Co-founder of Monetary Matters Network: https://t.co/yANVgsTvJU

7 subscribers

How to get URL link on X (Twitter) App

To be clear, Jim's point isn't just the nominal number of unprofitable CapEx being larger than late 1990s telecom boom (obviously true, numbers go up over time), but that *the percentage* of unprofitable spending is higher now too. This surprised me...

To be clear, Jim's point isn't just the nominal number of unprofitable CapEx being larger than late 1990s telecom boom (obviously true, numbers go up over time), but that *the percentage* of unprofitable spending is higher now too. This surprised me...

Trump Market Neutral basket up 1 rom March 4 to November 8

Trump Market Neutral basket up 1 rom March 4 to November 8

Realizing they were hedged the wrong way, $ZION is taking their losses on (receive-fixed interest rate swaps) & replacing them w/ (pay-fixed swaps)

Realizing they were hedged the wrong way, $ZION is taking their losses on (receive-fixed interest rate swaps) & replacing them w/ (pay-fixed swaps)

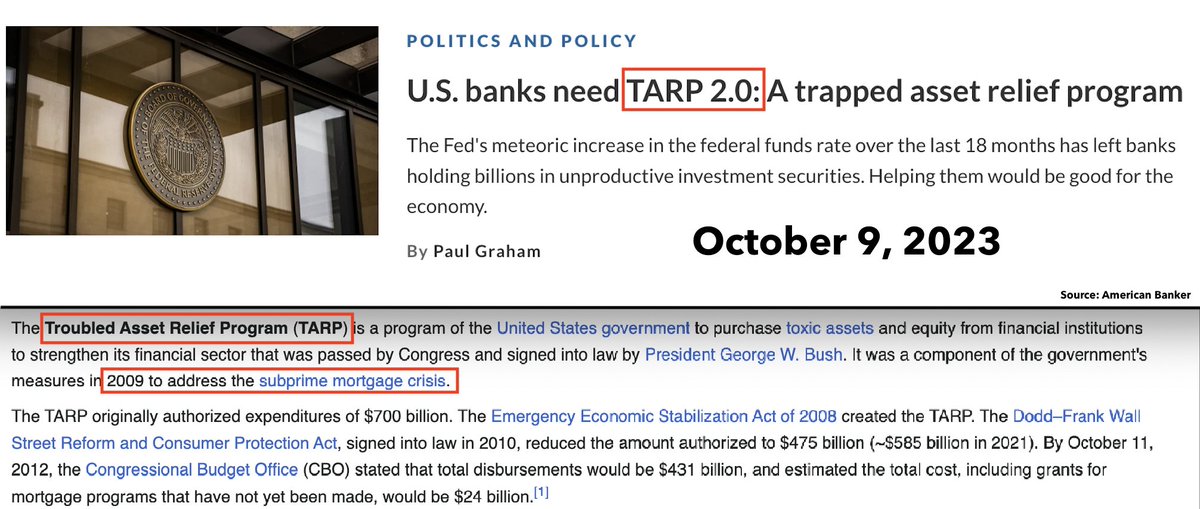

It would be a "Trapped Asset Relief Program" instead of "Troubled Asset Relief Program."

It would be a "Trapped Asset Relief Program" instead of "Troubled Asset Relief Program."

Nominally (blue line), U.S. commercial banks own as much agency mortgage-backed securities (MBS) now as they did in January 2021.

Nominally (blue line), U.S. commercial banks own as much agency mortgage-backed securities (MBS) now as they did in January 2021.

Before I share methodology, a huge caveat:

Before I share methodology, a huge caveat:

note: a fuller quote would be "hedging their interest rate risk WITH SWAPS"

note: a fuller quote would be "hedging their interest rate risk WITH SWAPS"

Michael's measure of Fed liquidity (red line) bottomed in October 2022, and he argues this has been supporting the stock market (NASDAQ in orange)...

Michael's measure of Fed liquidity (red line) bottomed in October 2022, and he argues this has been supporting the stock market (NASDAQ in orange)...

https://twitter.com/ForwardGuidance/status/1668646800780083200Cinch quote right here.

https://twitter.com/ForwardGuidance/status/1668646804685037568

- fiscal stimulus is offsetting tight monetary policy, meaning "higher for longer" is the law of the land

- fiscal stimulus is offsetting tight monetary policy, meaning "higher for longer" is the law of the land

This is his fund which has outperformed the S&P 500 since inception in January 2020

This is his fund which has outperformed the S&P 500 since inception in January 2020

A few notes...

A few notes...

I'll share a few thoughts below but before I do, I want to give a big thank you to @vaneck_us for helping make interviews like this one available to all.

I'll share a few thoughts below but before I do, I want to give a big thank you to @vaneck_us for helping make interviews like this one available to all.

Danielle's thesis is that Powell will not rest until the "Fed Put" is dead.

Danielle's thesis is that Powell will not rest until the "Fed Put" is dead.

First Republic preferred stock trading at a $0.28 cents in pre-market. This is just over "1 cent on the dollar" as par of $25.00 is typical for preferred instruments.

First Republic preferred stock trading at a $0.28 cents in pre-market. This is just over "1 cent on the dollar" as par of $25.00 is typical for preferred instruments.