1/24 OK's results are out, and they are not pretty.

OK blames the environment & competition from informal traders.

But maybe there is another a hidden issue that has been a blind spot for OK for over 10 years — Capital Allocation.

A thread🧵 with background & analysis.

OK blames the environment & competition from informal traders.

But maybe there is another a hidden issue that has been a blind spot for OK for over 10 years — Capital Allocation.

A thread🧵 with background & analysis.

2/24 For large companies it is IMPOSSIBLE to maintain a competitive edge if you don't do Capital Allocation well.

Harvard defines Capital Allocation below but hyper simplified Capital Allocation is how a company decides to invest or spend its money to generate returns.

Harvard defines Capital Allocation below but hyper simplified Capital Allocation is how a company decides to invest or spend its money to generate returns.

3/24 Generally there are 4 ways to allocate capital.

1. Invest in organic growth

2. Mergers & Acquisitions

3. Strengthen the Balance Sheet (e.g. pay off debts)

4. Return cash to shareholders (e.g. Dividends)

I think OK may have had some missteps on the above.

1. Invest in organic growth

2. Mergers & Acquisitions

3. Strengthen the Balance Sheet (e.g. pay off debts)

4. Return cash to shareholders (e.g. Dividends)

I think OK may have had some missteps on the above.

4/24 The first capital allocation decision that is hard to understand is the interim dividend.

The interim dividend was US$ 0.13 per share & the final dividend was 6.5 times smaller US$0.02 per share.

This is unusual. Interim dividends are usually smaller than final dividends.

The interim dividend was US$ 0.13 per share & the final dividend was 6.5 times smaller US$0.02 per share.

This is unusual. Interim dividends are usually smaller than final dividends.

5/24 Interim is like halftime in a football match. You may be doing well but you don't know what may happen in the 2nd half.

So normally companies leave some buffer to avoid paying too much cash as an interim dividends halfway through the year.

In the past that is what OK did.

So normally companies leave some buffer to avoid paying too much cash as an interim dividends halfway through the year.

In the past that is what OK did.

6/24 Below are OK's USD dividends. Only in 2015 was the interim bigger than the final (by a small amount).

This year it was 6.5x bigger 🤯.

This probably means they couldn't really afford to pay the $0.13c/share ($1.6m in total) at interim.

A capital allocation misstep?

This year it was 6.5x bigger 🤯.

This probably means they couldn't really afford to pay the $0.13c/share ($1.6m in total) at interim.

A capital allocation misstep?

7/24 The challenge with paying out too much dividend is effectively you are giving away the biggest advantage a large company has against informal traders - CAPITAL.

Especially in Zimbabwe where there isn't much lending to informal traders, capital is a massive advantage.

Especially in Zimbabwe where there isn't much lending to informal traders, capital is a massive advantage.

8/24 OK knew it was having a capital-intensive year with buying Food lovers, launching their pharmacies & a big store refurbishment program.

In 2016 management decided to pause on paying dividends to invest in the business.

Wouldn't it have made sense to do the same this year?

In 2016 management decided to pause on paying dividends to invest in the business.

Wouldn't it have made sense to do the same this year?

9/24 Had OK not paid dividends & saved capital, it could have allocated capital to strengthening the balance sheet by paying creditors quicker countering the issue they now are facing with shorter credit terms from suppliers.

10/24 They could have paid down debt or invested the $1.6milion elsewhere.

Even OK acknowledges that one of their constrains is "High interest rates and limited access to funding affecting capital expenditure and investment plans"

Even OK acknowledges that one of their constrains is "High interest rates and limited access to funding affecting capital expenditure and investment plans"

11/24 Moving on from the dividend, at least philosophically it is good that OK is being more adventurous e.g. acquiring Food Lovers, starting the Pharmacy business.

I think OK in the past could have been more aggressive in investing in new business opportunities.

I think OK in the past could have been more aggressive in investing in new business opportunities.

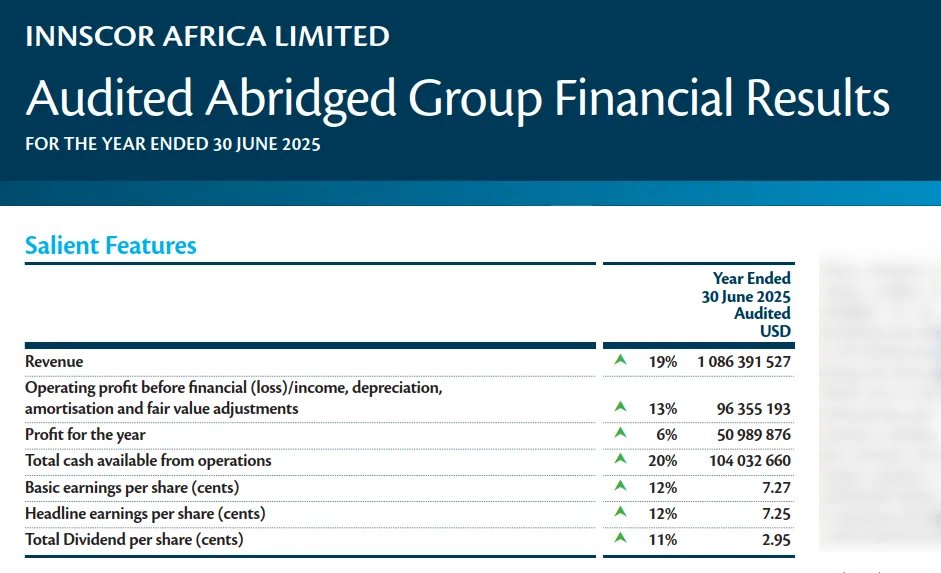

12/24 Below is a comparison between Innscor and OK looking at major transactions between 2009 - 2022.

Innscor on the right. OK on the left

Innscor has continually invested in new and diverse opportunities. OK has remained the same.

Innscor on the right. OK on the left

Innscor has continually invested in new and diverse opportunities. OK has remained the same.

13/24 I believe Innscor's ability to allocate capital to new opportunities has helped to to grow more and be more resilient as shown in the below.

I actually think OK's revenue has declined in real terms as the $451m is derived from the average official rate.

I actually think OK's revenue has declined in real terms as the $451m is derived from the average official rate.

14/24 OK could have diversified while remaining true to its retail core.

A common trend is that businesses where the shareholders are actively involved such as Innscor tend to be more ambitious.

OK's major shareholders are passive investors Datvest, NSSA, Old Mutual.

A common trend is that businesses where the shareholders are actively involved such as Innscor tend to be more ambitious.

OK's major shareholders are passive investors Datvest, NSSA, Old Mutual.

15/24 Instead, OK paid out over $30m of dividends between 2010-2017 more than the market cap of many listed companies on the ZSE.

16/24 OK is now struggling with competition from small players & unfortunately their new Pharmacy business is just as exposed to fierce competition.

The number of pharmacies has increased from 287 in 2011 to 933 in 2020.

Was this the best opportunity to chase?

Time will tell.

The number of pharmacies has increased from 287 in 2011 to 933 in 2020.

Was this the best opportunity to chase?

Time will tell.

17/24 OK has placed a lot of blame on the operating environment and a lot of their concerns are valid.

But it will always sounds strange hearing Goliath complain that the fight against about David is not fair.

But it will always sounds strange hearing Goliath complain that the fight against about David is not fair.

18/24 To succeed OK is going to need to find opportunities and allocate capital extremely well.

This is not easy because capital allocation is a skill that you don't really need to excel at until you are in executive management.

This is not easy because capital allocation is a skill that you don't really need to excel at until you are in executive management.

19/24 Overall, I hope OK can navigate successfully and this challenging season actually helps drive them into a period of innovation that will see OK transforming into a broader and more ambitious FMCG retail group.

20/24 Disclaimer: These thoughts are based on my interpretation of publicly available information and so I may be missing something.

Please comment let me know what you think.

Opposing views are more than welcome!

Please comment let me know what you think.

Opposing views are more than welcome!

21/24 I hope you found this insightful. If you did please leave a comment or repost this thread.

I write on the finance & strategy behind the most important companies impacting Africa + 🌍.

Follow me @tmukogo for more.

Repost or Comment on the first tweet below if you can.

I write on the finance & strategy behind the most important companies impacting Africa + 🌍.

Follow me @tmukogo for more.

Repost or Comment on the first tweet below if you can.

https://twitter.com/tmukogo/status/1709283832556646432

22/24 if you found the above interesting you should definitely check out these threads as well.

Recommendation 1 of 3!

Recommendation 1 of 3!

https://twitter.com/tmukogo/status/1701629412373090631

23/24 Recommendation 2 of 3!

https://twitter.com/tmukogo/status/1688596619103707136

24/24 Recommendation 3 of 3!

https://twitter.com/tmukogo/status/1706734822985801748

• • •

Missing some Tweet in this thread? You can try to

force a refresh