The #Bitcoin energy narrative is flipping! A new note out this morning on the Bloomberg Terminal looks at the rapid rise of sustainable energy sources in $BTC mining

🧵

🧵

Since 2016, I have noticed the attacks on Bitcoin's energy usage intensify. I will put aside the piousness of the argument that one form of energy use is better than another (that's a thread for another time)

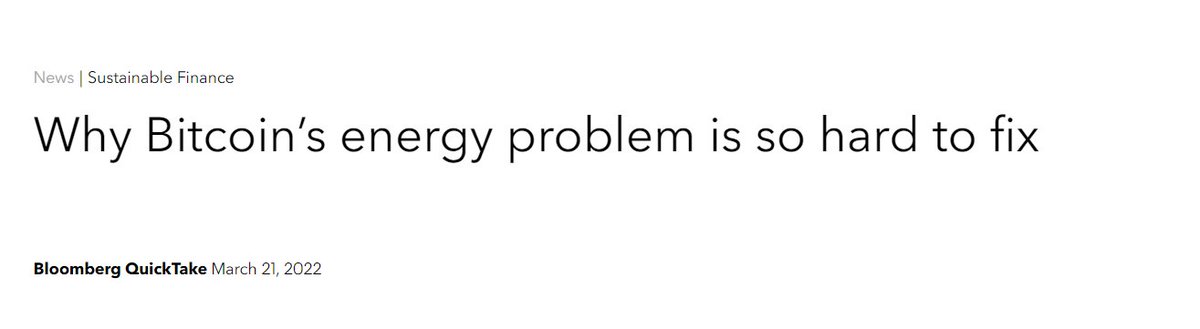

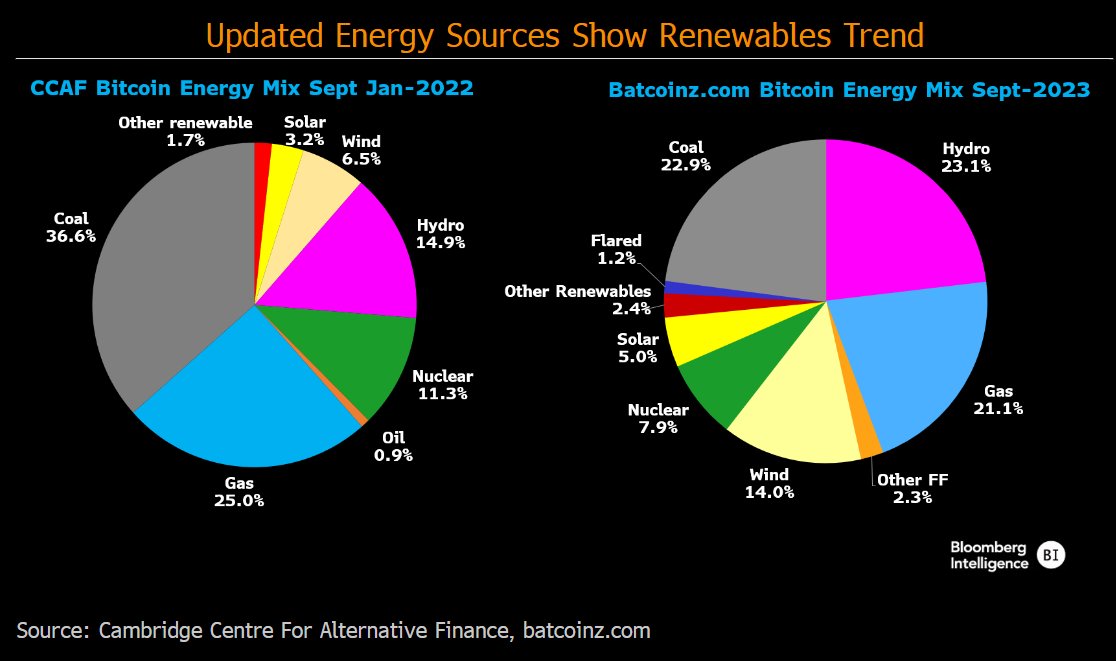

Firstly, there has been a big improvement in data visibility & modelling.@DSBatten @coinmetrics @JMellerud have contributed greatly to the space, building on the initial work from the pioneer @CambridgeAltFinrefin. Hopefully we start to see less variability btw models

@CambridgeAltFinrefin recently revised its 2022 estimate of electricity consumption from 95.5 terawatt-hours (TWh) from 105.3 TWh, after Coin Metrics produced a more accurate assessment of the application-specific integrated circuit (ASIC) machines used in the mining process.

Further enhancements by @DSBatten, a climate-tech VC, address deficiencies in the Cambridge model which exclude new sustainable energy sources such as off-grid power and flared gas, and the massive geographical shift to less fossil fuel-intensive grids of the past 3yrs.

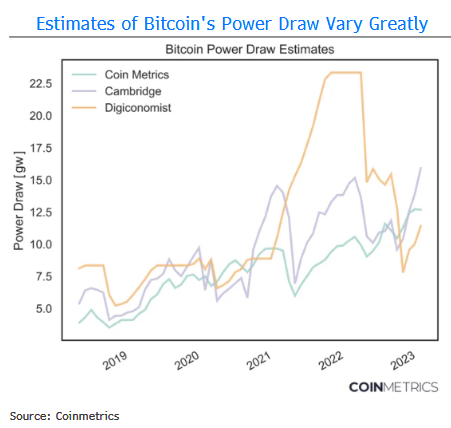

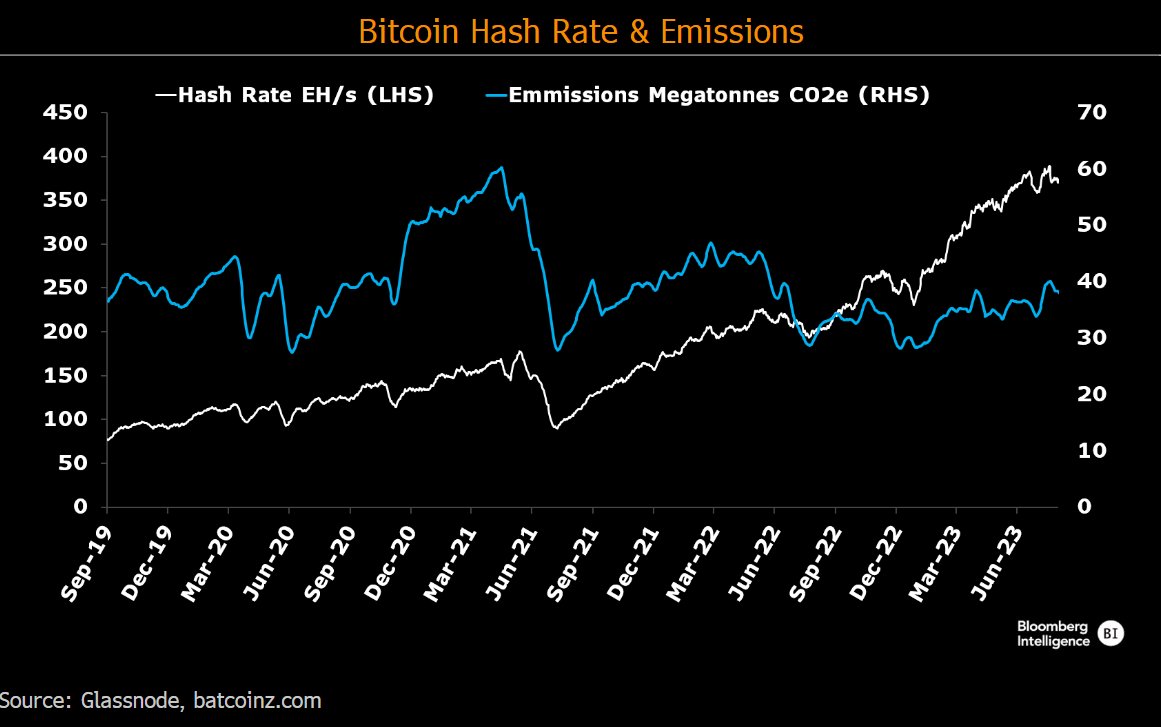

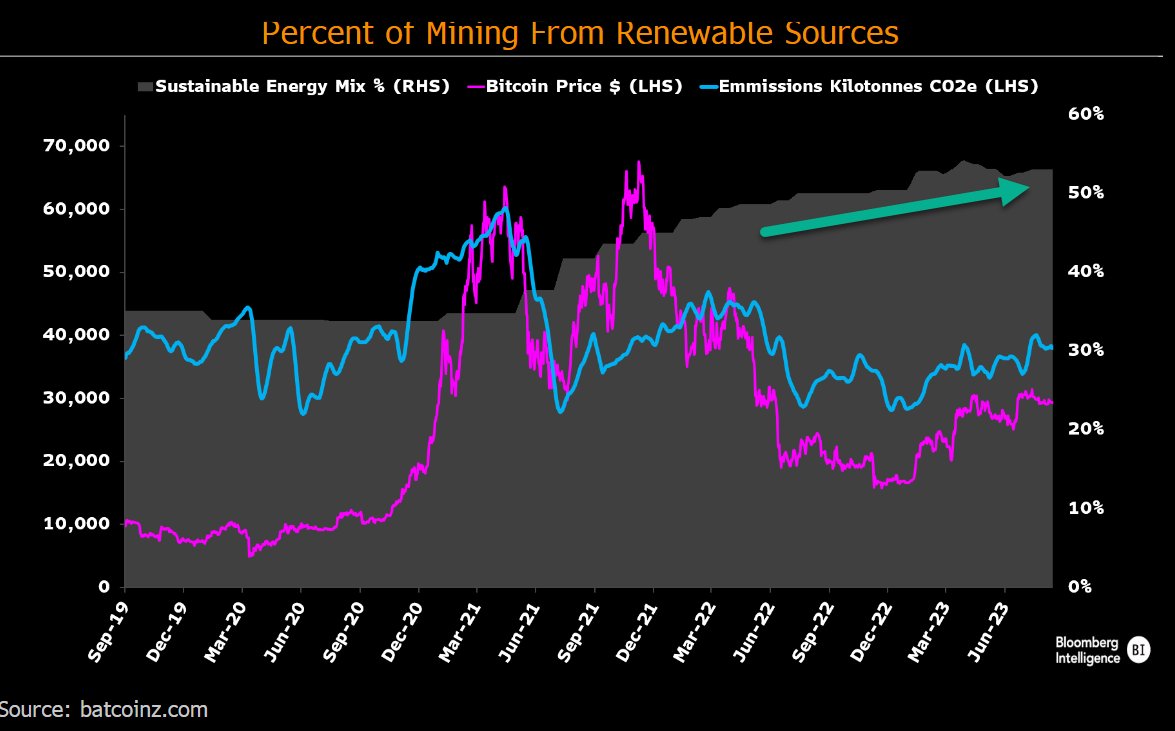

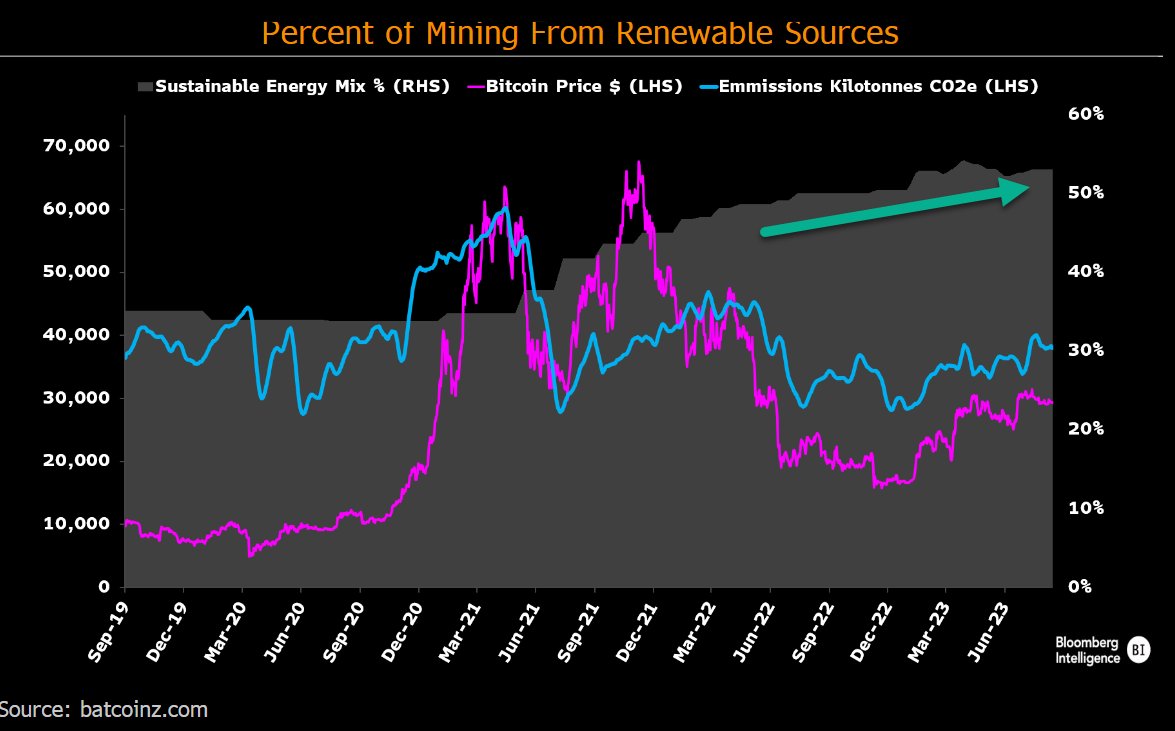

Emissions Decline as Energy Use⬆️

👉Despite 4x Hashrate, carbon emissions (blue) are only⬆️6.9% since 2019

🤔Remember, Miners don't "emit" but are consumers of purchased electricity (similar to EVs)

👉Despite 4x Hashrate, carbon emissions (blue) are only⬆️6.9% since 2019

🤔Remember, Miners don't "emit" but are consumers of purchased electricity (similar to EVs)

👉Since China's mining ban in mid-2021 when emissions peaked at 60.9 megatonnes of carbon dioxide equivalent (CO2e), emissions have declined 37.5%

👉suggesting the concern about Bitcoin's carbon footprint are being overstated

👉suggesting the concern about Bitcoin's carbon footprint are being overstated

Sustainable Energy Sources Rise >50%

👉Falling emissions plus a dramatically rising hash rate can only mean one thing; Bitcoin mining is consuming more sustainable energy in its mix.

👉Falling emissions plus a dramatically rising hash rate can only mean one thing; Bitcoin mining is consuming more sustainable energy in its mix.

While a significant % of mining occurs privately and off-grid, estimating energy use remains an imperfect science. Its also an incredibly fast moving industry. That said, @DSBatten modelling appears more accurate vs Cambridge. He has Sustainable energy source > 53% and⬆️

The chart shows how geographical dispersion caused by China's mining ban catalyzed a push toward renewables. Since mid-2021, renewable-energy use (gray) has trended higher as total emissions (blue) have trended lower or moved sideways.

With energy accounting for about 50% of miners' costs, the industry's shift to sustainables could impact global energy dynamics.

As we noted previously, growing interest in Bitcoin mining by nation states reflects miners' ability to monetize stranded and excess energy (mainly from renewable and nuclear sources), while helping to balance and modernize power grids.

What's becoming even more apparent is that the phasing out coal for wind and solar usually requires subsidies and involves suboptimal payoffs early in the life cycles of power plants. As a source of income based on excess power, Bitcoin mining can support this transition.

All of this paints a very different picture to what we typically hear from international organizations such as the WEF, UN, BIS and the EU.

additional thanks to @woonomic for providing access to the carbon data

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter