8 high probability set-ups for SPY every trader should know.

These are easy to learn and common so lets review them 🧵

(included my latest swing idea)

These are easy to learn and common so lets review them 🧵

(included my latest swing idea)

#1 reason why trader's lose money is they don't cut their losses quick and end up blowing up their account.

Follow my trading partner @itsmichaelluu to help you fix this bad habit:

Follow my trading partner @itsmichaelluu to help you fix this bad habit:

https://twitter.com/1626903792599076865/status/1660244579386376192

What you need to succeed:

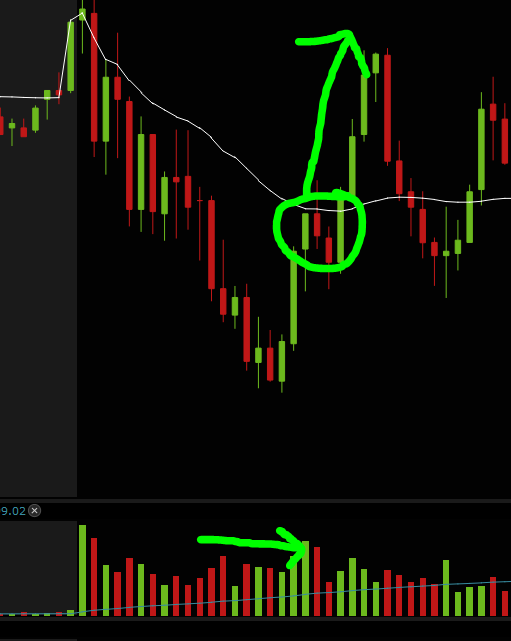

1. use 2min-5min time frames for scalping

2. if you risk $0.50 then try at least $1-$2 for your price targets.

3. start with 2-4 contracts only.

4. practice execution and consistency > profits.

5. control your impulses & stay focused

1. use 2min-5min time frames for scalping

2. if you risk $0.50 then try at least $1-$2 for your price targets.

3. start with 2-4 contracts only.

4. practice execution and consistency > profits.

5. control your impulses & stay focused

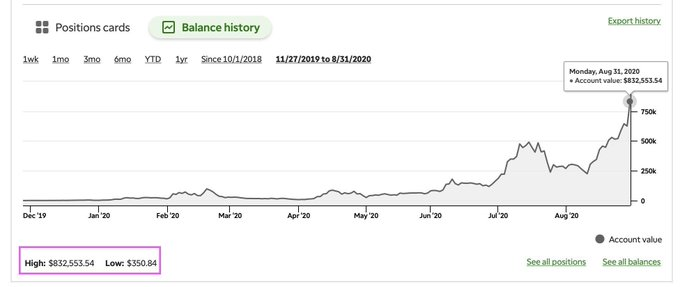

This is a perfect example of our strategies working and the guidance and lessons we provide our community:

https://twitter.com/1061650783333040129/status/1704874428046393482

Disclaimer: Trading is extremely difficult. You most likely will lose all your money before you make money.

Trading results are all performance based and depends on many variables. The chances of you duplicating this trades actual results are unlikely.

Trading results are all performance based and depends on many variables. The chances of you duplicating this trades actual results are unlikely.

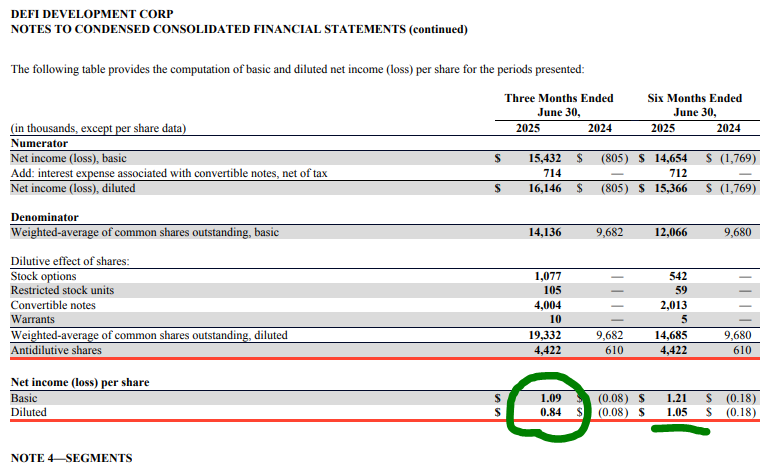

My latest swing idea which I think is now in undervalued territory is ENPH @enphase

Swing idea

• Jan 17 2025 calls for $180 for $20.25 stop $10 aiming for $70+ to $120+

Small account option:

• Oct 20 2023 calls for $132 for $3.95 stop $3 aim for $8+

Swing idea

• Jan 17 2025 calls for $180 for $20.25 stop $10 aiming for $70+ to $120+

Small account option:

• Oct 20 2023 calls for $132 for $3.95 stop $3 aim for $8+

https://twitter.com/1061650783333040129/status/1704926211020087497

@Enphase Follow me @SuperLuckeee for education, market analysis and trade-ideas.

- Retweet this to share with your audience!

- Make sure you ❤️the post below and BOOKMARK this so you can go back and study it later.

- Retweet this to share with your audience!

- Make sure you ❤️the post below and BOOKMARK this so you can go back and study it later.

https://twitter.com/1061650783333040129/status/1704961451188781320

• • •

Missing some Tweet in this thread? You can try to

force a refresh