Cloud remains the space I have been long since mid to end 2022.

I had the change to add to these positions during Q1 and Q2 and have held tight since.

The focus is around the service companies that are directly linked to the growth of cloud.

I had the change to add to these positions during Q1 and Q2 and have held tight since.

The focus is around the service companies that are directly linked to the growth of cloud.

Cloud security grew into a major bet through the growth my positions have benefitted from.

$CRWD $ZS ( $ZS replace $NET as per my tweet)

$GOOGL and $AMZN both are sizable as well through their 40%+ gains since the buys. Both are plays on Cloud and services around AI.

$CRWD $ZS ( $ZS replace $NET as per my tweet)

$GOOGL and $AMZN both are sizable as well through their 40%+ gains since the buys. Both are plays on Cloud and services around AI.

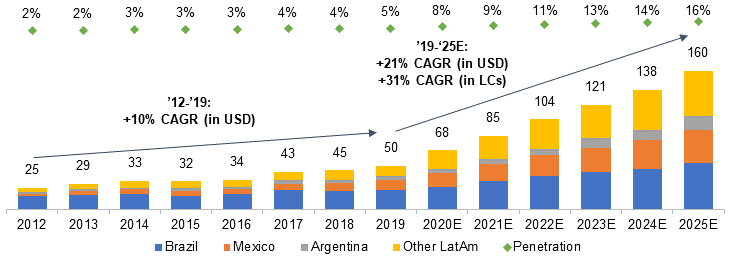

$MELI represents my bet on South America and has one of the best managements out there and pure execution within a growing space.

+21% projected CAGR and only 13% penetrated.

embodies the lessons I learned from the $AMZN bet made by Nick Sleep at Nomad.

+21% projected CAGR and only 13% penetrated.

embodies the lessons I learned from the $AMZN bet made by Nick Sleep at Nomad.

$ADYEY and $PYPL

This is my latest bet on payment (processors).

Value play via $PYPL and growth via $ADYEY.

$ADYEY is in my view one of the best businesses in Europe and has plenty of growth ahead.(plenty of material on twitter)

Fintech and payment got killed over the past 2y

This is my latest bet on payment (processors).

Value play via $PYPL and growth via $ADYEY.

$ADYEY is in my view one of the best businesses in Europe and has plenty of growth ahead.(plenty of material on twitter)

Fintech and payment got killed over the past 2y

$TEAM and $DDOG are smaller stock bets.

$DDOG is a leader in observability services for cloud applications.

$TEAM is a slightly different bet based on a compounder and technical setup of slightly shorter nature.

$DDOG is a leader in observability services for cloud applications.

$TEAM is a slightly different bet based on a compounder and technical setup of slightly shorter nature.

$TLT and 20y treasuries is my newest bet.

I believe in the coming months, rate cuts or at least a QT stop will ensue from a slowdown. This is the asset I have chosen to both secure passive income and/or to reflect a short yields bet.

I believe in the coming months, rate cuts or at least a QT stop will ensue from a slowdown. This is the asset I have chosen to both secure passive income and/or to reflect a short yields bet.

I have a small but increasing position within semiconductors

NO it is not $NVDA as it is overvalued imo with more competition to enter the space.Other players are more suitable to express my bet

This is a mid term bet and I will be aggressive into the next months if it lets me

NO it is not $NVDA as it is overvalued imo with more competition to enter the space.Other players are more suitable to express my bet

This is a mid term bet and I will be aggressive into the next months if it lets me

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter