💡New Traders Struggle with THREE things. And I'm here to give you a simple solution to #3.

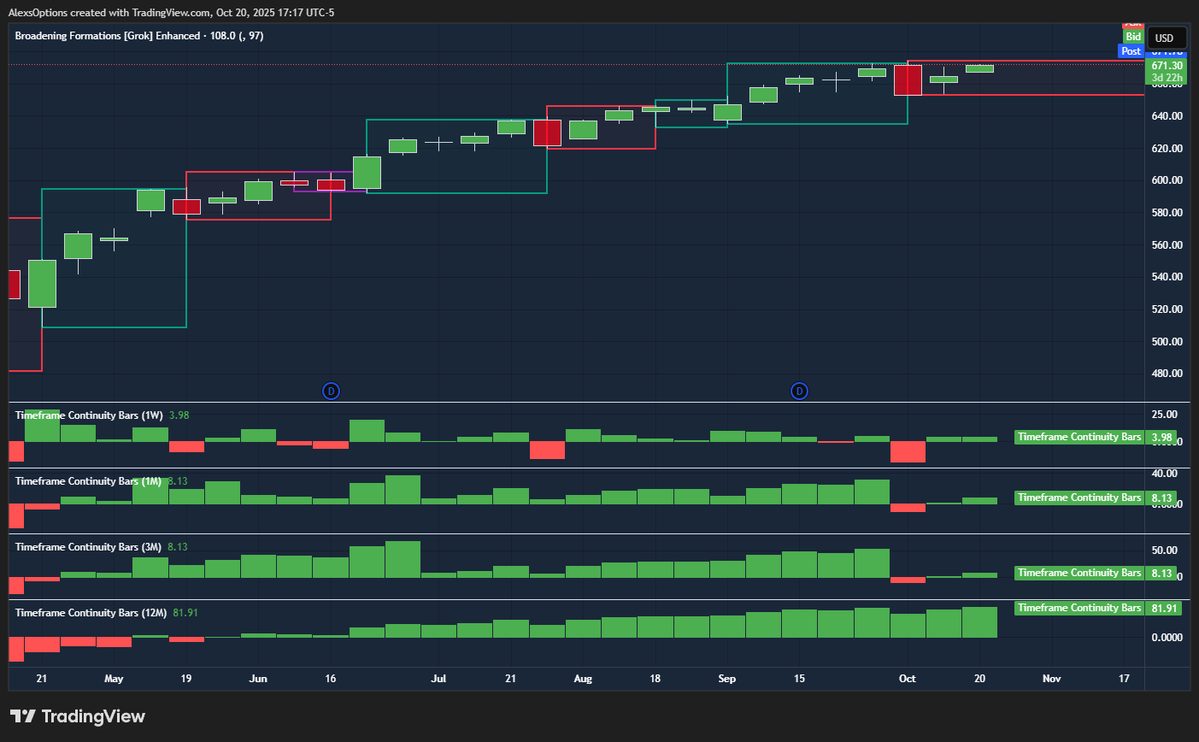

1) Not understanding who is in control of price.

When trading, it is super important to know the larger 'trend' or direction of the market. Even if you're trading a 5 minute chart.

1) Not understanding who is in control of price.

When trading, it is super important to know the larger 'trend' or direction of the market. Even if you're trading a 5 minute chart.

2) Most people do not have a solid strategy of identifying WHERE price is headed.

Without knowing where the move may likely end you will have no idea when you should be taking profits or be trading in the COMPLETE wrong direction.

Ever had this happen?

Without knowing where the move may likely end you will have no idea when you should be taking profits or be trading in the COMPLETE wrong direction.

Ever had this happen?

3) Trading things they should NOT be trading. Also known as trading 'chop'.

This is the SIMPLEST one to fix and I have the solution for you on the next tweet.

This is the SIMPLEST one to fix and I have the solution for you on the next tweet.

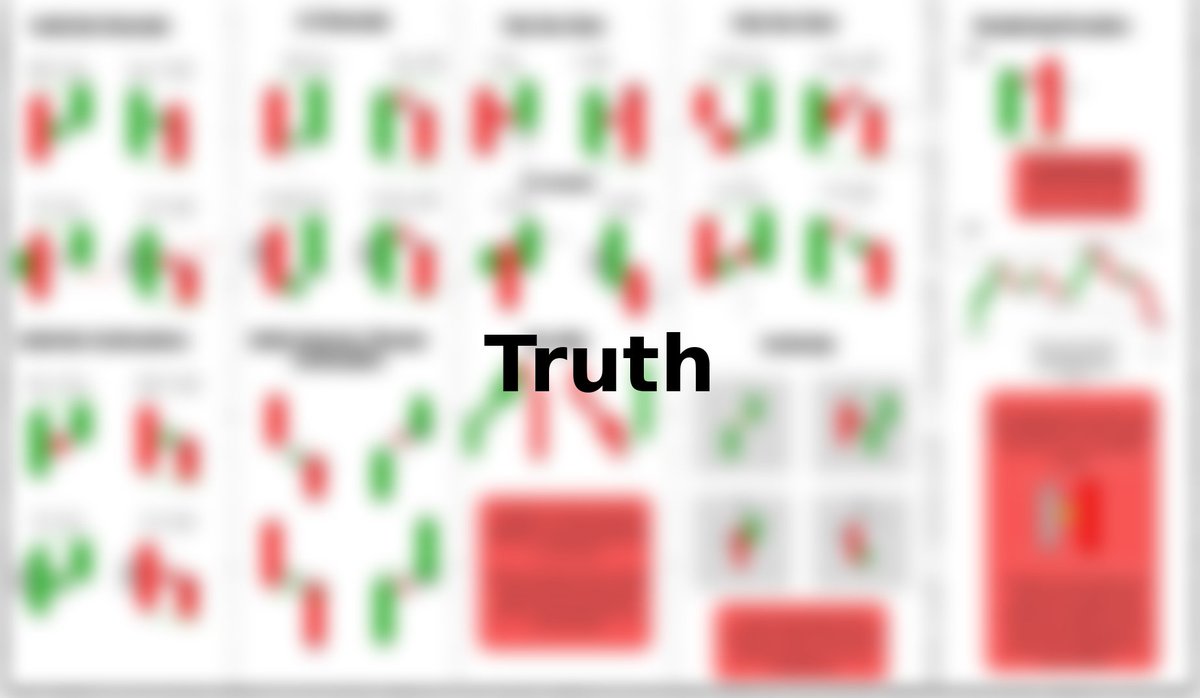

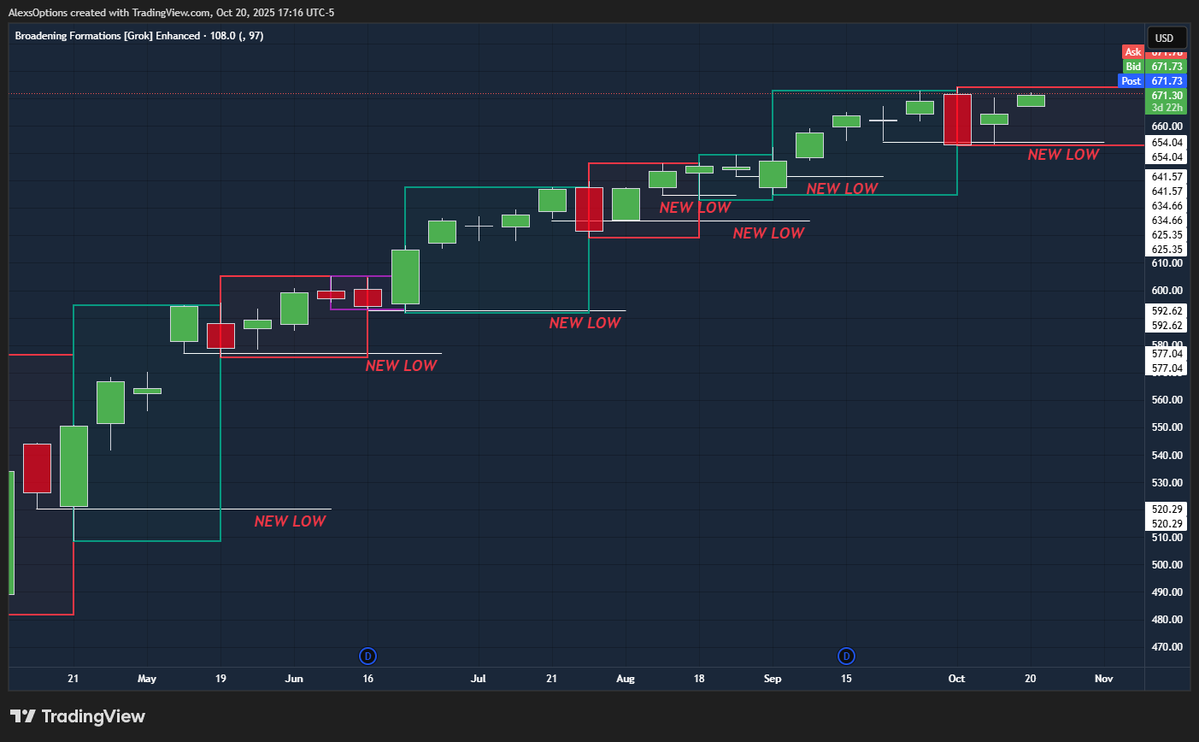

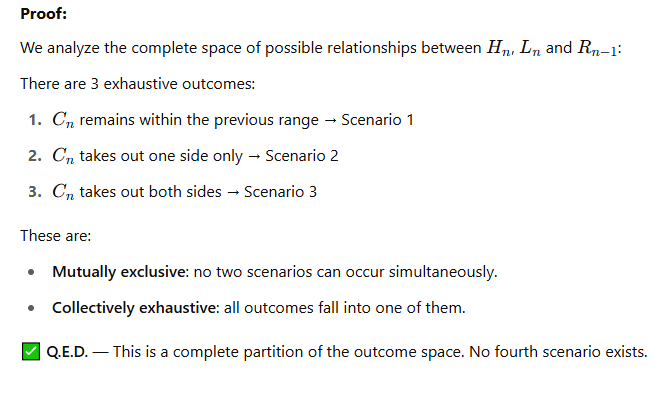

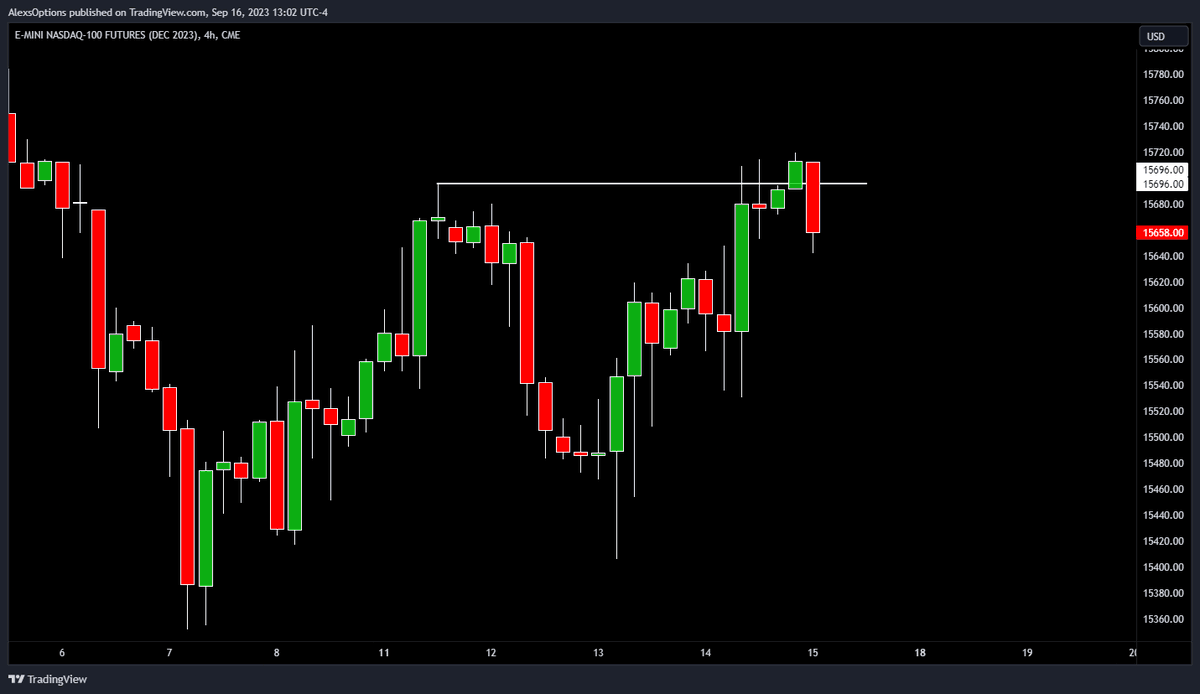

Stop trading things that are STILL INSIDE of the previous bar.

If you are a day trader and the week / day is STILL inside [lower high and higher low]

That is BY DEFINITION. Going sideways.

Swing traders, look to the week & month.

AND.. If you're still itching to trade.

If you are a day trader and the week / day is STILL inside [lower high and higher low]

That is BY DEFINITION. Going sideways.

Swing traders, look to the week & month.

AND.. If you're still itching to trade.

We know exactly how to trade this SPECIFIC market condition.

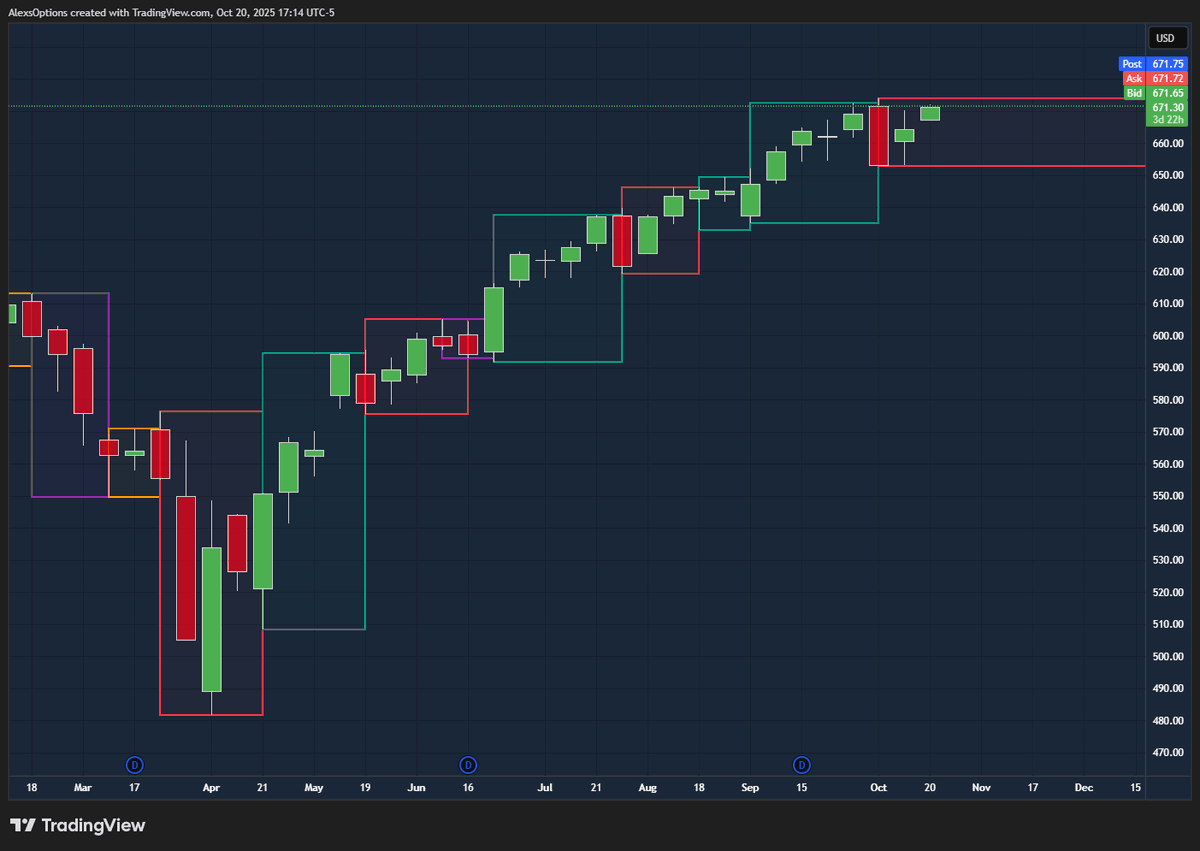

We want to see closes ABOVE old highs or BELOW old lows.

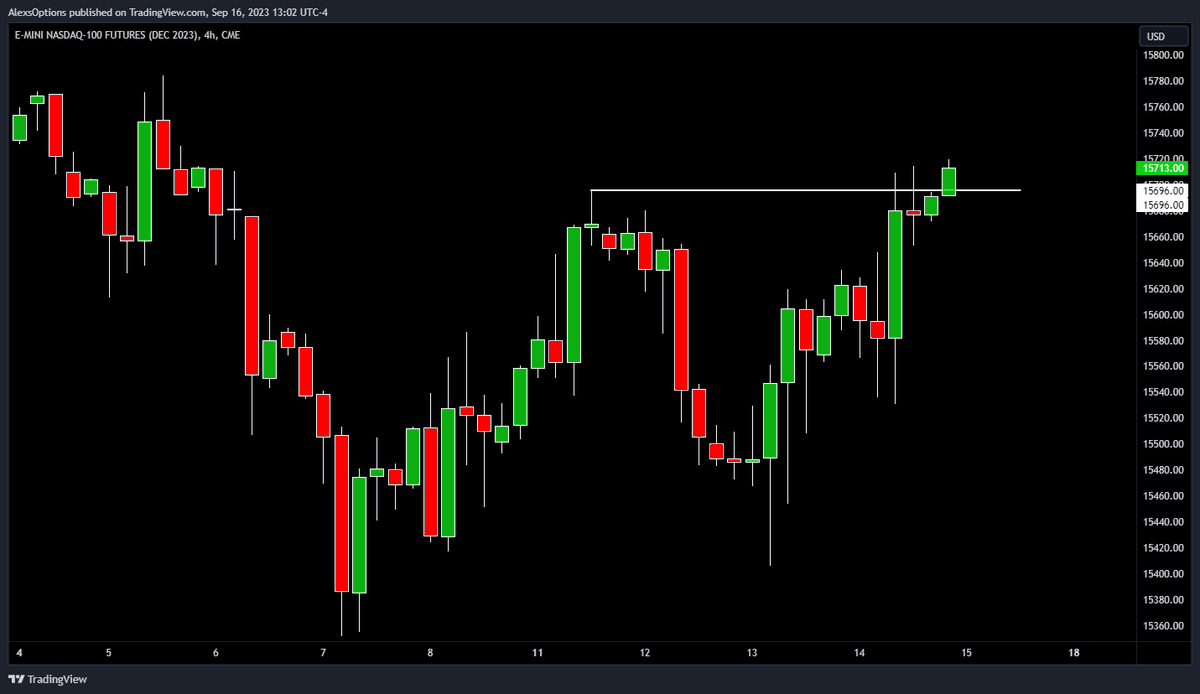

This is because, no one in their right mind looks at this chart & say's it looks bad.

Most new traders would say that's a successful breakout.

We want to see closes ABOVE old highs or BELOW old lows.

This is because, no one in their right mind looks at this chart & say's it looks bad.

Most new traders would say that's a successful breakout.

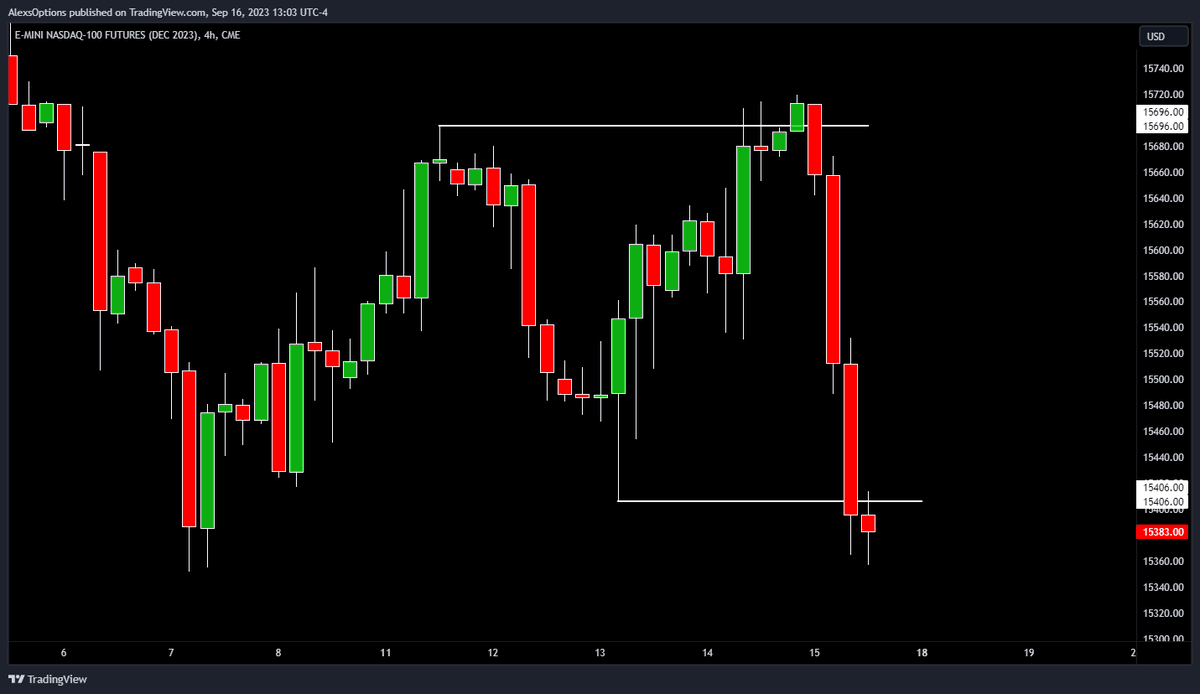

But since we know the secret of the higher timeframe. We know that the BEST looking chart can turn into the WORST looking chart in a single candle.

And since we KNOW it is a consolidation. We KNOW that the other side of the range has a HIGH likelihood of being tested

This specific example is what we talked about Thursday afternoon and Friday morning on my twitter.

You can see that here where we go more in depth.

x.com/AlexsOptions/s…

You can see that here where we go more in depth.

x.com/AlexsOptions/s…

I want to help losing traders make smarter decisions, if you feel this has helped you. Please RETWEET the original tweet. Help out another trader. Until the next one, stay safe & don't hold losers.

• • •

Missing some Tweet in this thread? You can try to

force a refresh