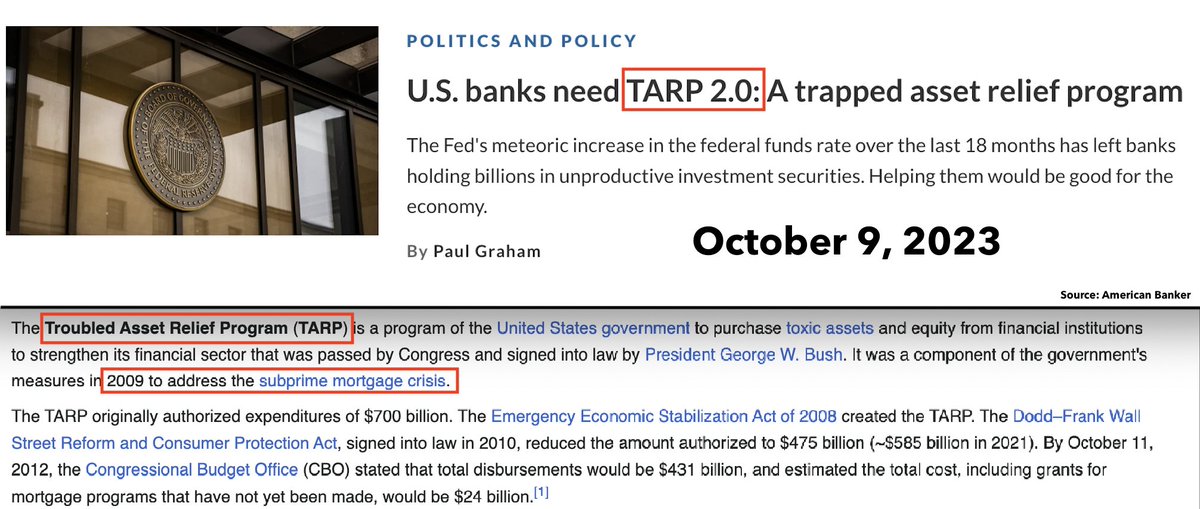

Veteran banker calling for "TARP 2.0" in Op-Ed to help banks with steep unrealized losses on their securities holdings

Proposal would lend up to $1 Trillion against securities that have lost value to Fed's "meteoric increase" in interest rates

1/5

Proposal would lend up to $1 Trillion against securities that have lost value to Fed's "meteoric increase" in interest rates

1/5

It would be a "Trapped Asset Relief Program" instead of "Troubled Asset Relief Program."

Author wants U.S. gov to allow banks to borrow on a secured basis by pledging investment collateral & borrowing at the weighted average rate of that collateral.

h/t @TheBondFreak

2/5

Author wants U.S. gov to allow banks to borrow on a secured basis by pledging investment collateral & borrowing at the weighted average rate of that collateral.

h/t @TheBondFreak

2/5

Funded by warrants issued to Treasury on behalf of FDIC/Fed, this assistance would only be applicable to available-for-sale securities, not held-to-maturity.

As of writing, this is a highly non-conventional approach, and not one that I'm aware gov is considering.

3/5

As of writing, this is a highly non-conventional approach, and not one that I'm aware gov is considering.

3/5

Author estimates this financing would be 300 basis points below market rate, on $1 trillion of potential borrowings would cost $30 billion per year. That's a lot of warrants...

(warrants are similar to a dilutive version of a long-duration call option)

4/5

(warrants are similar to a dilutive version of a long-duration call option)

4/5

The "bailout" would not be the loan itself, but the exceptionally low interest rate of the loan (well below what the U.S. government borrows at, likely).

$30 billion per year in warrants is... a lot of warrants. No call for preferred equity as in original TARP

5/6

$30 billion per year in warrants is... a lot of warrants. No call for preferred equity as in original TARP

5/6

Just want to re-iterate, as I indicated earlier in this thread, this idea is not a policy proposal coming from the government. It's a banker writing an Op-Ed in @AmerBanker

Here is full piece (paywalled):

6/6americanbanker.com/opinion/u-s-ba…

Here is full piece (paywalled):

6/6americanbanker.com/opinion/u-s-ba…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter