6+ Years (ICT) Experience • Live Trading & More ↓ https://t.co/fKHtG2nEfG

3 subscribers

How to get URL link on X (Twitter) App

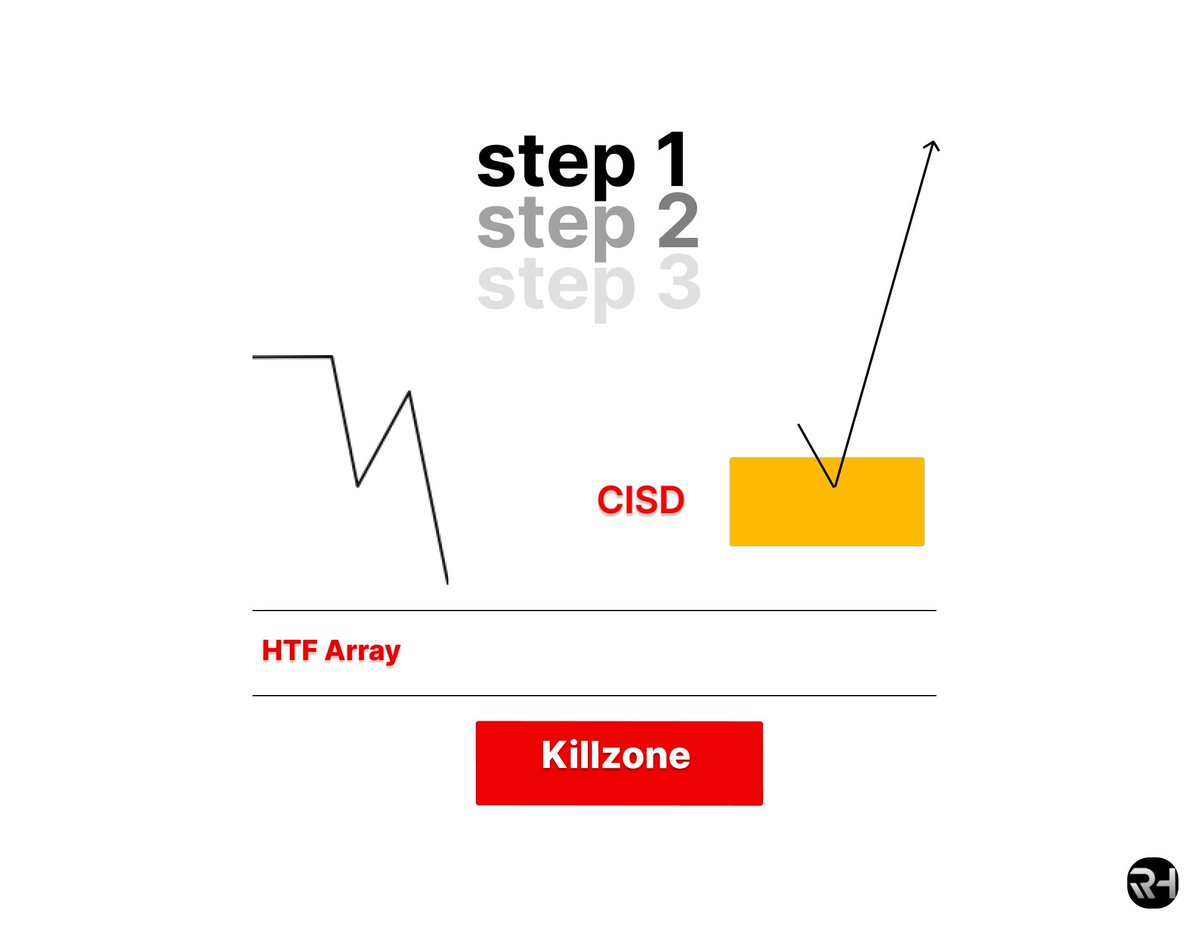

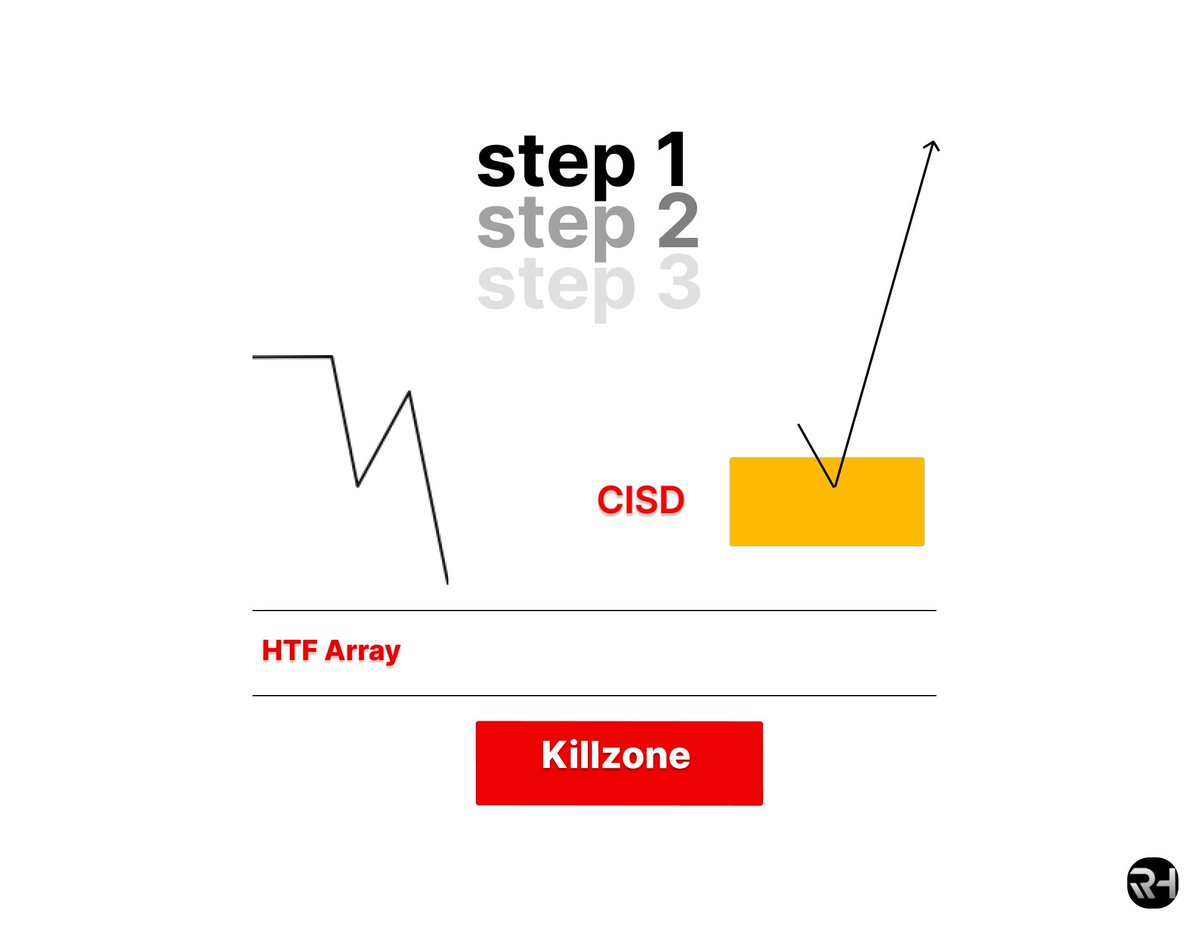

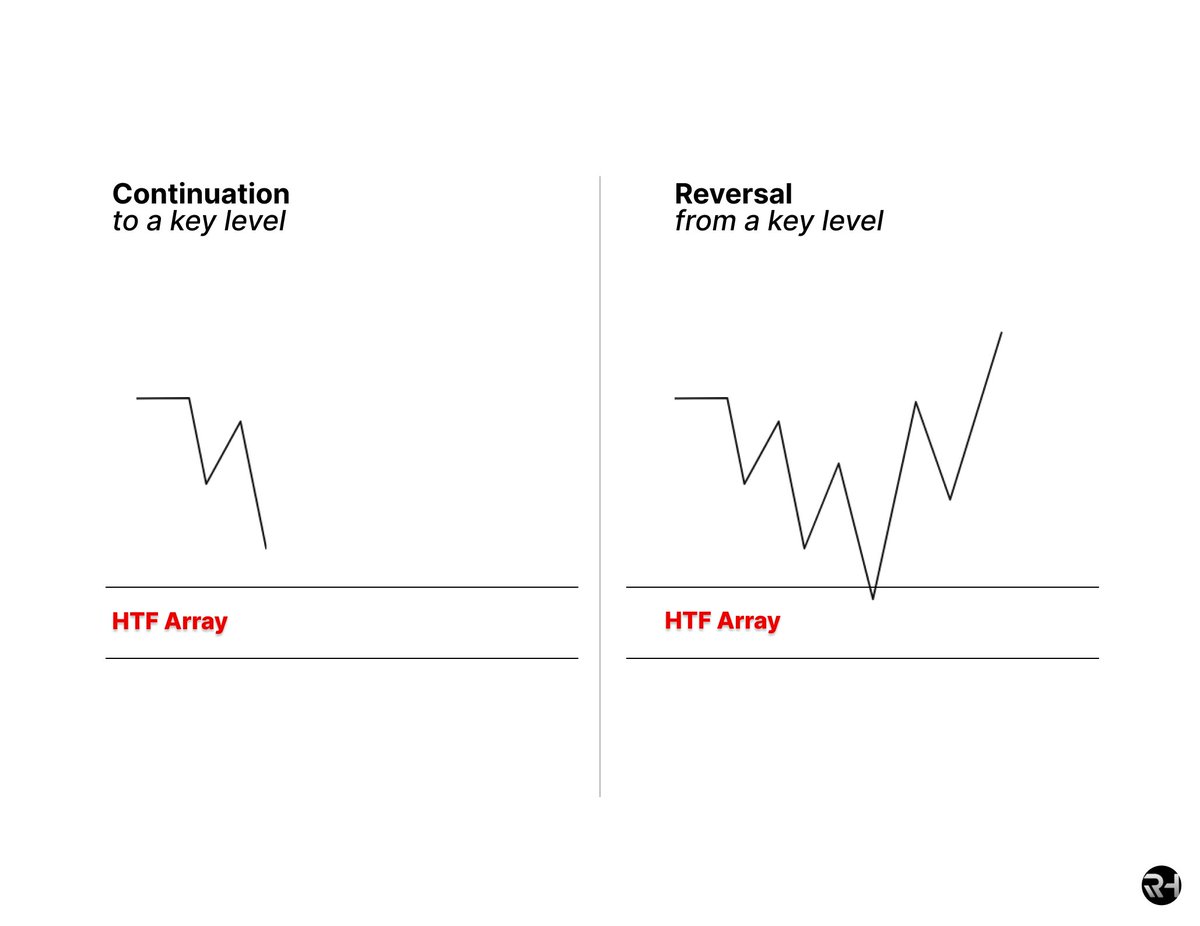

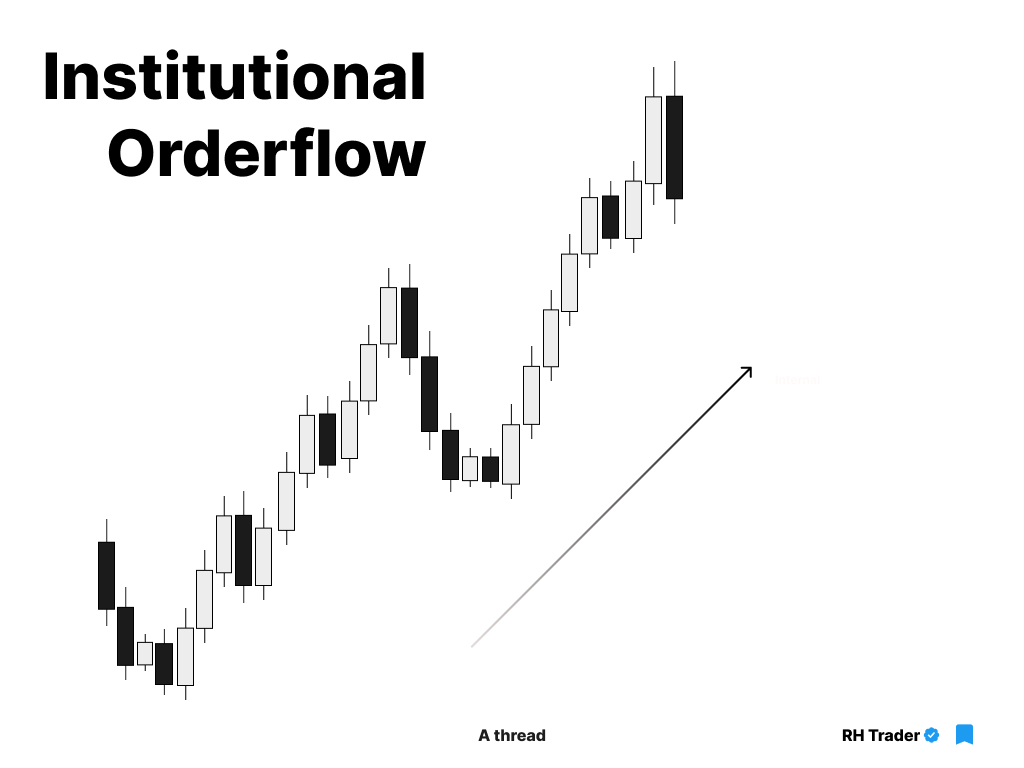

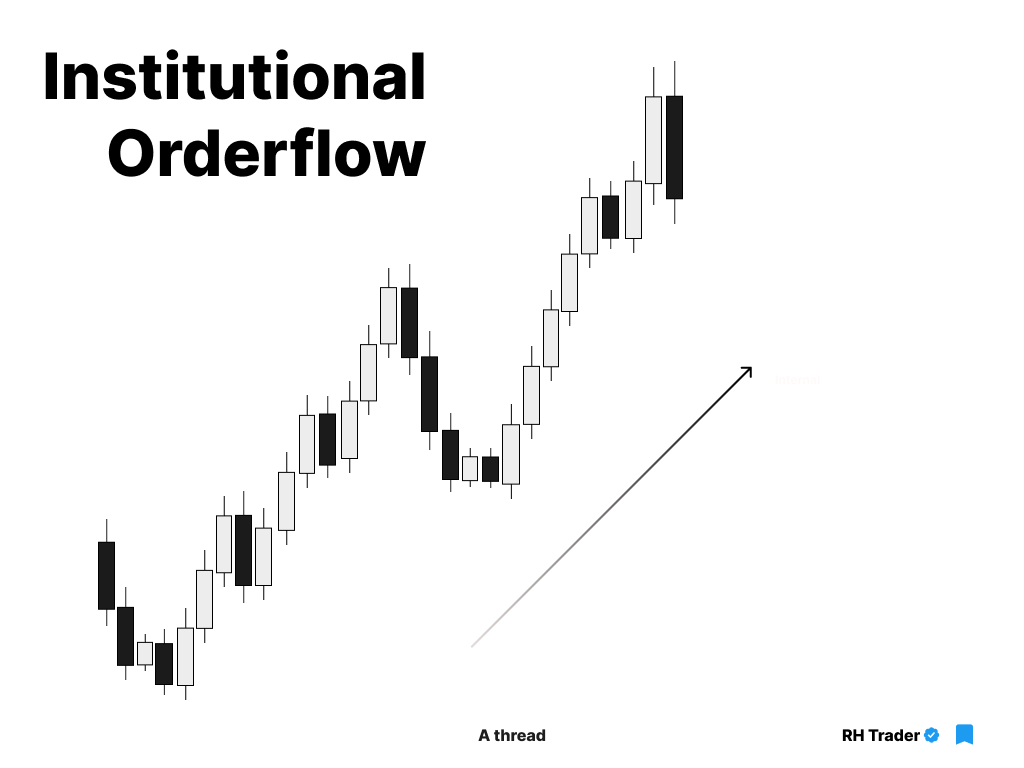

no matter what style you prefer, there are only two ways you can trade:

no matter what style you prefer, there are only two ways you can trade:

Let’s start with,

Let’s start with,

/start

/start

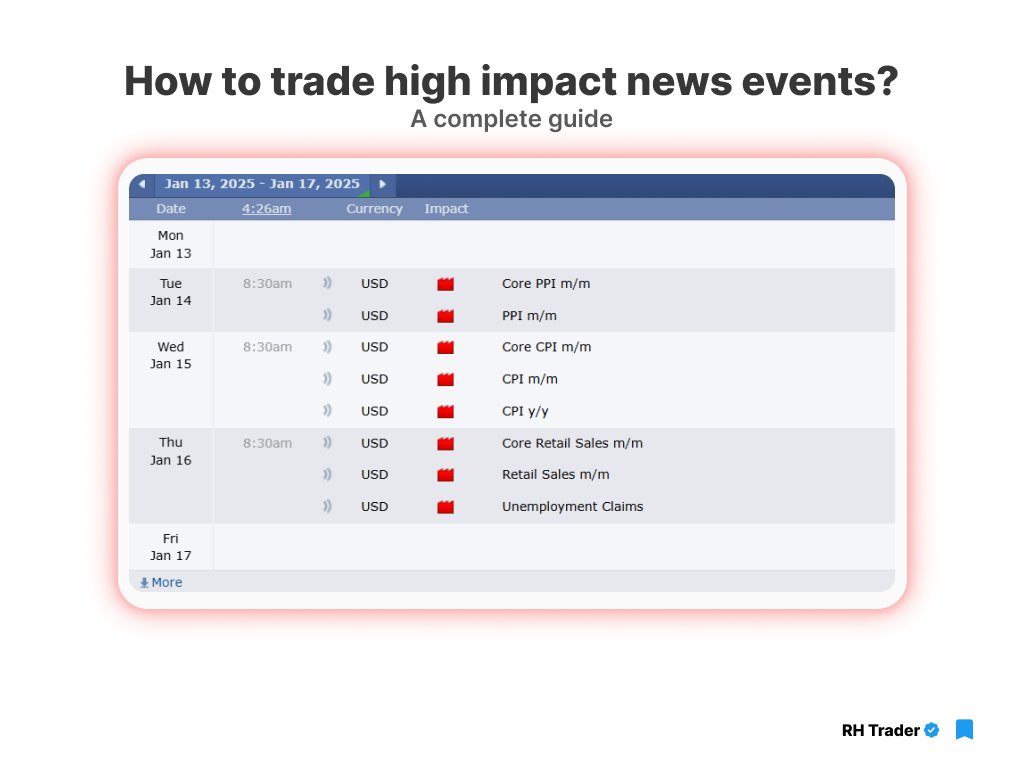

The first step is:

The first step is:

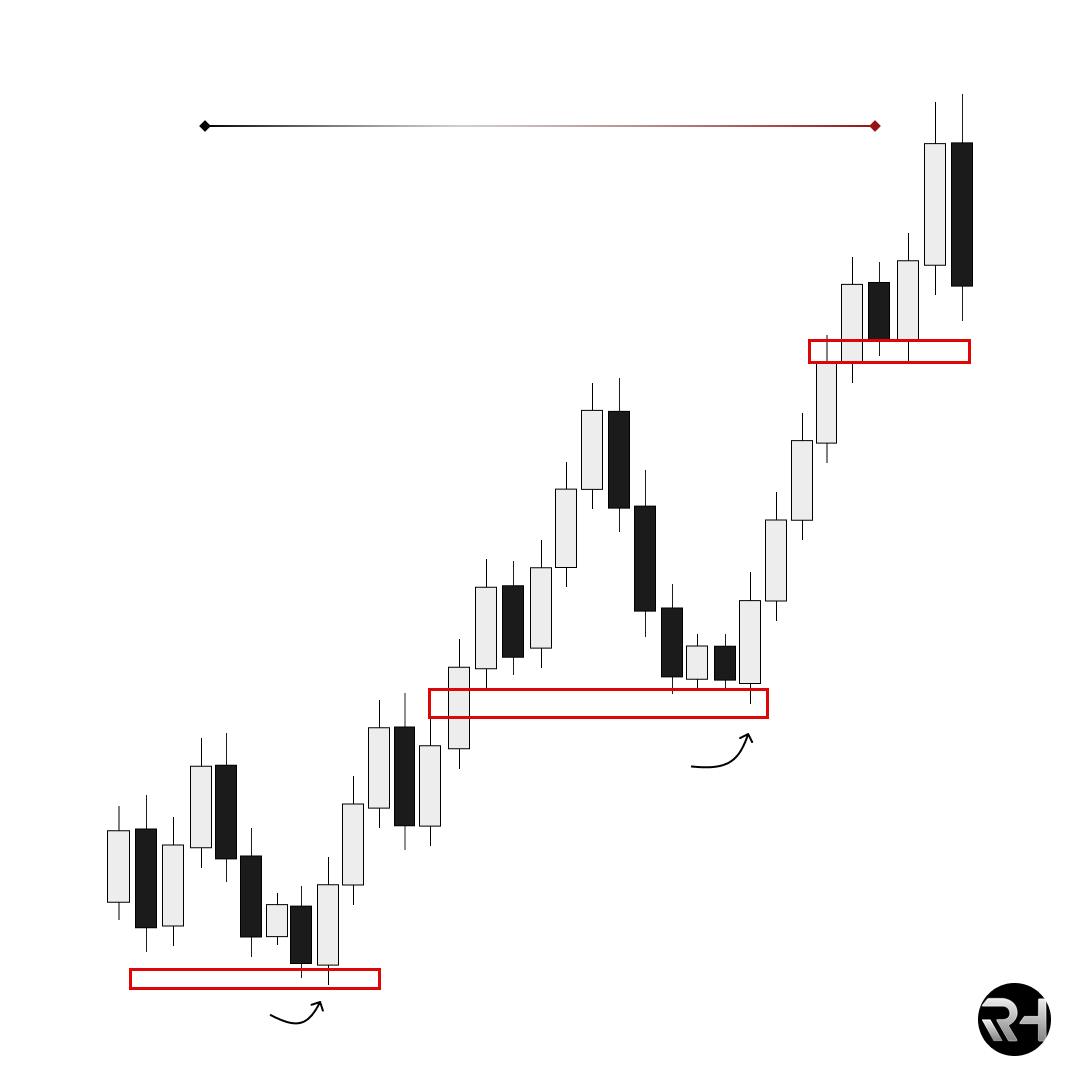

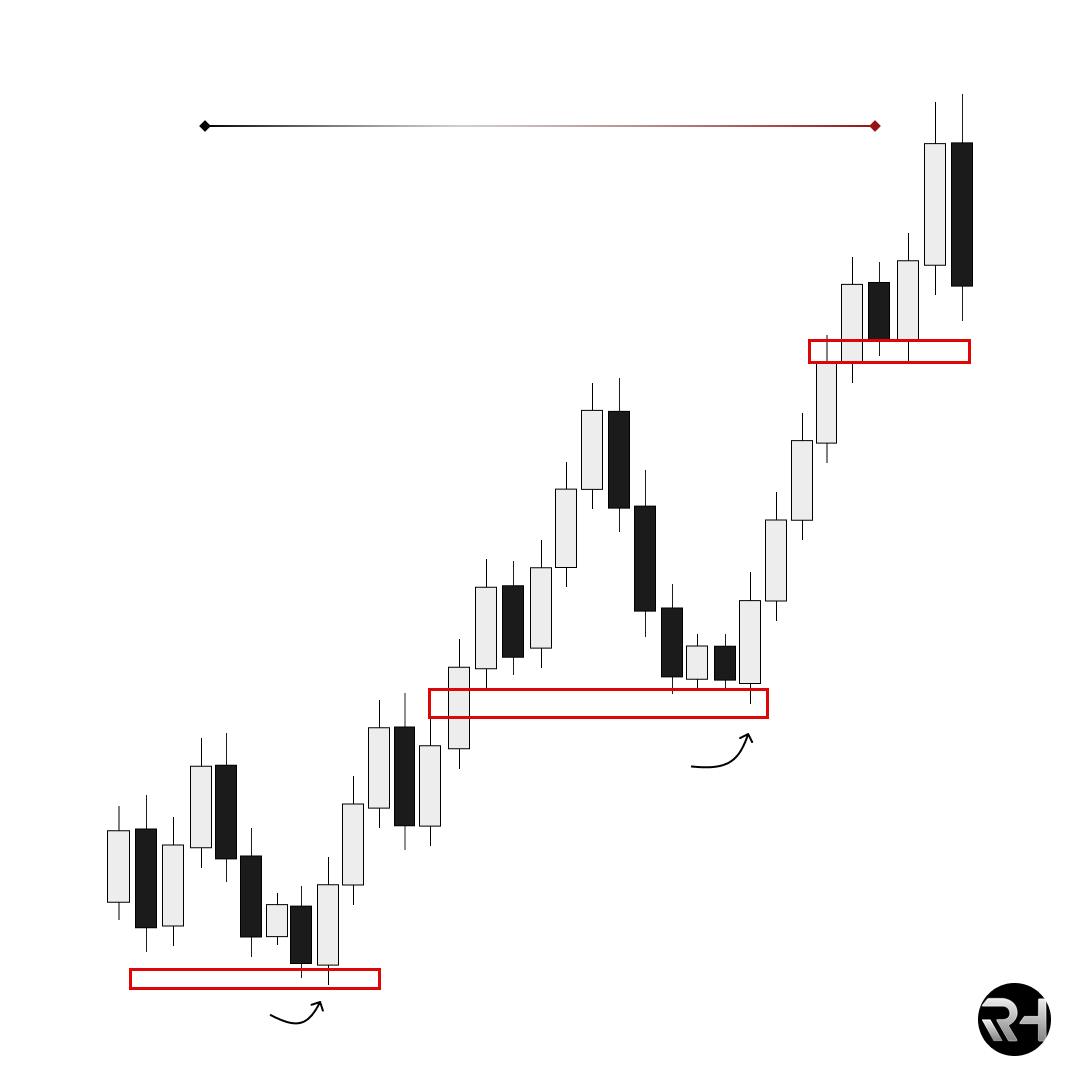

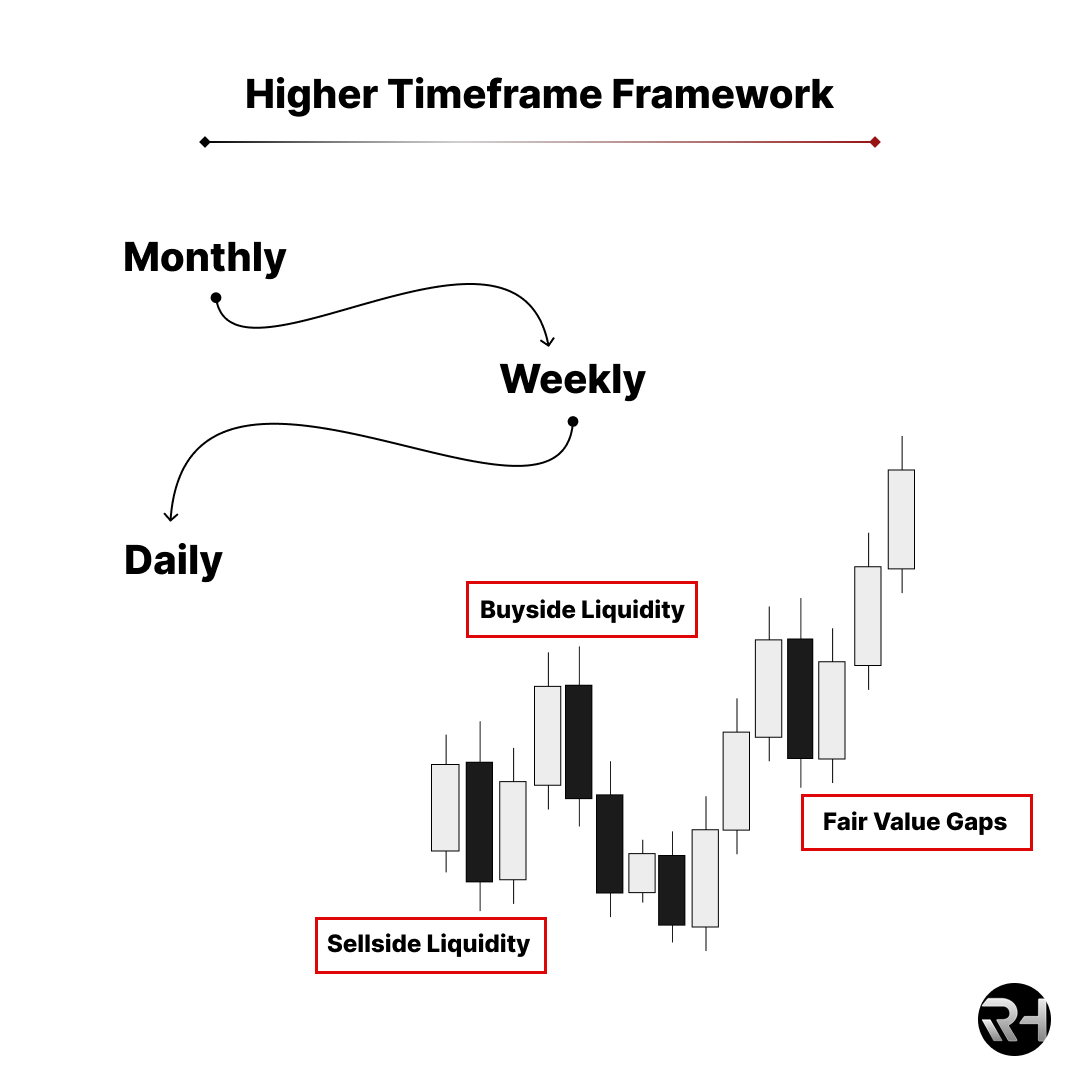

1) Higher Timeframe Framework:

1) Higher Timeframe Framework:

1. There is no enigma.

1. There is no enigma.

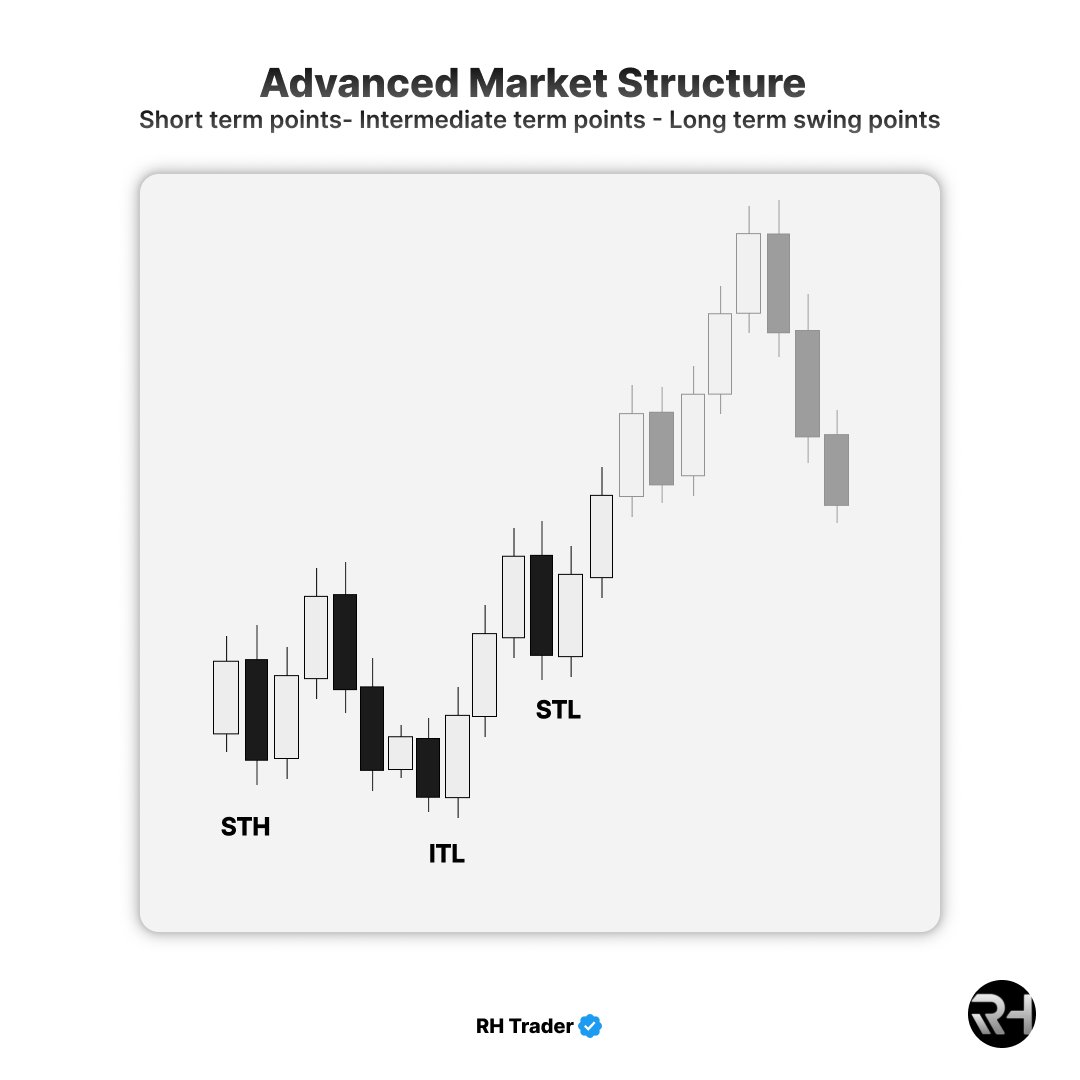

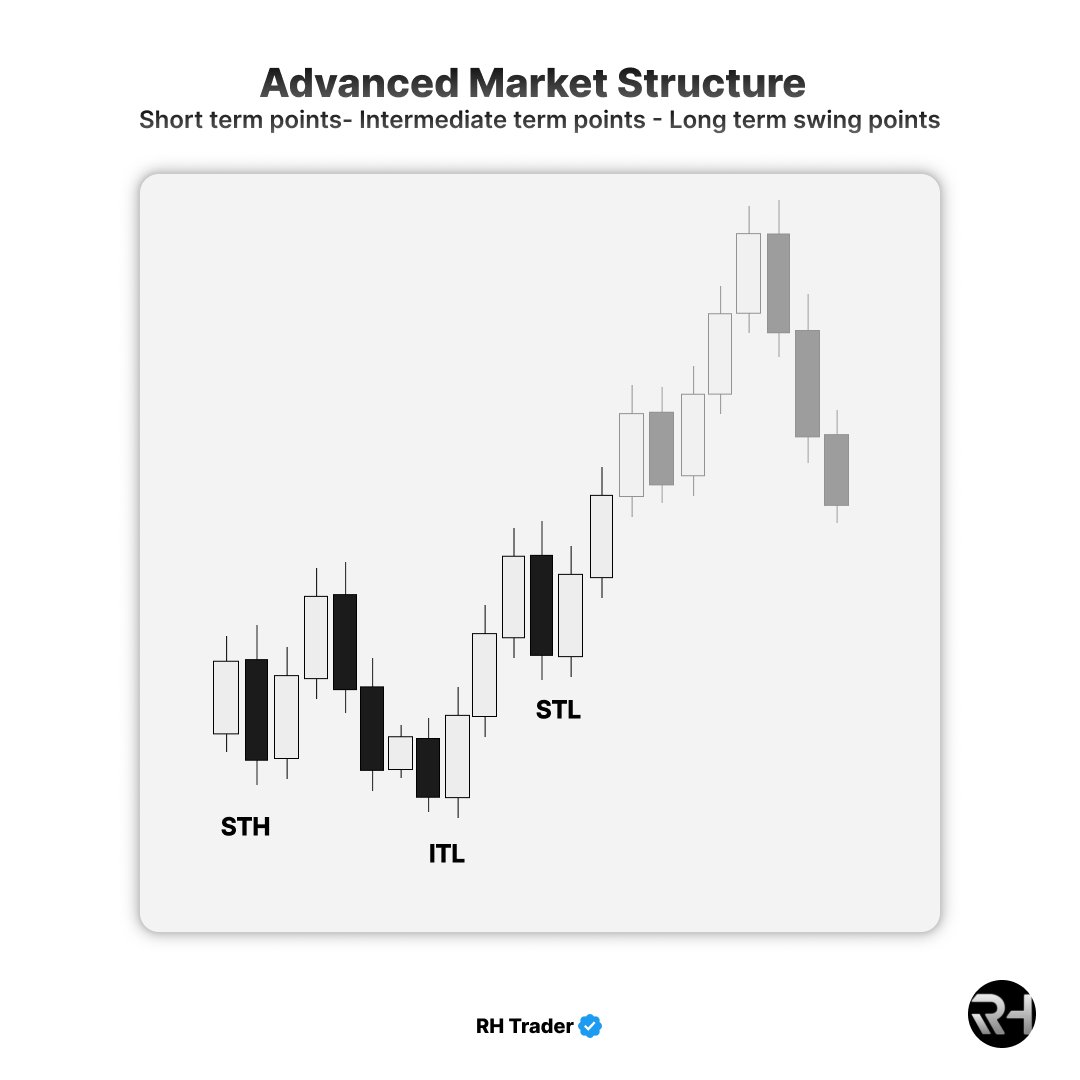

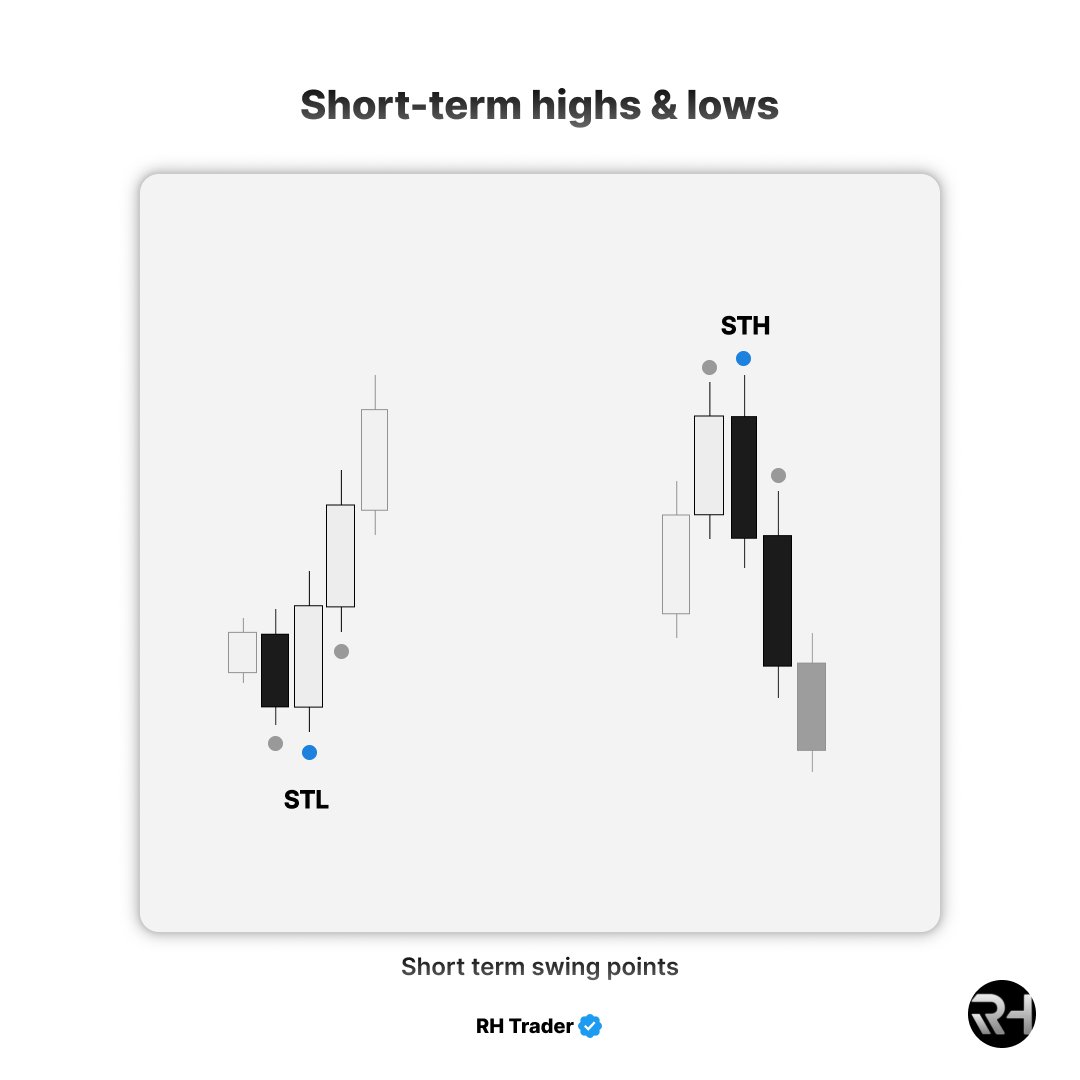

Let us first define what each of the concept means:

Let us first define what each of the concept means:

~start

~start

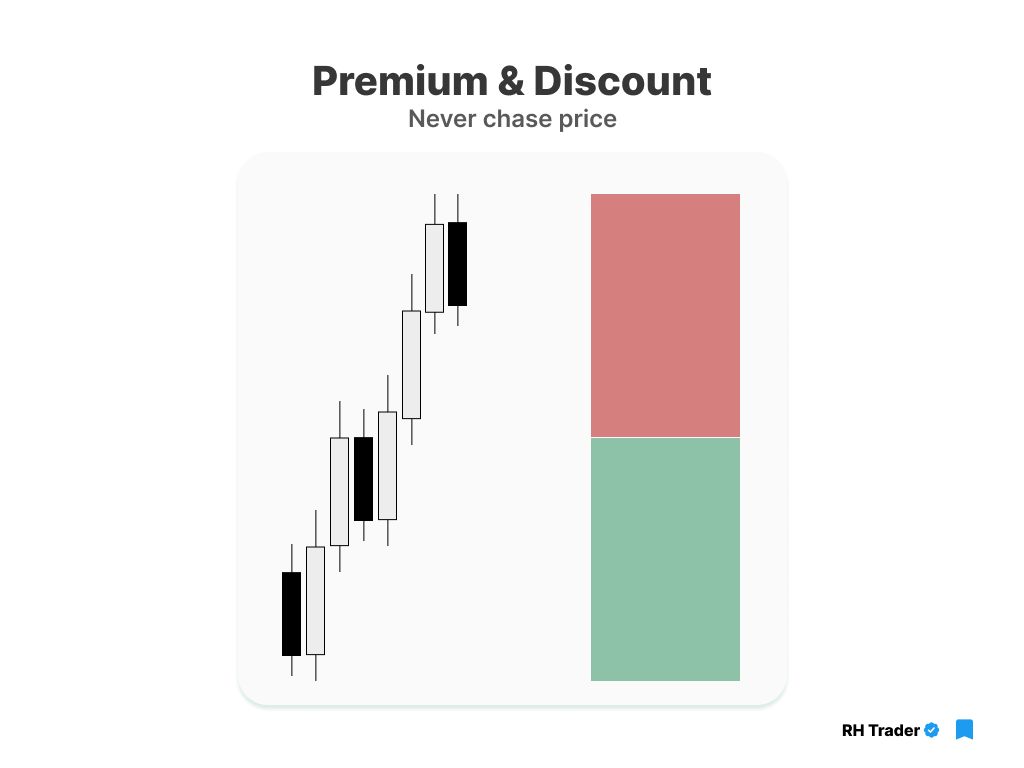

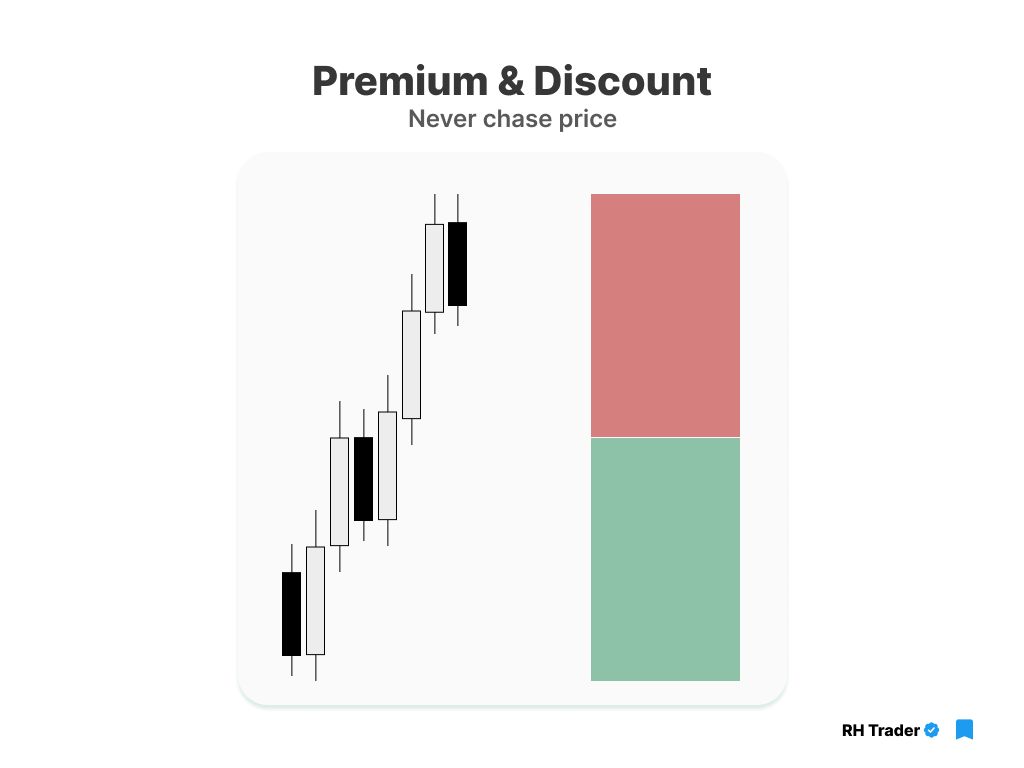

Premium & Discount,

Premium & Discount,

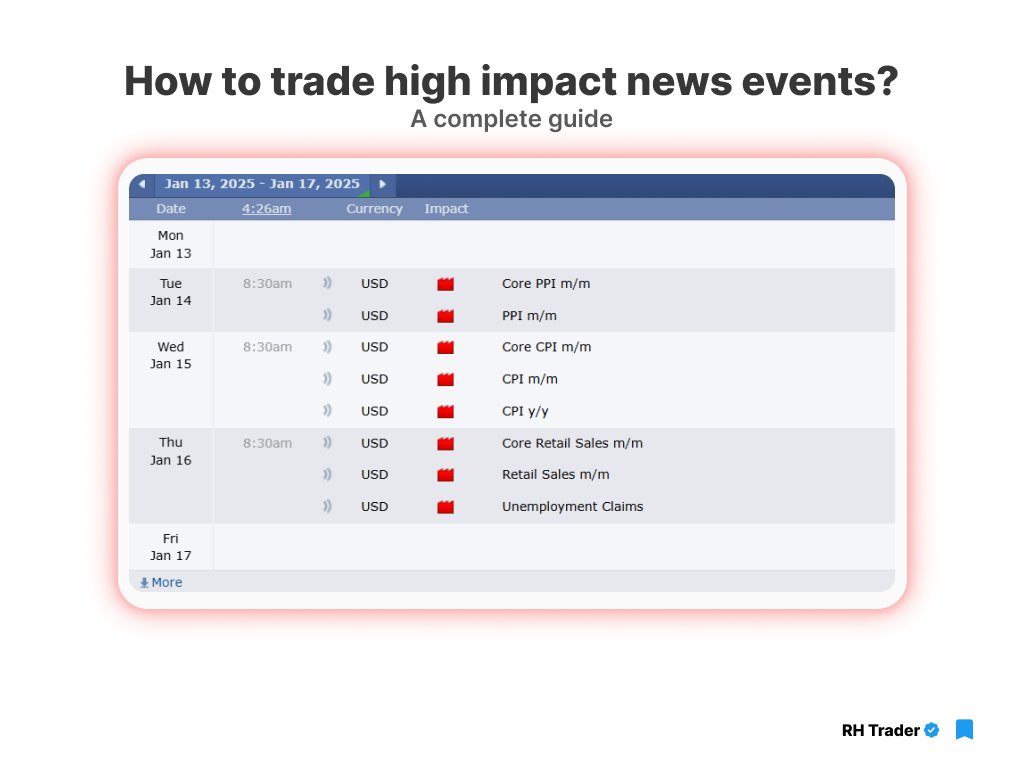

Silver bullets are specific time windows that the algorithm looks to reprice into key liquidity levels.

Silver bullets are specific time windows that the algorithm looks to reprice into key liquidity levels.

https://x.com/_rhtrader/status/1873367692255875101

First,

First,

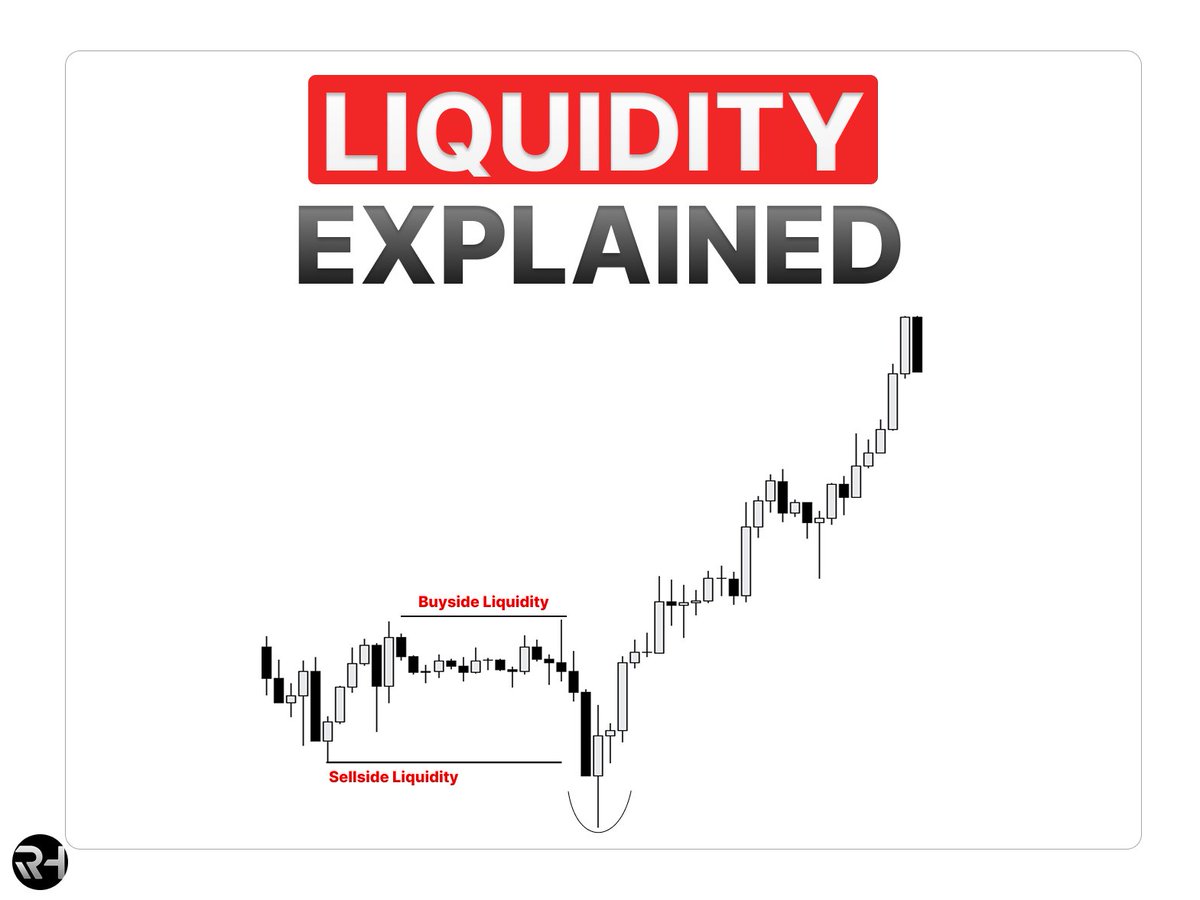

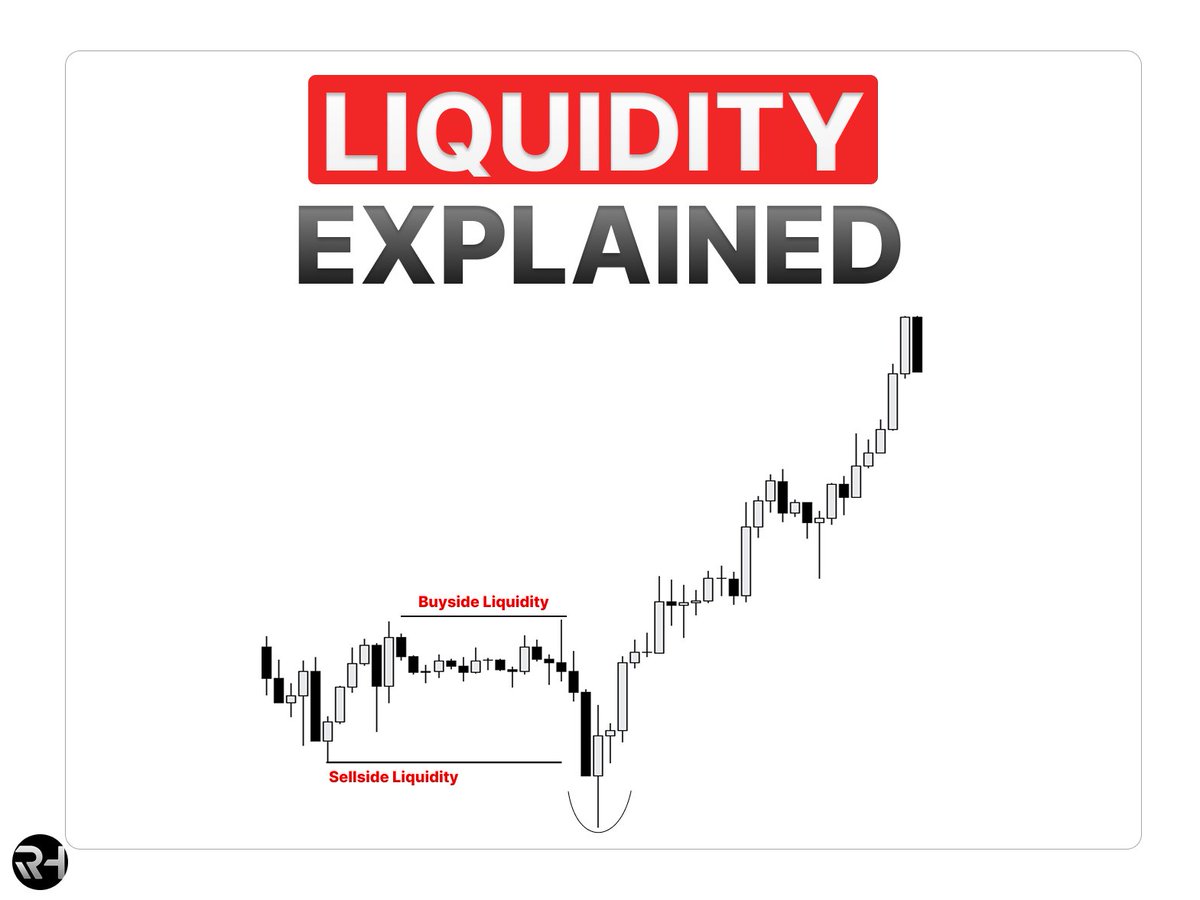

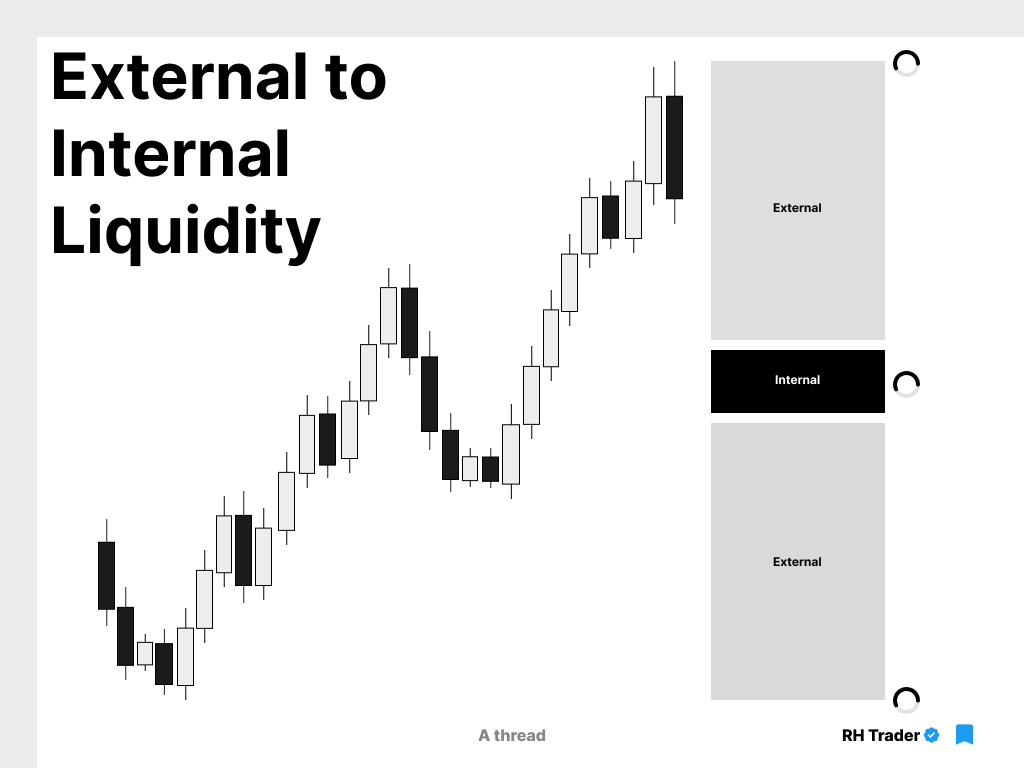

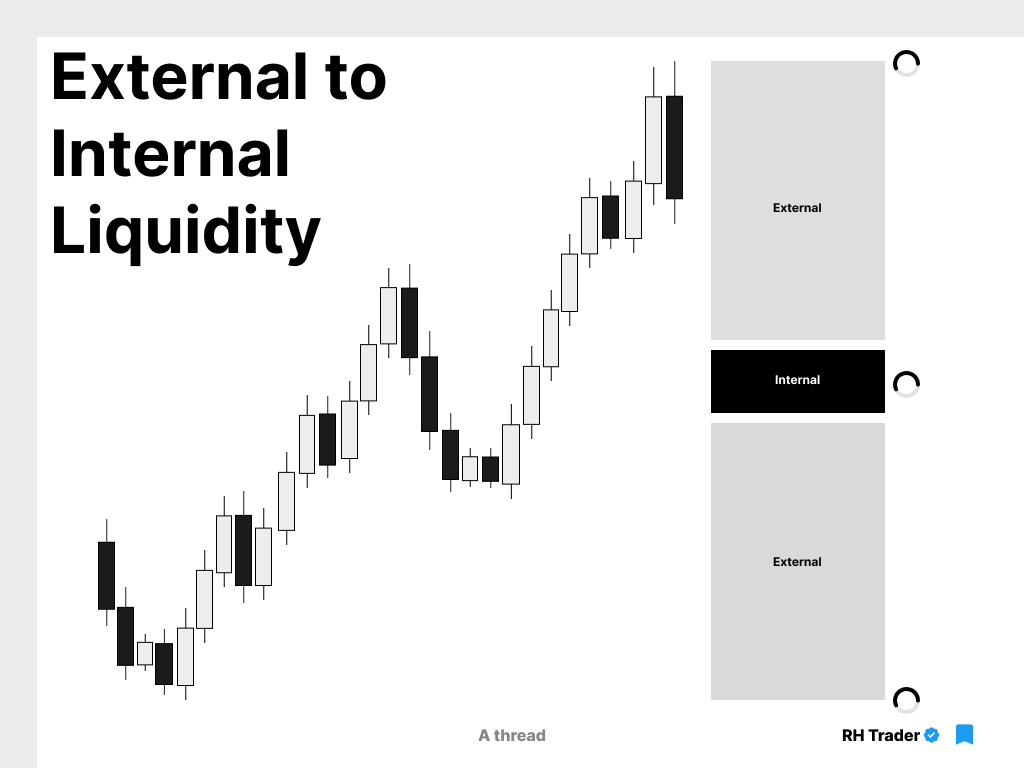

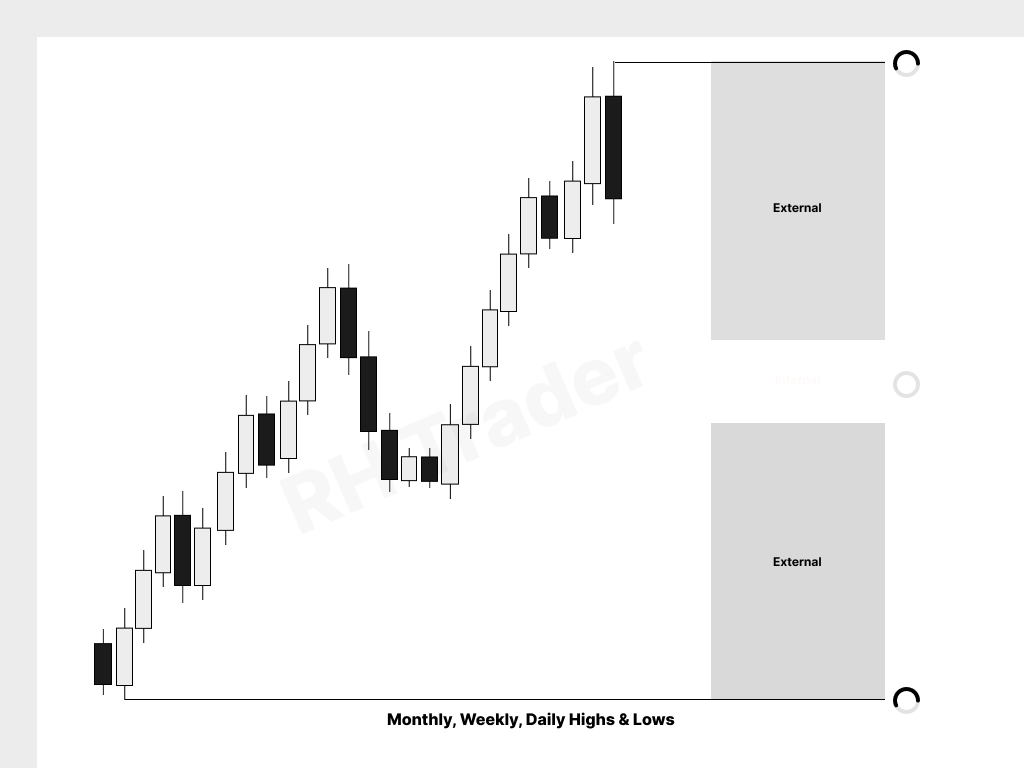

External Liquidity

External Liquidity

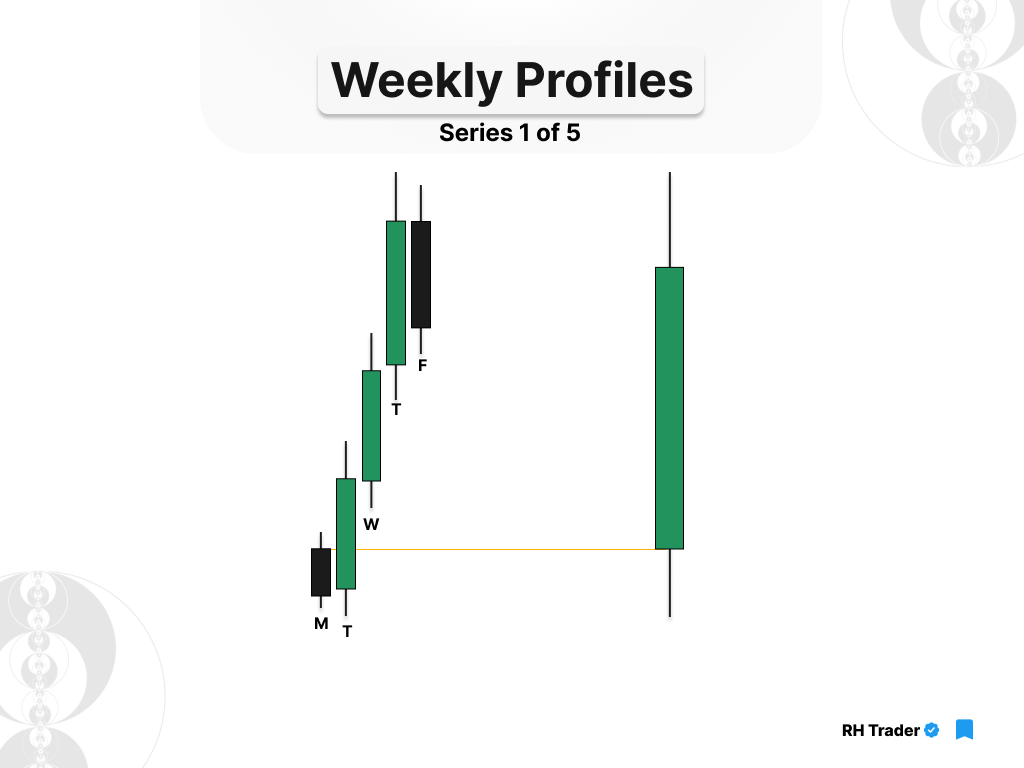

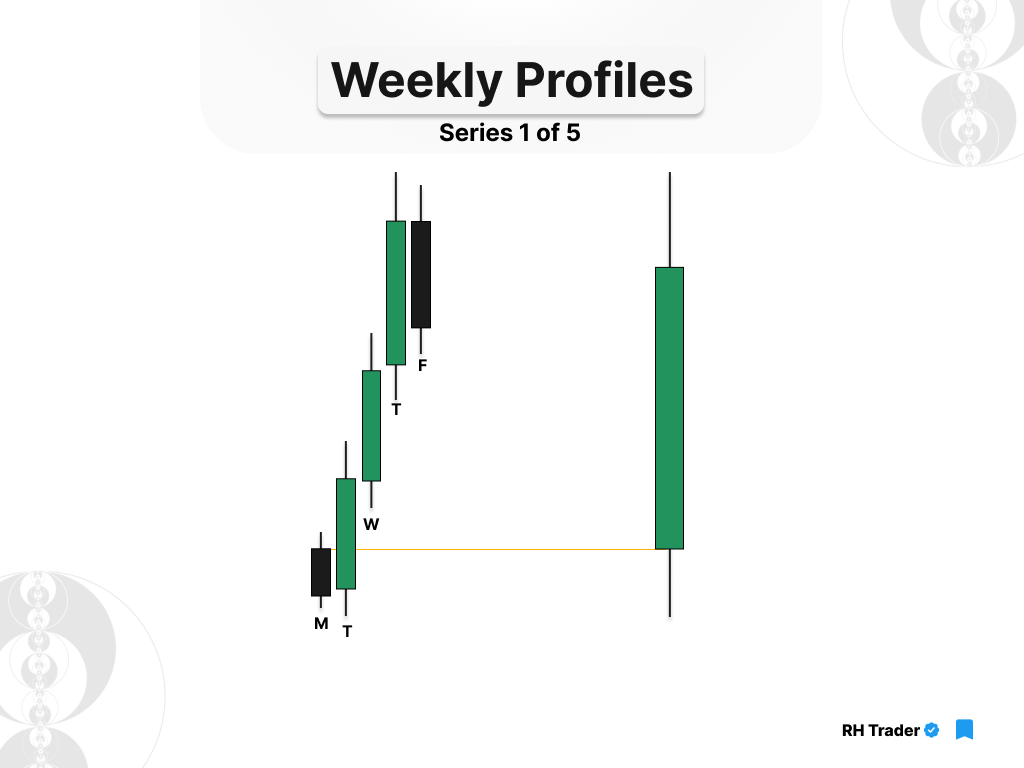

We have all heard ICT say numerous times that the direction of the weekly candle expansion is the 'Holy Grail' in trading.

We have all heard ICT say numerous times that the direction of the weekly candle expansion is the 'Holy Grail' in trading.

~ start

~ start

~ start

~ start

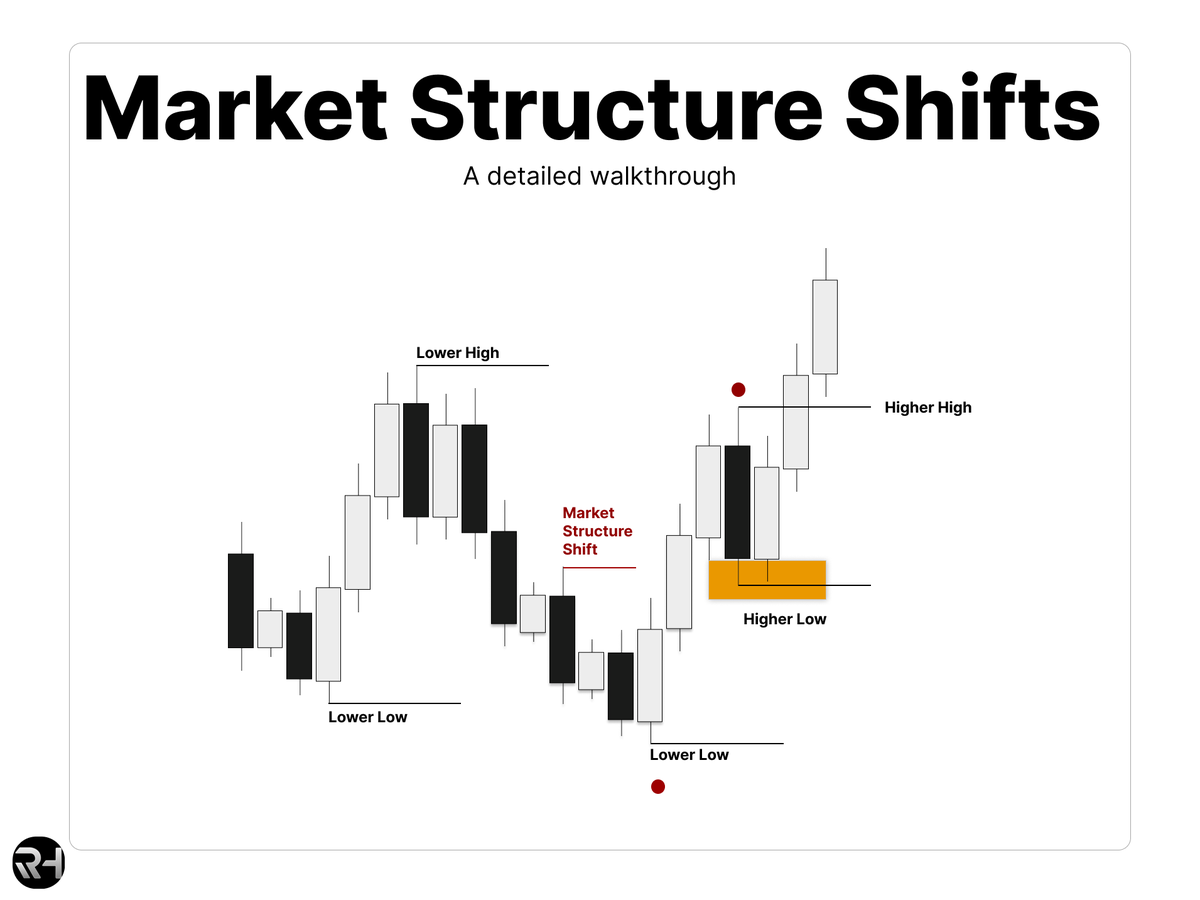

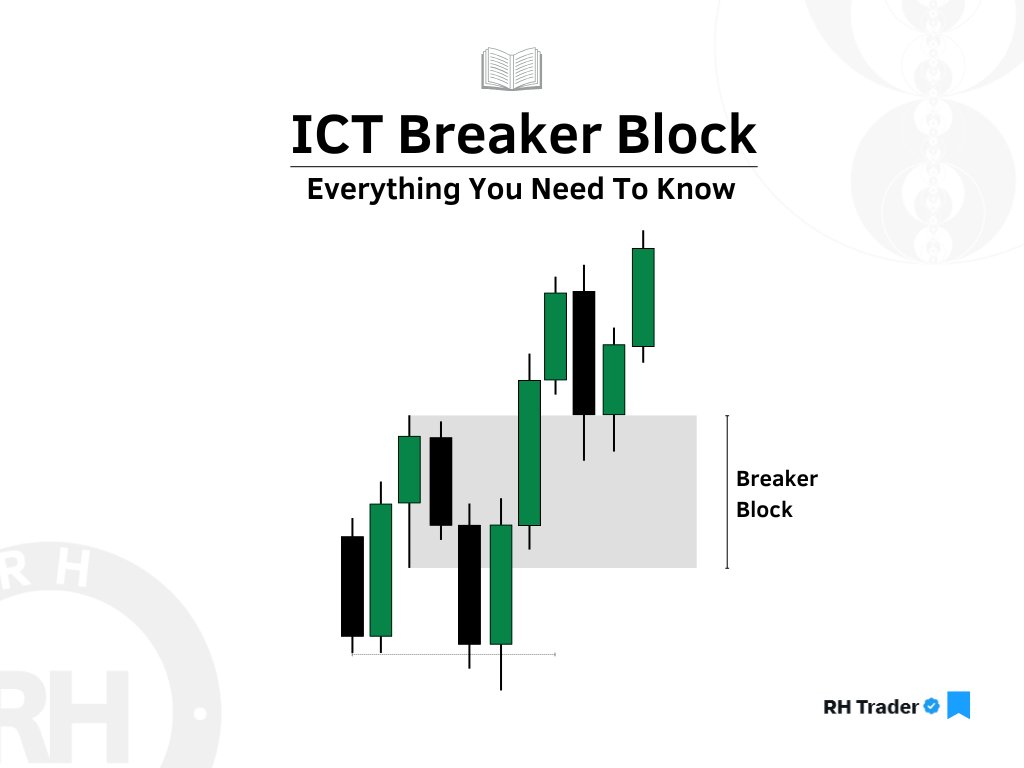

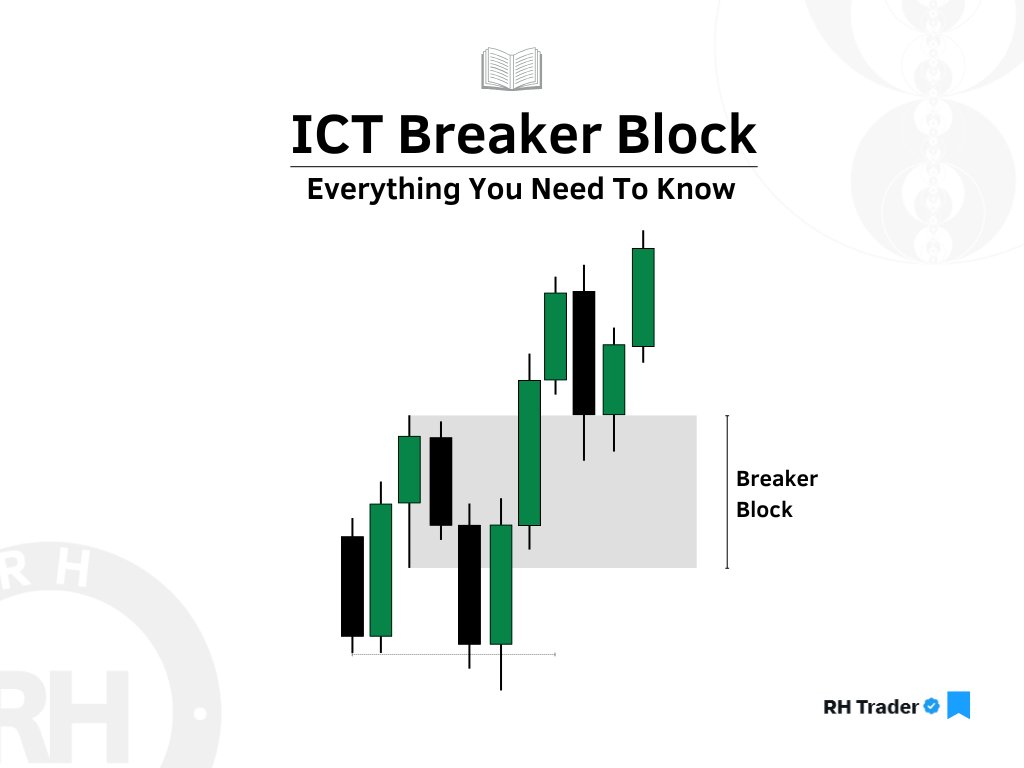

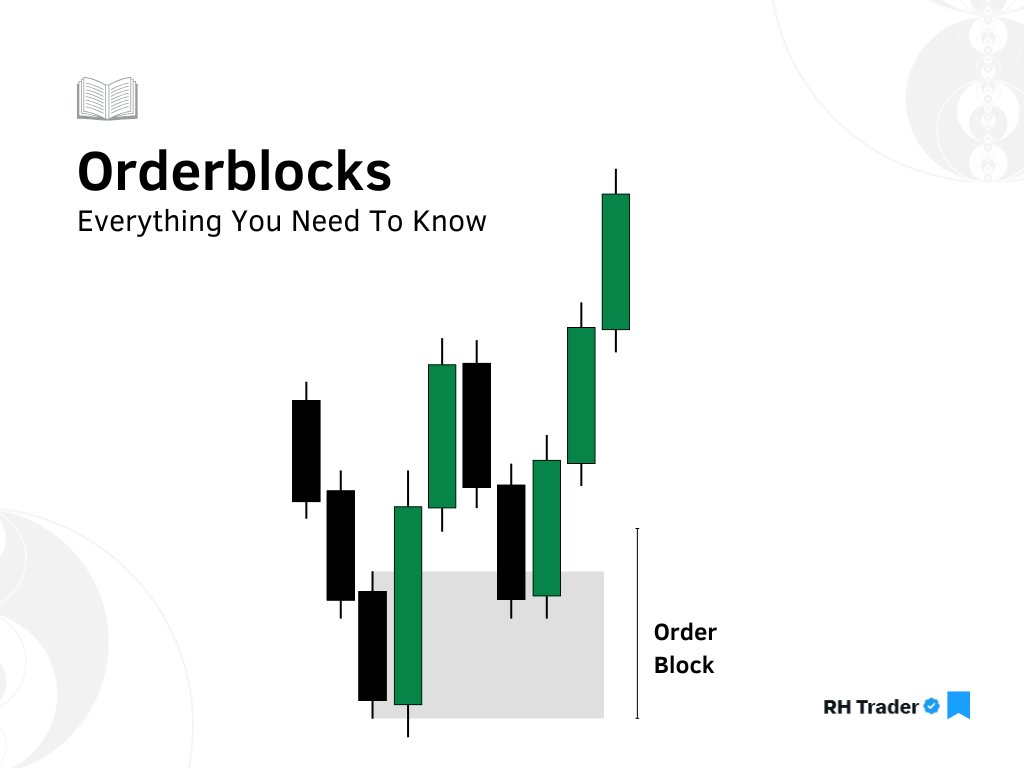

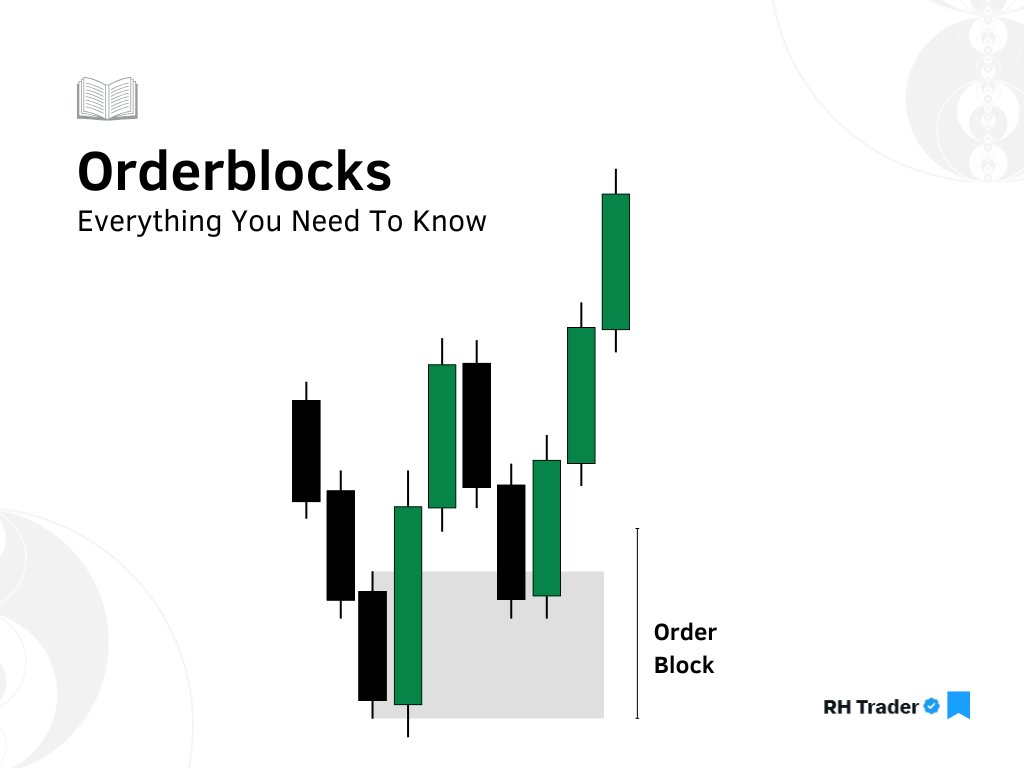

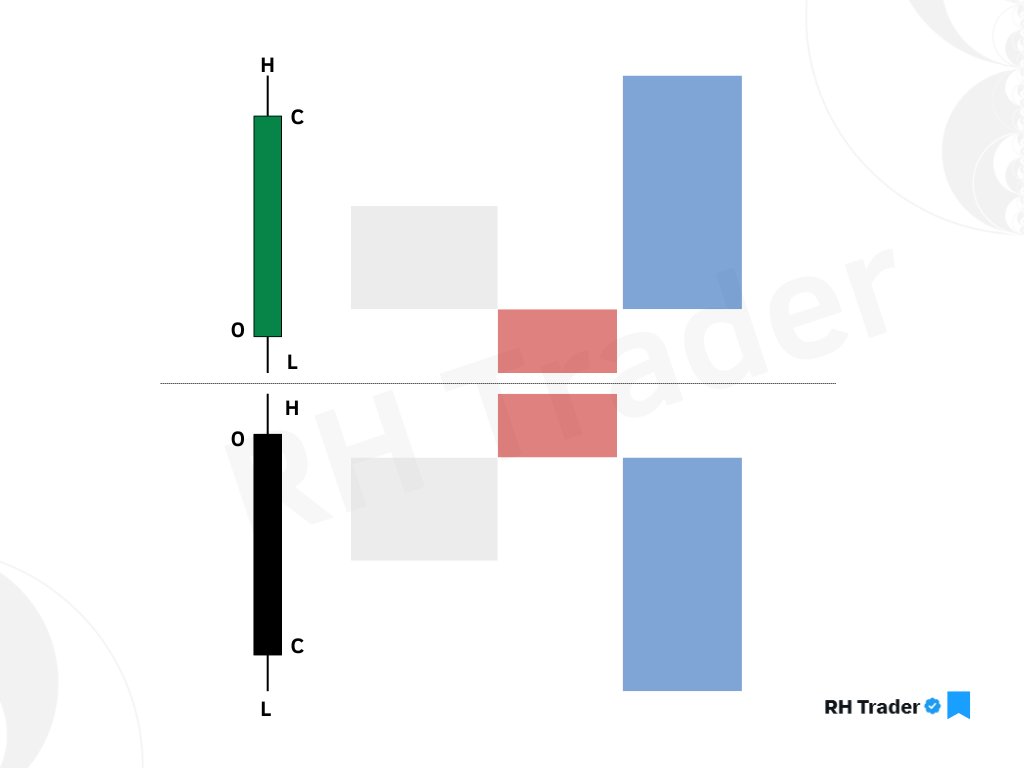

Orderblock (OB) is a series of down/up close candles that confirms the change in state of delivery that allows you to precisely enter the market at key swing points.

Orderblock (OB) is a series of down/up close candles that confirms the change in state of delivery that allows you to precisely enter the market at key swing points.

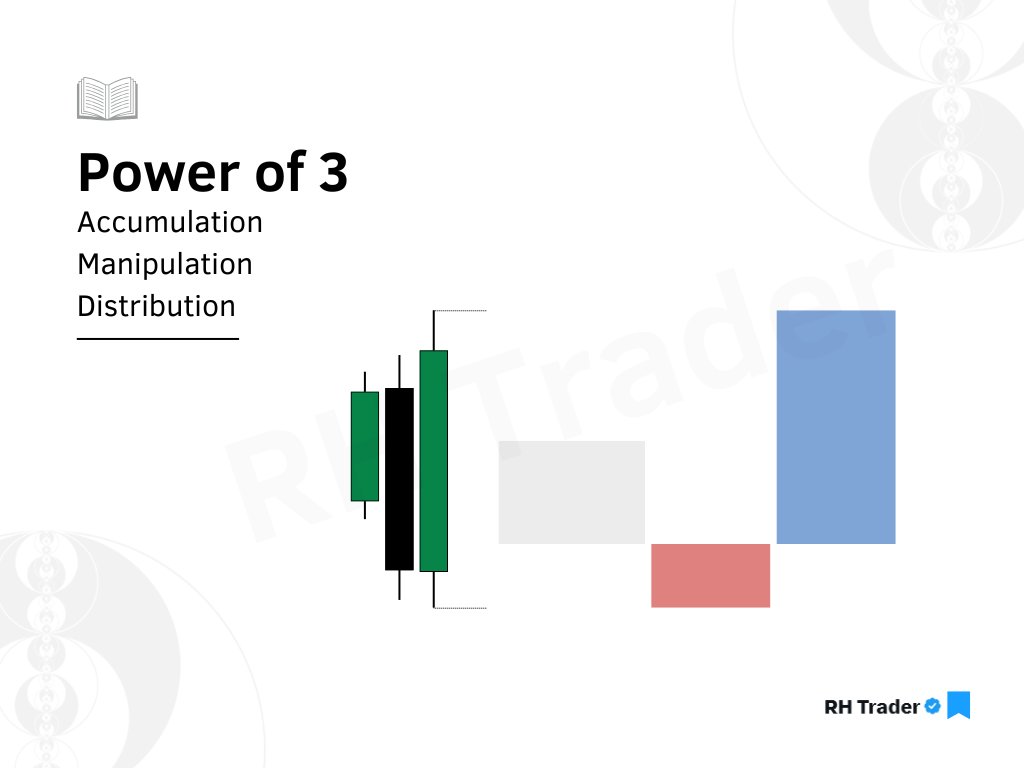

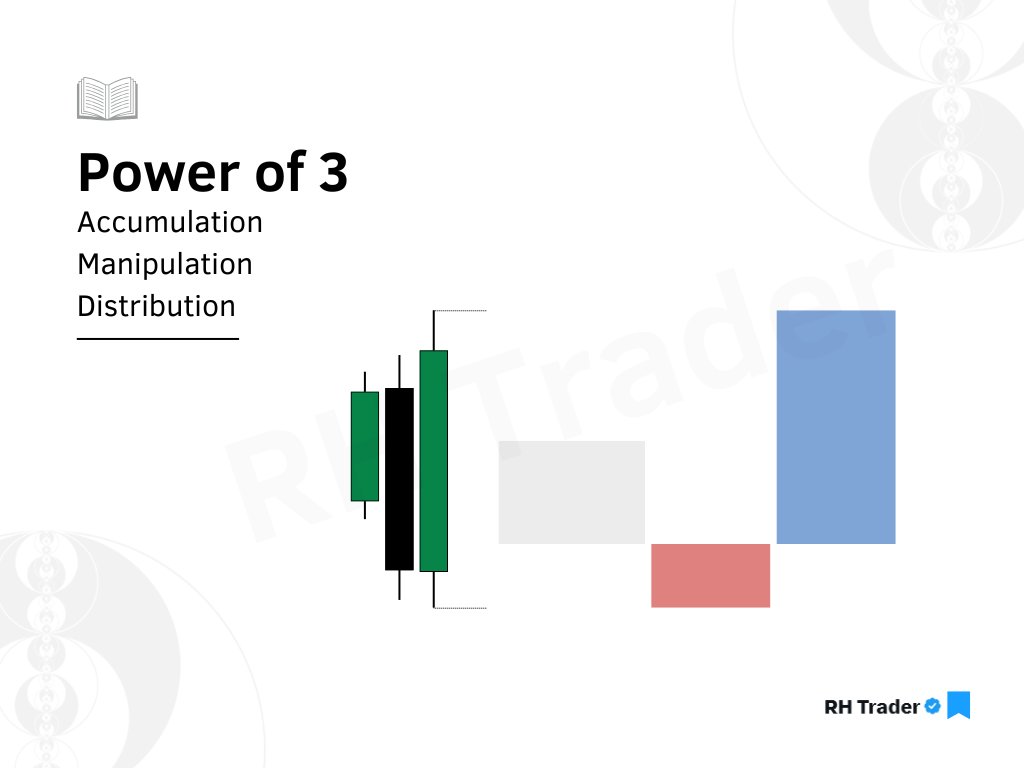

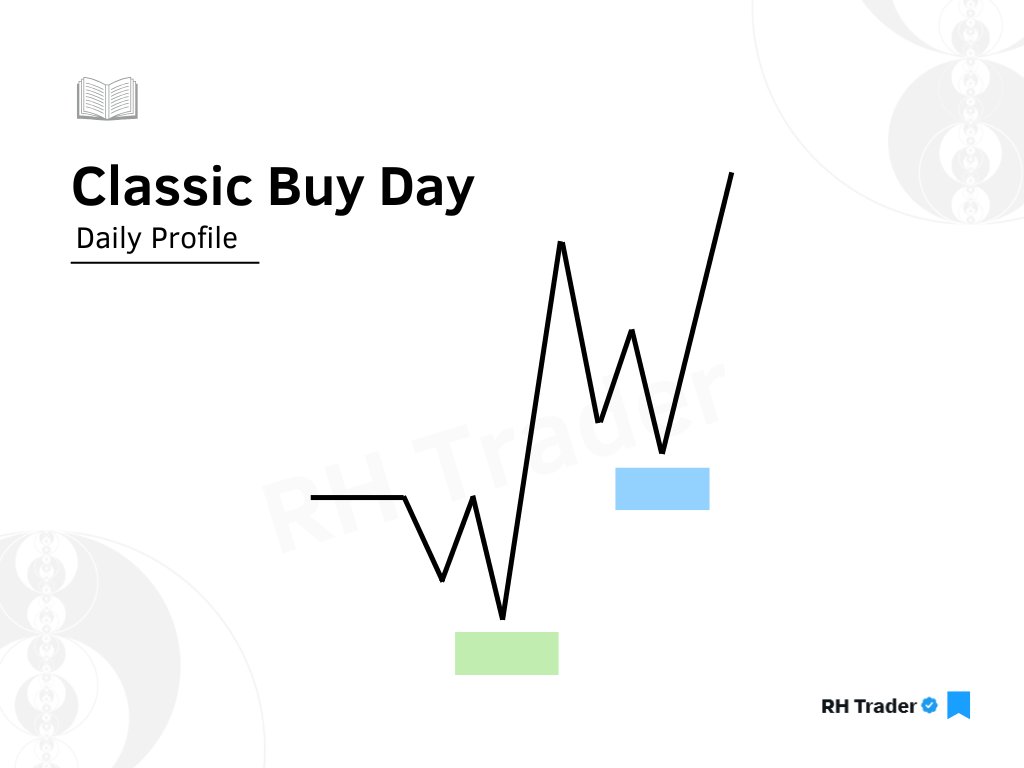

Power of 3 is a way to see price action through the lens of three phases.

Power of 3 is a way to see price action through the lens of three phases.

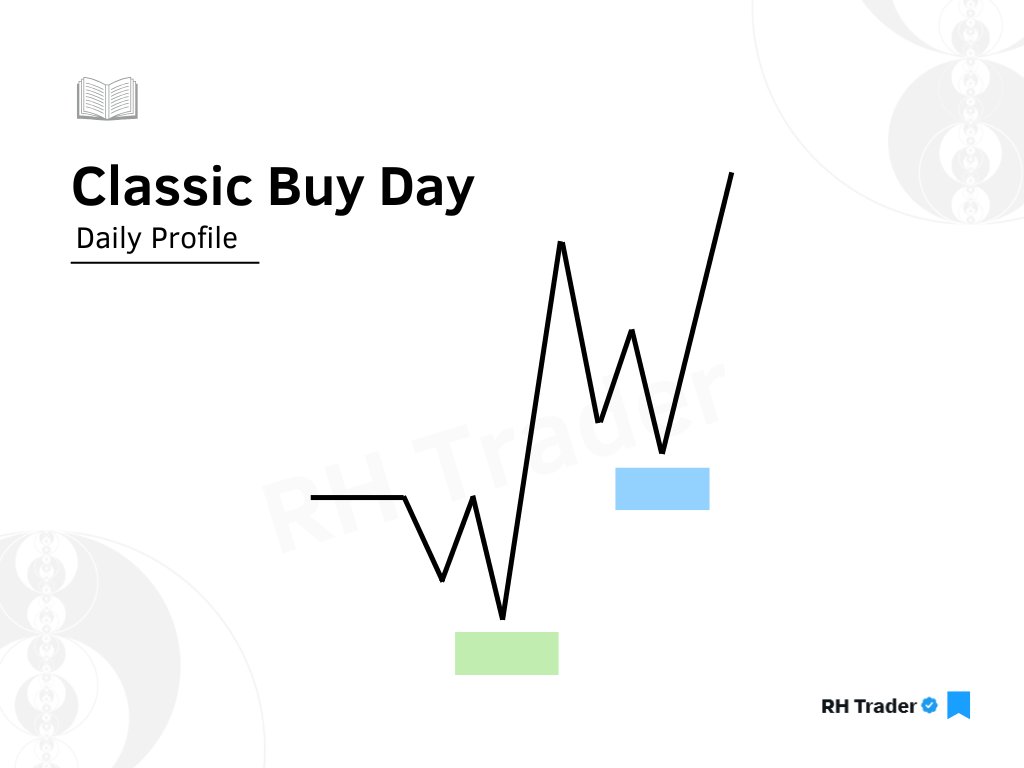

We are combining a few simple concepts to identify and trade this profile.

We are combining a few simple concepts to identify and trade this profile.