OK - SBF trial restart, Gary Wang still on cross examination, Bankman-Fried's lawyer want to ask him about other lawyers' role in his real estate purchases. On desk (and photogs waiting outside for) Caroline Ellison. Inner City Press will live tweet, thread below

Jury entering!

Judge Kaplan: Let's resume.

SBF's lawyer Everdell: Last week you said the amount was overstated by $8 billion?

Gary Wang: Yes.

Everdell: You had known about the bug since the end of 2021 but hadn't gotten a change to fix it?

Gary Wang: Yes.

Judge Kaplan: Let's resume.

SBF's lawyer Everdell: Last week you said the amount was overstated by $8 billion?

Gary Wang: Yes.

Everdell: You had known about the bug since the end of 2021 but hadn't gotten a change to fix it?

Gary Wang: Yes.

Gary Wang: I learned that Alameda was borrowing from FTX when Sam asked me to calculate how much interest they owed --

Everdell: I'm asking about the bug. Let's move to June of 2022.

Judge Kaplan: Did you know the amount of the overstatment?

Wang: $500 million

Everdell: I'm asking about the bug. Let's move to June of 2022.

Judge Kaplan: Did you know the amount of the overstatment?

Wang: $500 million

Everdell: The June 2022 spreadsheet, do you recognize it?

Gary Wang: Yes.

Everdell: How did Caroline & Nishad feel when they saw this?

Gary Wang: I can't say.

Everdell: There was a project to figure out Alameda's NAV, right?

Gary Wang: Yes.

[NAV = Net Asset Value]

Gary Wang: Yes.

Everdell: How did Caroline & Nishad feel when they saw this?

Gary Wang: I can't say.

Everdell: There was a project to figure out Alameda's NAV, right?

Gary Wang: Yes.

[NAV = Net Asset Value]

Everdell: If Alameda withdrew from FTX, it would not be reflected in the fiat account?

Gary Wang: Right.

Everdell: You said the line of credit Alameda had was $65 billion?

AUSA Roos: Objection, asked and answered.

Judge: Sustained

Gary Wang: Right.

Everdell: You said the line of credit Alameda had was $65 billion?

AUSA Roos: Objection, asked and answered.

Judge: Sustained

Everdell: But Alameda did not draw down nearly that $65 billion amount, right?

AUSA Roos: Objection! Vague.

Sustained.

Everdell: Mr. Wong, Alameda held assets on the FTX exchange right? Did it hold FTT?

Gary Wang: Yes.

Everdell: You helped create FTT?

Wnag: Yes.

AUSA Roos: Objection! Vague.

Sustained.

Everdell: Mr. Wong, Alameda held assets on the FTX exchange right? Did it hold FTT?

Gary Wang: Yes.

Everdell: You helped create FTT?

Wnag: Yes.

Everdell: FTX did not set the price on FTT, right?

Gary Wang: Alameda traded it.

Everdell: What was the price in 2022?

Wang: Can you be more specific?

Everdell: Let me show you this... Did Binance agree to buy that stake is sold in Nov 2022?

Wang: Yes.

Gary Wang: Alameda traded it.

Everdell: What was the price in 2022?

Wang: Can you be more specific?

Everdell: Let me show you this... Did Binance agree to buy that stake is sold in Nov 2022?

Wang: Yes.

Everdell: You didn't knowwhat Alameda could or couldn't do with the funds that were deposited in its bank accounts, did you?

Gary Wang: No.

Everdell: I want to ask you about the tweets you were shown, one of Sam's from 7/31/19 with Bitshine?

Gary Wang: Yes

Gary Wang: No.

Everdell: I want to ask you about the tweets you were shown, one of Sam's from 7/31/19 with Bitshine?

Gary Wang: Yes

Everdell: And Sam told Bitshine that Alameda was treated the same as all other customers?

Gary Wang: Yes.

Everdell: How did the question of frontrunning come up?

AUSA Roos: Objection. Foundation.

Judge Kaplan: Sustained.

Gary Wang: Yes.

Everdell: How did the question of frontrunning come up?

AUSA Roos: Objection. Foundation.

Judge Kaplan: Sustained.

Everdell: You said you overheard Sam - but you could only hear his end of the conversation, right?

Gary Wang: Yes.

Everdell: You don't know what question he was answered when he said Alameda was treated the same as others, correct?

Wang: I spoke with investors.

Gary Wang: Yes.

Everdell: You don't know what question he was answered when he said Alameda was treated the same as others, correct?

Wang: I spoke with investors.

Everdell: About the technical stuff, right?

Gary Wang: Right.

Everdell: FTX tried to prevent clawbacks, with the liquidity engine, right?

Wang: Yes.

Everdell: Didn't Sam acknowledge that clawbacks could occur?

AUSA Roos: Objection! Hearsay!

Judge: Sustained.

Gary Wang: Right.

Everdell: FTX tried to prevent clawbacks, with the liquidity engine, right?

Wang: Yes.

Everdell: Didn't Sam acknowledge that clawbacks could occur?

AUSA Roos: Objection! Hearsay!

Judge: Sustained.

Everdell: Let's talk about the "Korean friend" account - it would not appear, right?

Wang: Yes

Everdell: In September 2022 you took part in a discussion about whether to shut down Alameda, right?

Wang: Right.

Everdell: Look at this

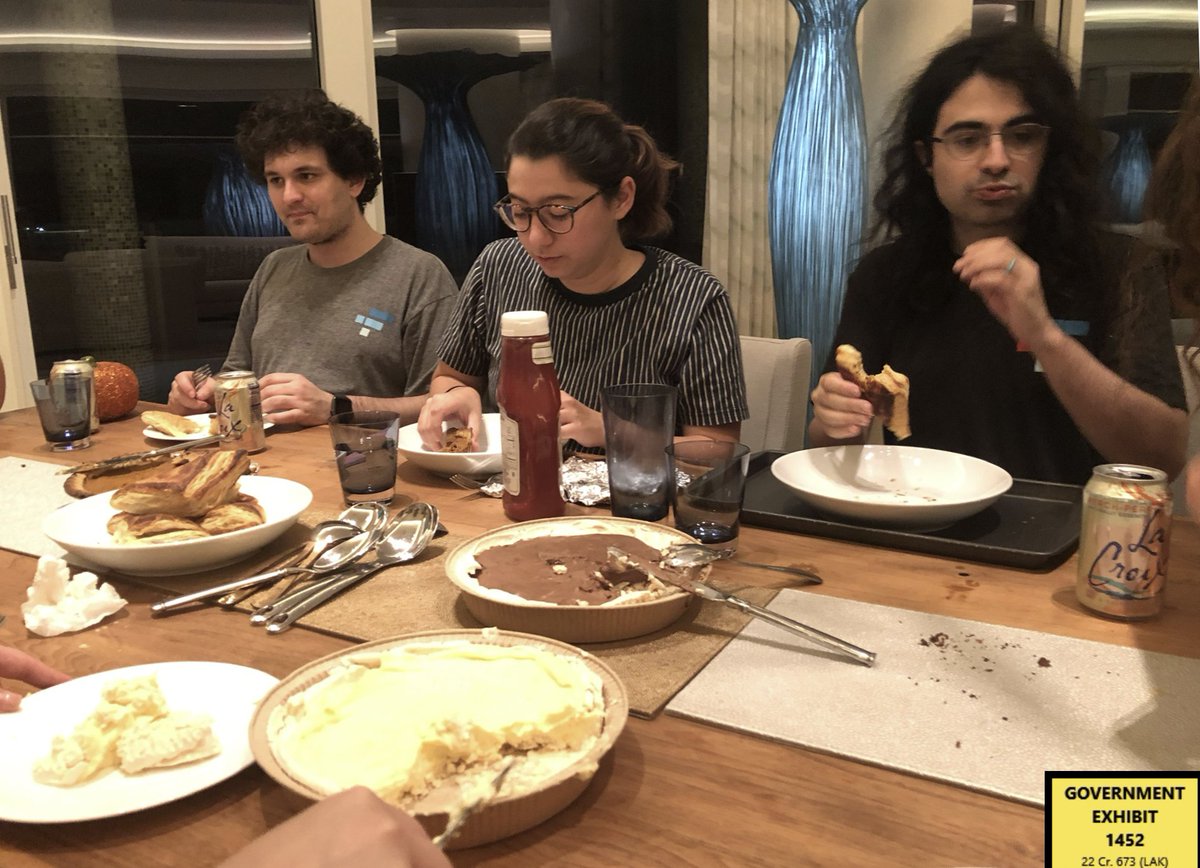

Here patreon.com/posts/90715078

Wang: Yes

Everdell: In September 2022 you took part in a discussion about whether to shut down Alameda, right?

Wang: Right.

Everdell: Look at this

Here patreon.com/posts/90715078

Everdell: Do you recall any issue with hedging prior to this memo being circulated?

Gary Wang: Sam was angry Alameda did not hedge its positions.

Everdell: And Caroline was the CEO in charge?

Gary Wang: Well, she was the CEO at the time

Gary Wang: Sam was angry Alameda did not hedge its positions.

Everdell: And Caroline was the CEO in charge?

Gary Wang: Well, she was the CEO at the time

Everdell: Sam wanted to shut Alameda down?

Gary Wang: He thought there was a 30% change it should be shut down. I wasn't sure.

Everdell: You thought they were necessary as a market maker?

Wang: There was more.

Everdell: Didn't you tell the FBI, "market maker"?

Gary Wang: He thought there was a 30% change it should be shut down. I wasn't sure.

Everdell: You thought they were necessary as a market maker?

Wang: There was more.

Everdell: Didn't you tell the FBI, "market maker"?

Everdell: So CZ's tweet caused a run on the bank at FTX?

AUSA: Objection!

Judge Kaplan: Sustained.

Everdell: CZ's tweet had an effect?

Wang: I'm not sure it was that or the leaked financials.

Everdell: How much was withdrawn on Nov 6?

Judge: What are you asking?

AUSA: Objection!

Judge Kaplan: Sustained.

Everdell: CZ's tweet had an effect?

Wang: I'm not sure it was that or the leaked financials.

Everdell: How much was withdrawn on Nov 6?

Judge: What are you asking?

Everdell: How much was being withdrawn per hour on Nov 6?

Gary Wang: About $100 million an hour.

Everdell: Sam asked you to calculate what was needed, including the Korean friend account?

Wang: We were down $8 billion.

Gary Wang: About $100 million an hour.

Everdell: Sam asked you to calculate what was needed, including the Korean friend account?

Wang: We were down $8 billion.

Everdell: Mr. Wang, do you know the difference between solvency and liquidity?

Gary Wang: Yes.

Everdell: So you said Sam's tweet about being solvent was true?

Wang: I said it was true but misleading.

Gary Wang: Yes.

Everdell: So you said Sam's tweet about being solvent was true?

Wang: I said it was true but misleading.

Everdell: Didn't you meet with the government on November 29 and said you thought it was true, FTX just wasn't liquid?

AUSA Roos: This tweet doesn't say solvent in it.

Everdell: You said Alameda had collateral?

Gary Wang: Yes.

AUSA Roos: This tweet doesn't say solvent in it.

Everdell: You said Alameda had collateral?

Gary Wang: Yes.

Everdell: You got over $200 million in loans from Alameda?

Gary Wang: Yes.

Everdell: To make venture investments, and to buy a house, right?

Wang: I used $200,000 for a house.

Everdell: What lawyers worked on the promissory notes?

Wang: General counsel, under Dan

Gary Wang: Yes.

Everdell: To make venture investments, and to buy a house, right?

Wang: I used $200,000 for a house.

Everdell: What lawyers worked on the promissory notes?

Wang: General counsel, under Dan

Everdell: Did you talk to the lawyers about the promissory notes before you signed them?

Gary Wang: No.

Everdell: You didn't have any concern at that time about how the loans were structured?

[This is what Team SBF wrote in about yesterday: patreon.com/posts/filing-b…

Gary Wang: No.

Everdell: You didn't have any concern at that time about how the loans were structured?

[This is what Team SBF wrote in about yesterday: patreon.com/posts/filing-b…

Everdell: I'm giving you a binder, Mr. Wang... Please review tabs 28 to 36.

Judge Kaplan: All of them?

Everdell: Tab 32. April 30, 2022, for $35 million. The house, where was it?

Wang: St. Kitts.

Judge Kaplan: All of them?

Everdell: Tab 32. April 30, 2022, for $35 million. The house, where was it?

Wang: St. Kitts.

Everdell: Nishad Singh left the Bahamas before you did, he on Nov 9, right?

Wang: Yes. He seemed distraught. He went back to the US. I stayed a few more days

Everdell: You and Sam met with the Bahamas regulators SCB on Nov 12, they required you, right?

Wang: Yes.

Wang: Yes. He seemed distraught. He went back to the US. I stayed a few more days

Everdell: You and Sam met with the Bahamas regulators SCB on Nov 12, they required you, right?

Wang: Yes.

Everdell: Let me read this letter to you --

Judge Kaplan: Mr. Everdell, the jury can read this letter as well as you can.

Everdell: OK. The penalty for not going would have been contempt, right?

Wang: I waited in a room outside. Then we all went back to FTX

Judge Kaplan: Mr. Everdell, the jury can read this letter as well as you can.

Everdell: OK. The penalty for not going would have been contempt, right?

Wang: I waited in a room outside. Then we all went back to FTX

Everdell: You were required to transfer the assets to the SCB, right?

Gary Wang: Yes. Police officers showed up around 9 pm at the office --

Everdell: Not the apartment?

Wang: No. They asked for our passports. We complied.

Gary Wang: Yes. Police officers showed up around 9 pm at the office --

Everdell: Not the apartment?

Wang: No. They asked for our passports. We complied.

Everdell: By Nov 13 you hired lawyers here in NY, right?

Gary Wang: Yes. I wanted to consider cooperating.

Everdell: You had to act quickly?

Wang: There are advantages to that.

Everdell: Your lawyers met the prosecutors then flew to the Bahamas to you?

Wang: Yes

Gary Wang: Yes. I wanted to consider cooperating.

Everdell: You had to act quickly?

Wang: There are advantages to that.

Everdell: Your lawyers met the prosecutors then flew to the Bahamas to you?

Wang: Yes

Judge Kaplan: We'll take out morning break. 15 minutes.

Inner City Press is covering it all

&

Feed will resume hereinnercitypress.com/literarysbf3ga…

matthewrussellleeicp.substack.com/p/inside-sbf-b…

Inner City Press is covering it all

&

Feed will resume hereinnercitypress.com/literarysbf3ga…

matthewrussellleeicp.substack.com/p/inside-sbf-b…

They're back.

Everdell: So next, there were proffer sessions with prosecutors, right?

Gary Wang: Yes.

Everdell: You signed a proffer agreement, right?

Wang: Yes.

Everdell: It says, this is not a cooperation agreement, right?

Wang: Right.

Everdell: So next, there were proffer sessions with prosecutors, right?

Gary Wang: Yes.

Everdell: You signed a proffer agreement, right?

Wang: Yes.

Everdell: It says, this is not a cooperation agreement, right?

Wang: Right.

Everdell: In your 5 proffer sessions with the government, you went over all these events, right?

Gary Wang: Yes.

Everdell: The charges carry a maximum sentence of 50 years?

Wang: Right.

Everdell: But the US could sent a 5K letter to the court?

Wang: Yes.

Gary Wang: Yes.

Everdell: The charges carry a maximum sentence of 50 years?

Wang: Right.

Everdell: But the US could sent a 5K letter to the court?

Wang: Yes.

Everdell: No further questions.

Judge Kaplan: Re-direct.

AUSA Roos: The $35 million loan, do you know what it was for?

Gary Wang: I don't recall.

AUSA: Roos: How about DX 184? For $2.6 million - do you know what this was for?

Wang: No.

Judge Kaplan: Re-direct.

AUSA Roos: The $35 million loan, do you know what it was for?

Gary Wang: I don't recall.

AUSA: Roos: How about DX 184? For $2.6 million - do you know what this was for?

Wang: No.

AUSA Roos: Why did you sign them?

Gary Wang: I was given them to sign, Sam wanted me to sign them. I trusted him. The money came from Alameda.

AUSA Roos: Did the lawyers tell you where Alameda got the money from?

SBF's lawyer: Objection! Calls for speculation.

Gary Wang: I was given them to sign, Sam wanted me to sign them. I trusted him. The money came from Alameda.

AUSA Roos: Did the lawyers tell you where Alameda got the money from?

SBF's lawyer: Objection! Calls for speculation.

AUSA Roos: Were they used for market making? Did Alameda make withdrawls? How much?

Gary Wang: $8 billion.

AUSA Roos: What that necessary for market making?

Everdell: Objection!

Judge: Overruled.

Wang: No.

Gary Wang: $8 billion.

AUSA Roos: What that necessary for market making?

Everdell: Objection!

Judge: Overruled.

Wang: No.

AUSA Roos: Could all of the FTT have been sold at the market price?

Wang: It would drive the price down.

AUSA: By how much?

SBF's lawyer: Objection! Calls for speculation!

AUSA: They opened the door to it.

SBF's lawyer: The question opens the door for speculation

Wang: It would drive the price down.

AUSA: By how much?

SBF's lawyer: Objection! Calls for speculation!

AUSA: They opened the door to it.

SBF's lawyer: The question opens the door for speculation

AUSA Roos: What was the real reason Alameda was not shut down?

SBF's lawyer: Objection!

Judge: Sustained....

AUSA Roos: Back to the tweet, why did you say it was misleading?

Wang: It was illiquid.

[Tweet shown on screen, this time in Dark Mode]

SBF's lawyer: Objection!

Judge: Sustained....

AUSA Roos: Back to the tweet, why did you say it was misleading?

Wang: It was illiquid.

[Tweet shown on screen, this time in Dark Mode]

AUSA Roos: At your first meeting with the government, did you admit to committing crimes with the defendant?

Gary Wang: Yes.

AUSA: What were you told to do?

Wang: To tell the truth or not get a 5K letter, or worse.

Gary Wang: Yes.

AUSA: What were you told to do?

Wang: To tell the truth or not get a 5K letter, or worse.

AUSA: Your cooperation agreement - you pled to four crimes. Did you talk about the facts underlying them?

Wang: Yes.

AUSA: Three are four conspiracies - with who?

Wang: With Sam, Nishad and Caroline.

Wang: Yes.

AUSA: Three are four conspiracies - with who?

Wang: With Sam, Nishad and Caroline.

No re-direct. But...

Judge Kaplan: I have a couple of questions. This promissory note, you said it was for $35 million to make an investment - by whom?

Wang: I don't know. Some company Sam wanted me to invest in. My understanding was that Sam signed a larger note

Judge Kaplan: I have a couple of questions. This promissory note, you said it was for $35 million to make an investment - by whom?

Wang: I don't know. Some company Sam wanted me to invest in. My understanding was that Sam signed a larger note

Judge Kaplan: It was payable to Alameda research, right?

Wang: Yes.

Judge Kaplan: Either counsel want to follow up?

AUSA Roos: No, your Honor.

SBF's Everdell: It was for equity stakes?

Wang: I don't know.

Judge Kaplan: Witness is excused

Wang: Yes.

Judge Kaplan: Either counsel want to follow up?

AUSA Roos: No, your Honor.

SBF's Everdell: It was for equity stakes?

Wang: I don't know.

Judge Kaplan: Witness is excused

AUSA Sassoon: The government would like to call Caroline Ellison.

SBF's lawyer: We have some burning issues.

Judge Kaplan: And I'll do it on my timeline.

[Caroline Ellison enters the courtroom, in a red dress]

SBF's lawyer: We have some burning issues.

Judge Kaplan: And I'll do it on my timeline.

[Caroline Ellison enters the courtroom, in a red dress]

AUSA Sassoon: How do you know the defendant?

Ellison: At Jane Street then Alameda. We dated for a couple of years.

AUSA: Did you commit crimes?

Ellison: Fraud.

AUSA: With others?

Ellison: Yes.

AUSA: Do you see Sam Bankman-Fried?

Ellison: He's over there...

Ellison: At Jane Street then Alameda. We dated for a couple of years.

AUSA: Did you commit crimes?

Ellison: Fraud.

AUSA: With others?

Ellison: Yes.

AUSA: Do you see Sam Bankman-Fried?

Ellison: He's over there...

AUSA: What was his involvement in the crimes?

Ellison: He was the head of Alameda then FTX. He directed me to commit these crimes.

AUSA: What makes you guilty?

Ellison: Alameda took several billions of dollars from FTX customers and used it for investments.

Ellison: He was the head of Alameda then FTX. He directed me to commit these crimes.

AUSA: What makes you guilty?

Ellison: Alameda took several billions of dollars from FTX customers and used it for investments.

AUSA: What was the defendant's role?

Ellison: He set up the systems and told us to take the money.

AUSA: How much did Alameda take to repay its lenders?

Ellison: In the ballpark of $10 billion. Ultimately around $14 billion

Ellison: He set up the systems and told us to take the money.

AUSA: How much did Alameda take to repay its lenders?

Ellison: In the ballpark of $10 billion. Ultimately around $14 billion

AUSA: How did you defraud Alameda's lenders?

Ellison: I sent balance sheets that made Alameda look less risky that it was.

AUSA: Why was there not enough money for customers in Nov 2022?

Ellison: We had take it to repay lenders.

Ellison: I sent balance sheets that made Alameda look less risky that it was.

AUSA: Why was there not enough money for customers in Nov 2022?

Ellison: We had take it to repay lenders.

AUSA Sassoon: Your Honor, I can now get into the witness' background, or break for lunch.

Judge Kaplan: We'll take our break. Be back at 2 pm.

[Jury leaves. SBF looked straight ahead, then closes his air-gapped laptop. He walks back into holding cell.

Judge Kaplan: We'll take our break. Be back at 2 pm.

[Jury leaves. SBF looked straight ahead, then closes his air-gapped laptop. He walks back into holding cell.

Live tweeting of Ellison testimony will resume at 2 pm, here. Inner CIty Press is covering the case & and fillings: Watch this feed - at 2 pm and beyond...innercitypress.com/literarysbf3ga…

matthewrussellleeicp.substack.com/p/inside-sbf-b…

patreon.com/posts/filing-b…

matthewrussellleeicp.substack.com/p/inside-sbf-b…

patreon.com/posts/filing-b…

And they're back.

Judge Kaplan: You may proceed, Ms. Sassoon.

AUSA: Where did you grow up, and go to college?

Ellison: I grew up around Boston, then went to Stanford. I met the defendant at Jane Street. Then he left and started Alameda. We got coffee...

Judge Kaplan: You may proceed, Ms. Sassoon.

AUSA: Where did you grow up, and go to college?

Ellison: I grew up around Boston, then went to Stanford. I met the defendant at Jane Street. Then he left and started Alameda. We got coffee...

AUSA: Once you were at Alameda, and you discovered losses, what did the defendant tell you?

Ellison: That he was sorry and would tell me more.

AUSA: Did your relationship remain strictly professional?

Ellison: No.

Ellison: That he was sorry and would tell me more.

AUSA: Did your relationship remain strictly professional?

Ellison: No.

Ellison: We started sleeping together on and off in the summer of 2020. We dated and broke up.

AUSA: What did the defendant tell you about his ambitions?

Ellison: That he would be President.

AUSA: Of what?

Ellison: The United States.

AUSA: What did the defendant tell you about his ambitions?

Ellison: That he would be President.

AUSA: Of what?

Ellison: The United States.

AUSA: Did there come a time the defendant told you to use FTX funds?

SBF lawyer: Objection! Leading!

Judge Kaplan: Sustained.

AUSA: Where did you borrow from?

Ellison: Third parties and... FTX.

SBF lawyer: Objection! Leading!

Judge Kaplan: Sustained.

AUSA: Where did you borrow from?

Ellison: Third parties and... FTX.

AUSA: When did FTX receive money into Alameda's bank accounts?

Ellison: 2020. And into 2022. North Dimension was the name I was aware of.

AUSA: How much FTX money got deposited with Alameda?

Ellison: Ten to twenty billion dollars.

Ellison: 2020. And into 2022. North Dimension was the name I was aware of.

AUSA: How much FTX money got deposited with Alameda?

Ellison: Ten to twenty billion dollars.

AUSA: What did Alameda do with the money?

Ellison: Repay loans, investments, and stable coin conversions like USDC. That was about $2 billion.

AUSA: What happened to the rest?

Ellison: It was used for Alameda's purpose and other purposes.

Ellison: Repay loans, investments, and stable coin conversions like USDC. That was about $2 billion.

AUSA: What happened to the rest?

Ellison: It was used for Alameda's purpose and other purposes.

Ellison: FTX marketed itself as safe and well regulated.

AUSA: Was it?

Ellison: No. We also had a line of credit on FTX - we could withdraw coins even if we didn't have them.

AUSA: Were you told the size of the line of credit?

Ellison: No.

AUSA: Was it?

Ellison: No. We also had a line of credit on FTX - we could withdraw coins even if we didn't have them.

AUSA: Were you told the size of the line of credit?

Ellison: No.

AUSA: What size of line of credit would Alameda really have needed?

Ellison: One hundred or two hundred million.

AUSA: Million with an M?

Ellison: Yes, with an M.

AUSA: Were you aware if and when Alameda had to return the money?

Ellison: No.

Ellison: One hundred or two hundred million.

AUSA: Million with an M?

Ellison: Yes, with an M.

AUSA: Were you aware if and when Alameda had to return the money?

Ellison: No.

Ellison: If a coin was tradin g for higher on Binance, we could withdraw from FTX and sell there.

AUSA: Did you have concerns about Alameda using FTX customer funds?

Ellison: I thought customers weren't aware of. But I was just a trader at the time

AUSA: Did you have concerns about Alameda using FTX customer funds?

Ellison: I thought customers weren't aware of. But I was just a trader at the time

AUSA: Did you raise it to the defendant?

Ellison: Yes, I asked if it would show up on the audit. He said don't worry, the auditors won't be looking at that.

AUSA: When was that?

Ellison: 2020.

Ellison: Yes, I asked if it would show up on the audit. He said don't worry, the auditors won't be looking at that.

AUSA: When was that?

Ellison: 2020.

AUSA: Why did the defendant say you were having an audit?

Allison: He said, to appeal to investors.

AUSA: Was FTX disclosing to customers the Alameda line of credit?

Judge Kaplan: Compound. Rephrase.

AUSA: To auditors?

Ellison: No.

AUSA: Investors?

Ellison: No

Allison: He said, to appeal to investors.

AUSA: Was FTX disclosing to customers the Alameda line of credit?

Judge Kaplan: Compound. Rephrase.

AUSA: To auditors?

Ellison: No.

AUSA: Investors?

Ellison: No

AUSA: What is Binance?

Ellison: A competitor which owned $2 billion of our FTX stock. Sam wanted to buy it back in the summer of 2021.

AUSA: Who's in this photo?

Ellison: Sam and CZ.

AUSA: Exhibit 1638.

Ellison: A competitor which owned $2 billion of our FTX stock. Sam wanted to buy it back in the summer of 2021.

AUSA: Who's in this photo?

Ellison: Sam and CZ.

AUSA: Exhibit 1638.

AUSA: What did the defendant say about buying it back?

Ellison: Otherwise Binance would cause trouble.

AUSA: Who was in this discussion and where?

Ellison: Hong Kong office. It was me, Sam and Trabucco.

AUSA: Who is Trabucco?

Ellison: Sam Trabucco, Alameda co-CEO

Ellison: Otherwise Binance would cause trouble.

AUSA: Who was in this discussion and where?

Ellison: Hong Kong office. It was me, Sam and Trabucco.

AUSA: Who is Trabucco?

Ellison: Sam Trabucco, Alameda co-CEO

AUSA: What did you conclude from the defendant telling you to use the line of credit to buy out Binance?

Ellison: That he viewed it as a fund to use for our needs

AUSA: What was Alameda's source of funds in 2021?

Ellison: Loan from third party crypto lending desks

Ellison: That he viewed it as a fund to use for our needs

AUSA: What was Alameda's source of funds in 2021?

Ellison: Loan from third party crypto lending desks

AUSA: Which ones?

Ellison: Genesis. Later in 2021 we found more.

AUSA: What did Alameda pay for the FTT tokens?

Ellison: We paid nothing. Later the price in the seed round was ten cents. Then it went up to a dollar.

Ellison: Genesis. Later in 2021 we found more.

AUSA: What did Alameda pay for the FTT tokens?

Ellison: We paid nothing. Later the price in the seed round was ten cents. Then it went up to a dollar.

AUSA: What did the defendant tell you about FTT?

Ellison: That the one dollar threshold was important and that if it went below that we should start buying.

AUSA: Who was "we"?

Ellison: Alameda. Later FTT went up to $50

Ellison: That the one dollar threshold was important and that if it went below that we should start buying.

AUSA: Who was "we"?

Ellison: Alameda. Later FTT went up to $50

Ellison: Sam got upset at me when I discussed our FTT trading in front of others.

AUSA: GX 1622 - what is it?

Ellison: A Signal chat between me and Victor Xu, an Alameda trader at the time

AUSA: GX 1622 - what is it?

Ellison: A Signal chat between me and Victor Xu, an Alameda trader at the time

In the message, with self-erase set for 1 week, Ellison told Xu sorry for being cagey in discussing FTT trading, "SBF was upset at me."

AUSA: Did you put FTT on Alameda's balance sheet?

Ellison: Initially no. Because we couldn't sell it for the current price.

AUSA: Did you put FTT on Alameda's balance sheet?

Ellison: Initially no. Because we couldn't sell it for the current price.

AUSA: When the defendant told you to put FTT on the balance sheet, did he say why?

Ellison: To get loans from Genesis. I thought it was misleading.

AUSA: But you did it.

Ellison: Yes.

Ellison: To get loans from Genesis. I thought it was misleading.

AUSA: But you did it.

Ellison: Yes.

Ellison: Then there were the Sam coins, including Solano which he didn't create but played a big role in promoting. It was more liquid than the other Sam coins.

AUSA: Who owned the Sam coins?

Ellison: Alameda was a large holder.

AUSA: Who owned the Sam coins?

Ellison: Alameda was a large holder.

AUSA: When did you become co-CEO?

Ellison: 2021. Sam said he wanted to step down, to separate things optically. We were on a break. But we started dating again.

AUSA: How would you describe the power dynamic of your personal relationship?

SBF's lawyer: Objection!

Ellison: 2021. Sam said he wanted to step down, to separate things optically. We were on a break. But we started dating again.

AUSA: How would you describe the power dynamic of your personal relationship?

SBF's lawyer: Objection!

AUSA: Why did you break up?

Ellison: He wasn't spending much time with me.

AUSA: Was it secret?

Ellison: At first. Then he told me I could say we were living together, but no more.

AUSA: What was your salary?

Ellison: $200,000. Then a bonus in 2021 of $20 million

Ellison: He wasn't spending much time with me.

AUSA: Was it secret?

Ellison: At first. Then he told me I could say we were living together, but no more.

AUSA: What was your salary?

Ellison: $200,000. Then a bonus in 2021 of $20 million

Ellison: I withdrew $10 million for an investment in a start up. $100,000 for a loan to my parents. And $2 million for my own donor-advised fund.

AUSA: Did you have equity in Alameda?

Ellison No. And 0.5% of FTX.

AUSA: Did you have equity in Alameda?

Ellison No. And 0.5% of FTX.

AUSA: When you were co-CEO, what did you do?

Ellison: It didn't change much.

AUSA: Did you feel qualified?

Ellison: Not really. But Sam said I should do it. I checked everything with him. He was the person I reported to. He could fire me

Ellison: It didn't change much.

AUSA: Did you feel qualified?

Ellison: Not really. But Sam said I should do it. I checked everything with him. He was the person I reported to. He could fire me

AUSA: Did you get any loans from Alameda?

Ellison: One loan of $3.5 million for a gambling company people at FTX wanted to put in my name since I wasn't on the books of FTX. Money also went to political contributions. Ryan Salame got a $35 million loan

Ellison: One loan of $3.5 million for a gambling company people at FTX wanted to put in my name since I wasn't on the books of FTX. Money also went to political contributions. Ryan Salame got a $35 million loan

AUSA: What was Ryan Salame using the loans for?

Ellison: Contributions to Republicans. Sam gave $10 million to Biden, he thought it bought him access.

Ellison: Contributions to Republicans. Sam gave $10 million to Biden, he thought it bought him access.

AUSA: What did the defendant you about risk?

Ellison: He said it was OK if positive EV, expected value. He said he was willing to take large coin flips - he talked about being willing to flip a coin & destroy the world, as long as a win would make it twice as good

Ellison: He said it was OK if positive EV, expected value. He said he was willing to take large coin flips - he talked about being willing to flip a coin & destroy the world, as long as a win would make it twice as good

AUSA Sassoon: This would be a good place to take a break, if we are going to take a mid afternoon break.

Judge Kaplan. We are. Fifteen minutes.

Inner City Press covering case(s)

&…

Back in 15

Feed continues in 15 minmatthewrussellleeicp.substack.com/p/inside-sbf-b…

patreon.com/posts/filing-b…

Judge Kaplan. We are. Fifteen minutes.

Inner City Press covering case(s)

&…

Back in 15

Feed continues in 15 minmatthewrussellleeicp.substack.com/p/inside-sbf-b…

patreon.com/posts/filing-b…

They're back.

AUSA: You were speaking about expected value

[Inner City Press: actually, about destroying the world]

AUSA: What is this?

Ellison: One of my Google Docs.

AUSA: Did you write parts of this page?

Ellison: Yes. I would keep these Docs, I'd add notes

AUSA: You were speaking about expected value

[Inner City Press: actually, about destroying the world]

AUSA: What is this?

Ellison: One of my Google Docs.

AUSA: Did you write parts of this page?

Ellison: Yes. I would keep these Docs, I'd add notes

AUSA: What's this?

Ellison: I cut and pasted from Sam's bad case scenario, with FTT, SOL - we owned a lot of Solana -- and SRM down 75%, and investments down 100%

AUSA: How would that be possible?

Ellison: They were speculative.

Ellison: I cut and pasted from Sam's bad case scenario, with FTT, SOL - we owned a lot of Solana -- and SRM down 75%, and investments down 100%

AUSA: How would that be possible?

Ellison: They were speculative.

AUSA: At this time, what was FTX's equity value?

Ellison: $20 billion.

AUSA: Did you share your conclusions on possible impacts on Alameda with the defendant?

Ellison: Yes. He suggested we shift our loans to fixed term...

AUSA: Did he dispute the risk?

Ellison: No

Ellison: $20 billion.

AUSA: Did you share your conclusions on possible impacts on Alameda with the defendant?

Ellison: Yes. He suggested we shift our loans to fixed term...

AUSA: Did he dispute the risk?

Ellison: No

AUSA: What was the value on paper of the Sam coins?

Ellison: About $10 billion, on paper.

Judge Kaplan: Valued how?

Ellison: Mark to market.

AUSA: Why exclude them?

Ellison: We couldn't see them easily

Ellison: About $10 billion, on paper.

Judge Kaplan: Valued how?

Ellison: Mark to market.

AUSA: Why exclude them?

Ellison: We couldn't see them easily

[Ellison: we couldn't SELL them easily]

AUSA: What's in Cell E-18 of this spread sheet?

Ellison: I thought, We're negative $2.7 billion

AUSA: When you saw the negative, how did it impact your view of making more illiquid investments?

Ellison: We shouldn't continue

AUSA: What's in Cell E-18 of this spread sheet?

Ellison: I thought, We're negative $2.7 billion

AUSA: When you saw the negative, how did it impact your view of making more illiquid investments?

Ellison: We shouldn't continue

AUSA: What's this?

Ellison: What Sam thought the investments would be worth, $300 million and more.

AUSA: This asks what would be the impact of selling more FTT - what did you say?

Ellison: That it would go down 50% and reduce our loans from Genesis.

Ellison: What Sam thought the investments would be worth, $300 million and more.

AUSA: This asks what would be the impact of selling more FTT - what did you say?

Ellison: That it would go down 50% and reduce our loans from Genesis.

AUSA: What was the volume of Alameda's loans at the time?

Ellison: Over $9 billion.

AUSA: When you wrote "FTX borrows" what did you mean?

Ellison: The money on the FTX exchange that Alameda could make use of: $7 billion. We had done it before.

Ellison: Over $9 billion.

AUSA: When you wrote "FTX borrows" what did you mean?

Ellison: The money on the FTX exchange that Alameda could make use of: $7 billion. We had done it before.

AUSA: Did the defendant question the thinking behind your spread sheet?

SBF's lawyer: Objection!

Judge Kaplan: On what basis?

SBF's lawyer: It builds in an assumption.

Judge: Overruled.

AUSA: How are these numbers different?

Ellison: We're down $3 billion

SBF's lawyer: Objection!

Judge Kaplan: On what basis?

SBF's lawyer: It builds in an assumption.

Judge: Overruled.

AUSA: How are these numbers different?

Ellison: We're down $3 billion

AUSA: You were assuming that FTX customer money would be available to Alameda?

Ellison: That's right.

AUSA: What does this mean, "Genesis freaks out immediately?"

Ellison: That Genesis would call in all our loans.

Ellison: That's right.

AUSA: What does this mean, "Genesis freaks out immediately?"

Ellison: That Genesis would call in all our loans.

AUSA: You calculated a 30% chance Alameda could not repay its loans - was that of concern?

Ellison: Yes.

AUSA: Even if you used FTX customer funds?

SBF's lawyer: Objection!

Judge Kaplan: Overruled

AUSA: And you still wouldn't be able to repay

Ellison: That's right

Ellison: Yes.

AUSA: Even if you used FTX customer funds?

SBF's lawyer: Objection!

Judge Kaplan: Overruled

AUSA: And you still wouldn't be able to repay

Ellison: That's right

AUSA: Do you remember how you conveyed this document to the defendant?

Ellison: I don't remember if it was over Signal or in person.

AUSA: What was his reponse?

Ellison: He didn't raise any objections.

Ellison: I don't remember if it was over Signal or in person.

AUSA: What was his reponse?

Ellison: He didn't raise any objections.

AUSA: Were you able to convert over to fixed term loans?

Ellison: Not much.

AUSA: Did you tell the defendant?

Ellison: Yes, I regularly updated him. He wanted to expand investments.

AUSA: And if Genesis recalled the loans?

Ellison: We'd borrow from FTX

Ellison: Not much.

AUSA: Did you tell the defendant?

Ellison: Yes, I regularly updated him. He wanted to expand investments.

AUSA: And if Genesis recalled the loans?

Ellison: We'd borrow from FTX

AUSA: What did the defendant say in this tweet?

Ellison: That FTX was starting a venture fund. This was part of Sam's general push to do more investments.

AUSA: If the money was coming from Alameda, why was it called FTX?

Ellison: The brand.

Ellison: That FTX was starting a venture fund. This was part of Sam's general push to do more investments.

AUSA: If the money was coming from Alameda, why was it called FTX?

Ellison: The brand.

AUSA: In 2022 did the defendant buy shares in Robin Hood?

Ellison: Yes. It was paid for by Alameda.

AUSA: But why did he move the shares?

Ellison: He didn't want his name associated with Alameda.

Ellison: Yes. It was paid for by Alameda.

AUSA: But why did he move the shares?

Ellison: He didn't want his name associated with Alameda.

AUSA: Here is GX 48A

[It has names redacted, except for USD and coin SOL]

AUSA: How much crypto was Alameda borrowing from FTX?

Ellison: $3 billion.

AUSA: Here's GX 49A, May 7, 2022 update

Judge Kaplan: Received.

SBF's lawyer: I was about to say, No objection

[It has names redacted, except for USD and coin SOL]

AUSA: How much crypto was Alameda borrowing from FTX?

Ellison: $3 billion.

AUSA: Here's GX 49A, May 7, 2022 update

Judge Kaplan: Received.

SBF's lawyer: I was about to say, No objection

AUSA: What did you mean by worries slash questions?

Ellison: Just that. I was concerned about telling lenders.

AUSA: Sam Bankman-Fried wrote, it could get worse. You wrote, I don't think so.

Ellison: Our lenders had no resource against Paper Bird

Ellison: Just that. I was concerned about telling lenders.

AUSA: Sam Bankman-Fried wrote, it could get worse. You wrote, I don't think so.

Ellison: Our lenders had no resource against Paper Bird

AUSA Sassoon. Did it get worse?

Ellison: Yes

AUSA Sassoon: This would be a good time to break.

Judge Kaplan: OK. The head of our jury department wants to speak with the jurors, please wait for her

Ellison: Yes

AUSA Sassoon: This would be a good time to break.

Judge Kaplan: OK. The head of our jury department wants to speak with the jurors, please wait for her

[Jury leaves]

Judge Kaplan: Who are the next witnesses?

AUSA Sassoon: This is by far our longest witness. The cross and direct will definitely take tomorrow. Then Zac Prince, Chris "Drapie" (sp)

Judge Kaplan: When might you rest?

AUSA: October 26 or 27

Judge Kaplan: Who are the next witnesses?

AUSA Sassoon: This is by far our longest witness. The cross and direct will definitely take tomorrow. Then Zac Prince, Chris "Drapie" (sp)

Judge Kaplan: When might you rest?

AUSA: October 26 or 27

Judge Kaplan: And a defense case?

SBF's lawyer: A week? Ten days?

Judge Kaplan: What else?

AUSA: The virtual Ukraine witness.

Judge Kaplan: Can't someone else say his things?

AUSA: We're asking for him.

Judge Kaplan: Consider alternatives. I have to be satisfied

SBF's lawyer: A week? Ten days?

Judge Kaplan: What else?

AUSA: The virtual Ukraine witness.

Judge Kaplan: Can't someone else say his things?

AUSA: We're asking for him.

Judge Kaplan: Consider alternatives. I have to be satisfied

AUSA: We'll resubmit this issue later this week... We filed a letter about precluding the value of Anthropic.

SBF's lawyer: We would like to respond.

AUSA Sassoon: This witness made a personal investment in Anthropic.

SBF's lawyer: We'll file by 8 pm

SBF's lawyer: We would like to respond.

AUSA Sassoon: This witness made a personal investment in Anthropic.

SBF's lawyer: We'll file by 8 pm

AUSA Sassoon: We have a motion in limine about the all-hands meeting, statements she made before ever talking with the government, in Nov 9, after Binance agreed to acquire FTX and make the customers whole

SBF's lawyer: Coming clean to co-conspirators?

SBF's lawyer: Coming clean to co-conspirators?

Judge Kaplan: Thanks folks.

[Judge leaves - Stories coming on ,

& InnerCityPress.com

matthewrussellleeicp.substack.com/p/inside-sbf-b…

patreon.com/posts/filing-b…

[Judge leaves - Stories coming on ,

& InnerCityPress.com

matthewrussellleeicp.substack.com/p/inside-sbf-b…

patreon.com/posts/filing-b…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter