SwingTrading Pro

SwingTrading Pro is all about finding the market natural swings and riding on them with the direction of the Trend. Also known as, 123 pattern or ABC pattern.

"SwingTrading Pro" Thread 🧵

Scroll down 👇

SwingTrading Pro is all about finding the market natural swings and riding on them with the direction of the Trend. Also known as, 123 pattern or ABC pattern.

"SwingTrading Pro" Thread 🧵

Scroll down 👇

Finding 123 pattern in objective way is super hard and we believe that we have the framework that would help us to identify while it happens in live market.

Scroll down 👇

Scroll down 👇

How will the Framework identify the 123 patterns?

Our framework is…

· Trend.

· Momentum.

· Pullback Evaluation.

· Structure Breakout.

Scroll down 👇

Our framework is…

· Trend.

· Momentum.

· Pullback Evaluation.

· Structure Breakout.

Scroll down 👇

TREND

As you can see identifying the right Trend is a monumental task. We have the internal calculation that tracks the Daily timeframe Trend.

Scroll down 👇

As you can see identifying the right Trend is a monumental task. We have the internal calculation that tracks the Daily timeframe Trend.

Scroll down 👇

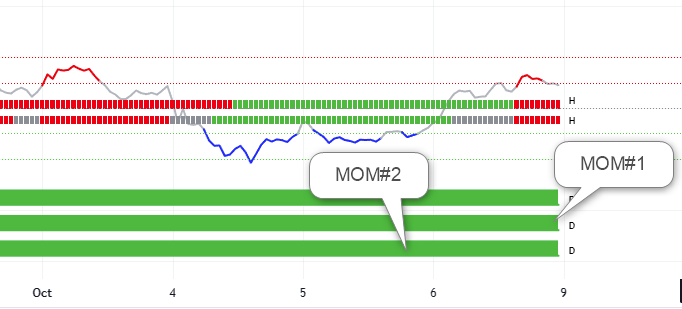

MOMENTUM

Once we have the Trend; how do we know the Trend is active or dying?

This is where the Momentum comes into play. Momentum measures the trend strength.

Scroll down 👇

Once we have the Trend; how do we know the Trend is active or dying?

This is where the Momentum comes into play. Momentum measures the trend strength.

Scroll down 👇

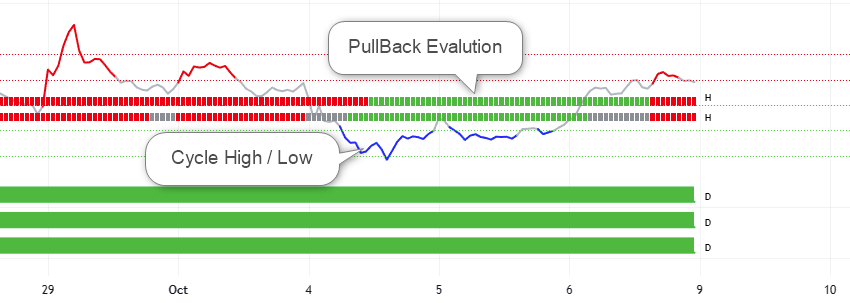

PULLBACK EVALUATION

Evaluating the retracement from the trend move is super hard. We have added multi-dimensional (MTF) analysis to measure the retracement and help us know its reaching the optimum level for us to enter.

Scroll down 👇

Evaluating the retracement from the trend move is super hard. We have added multi-dimensional (MTF) analysis to measure the retracement and help us know its reaching the optimum level for us to enter.

Scroll down 👇

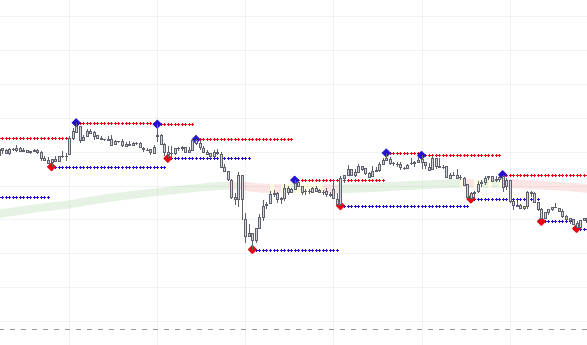

STRUCTURE BREAKOUT

Structure breakout help us to filter out the unqualified entries. Also, breakout help us place the right Stop loss, and Take profit.

Scroll down 👇

Structure breakout help us to filter out the unqualified entries. Also, breakout help us place the right Stop loss, and Take profit.

Scroll down 👇

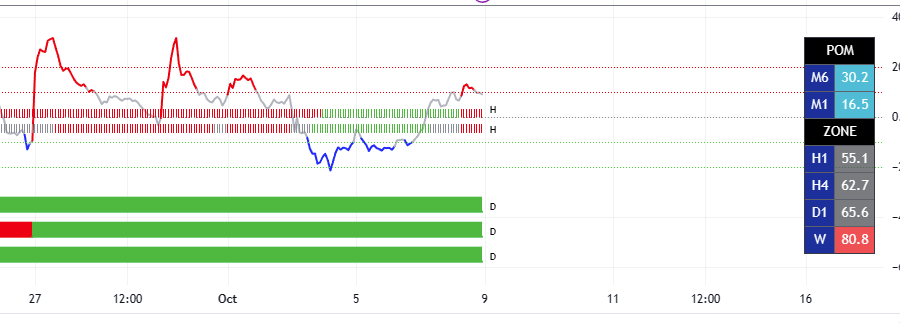

SwingTrading Pro also comes with important information in Dashboard.

POM = Probability of Move

ZONE = MTF Cycle High / Low

Scroll down 👇

POM = Probability of Move

ZONE = MTF Cycle High / Low

Scroll down 👇

SwingTrading Pro in Action

This is how we identify the 123 Pattern with objective framework.

End of thread. 🧵

This is how we identify the 123 Pattern with objective framework.

End of thread. 🧵

@threadreaderapp

unroll

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter