HDFC Bank is continuing to underperform the Nifty!

Is the market worried about how the merged entity will play out?

Is this the 2019 ITC moment for HDFC Bank?

A thread🧵on what lies ahead for HDFC Bank?

Lets go👇

Is the market worried about how the merged entity will play out?

Is this the 2019 ITC moment for HDFC Bank?

A thread🧵on what lies ahead for HDFC Bank?

Lets go👇

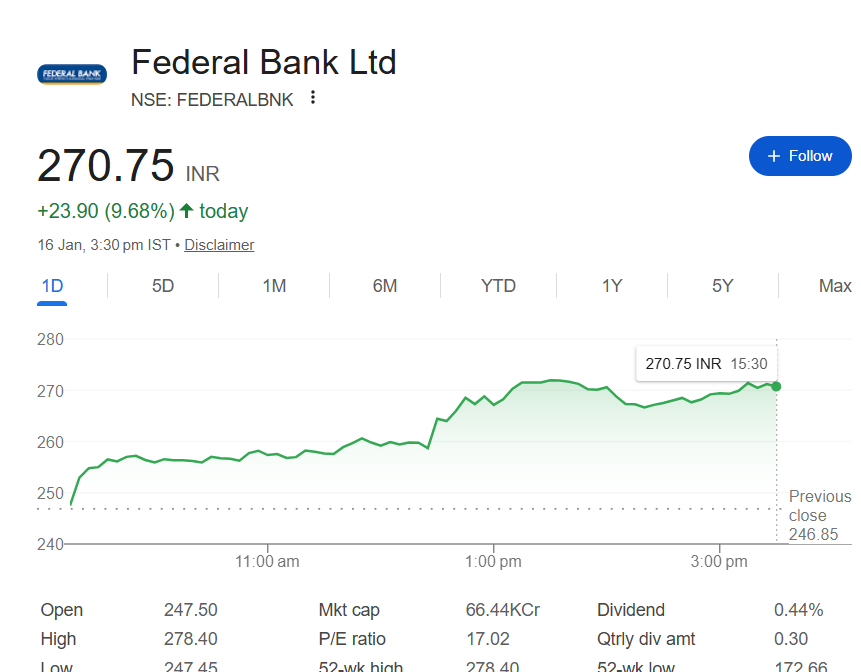

What is happening?

HDFC Bank ever since the merger was announced has continued to underperform the index.

How is the business shaping up?

Lets find out👇

HDFC Bank ever since the merger was announced has continued to underperform the index.

How is the business shaping up?

Lets find out👇

Q1FY24 Results:-

Loan growth:-

🏦The loan growth was at 16%

🏦Missing retail loan growth came back to 18%

🏦Retail to Wholesale mix was at 47:53

Overall steady growth from on the loan side

Loan growth:-

🏦The loan growth was at 16%

🏦Missing retail loan growth came back to 18%

🏦Retail to Wholesale mix was at 47:53

Overall steady growth from on the loan side

Deposit Growth:-

🏦Overall system deposit growth was at 10-12%

🏦HDFC Bank grew its deposits at 19%

🏦New branches will certainly help the bank ramp up deposits

HDFC Bank is gaining market share in both loan and deposits

🏦Overall system deposit growth was at 10-12%

🏦HDFC Bank grew its deposits at 19%

🏦New branches will certainly help the bank ramp up deposits

HDFC Bank is gaining market share in both loan and deposits

Cost of funds:-

🏦Cost of funds for the bank is now at 4%

🏦Yield is now at 8.1%

🏦NIMs have stabilized at 4.1%

🏦Cost of funds for the bank is now at 4%

🏦Yield is now at 8.1%

🏦NIMs have stabilized at 4.1%

NPAs:-

🏦Gross NPAs rose marginally sequentially

🏦Agri loans continue to be a pain point for the bank

🏦All other loans continue to show stable asset quality

🏦Gross NPAs rose marginally sequentially

🏦Agri loans continue to be a pain point for the bank

🏦All other loans continue to show stable asset quality

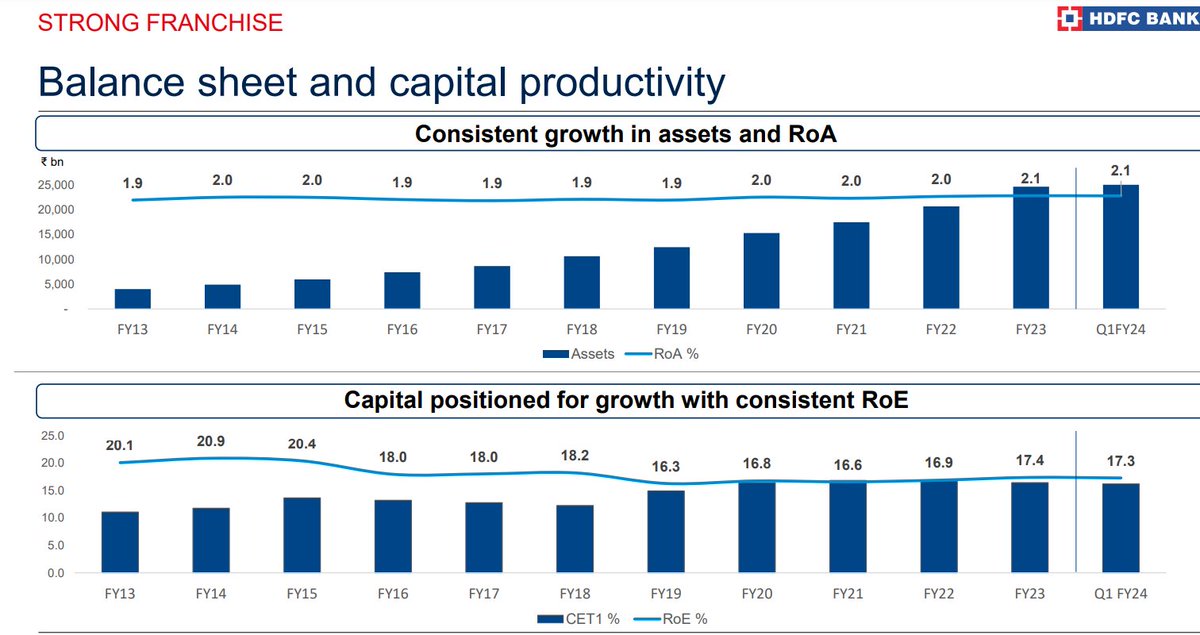

Capital Adequacy:-

The bank has a strong Captial Adequacy 18.9%

TIER-1 capital is at 16.9%

With strong profitability, the bank has enough capital for near-term growth

The bank has a strong Captial Adequacy 18.9%

TIER-1 capital is at 16.9%

With strong profitability, the bank has enough capital for near-term growth

So why is the market worried?

RoA and RoE could get hit in the near term as the HDFC book comes with a lower NIM.

This is one of the major concerns for the market.

NIM erosion below 4% is a key concern for the market.

RoA and RoE could get hit in the near term as the HDFC book comes with a lower NIM.

This is one of the major concerns for the market.

NIM erosion below 4% is a key concern for the market.

Aggressive expansion of branches by HDFC Bank

The bank envisions to be 1-2 km of clients rather than the current 5-6 Km

This could inflate costs for the bank in the near term and needs to be monitored

The bank envisions to be 1-2 km of clients rather than the current 5-6 Km

This could inflate costs for the bank in the near term and needs to be monitored

Valuation:-

The bank now trades at historically low valuations of about 3x P/Bx

While this is not cheap,It is the lowest in the history of the bank

The bank now trades at historically low valuations of about 3x P/Bx

While this is not cheap,It is the lowest in the history of the bank

Conclusion:-

HDFC Bank's business is strong

Strong Loan Growth

Strong Deposit growth

Strong Asset quality

Strong capital

There is nothing to complain about per se

However near term merger concerns with ROE and NIM are something the market is worried about

HDFC Bank's business is strong

Strong Loan Growth

Strong Deposit growth

Strong Asset quality

Strong capital

There is nothing to complain about per se

However near term merger concerns with ROE and NIM are something the market is worried about

Keep following me -@AdityaD_Shah as I write daily to make you aware around:

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

Disclaimer:-

This is my study

Not an Investment Advise

Please consult your own investment advisor before investing.

This is my study

Not an Investment Advise

Please consult your own investment advisor before investing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh