Geoeconomics @ecfr • Columnist @ForeignPolicy • Ex @TheEIU & @DGTresor • Sanctions book Backfire @ColumbiaUP • Find me where the sky is blue

2 subscribers

How to get URL link on X (Twitter) App

The big sanctions are already in place:

The big sanctions are already in place:

• Publication of EU list of critical tech will be signal of bloc's willingness/ability to pursue de-risking

• Publication of EU list of critical tech will be signal of bloc's willingness/ability to pursue de-risking

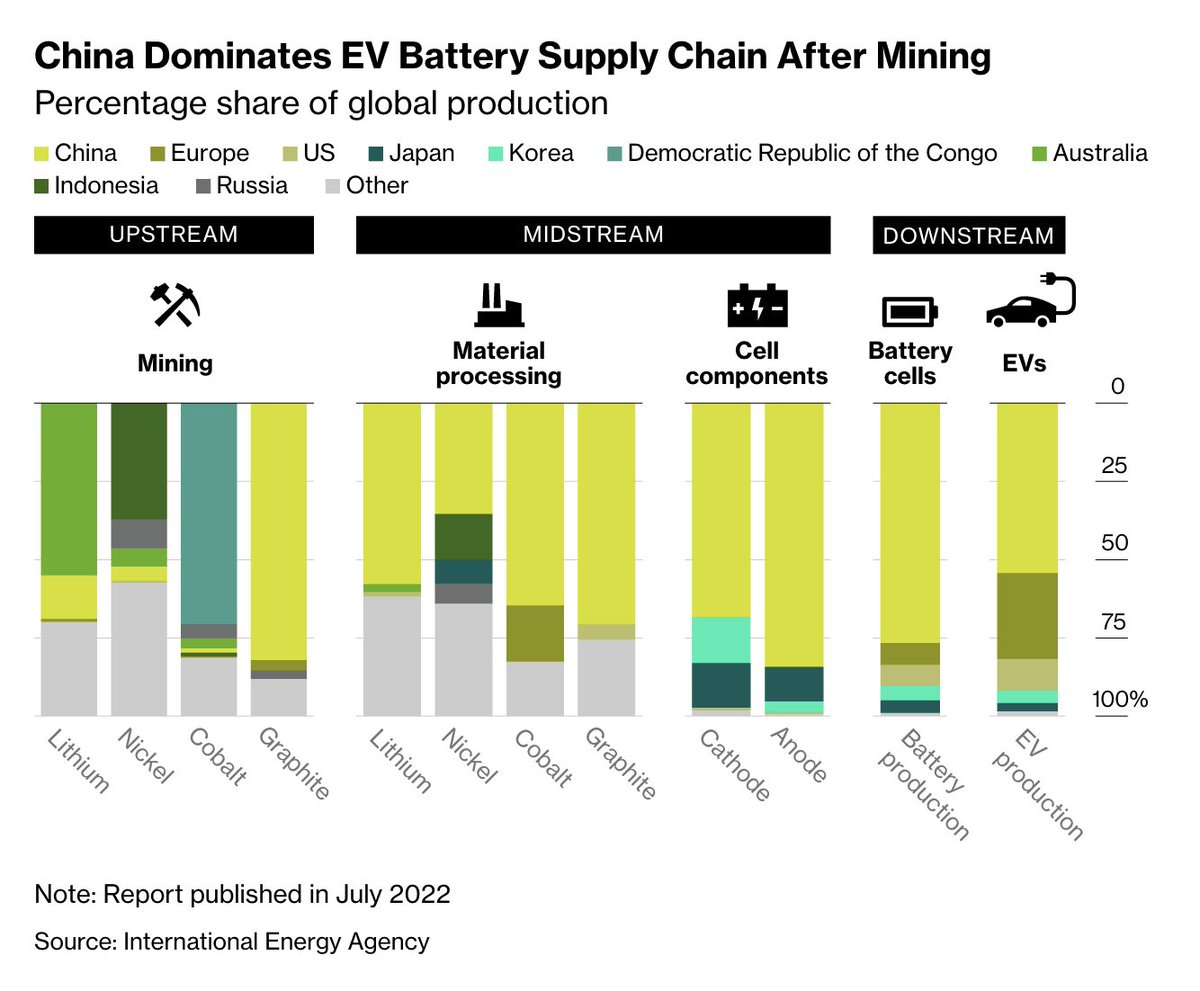

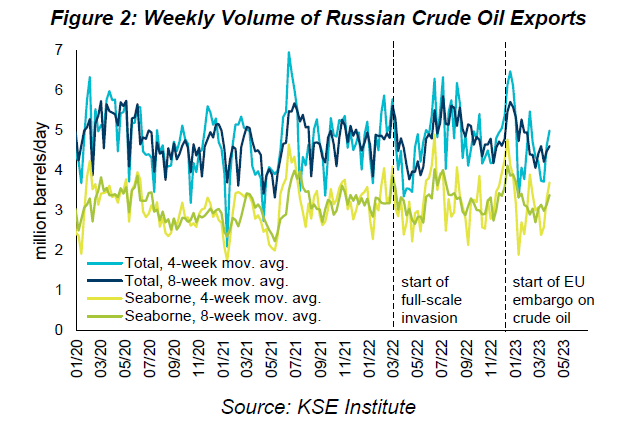

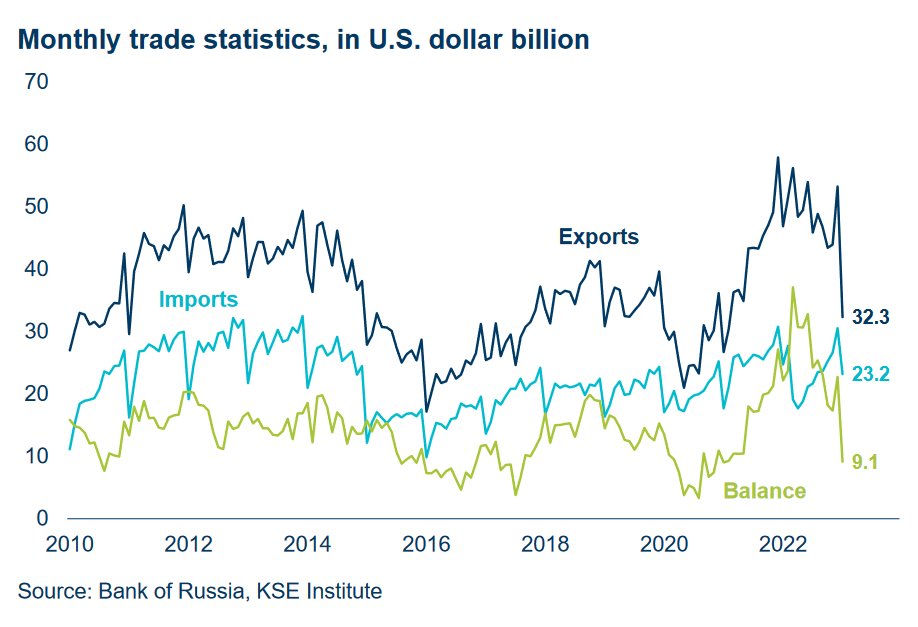

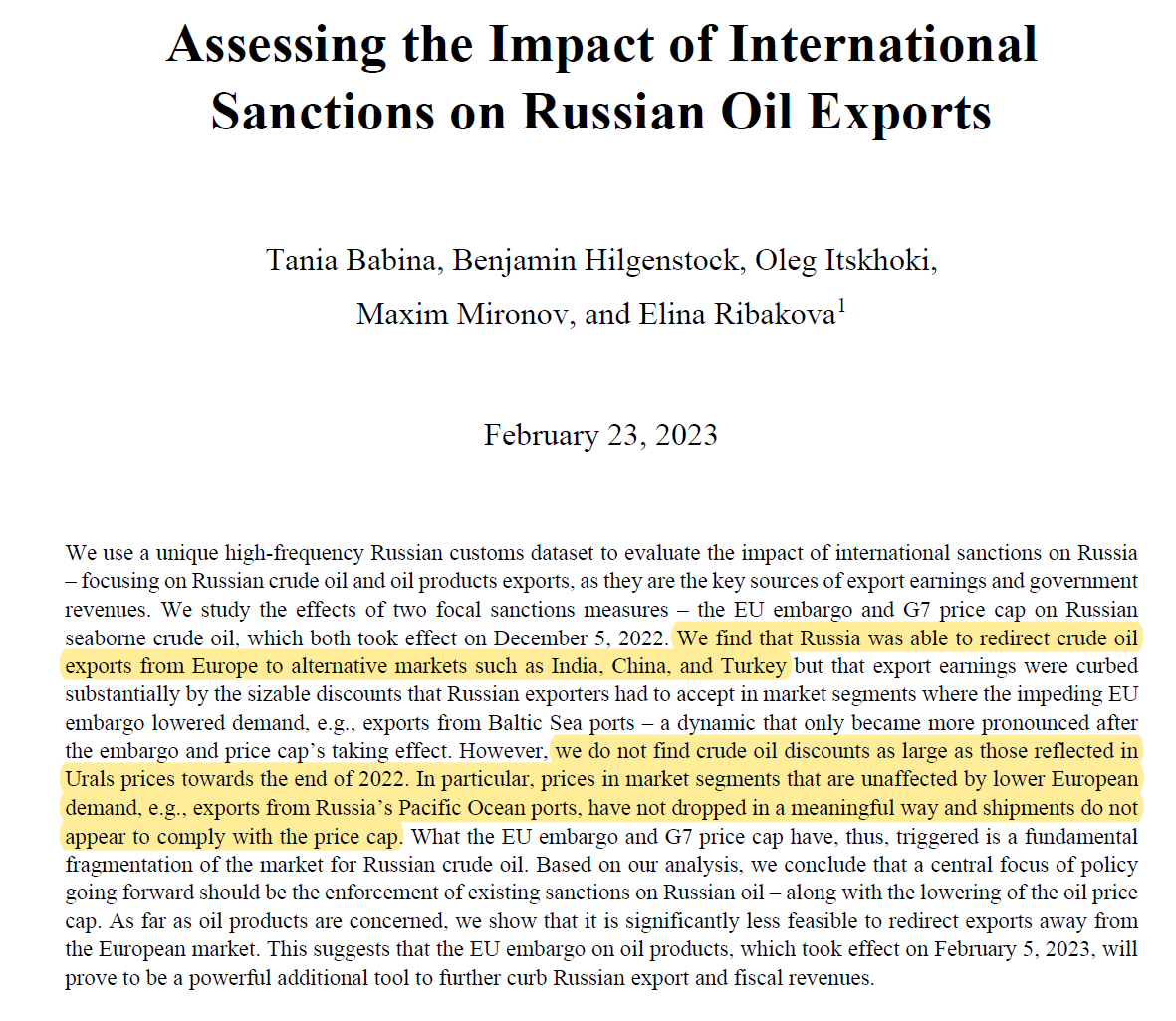

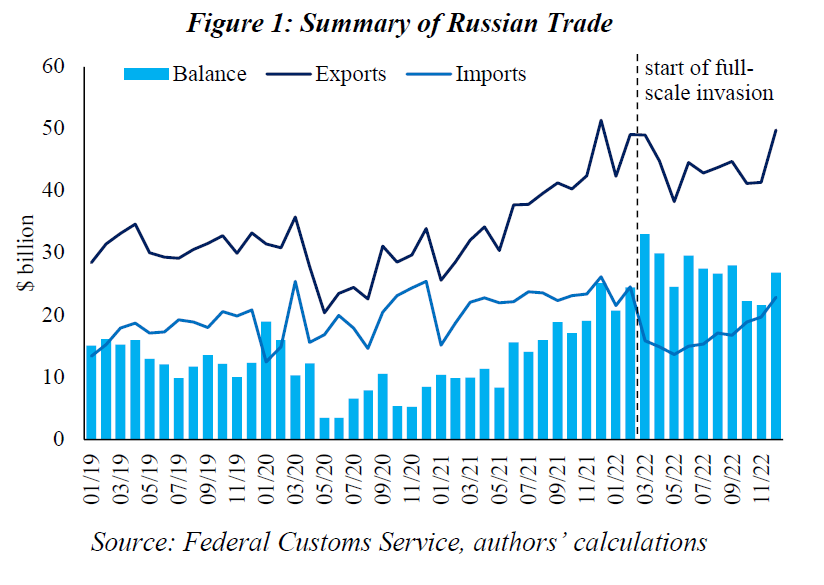

- Sanctions on Russian oil exports - in the form of the EU embargo on Russian oil and the G7/EU price cap - are weighing heavily on Moscow's finances.

- Sanctions on Russian oil exports - in the form of the EU embargo on Russian oil and the G7/EU price cap - are weighing heavily on Moscow's finances.

- In 2022 Western sanctions on Russia mostly hit the country's imports.

- In 2022 Western sanctions on Russia mostly hit the country's imports.

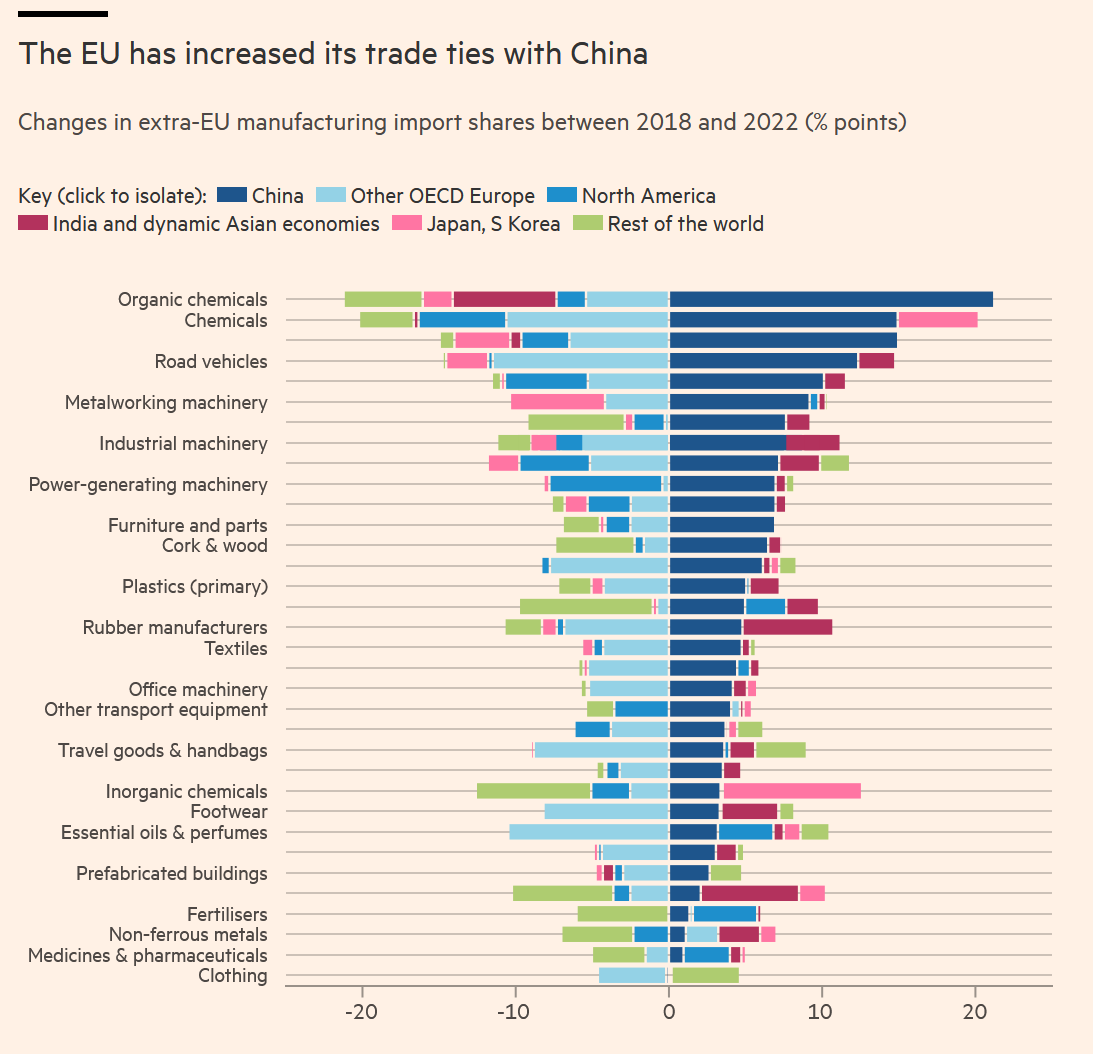

TRADE

TRADE

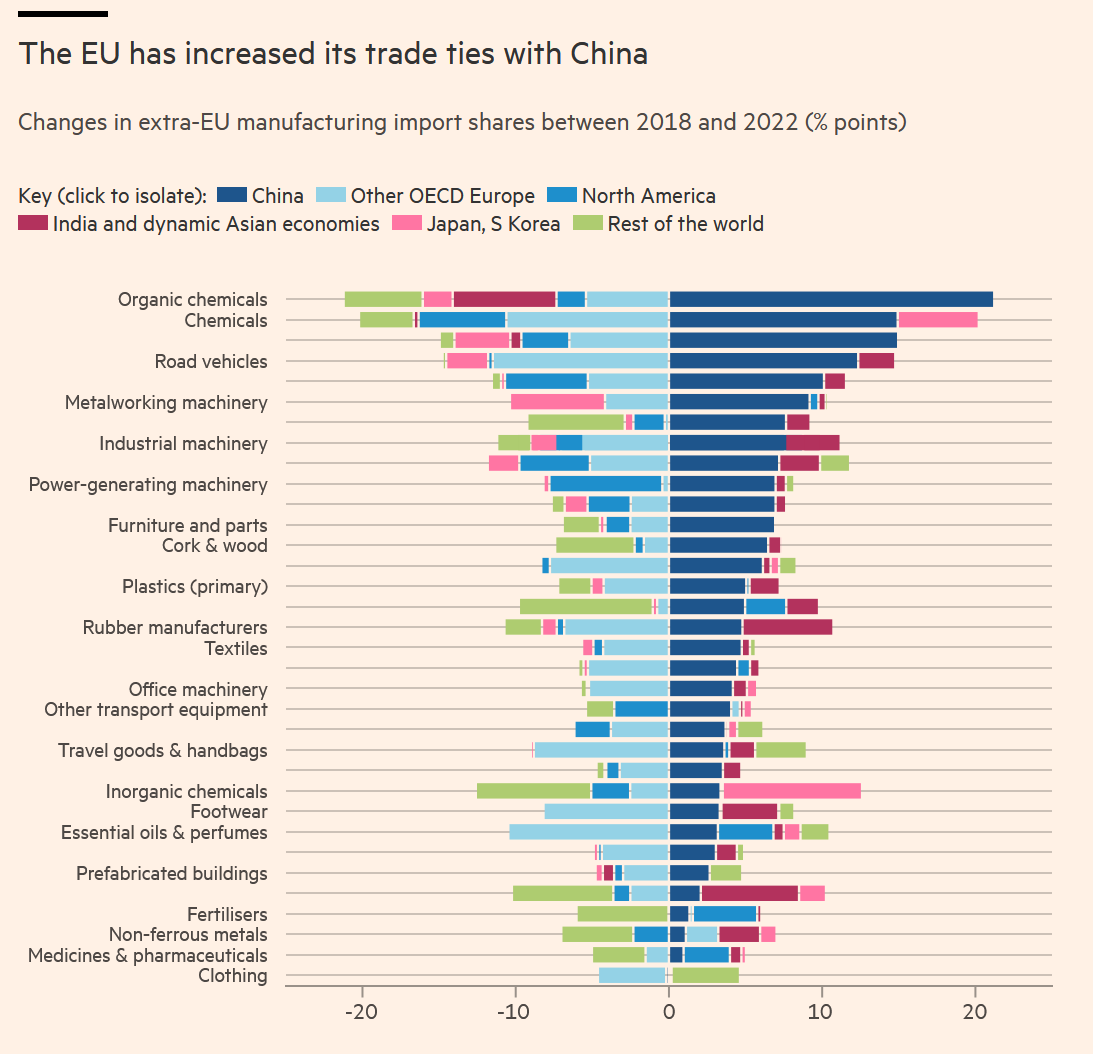

⛏️ - Russia produces 14% of the world's mining output, giving the country significant global leverage.

⛏️ - Russia produces 14% of the world's mining output, giving the country significant global leverage.

• Russia's current-account surplus stood at its lowest level in December since the pandemic year of 2020 - highlighting a rapid deterioration of external environment

• Russia's current-account surplus stood at its lowest level in December since the pandemic year of 2020 - highlighting a rapid deterioration of external environment

FDI screening decisions taken by member states - criteria include:

FDI screening decisions taken by member states - criteria include: