1️⃣Software Services Companies:

These companies offer software development, maintenance, and testing services.

They work on projects for clients worldwide, often providing customised solutions.

Companies -

• TCS

• Infosys

• Wipro

• HCL Technologies

These companies offer software development, maintenance, and testing services.

They work on projects for clients worldwide, often providing customised solutions.

Companies -

• TCS

• Infosys

• Wipro

• HCL Technologies

2️⃣Product-Based Companies:

They create and sell their software products or solutions.

They specialise in areas like enterprise software, security solutions, or data analytics.

Companies -

• Intellect Design Arena Ltd

• Oracle Fin.Serv.

They create and sell their software products or solutions.

They specialise in areas like enterprise software, security solutions, or data analytics.

Companies -

• Intellect Design Arena Ltd

• Oracle Fin.Serv.

3️⃣Business Process Outsourcing (BPO) Companies:

BPOs in India often involve IT-related processes such as customer support, data entry, and call centre operations.

Companies

• Hinduja Global Solutions Ltd

BPOs in India often involve IT-related processes such as customer support, data entry, and call centre operations.

Companies

• Hinduja Global Solutions Ltd

4️⃣AI and ER&D -

Engineering and R&D (ER&D) services are about improving how things are made and developed, and also making sure products last longer and work better.

Companies

• Tata Elxsi Ltd.,

• Happiest Minds Technologies Ltd.

• Zensar Technologies Ltd.

Engineering and R&D (ER&D) services are about improving how things are made and developed, and also making sure products last longer and work better.

Companies

• Tata Elxsi Ltd.,

• Happiest Minds Technologies Ltd.

• Zensar Technologies Ltd.

Which industry would you like us to cover in the next upcoming posts?

Let us know in the comments.

Follow @Finology_Quest to be a pro at finance

Let us know in the comments.

Follow @Finology_Quest to be a pro at finance

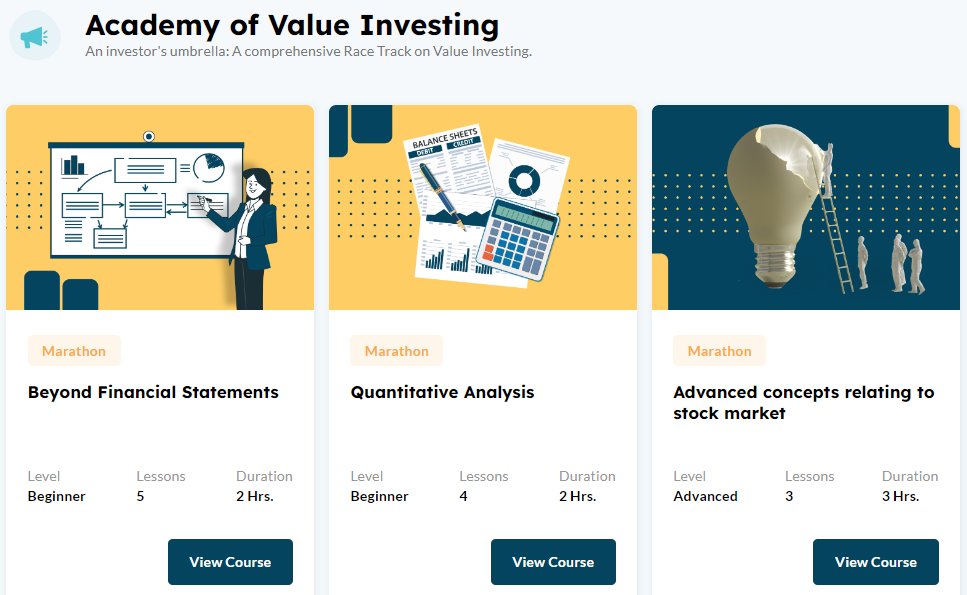

To learn how to Fundamental analysis, watch this course on Value Investing on Quest - bit.ly/quest-value-in…

• • •

Missing some Tweet in this thread? You can try to

force a refresh