Follow the money, a lot of noise is being made about possible China capital flight.

Something is going on because $CNY has depreciated almost 15% YTD.

Something is going on because $CNY has depreciated almost 15% YTD.

I asked Andrew Collier a china researcher what the best metric would be to quantify possible capital flight. He said to look at the difference between China intl net export earnings and the official foreign reserves.

YTD China foreign reserves increased +$32.407bn, but total next exports are +$553.253bn, that means there is $520.846bn in money that has left China to do something ???? 🧐🧐🧐🧐🧐🧐

Some possibilities:

1. China is buying a lot of gold

2. China is paying down USD offshore debt of its banks and corporates

3. Some wealthy comrades are fleeing the coop

Most importantly what China is not doing is:

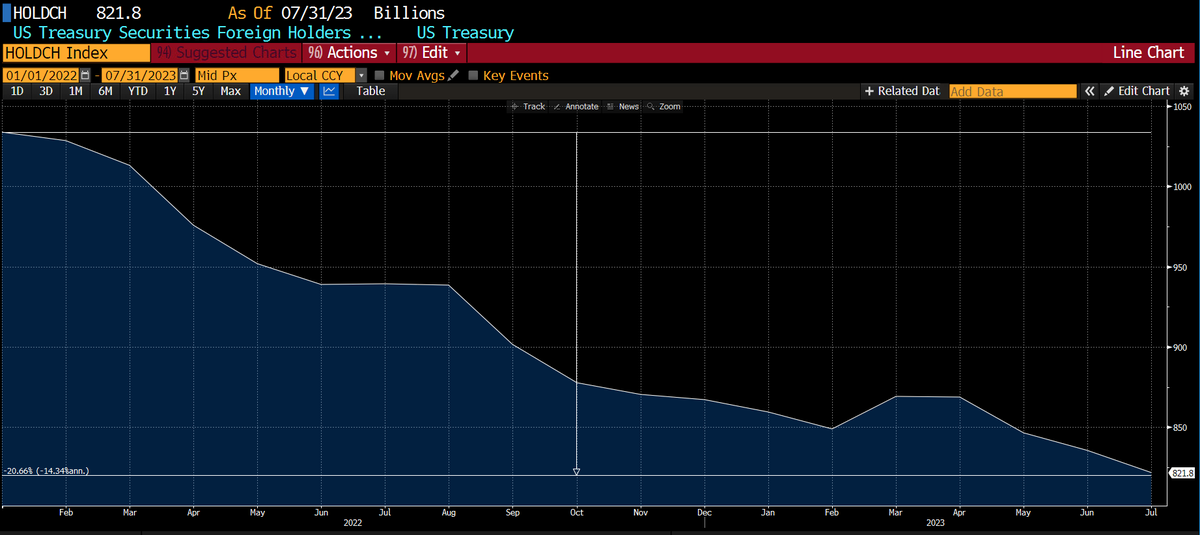

BUYING MORE US TREASURIES!!!!!

1. China is buying a lot of gold

2. China is paying down USD offshore debt of its banks and corporates

3. Some wealthy comrades are fleeing the coop

Most importantly what China is not doing is:

BUYING MORE US TREASURIES!!!!!

As long as the $JPY weakens, the $CNY must weaken so that Chinese exports remain competitive vs. Japan.

Wherever the Chinese capital is going, it will keep going in SIZE.

I hope some finds its way to Lord Satoshi and $BTC

Wherever the Chinese capital is going, it will keep going in SIZE.

I hope some finds its way to Lord Satoshi and $BTC

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter