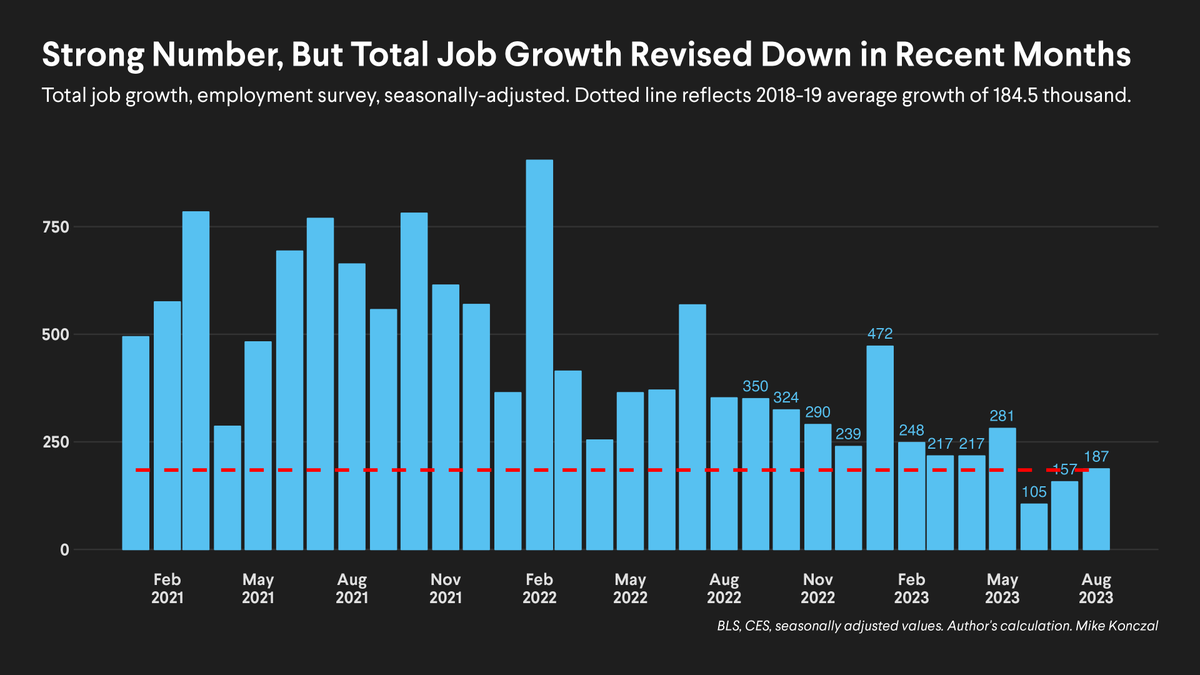

Two things to catch in the jobs numbers - nominal wages have decelerated such that the last two monthly numbers are actually below 2018-2019 levels.

There's a lot of noise and revisions, I wouldn't go off any one number, but this is not an overheated labor market. /1

There's a lot of noise and revisions, I wouldn't go off any one number, but this is not an overheated labor market. /1

Unemployment stayed at 3.8%. But who is counted as unemployed shifted last couple months. Much more likely to be "new entrants/reentrants" than earlier 2023.

That's great. That's who we want in unemployed, people pulled into the labor market (not job losers). Expanded supply. /2

That's great. That's who we want in unemployed, people pulled into the labor market (not job losers). Expanded supply. /2

Last, something people haven't been watching, (because why would they - it's not the early/mid 2010s) but, mirroring JOLTs slowdown trends, unemployment duration has crept back up to 2019 levels in recent months.

That's not a sign of overheating. 3/3

That's not a sign of overheating. 3/3

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter