Chief Crypto Analyst, @Realvision |

Built the crypto research product at Bloomberg Intelligence |

Freedom over Fear. Always. #Bitcoin

How to get URL link on X (Twitter) App

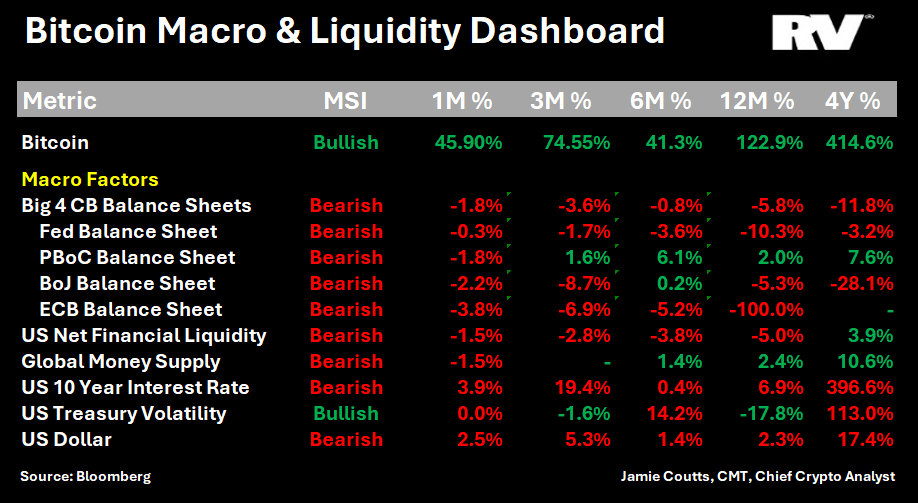

In the US, corporate bond spreads are starting to price in a severe market decline and potential recession.

In the US, corporate bond spreads are starting to price in a severe market decline and potential recession.

Backtest 1: DXY declines of < -2.5%

Backtest 1: DXY declines of < -2.5%

2/

2/

Seeing a sharp move higher on the Altseason indicator (alts outperforming BTC). Without a sustained #Bitcoin rally, which requires > ATH, this may be a short-lived phenomenon. But I suspect we are in the final throes of the bearish thrust.

Seeing a sharp move higher on the Altseason indicator (alts outperforming BTC). Without a sustained #Bitcoin rally, which requires > ATH, this may be a short-lived phenomenon. But I suspect we are in the final throes of the bearish thrust.

Firstly, I have not done a deep dive on TIA. So feel free to shred these thoughts with more educated takes. Here to learn.

Firstly, I have not done a deep dive on TIA. So feel free to shred these thoughts with more educated takes. Here to learn.

1/ Bitcoin's journey towards becoming a global reserve asset involves developing greater utility and robust collateralization use cases. Shared security and staking are key innovations driving this evolution.

1/ Bitcoin's journey towards becoming a global reserve asset involves developing greater utility and robust collateralization use cases. Shared security and staking are key innovations driving this evolution.

ETH vs BTC

ETH vs BTC

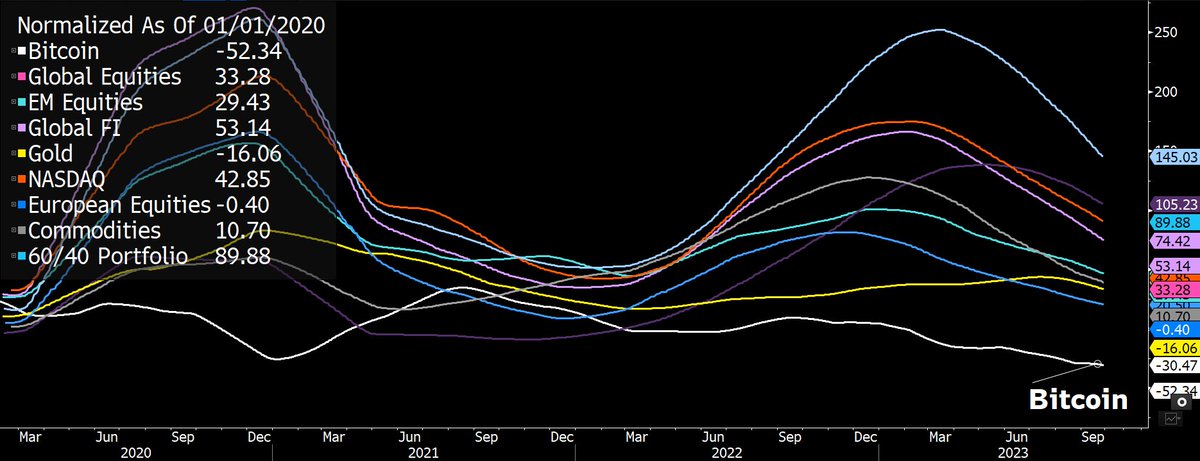

2/ 🌐 The Global Money Supply index tracks M2 money aggregates from 12 of the world's largest economies, all in USD. In our fiat, credit-based financial system, the money stock often moves in one direction. Significant drops, like in 2022, are rare and typically brief.

2/ 🌐 The Global Money Supply index tracks M2 money aggregates from 12 of the world's largest economies, all in USD. In our fiat, credit-based financial system, the money stock often moves in one direction. Significant drops, like in 2022, are rare and typically brief.

Absolute Price Momentum:

Absolute Price Momentum:

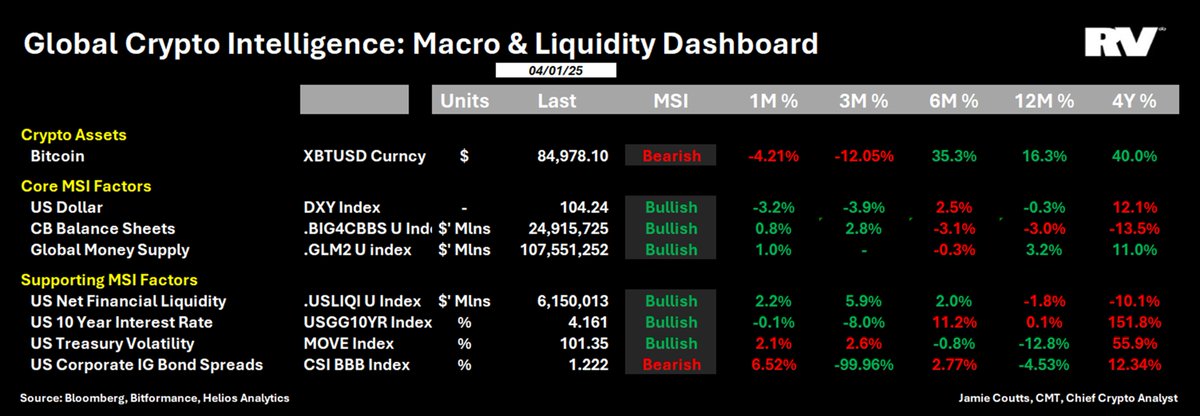

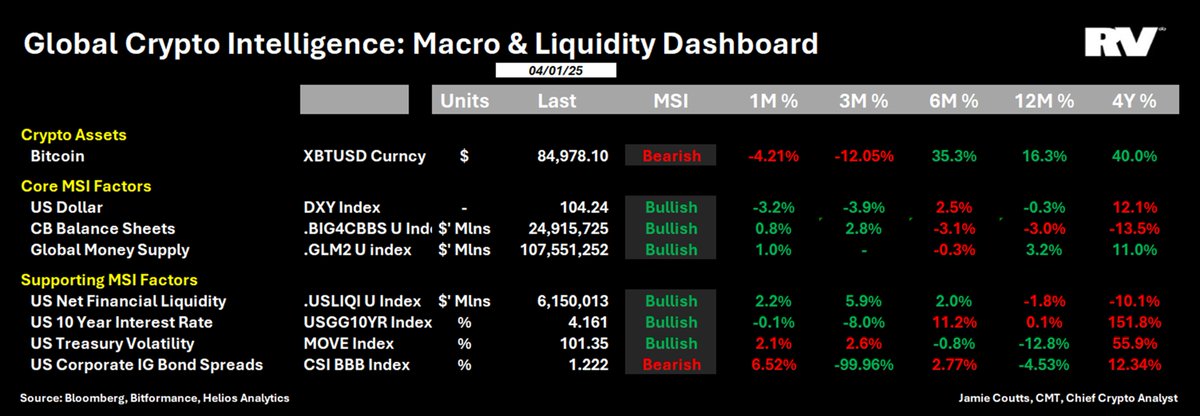

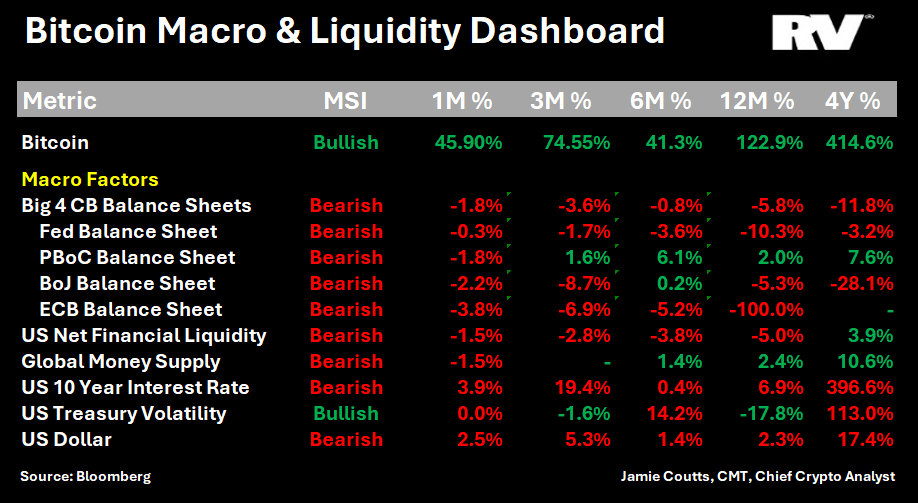

Over the past several weeks, most of the macro/ liquidity-related factors relevant to the Bitcoin price have turned lower.

Over the past several weeks, most of the macro/ liquidity-related factors relevant to the Bitcoin price have turned lower.

Whenever the indicator hits 5 or 6, conditions are extremely favorable for Bitcoin, #crypto and all risk assets. And when the indicator hits 3 or lower, long positions usually get rekt'ed

Whenever the indicator hits 5 or 6, conditions are extremely favorable for Bitcoin, #crypto and all risk assets. And when the indicator hits 3 or lower, long positions usually get rekt'ed

Thesis: After a period dominated by innovators/early adopters, the structural uptrend in blockchain users is on the verge of the next major inflection point. The convergence of self-reinforcing tech, will address bottlenecks/UX issues, driving it to mainstream for the 1st time.

Thesis: After a period dominated by innovators/early adopters, the structural uptrend in blockchain users is on the verge of the next major inflection point. The convergence of self-reinforcing tech, will address bottlenecks/UX issues, driving it to mainstream for the 1st time.

Dont focus on winning vs. losing trades especially over short time horizons.

Dont focus on winning vs. losing trades especially over short time horizons.

As of Q3 2023

As of Q3 2023

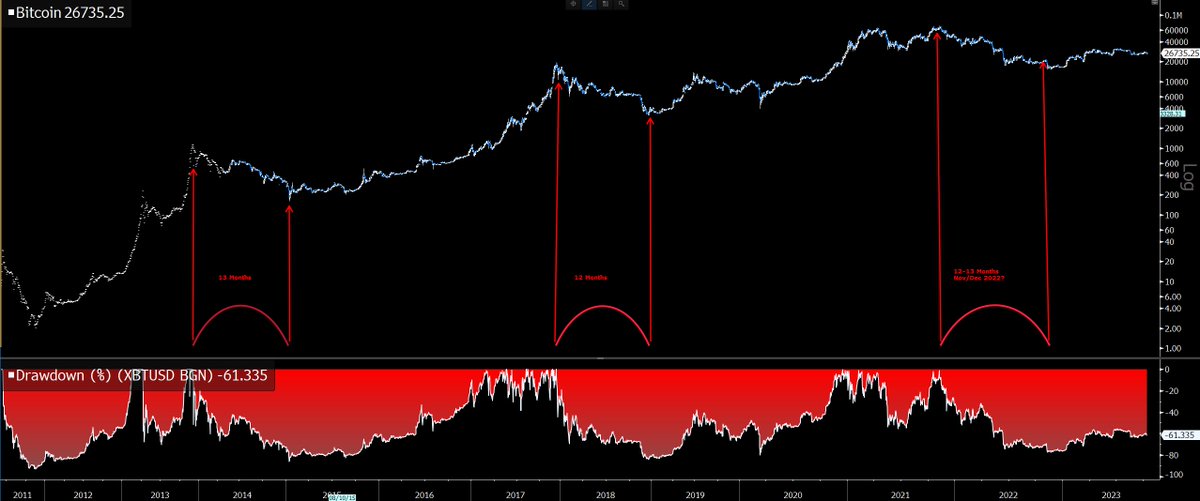

Rather than looking at the good years, allocators must focus on the horrible ones. And they should also look at the relative performance of all assets in those severe drawdown years. This sober approach illuminates the critical shifts in global asset dynamics.

Rather than looking at the good years, allocators must focus on the horrible ones. And they should also look at the relative performance of all assets in those severe drawdown years. This sober approach illuminates the critical shifts in global asset dynamics.

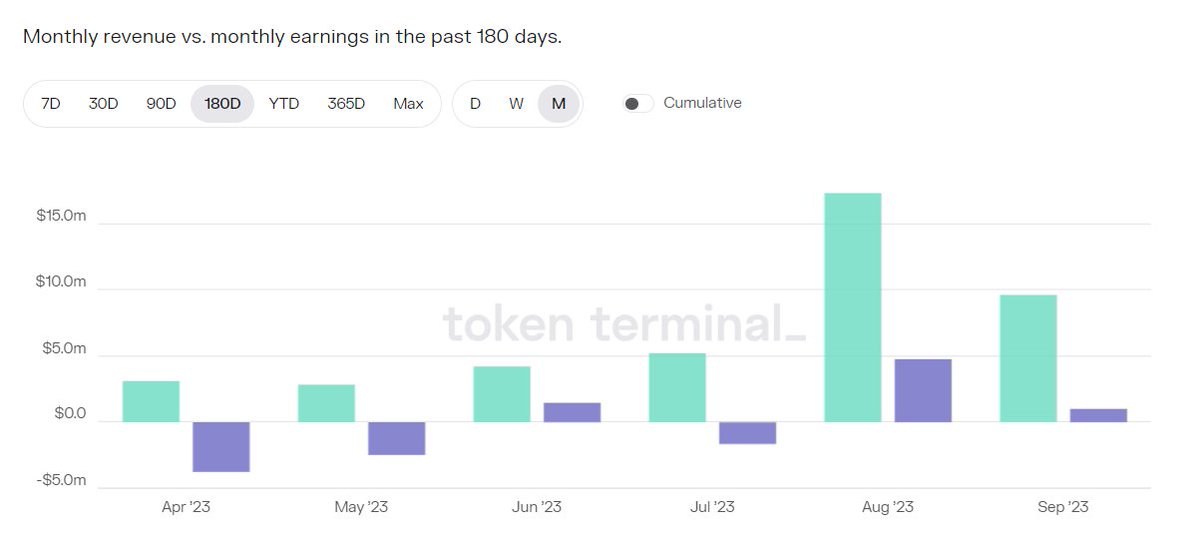

Previously, we introduced a novel way to assess financial strength, the "Fee-conversion rate" i.e. fees per unit of activity (Tx or address), in the same way as average revenue per user (ARPU) is used for online, software, telco businesses.

Previously, we introduced a novel way to assess financial strength, the "Fee-conversion rate" i.e. fees per unit of activity (Tx or address), in the same way as average revenue per user (ARPU) is used for online, software, telco businesses.

Monthly revenues have doubled since the start of the year

Monthly revenues have doubled since the start of the year

Since 2020 the only assets that have seen their volatility profile decline have been hard assets #Bitcoin & #Gold. Everything else has become more volatile;

Since 2020 the only assets that have seen their volatility profile decline have been hard assets #Bitcoin & #Gold. Everything else has become more volatile;

Since 2016, I have noticed the attacks on Bitcoin's energy usage intensify. I will put aside the piousness of the argument that one form of energy use is better than another (that's a thread for another time)

Since 2016, I have noticed the attacks on Bitcoin's energy usage intensify. I will put aside the piousness of the argument that one form of energy use is better than another (that's a thread for another time)