In 2023, I perfected the SPY winning 500%-1000% options play.

I wish someone shared this with me at the beginning of my career.

Here's my checklist for trading high probability options🧵

I wish someone shared this with me at the beginning of my career.

Here's my checklist for trading high probability options🧵

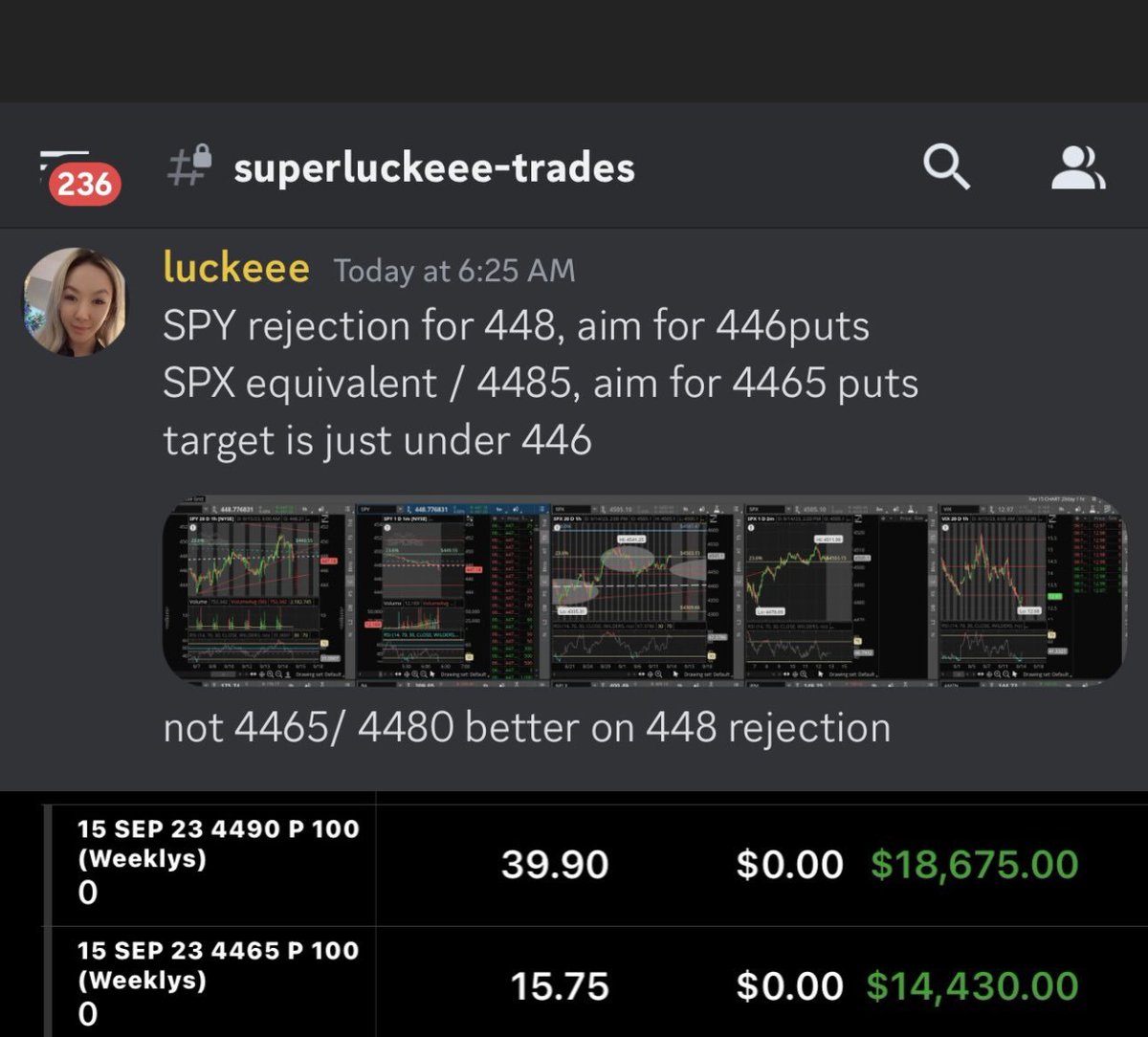

Several of our students use this strategy and our education to help them:

• choose which options to take

• when to take them

• how long to hold for

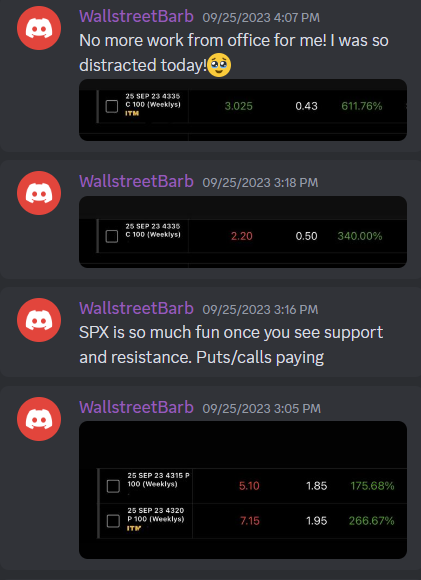

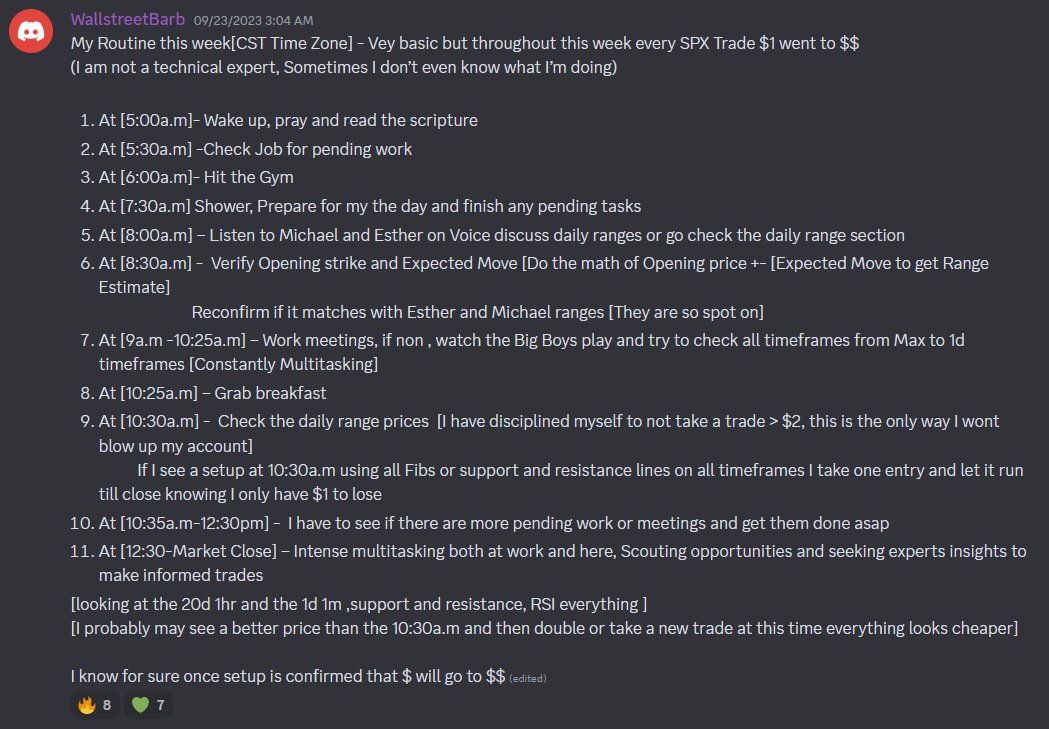

This is Barb's routine each day to help her make these gains consistently.

• choose which options to take

• when to take them

• how long to hold for

This is Barb's routine each day to help her make these gains consistently.

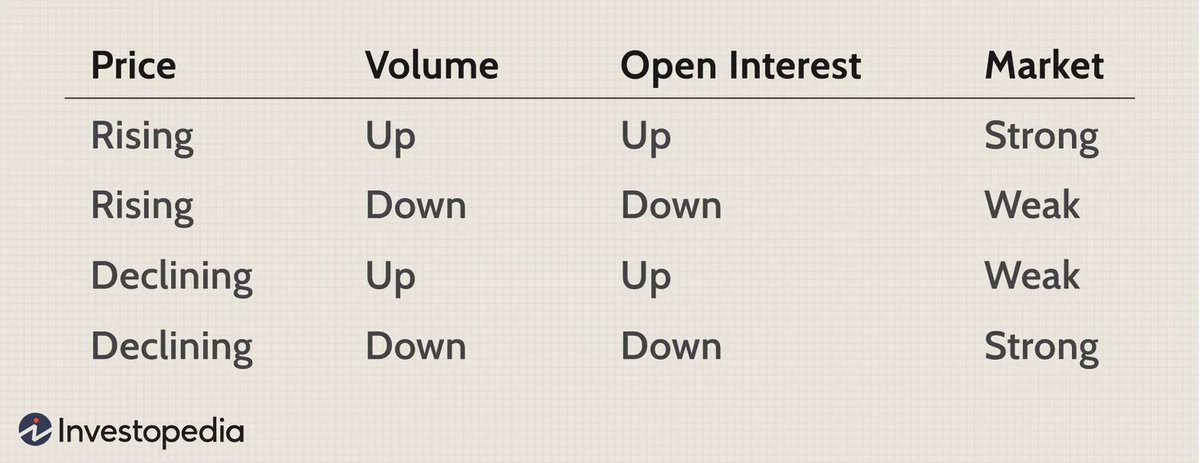

These 4 factors and criteria for picking options will drastically improve your chances of trading options that get 100%-500%

1. Trade on breakout and trend days

2. News and catalyst days

3. Choosing the right expiry price

4. Choosing the right strike price

1. Trade on breakout and trend days

2. News and catalyst days

3. Choosing the right expiry price

4. Choosing the right strike price

Disclaimer: Trading is extremely difficult. You most likely will lose all your money before you make money.

Trading results are all performance based and depends on many variables. The chances of you duplicating this trades actual results are unlikely.

Trading results are all performance based and depends on many variables. The chances of you duplicating this trades actual results are unlikely.

✅#1. Trade on breakout and trend days

Pay attention to SPY DAILY chart.

500%-1000% option winners happen frequently when SPY breakouts or breakdowns from consolidation.

There will be multiple and more frequent trend days so holding on to calls or puts will be a lot easier.

Pay attention to SPY DAILY chart.

500%-1000% option winners happen frequently when SPY breakouts or breakdowns from consolidation.

There will be multiple and more frequent trend days so holding on to calls or puts will be a lot easier.

✅#2. News and catalyst days

Monday there was nothing scheduled so I wasn't expecting volatility.

Events like FOMC, CPI, PPI, PCE and unemployment rate are big news days where a lot of volume is in play.

You 'd have a lot better chance of getting 100%-500% winners those days.

Monday there was nothing scheduled so I wasn't expecting volatility.

Events like FOMC, CPI, PPI, PCE and unemployment rate are big news days where a lot of volume is in play.

You 'd have a lot better chance of getting 100%-500% winners those days.

✅#3. Choosing the right expiry price

Assuming you're trading a big trend or news day,

Start with less risky play of getting 1-2 day to expiry. In my experience getting 2DTE is great and is less volatile.

You can also swing it overnight if you want to. ODTE is most risky.

Assuming you're trading a big trend or news day,

Start with less risky play of getting 1-2 day to expiry. In my experience getting 2DTE is great and is less volatile.

You can also swing it overnight if you want to. ODTE is most risky.

For example for PCE this Friday Sept 29th:

If the price action is going up get calls for Oct 2-3 expiry. And then put in a wider stop loss and use less size.

The key will be to hold through the volatility and not sell early.

If the price action is going up get calls for Oct 2-3 expiry. And then put in a wider stop loss and use less size.

The key will be to hold through the volatility and not sell early.

✅#4. Choosing right strike price

Assuming you're trading a big trend or news day,

Start with less risk play of ATM (at the money) calls or puts. Yes, you'd have to hold longer and requires practice.

Get at most $2 out of the money (OTM) if you want your returns to compound.

Assuming you're trading a big trend or news day,

Start with less risk play of ATM (at the money) calls or puts. Yes, you'd have to hold longer and requires practice.

Get at most $2 out of the money (OTM) if you want your returns to compound.

For example for PCE this Friday Sept 29th:

If the price action opens at $418-$419 then get strikes for $418 all the way to $421. And then put in a wider stop loss and use less size.

The key will be to hold through the volatility and not sell early.

If the price action opens at $418-$419 then get strikes for $418 all the way to $421. And then put in a wider stop loss and use less size.

The key will be to hold through the volatility and not sell early.

🔑 Golden Rule for SCALPING & SWINGING:

Whatever price you think its going to choose a LOWER strike then target.

However long you think it will take to get there choose MORE time and expiry.

Print this rule out and glue it to your forehead (not joking).

Whatever price you think its going to choose a LOWER strike then target.

However long you think it will take to get there choose MORE time and expiry.

Print this rule out and glue it to your forehead (not joking).

We've made lots of money for with our members in 2023 mainly because:

✅our education is high quality and proven to work

✅our market analysis and research is respected and accurate

✅our community maintains skilled and advanced leaders

✅our education is high quality and proven to work

✅our market analysis and research is respected and accurate

✅our community maintains skilled and advanced leaders

https://twitter.com/1061650783333040129/status/1699609739884154979

Follow me @SuperLuckeee for education, market analysis and trade-ideas.

- Retweet this to share with your audience!

- Make sure you ❤️the post below and BOOKMARK this so you can go back and study it later.

- Retweet this to share with your audience!

- Make sure you ❤️the post below and BOOKMARK this so you can go back and study it later.

https://twitter.com/1061650783333040129/status/1707003529351565741

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter