In my classes, I strive to create an inclusive environment for all perspectives. That's partly why I avoid public statements outside my lane. But as a member of the Harvard community, I feel compelled to address the statement from 36 Harvard student groups docs.google.com/document/d/1TG…

It is getting global attention and the sentiments it expresses are egregious. Blaming the victims for the slaughter of hundreds of civilians. Absolving the perpetrators of any agency. This is morally ignorant and painful for other members of the community.

I deeply hope--and from my experience believe--that this statement does not speak for most students. Maybe not even most students in these groups--possibly a quick first impression before the full scale of the horror perpetrated by Hamas became clear.

Listen to what 1 student in some of these groups (an econ grad student!) had to say about the statement that was allegedly in her name. I would love to hear others saying this (& you don't even need to stand with Israel, just say what Hamas did was wrong).

https://x.com/nummoose/status/1711199876116250690?s=20

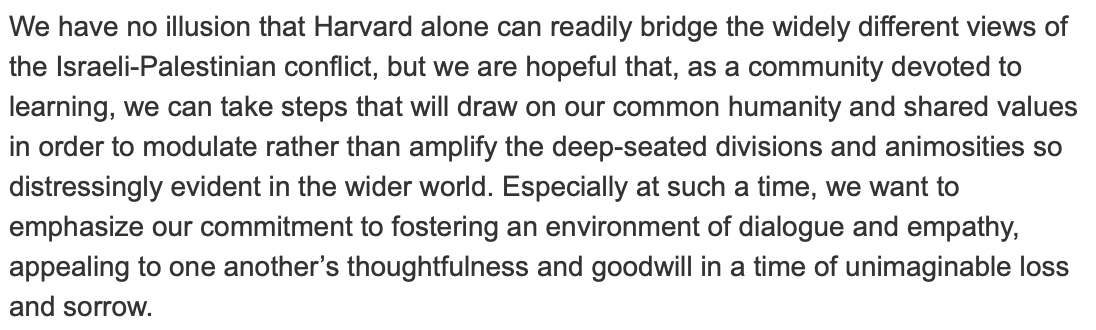

Our President Claudine Gay & school leaders have asked us to "foster... an environment of dialogue & empathy, appealing to one another’s thoughtfulness & goodwill". I hope to help. Acknowledging that killing hundreds of innocents is wrong should be an easy place to start.

I will now return to my lane.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter