[1] Introduction

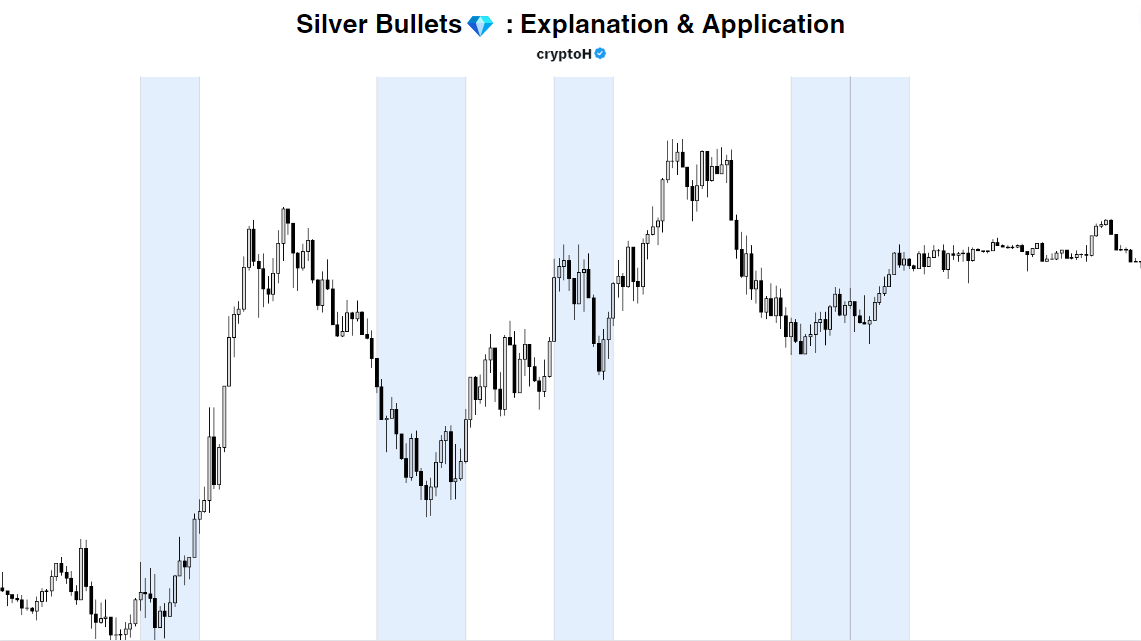

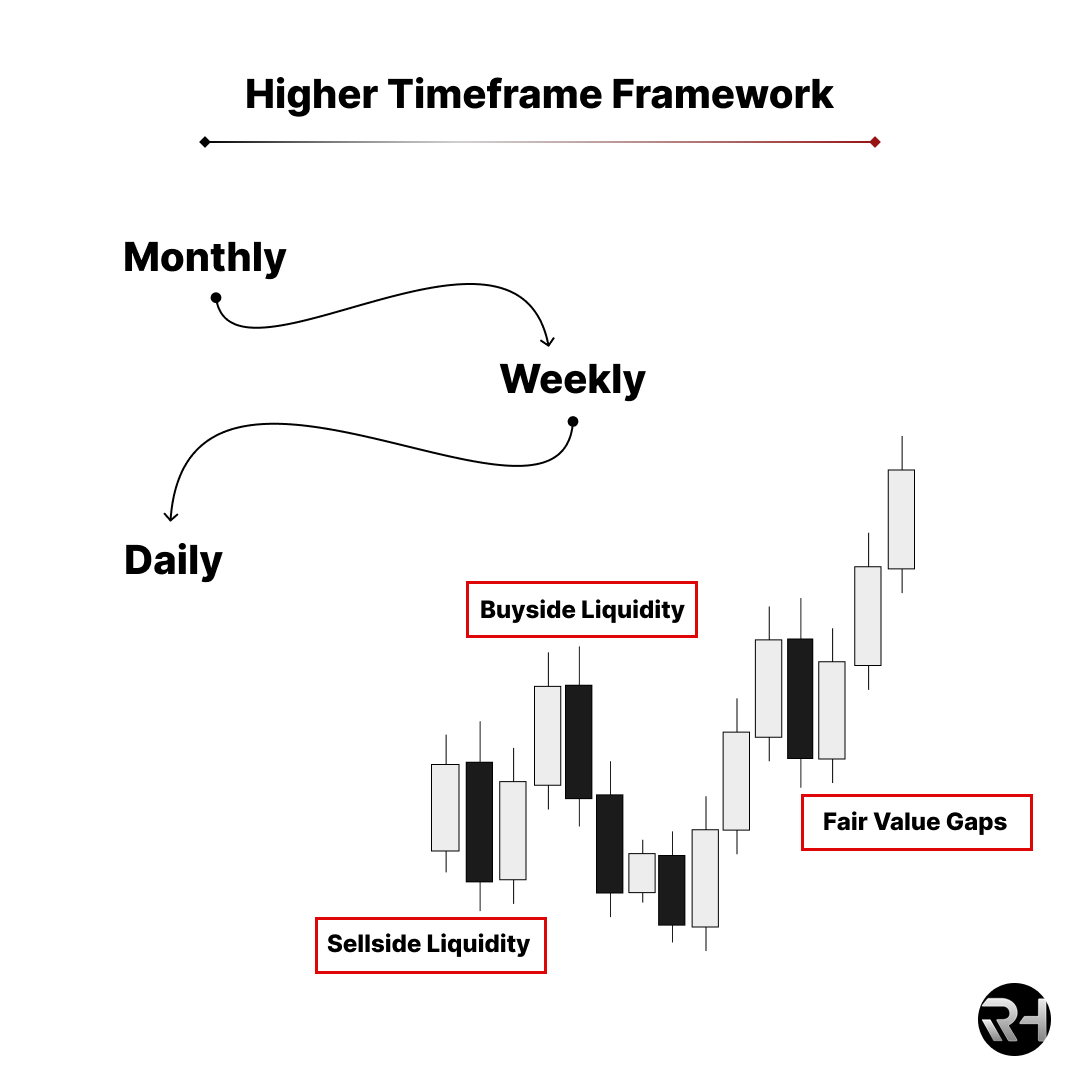

Silver bullets occur at specific time windows which push price aggressively algorithmically towards a higher timeframe draw on liquidity

A bias formed in line with the weekly candle expansion gives the highest probability, I have my thread attached here

Silver bullets occur at specific time windows which push price aggressively algorithmically towards a higher timeframe draw on liquidity

A bias formed in line with the weekly candle expansion gives the highest probability, I have my thread attached here

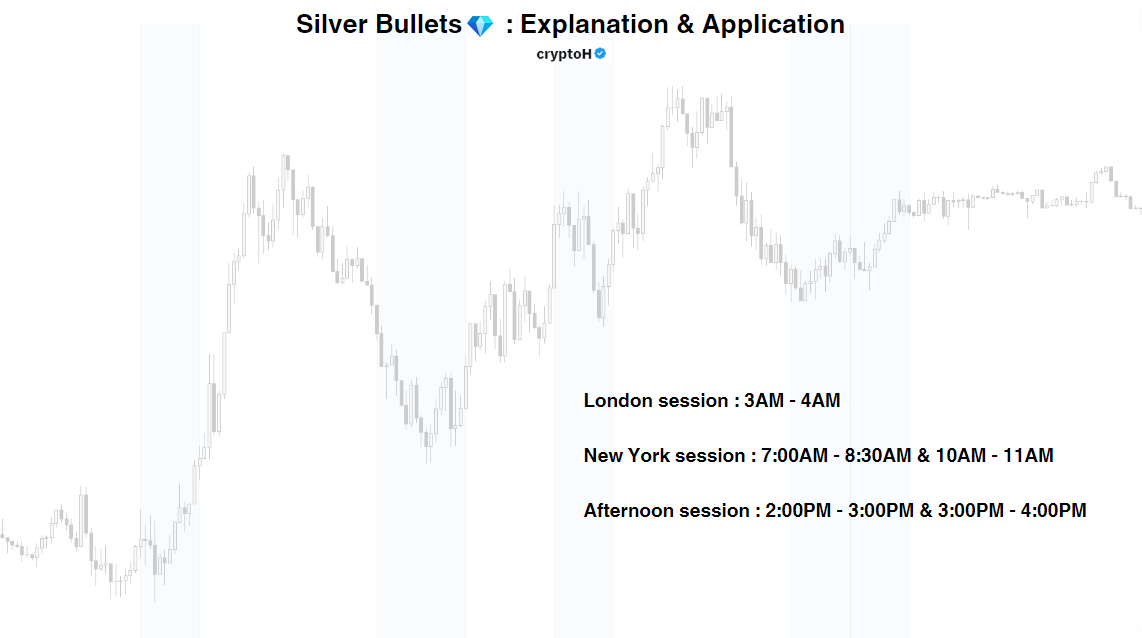

[2] Timings

London session : 3AM - 4AM

New York session : 7:00AM - 8:30AM & 10AM - 11AM

Afternoon session : 2:00PM - 3:00PM & 3:00PM - 4:00PM

You only need to be present in-front of your screen during this time and make your decisions accordingly.

London session : 3AM - 4AM

New York session : 7:00AM - 8:30AM & 10AM - 11AM

Afternoon session : 2:00PM - 3:00PM & 3:00PM - 4:00PM

You only need to be present in-front of your screen during this time and make your decisions accordingly.

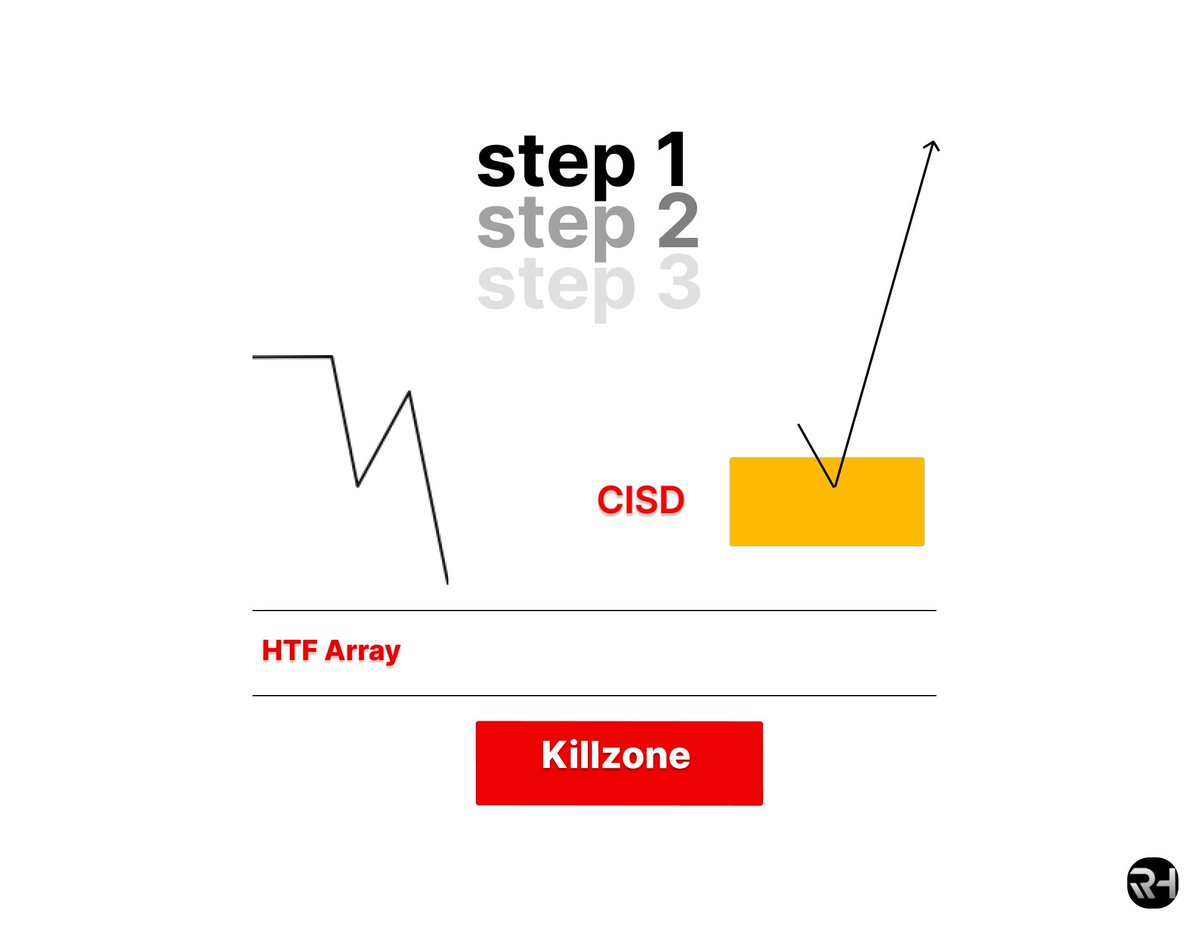

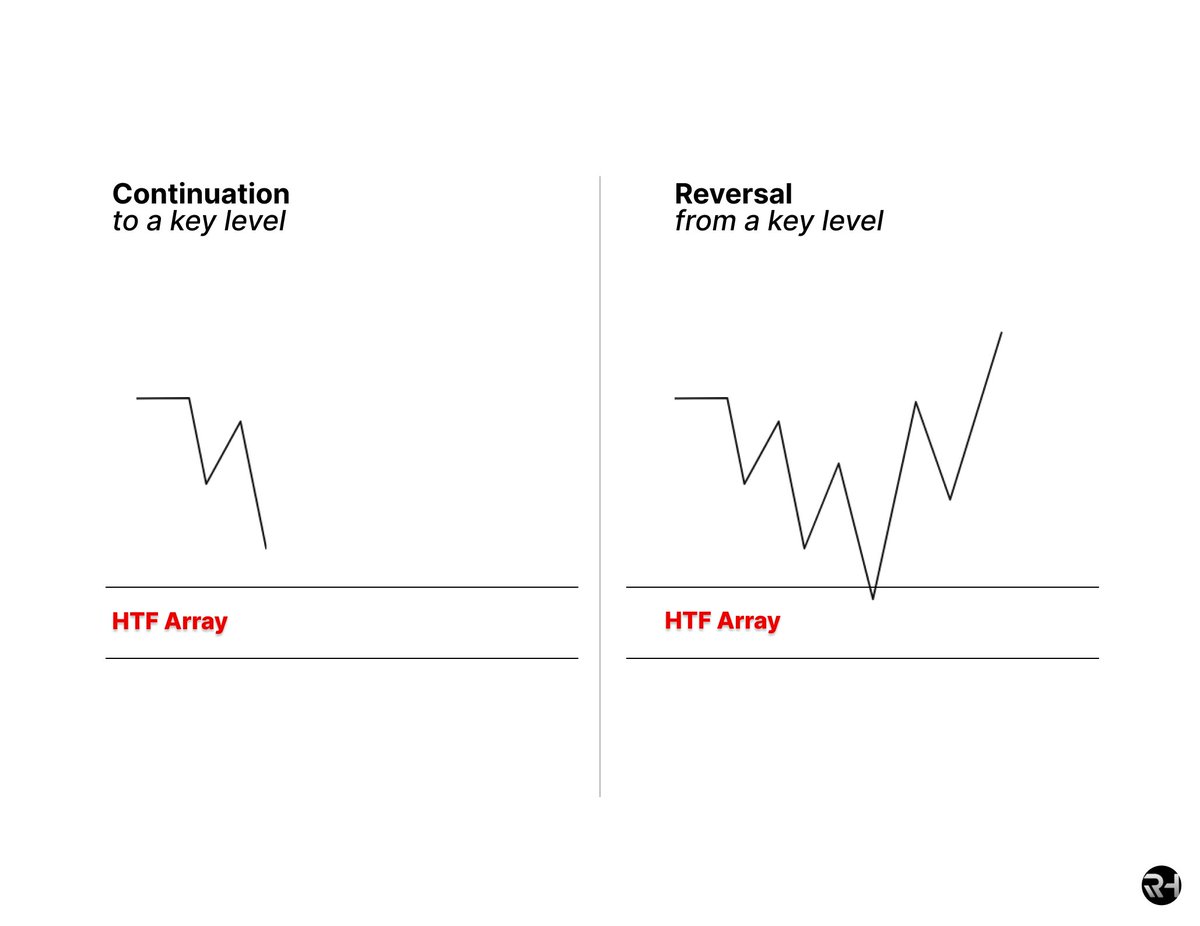

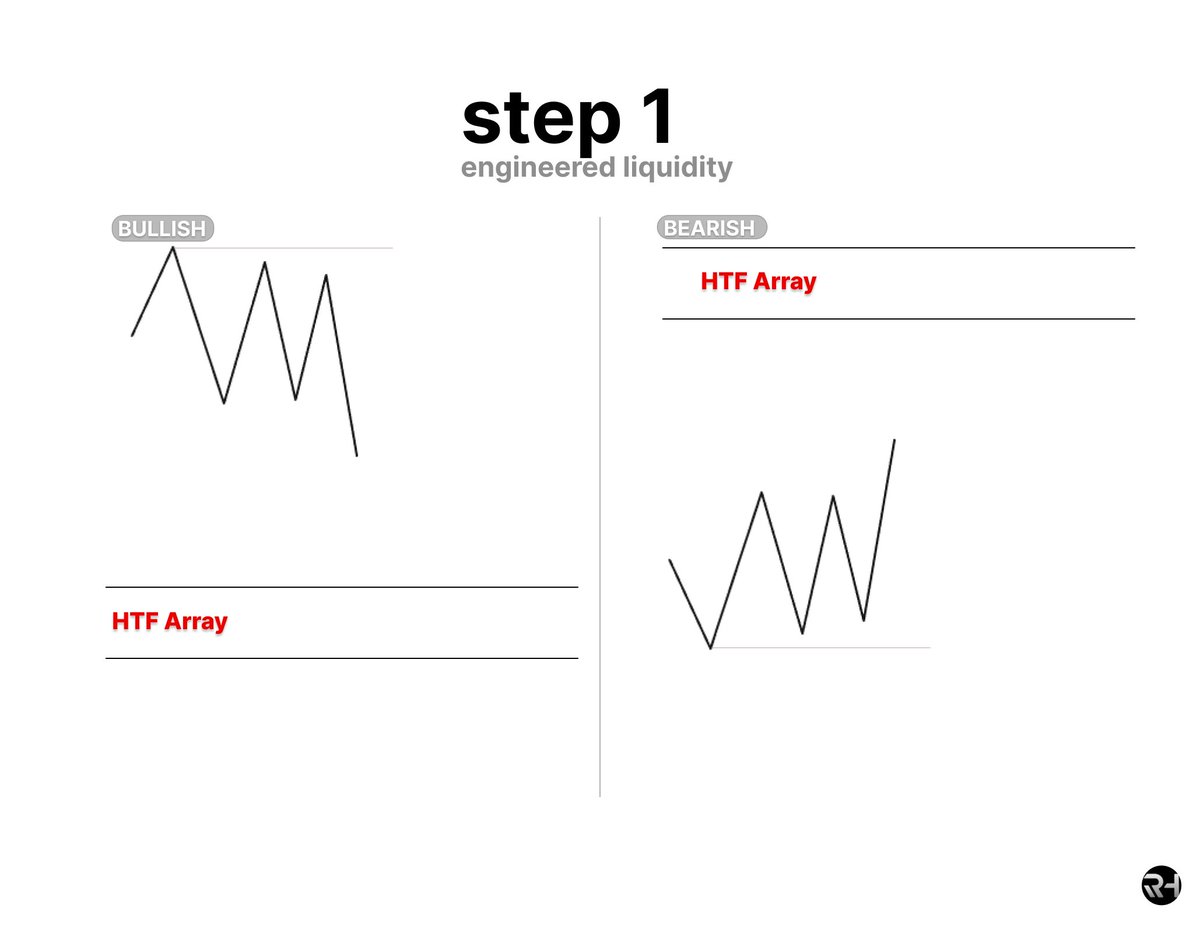

[3] How do you find the higher probability setups?

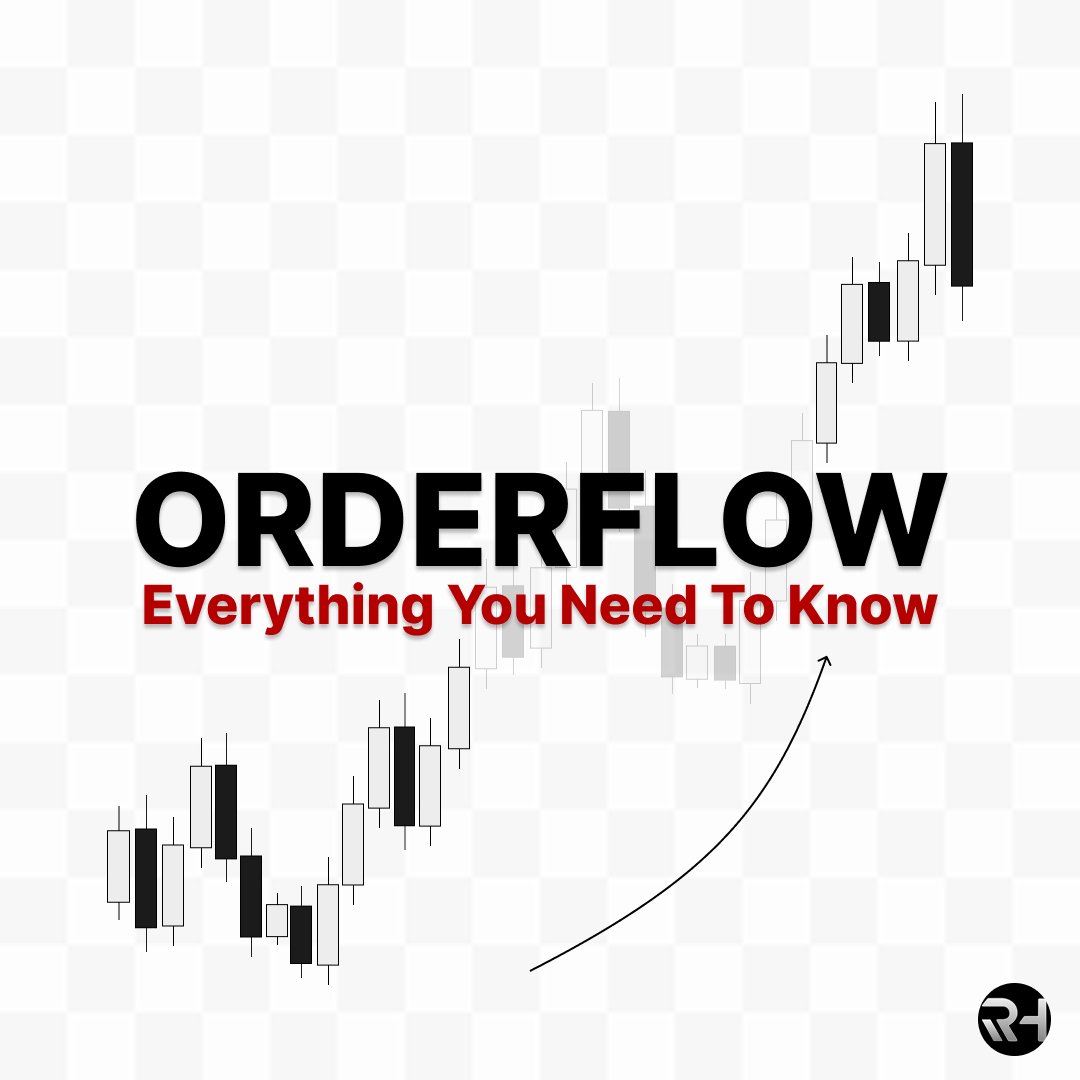

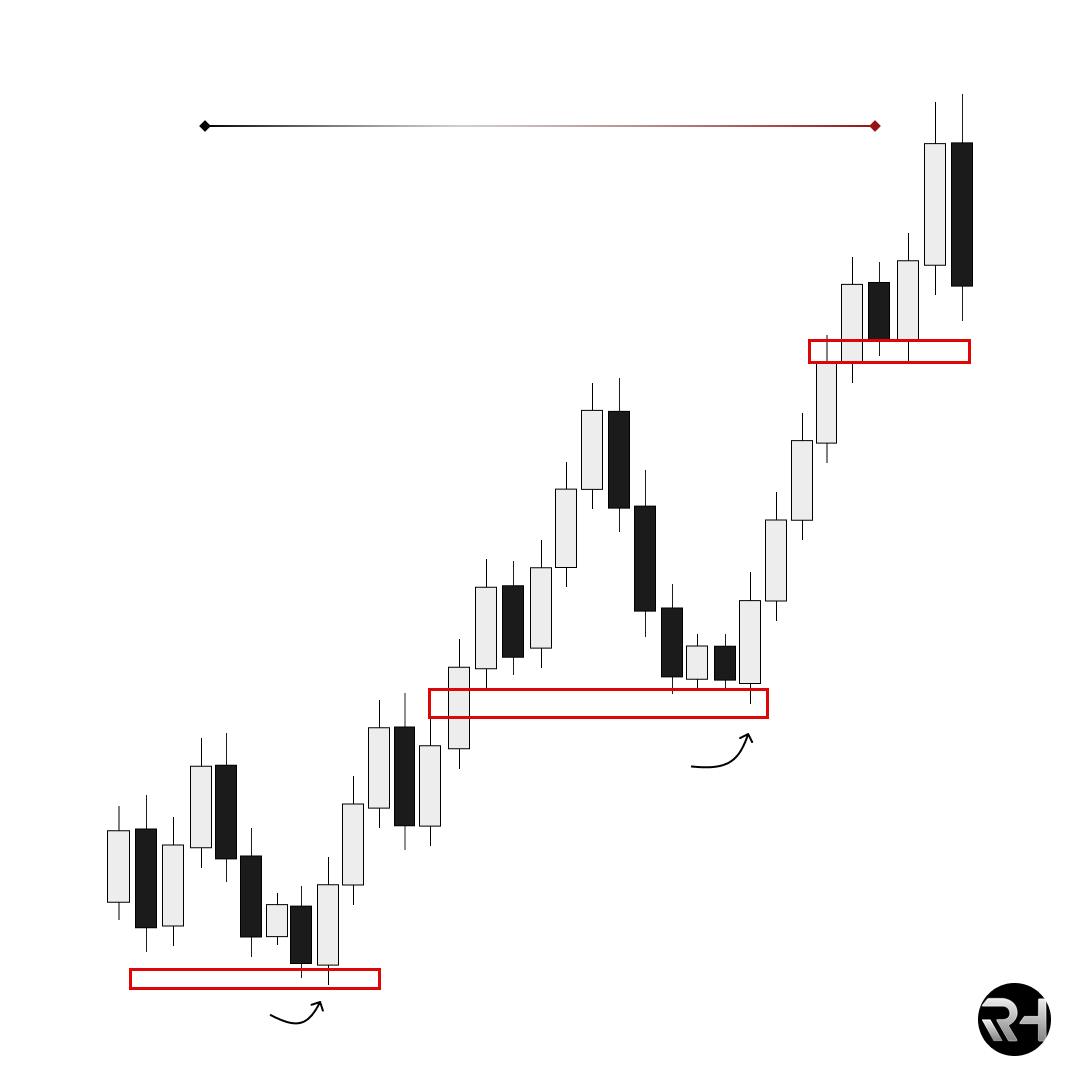

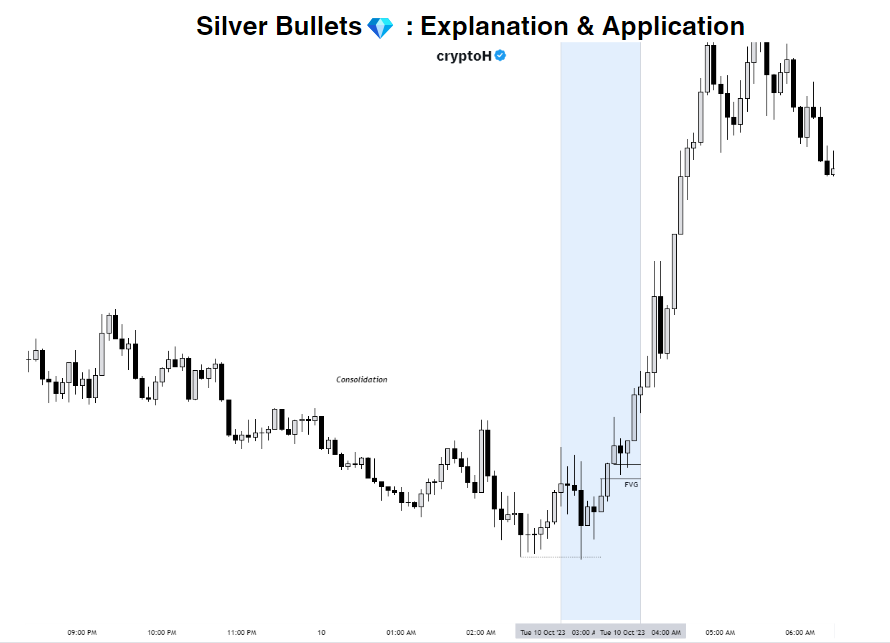

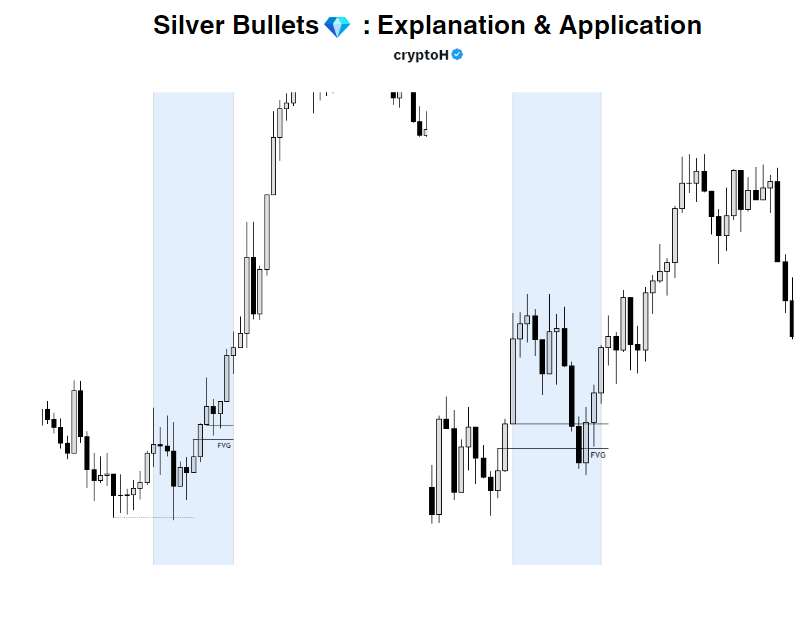

As price always moves from consolidation -> expansion and so on

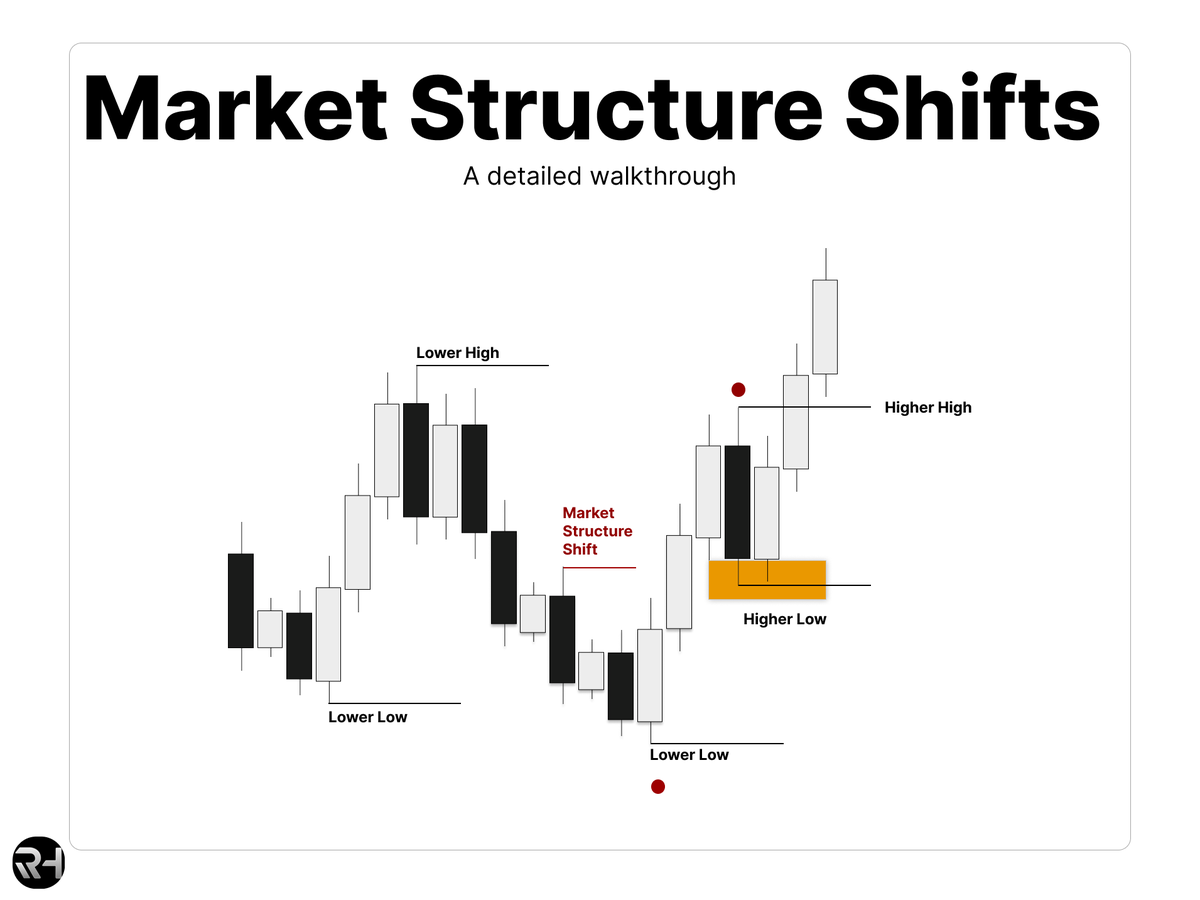

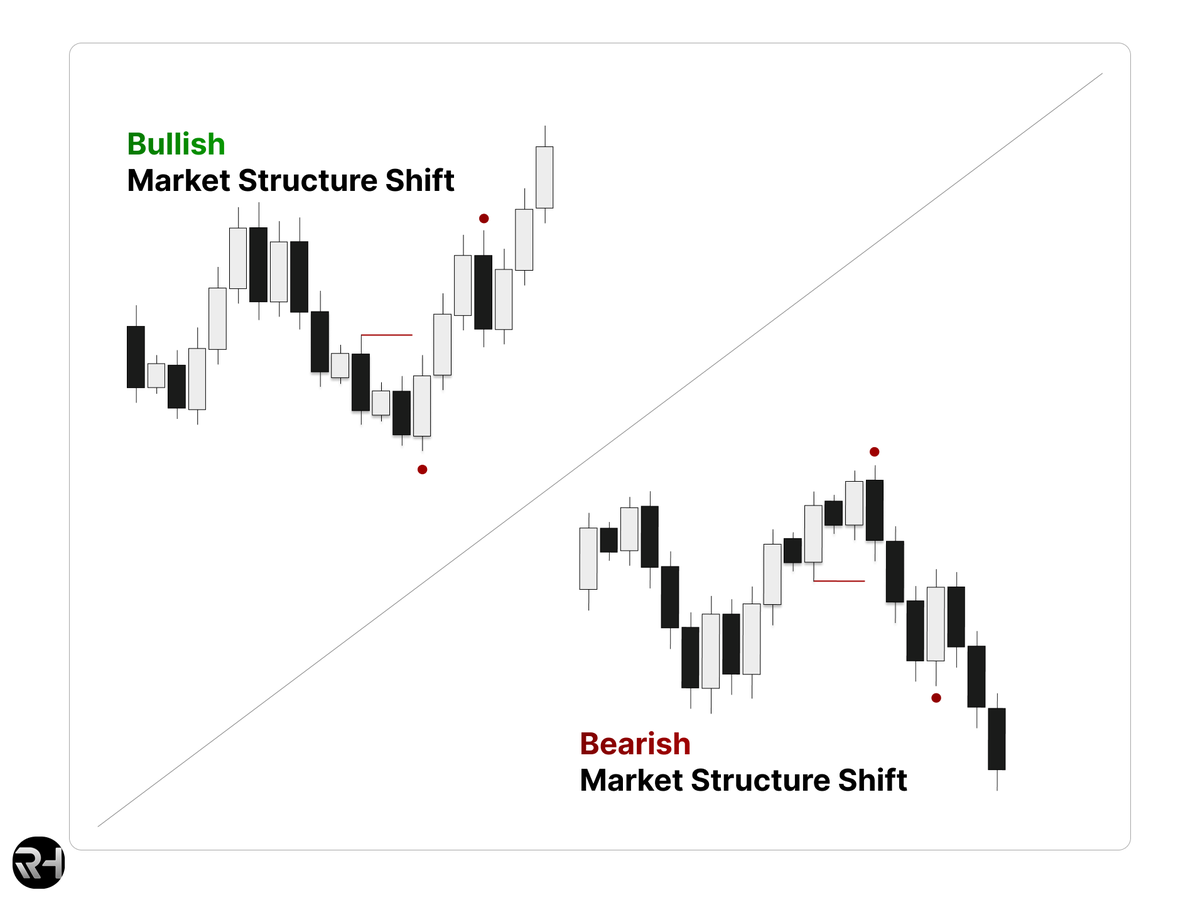

You wait for price to show you market structure before the silver bullet timings which can then be used as an entry i.e an FVG

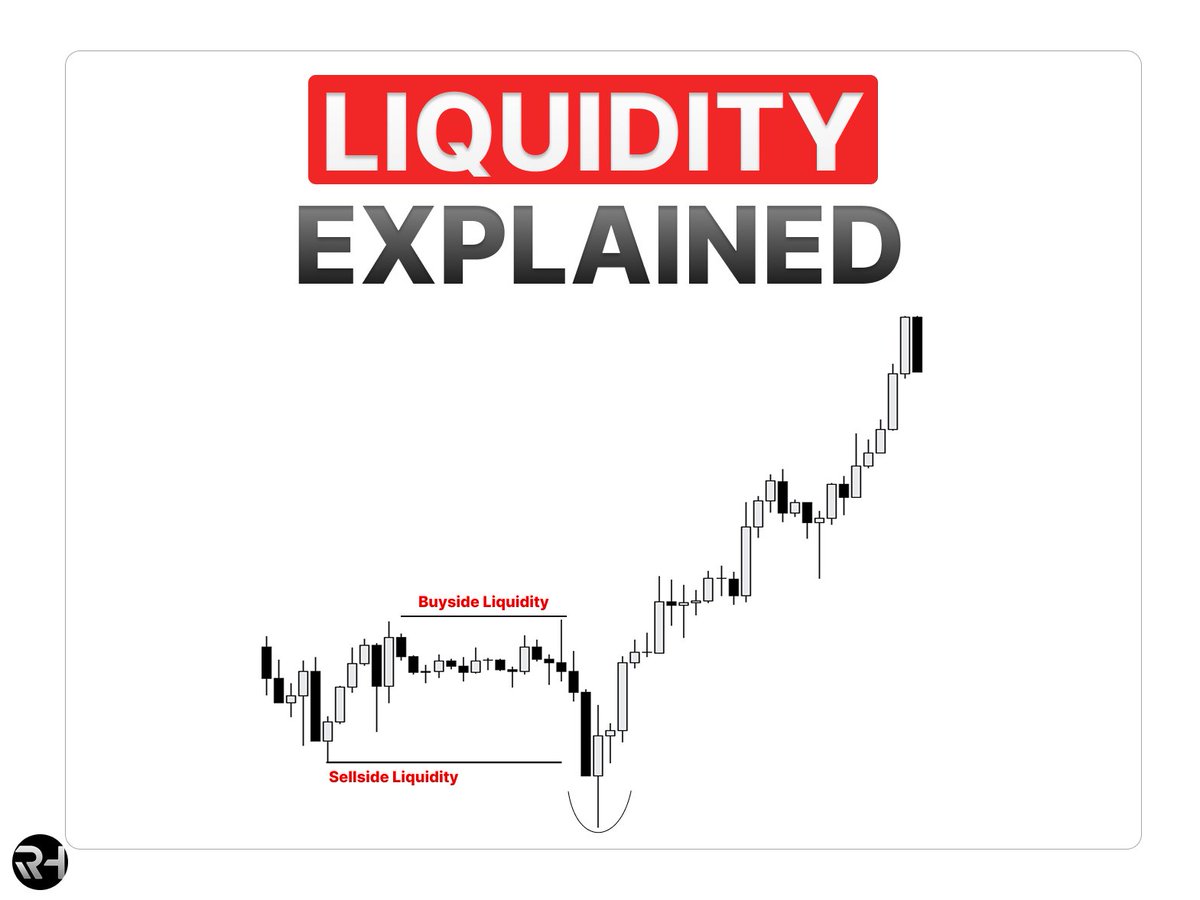

A clear draw on liquidity is vital

As price always moves from consolidation -> expansion and so on

You wait for price to show you market structure before the silver bullet timings which can then be used as an entry i.e an FVG

A clear draw on liquidity is vital

[4] Another confirmation

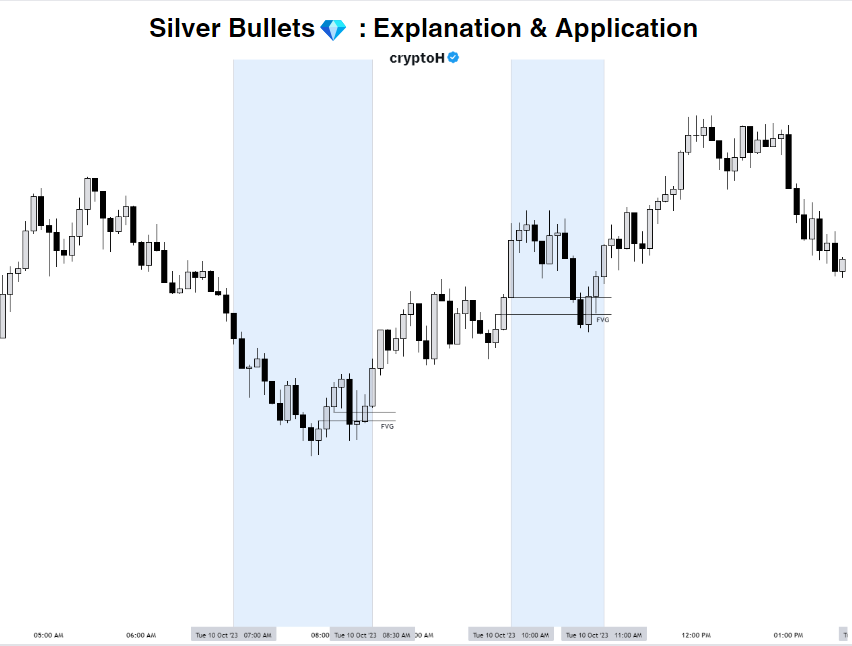

If you can spot a clear lower timeframe liquidity raid, it increases the probability of the setup being played out

Silver bullets are prioritized as price moves aggressively from the entry point attacking the liquidity in little or no drawdown

If you can spot a clear lower timeframe liquidity raid, it increases the probability of the setup being played out

Silver bullets are prioritized as price moves aggressively from the entry point attacking the liquidity in little or no drawdown

[5] Validation

The FVG can form before the window and can trade to it during the silver bullet zone and it is valid

The FVG can also form during the time window and retrace and give you can entry outside of the silver bullet zone

The FVG can form before the window and can trade to it during the silver bullet zone and it is valid

The FVG can also form during the time window and retrace and give you can entry outside of the silver bullet zone

[6] This is a💎because any of you can choose a specific time-window that you are comfortable with and trade at just those timings

You can form a model around this time window and with sound money management, you have the highest probability of success in trading the markets

You can form a model around this time window and with sound money management, you have the highest probability of success in trading the markets

[6] Likes and Reposts are appreciated.

Suggestions are welcome below

You can use my link to purchase an account with 5% off

app.fundingpips.com/register?ref=b…

Suggestions are welcome below

You can use my link to purchase an account with 5% off

app.fundingpips.com/register?ref=b…

• • •

Missing some Tweet in this thread? You can try to

force a refresh