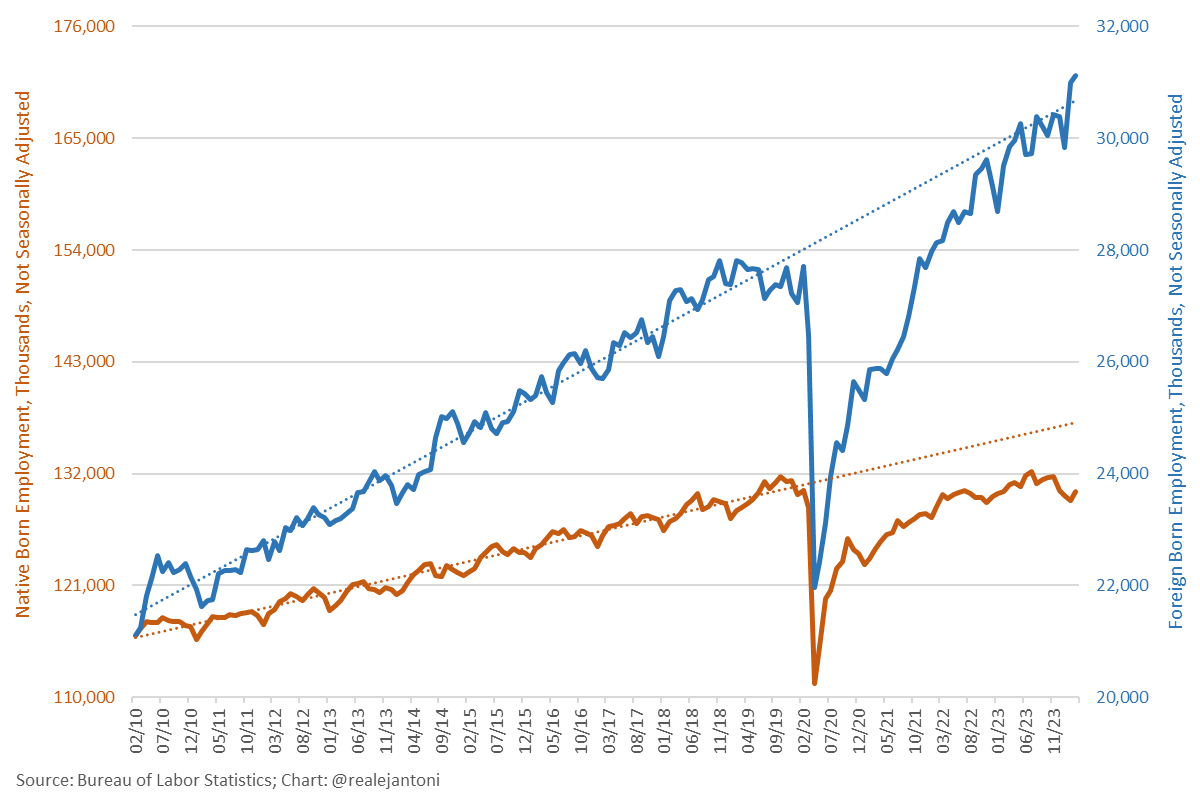

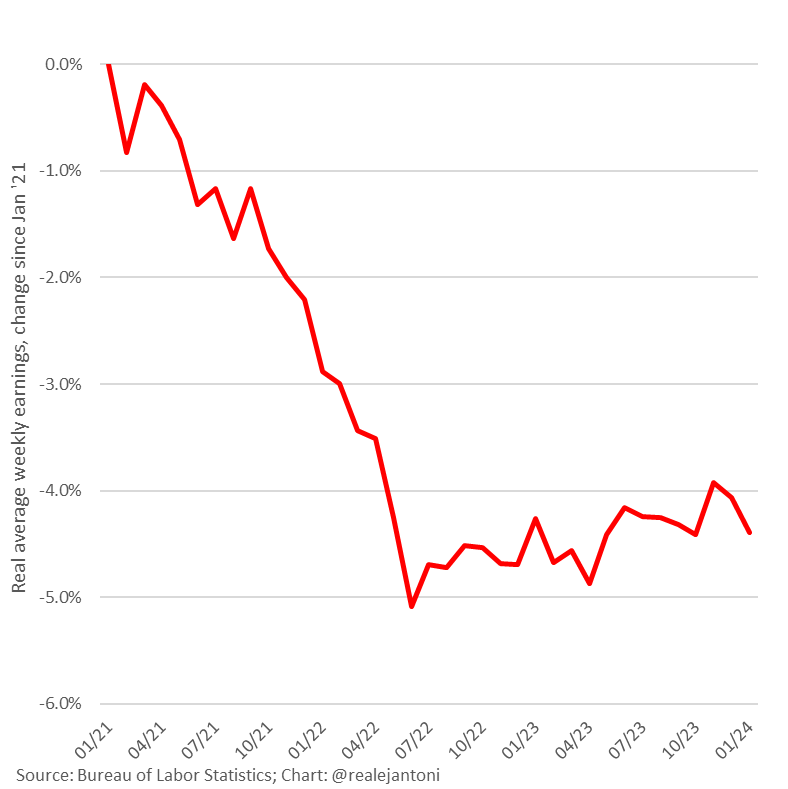

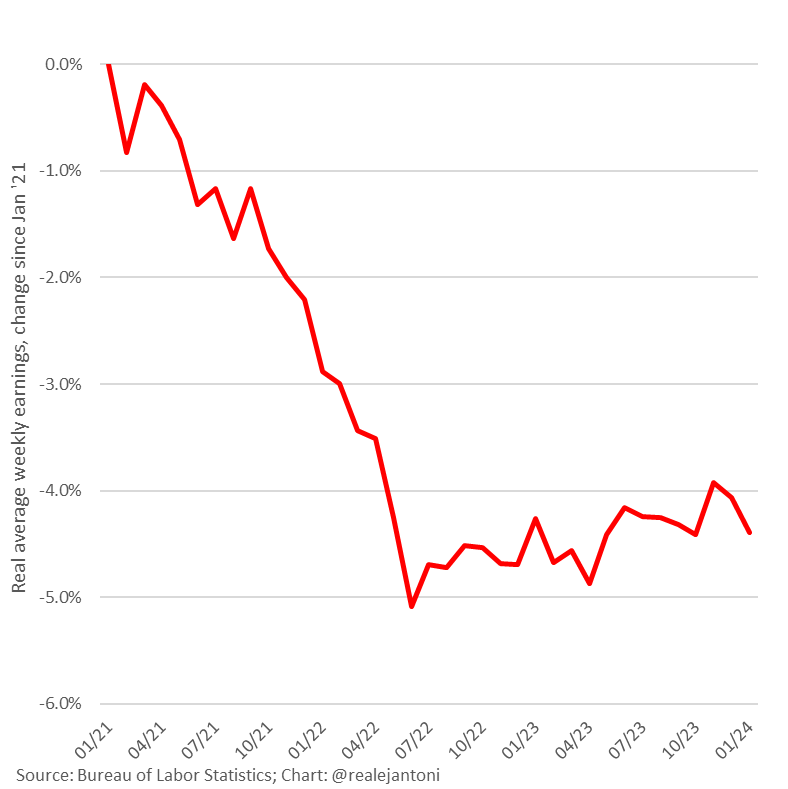

First some important context: annual inflation has outpaced weekly earnings growth for 26 of last 30 months as people pay hidden tax of inflation:

First some important context: annual inflation has outpaced weekly earnings growth for 26 of last 30 months as people pay hidden tax of inflation:

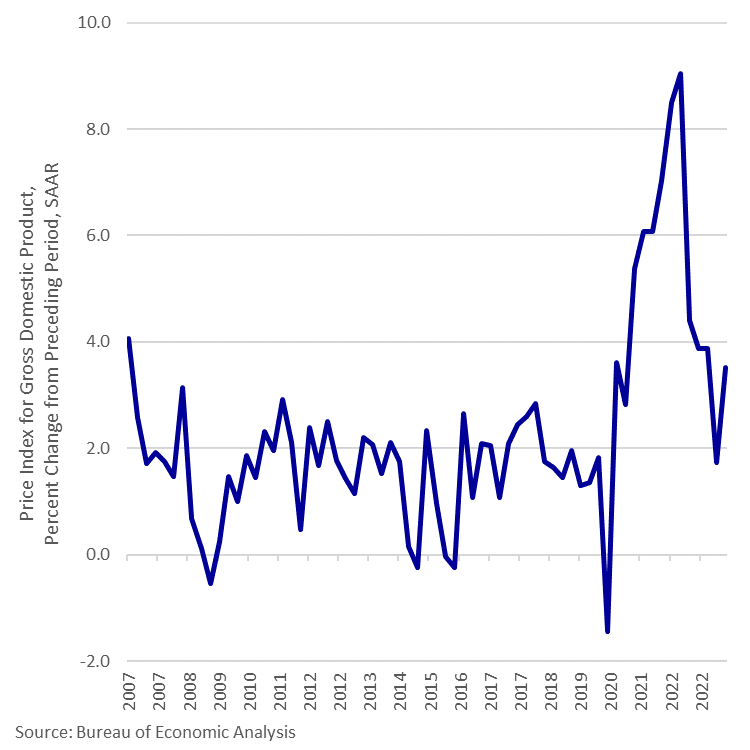

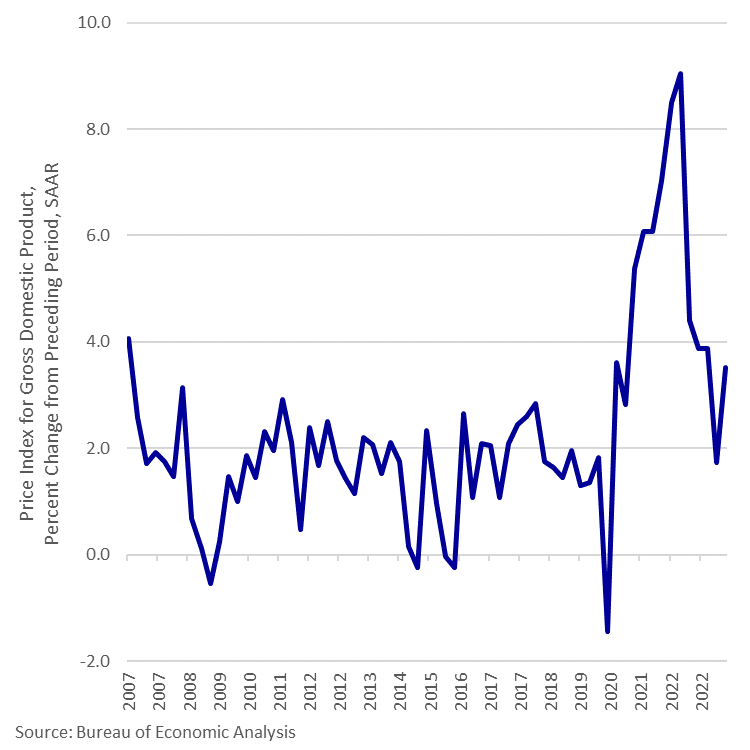

Inflation went from 1.4% under Biden to 40-year highs, and remains "sticky" i.e., not going away; it has risen faster than wages for the last 26 months - a record; so your paycheck is bigger but buys less...

Inflation went from 1.4% under Biden to 40-year highs, and remains "sticky" i.e., not going away; it has risen faster than wages for the last 26 months - a record; so your paycheck is bigger but buys less...

NY Fed manufacturing survey has gyrated violently recently but has averaged below zero (contraction territory) for a year; price increases have slowed but not stopped; labor market contracting; planned investment remains low:

NY Fed manufacturing survey has gyrated violently recently but has averaged below zero (contraction territory) for a year; price increases have slowed but not stopped; labor market contracting; planned investment remains low: