🇪🇺 - EU will publish list of critical technologies today - a key step to kickstart Europe's de-risking efforts vis à vis China

• A short thread with graphs on why this list matters, what we can expect, and what's next for EU de-risking plans 👇🧵 [1/8]

• A short thread with graphs on why this list matters, what we can expect, and what's next for EU de-risking plans 👇🧵 [1/8]

• Publication of EU list of critical tech will be signal of bloc's willingness/ability to pursue de-risking

• List will provide concrete insights into EU thinking about what risk of doing business with China really is – a key question to answer before de-risking [2/8]

• List will provide concrete insights into EU thinking about what risk of doing business with China really is – a key question to answer before de-risking [2/8]

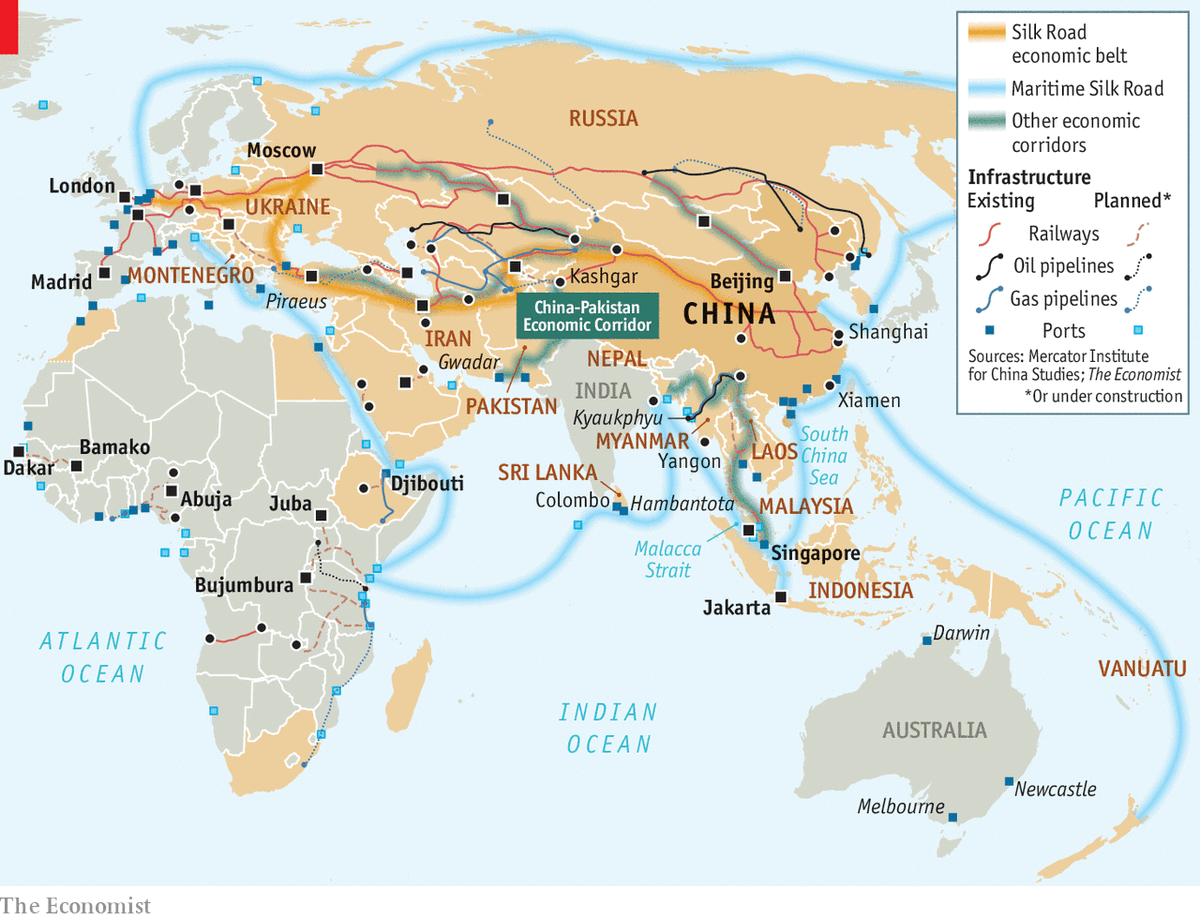

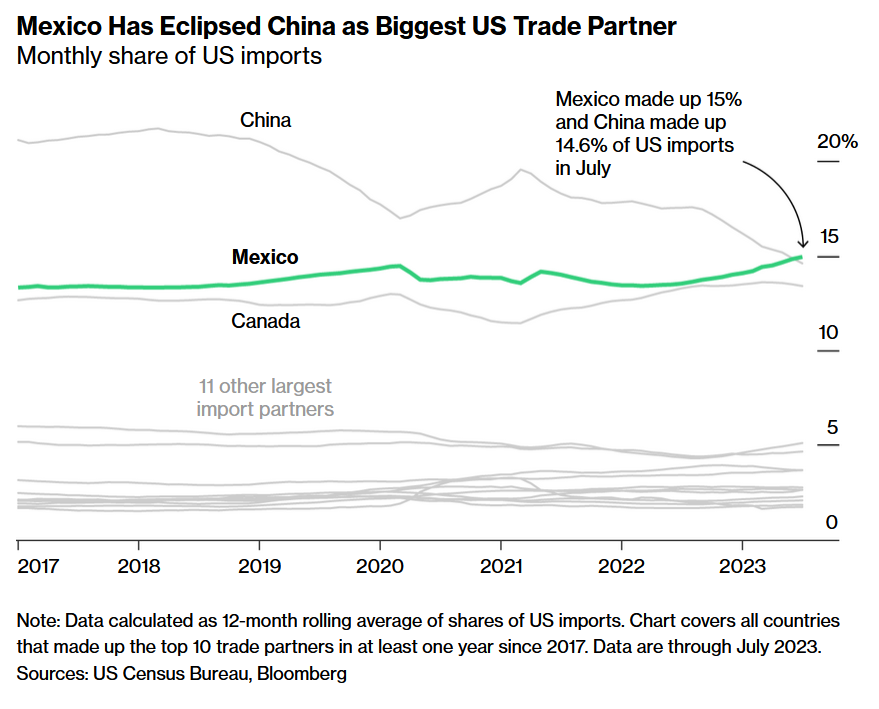

• By selecting only few flagship, priority sectors, EU will be keen to reiterate message that it is willing to de-risk, not decouple, from China

• EU also wants to show that it is carving its own, European, de-risking strategy, instead of following US lead in the field [3/8]

• EU also wants to show that it is carving its own, European, de-risking strategy, instead of following US lead in the field [3/8]

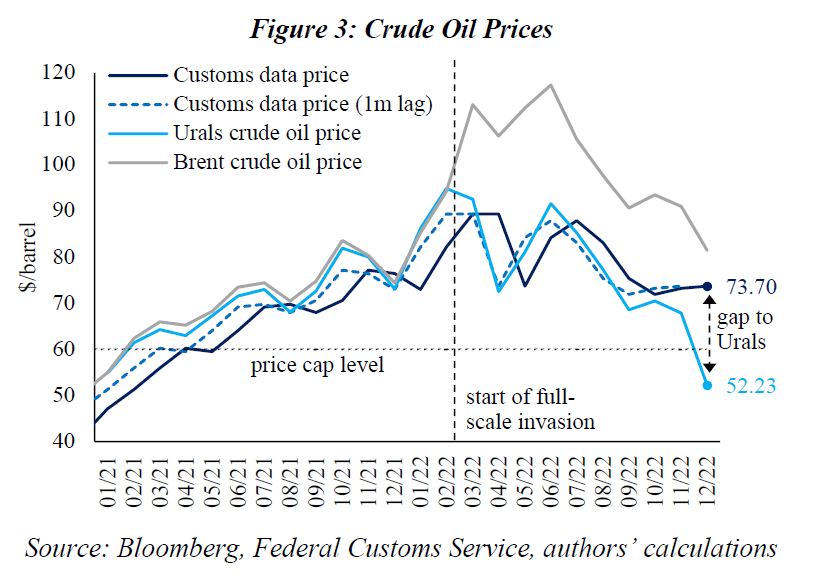

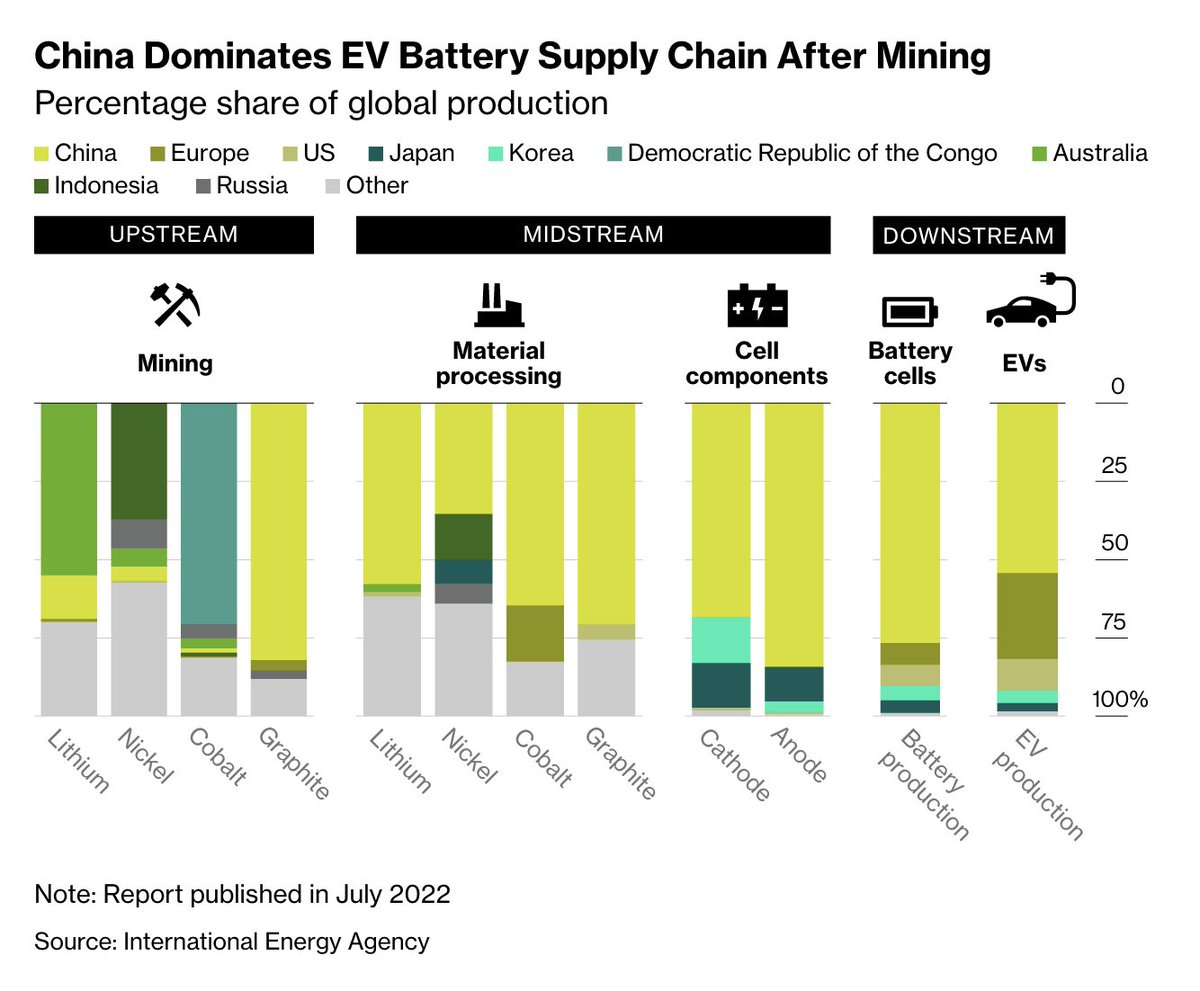

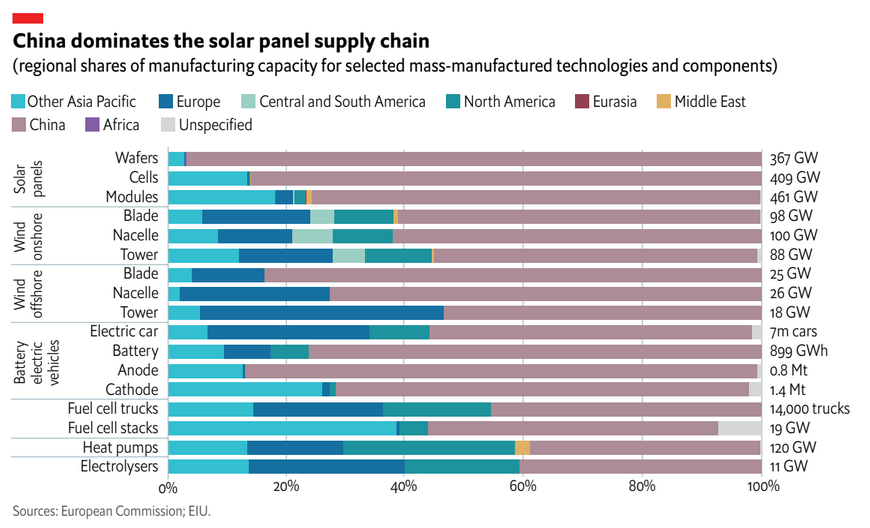

• List will almost certainly include tech related to green energy transition - a key area for EU de-risking

• EU wants to ensure safety of supplies for critical raw materials (lithium), tech (EV batteries) and equipment (solar panels) that are vital for net-zero economy [4/8]

• EU wants to ensure safety of supplies for critical raw materials (lithium), tech (EV batteries) and equipment (solar panels) that are vital for net-zero economy [4/8]

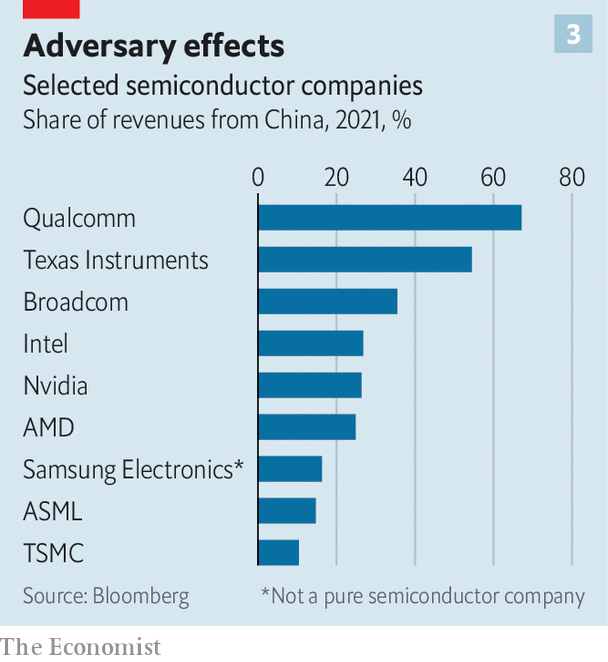

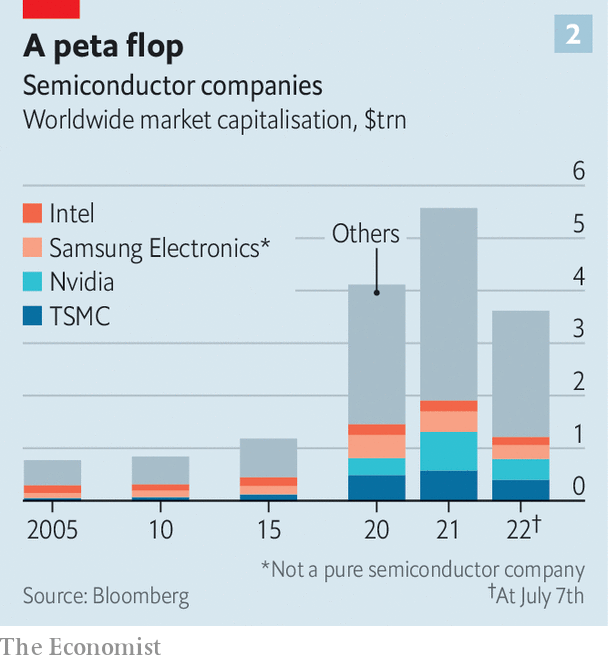

• List will also likely include know-how related to semiconductors, Artificial Intelligence (AI) and quantum computing

• EU's efforts to mitigate risks associated with these technologies stem from their dual nature: these tech have both civilian and military applications [5/8]

• EU's efforts to mitigate risks associated with these technologies stem from their dual nature: these tech have both civilian and military applications [5/8]

• List will be of critical importance to private firms: document will likely define which sectors could fall under remit of potential EU tool to screen outbound investment, notably to China

• Adoption of such a tool would signal greater EU-US alignment on de-risking [6/8]

• Adoption of such a tool would signal greater EU-US alignment on de-risking [6/8]

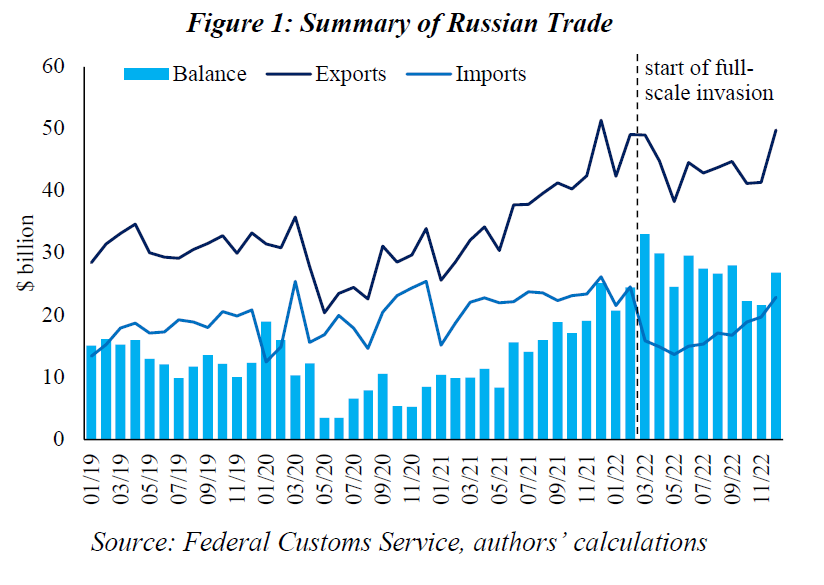

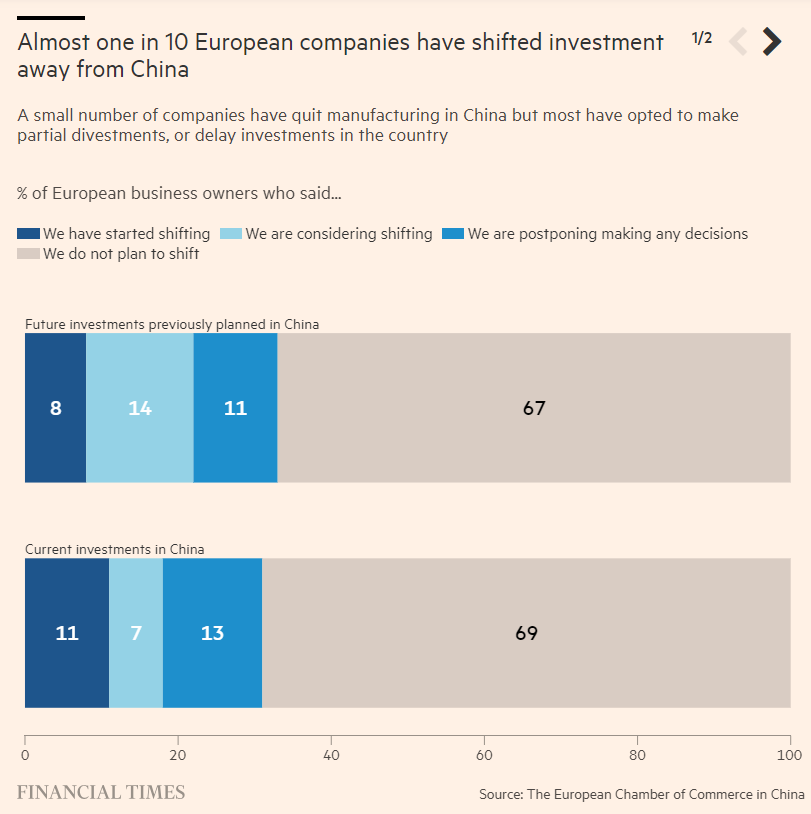

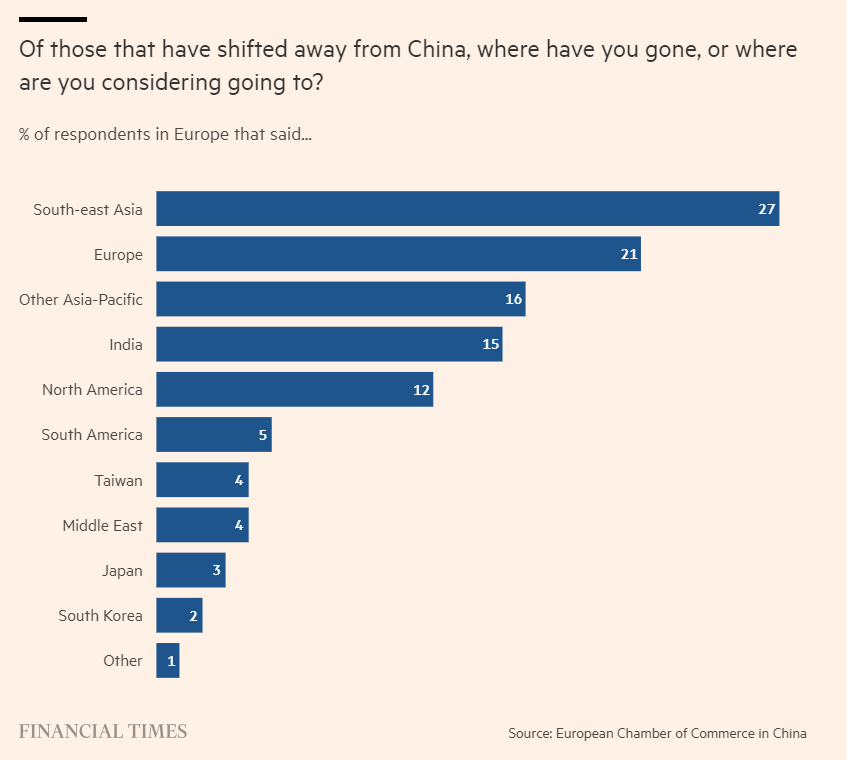

• Discussions on outbound FDI screening show how Western countries are willing to enforce intrusive measures that were previously unthinkable

• Yet getting companies on board with de-risking will be difficult: two-thirds of EU firms have no plans to shift away from China [7/8]

• Yet getting companies on board with de-risking will be difficult: two-thirds of EU firms have no plans to shift away from China [7/8]

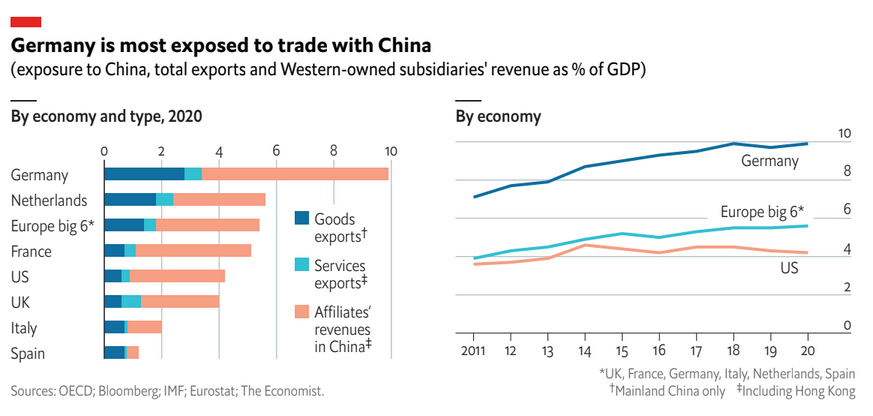

• Overall, bridging gap between de-risking rhetoric and practice will remain hard for EU

• Politically, de-risking plans have created divisions among EU member states

• In particular, Germany's economy remains far more exposed to China than other European economies

[8/8 - END]

• Politically, de-risking plans have created divisions among EU member states

• In particular, Germany's economy remains far more exposed to China than other European economies

[8/8 - END]

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter