Today, we are sharing a MONSTER thread with some of the most outrageous $TSLA earnings call quotes from @elonmusk over the years🧵

1. This one from 2018 is hilarious. Elon refuses to answer a "boring bonehead question" and then the operator just moves along to the next analyst:

1. This one from 2018 is hilarious. Elon refuses to answer a "boring bonehead question" and then the operator just moves along to the next analyst:

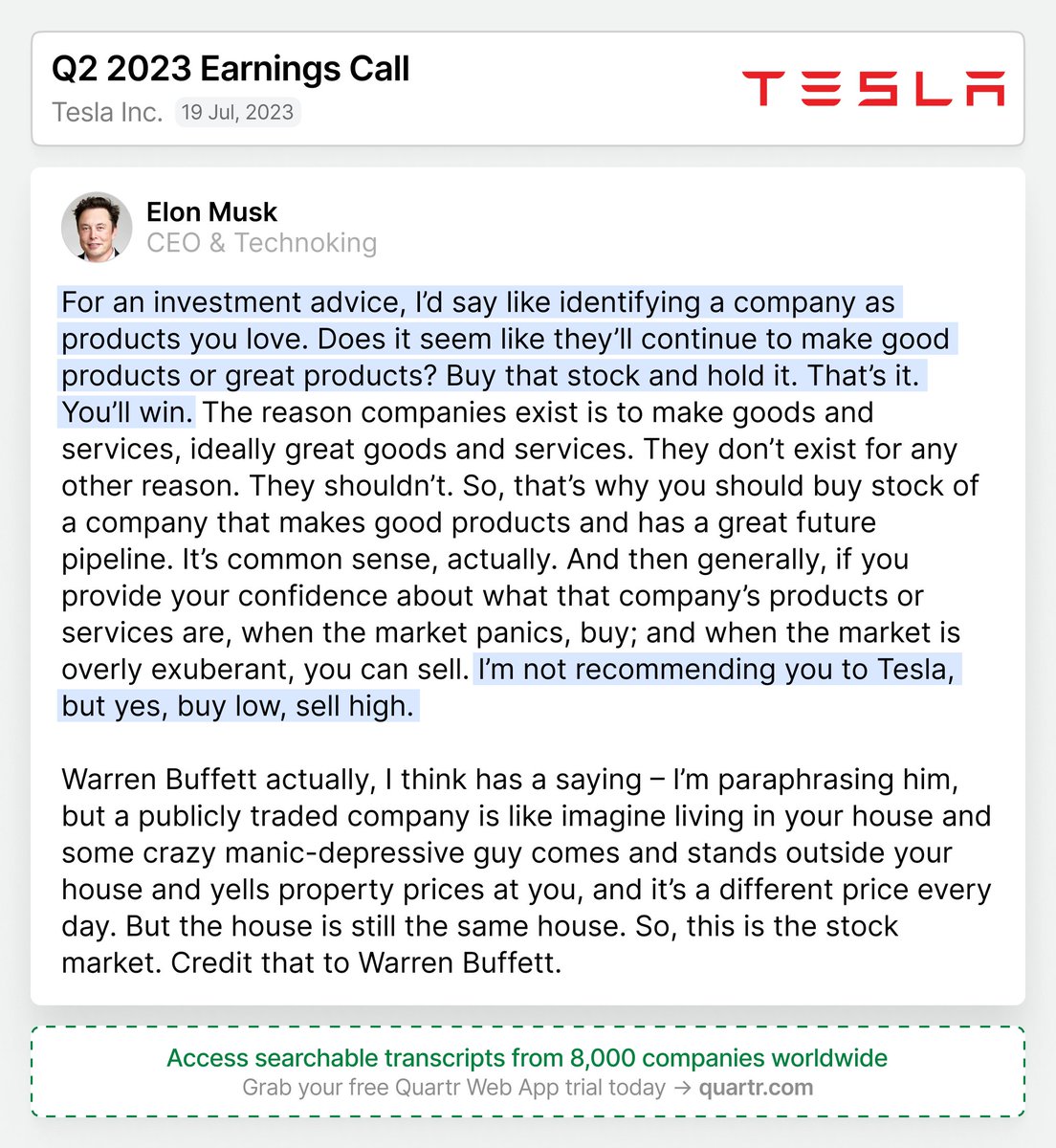

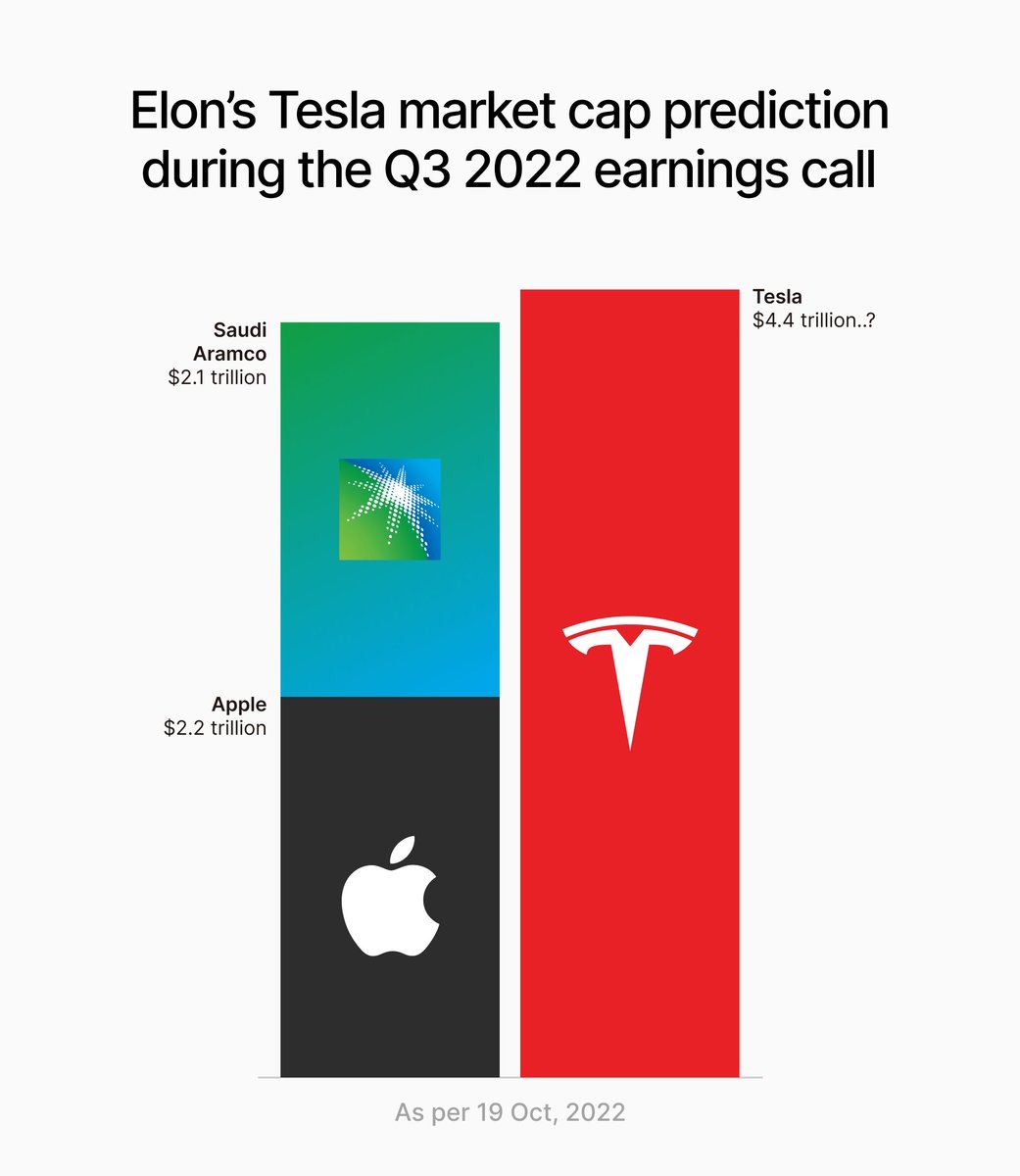

3. And to @elonmusk's credit, $TSLA's market cap did in fact surpass $700B. So, almost exactly a year ago, Elon went for another prediction.

This time, he claimed to see a path for Tesla to be worth more than Apple and Saudi Aramco *combined* (this would mean >$4.3T):

This time, he claimed to see a path for Tesla to be worth more than Apple and Saudi Aramco *combined* (this would mean >$4.3T):

To give that wild statement some more color, here's a visualization (at the time, $TSLA's market cap was roughly $700B):

4. This is where things go really crazy though.

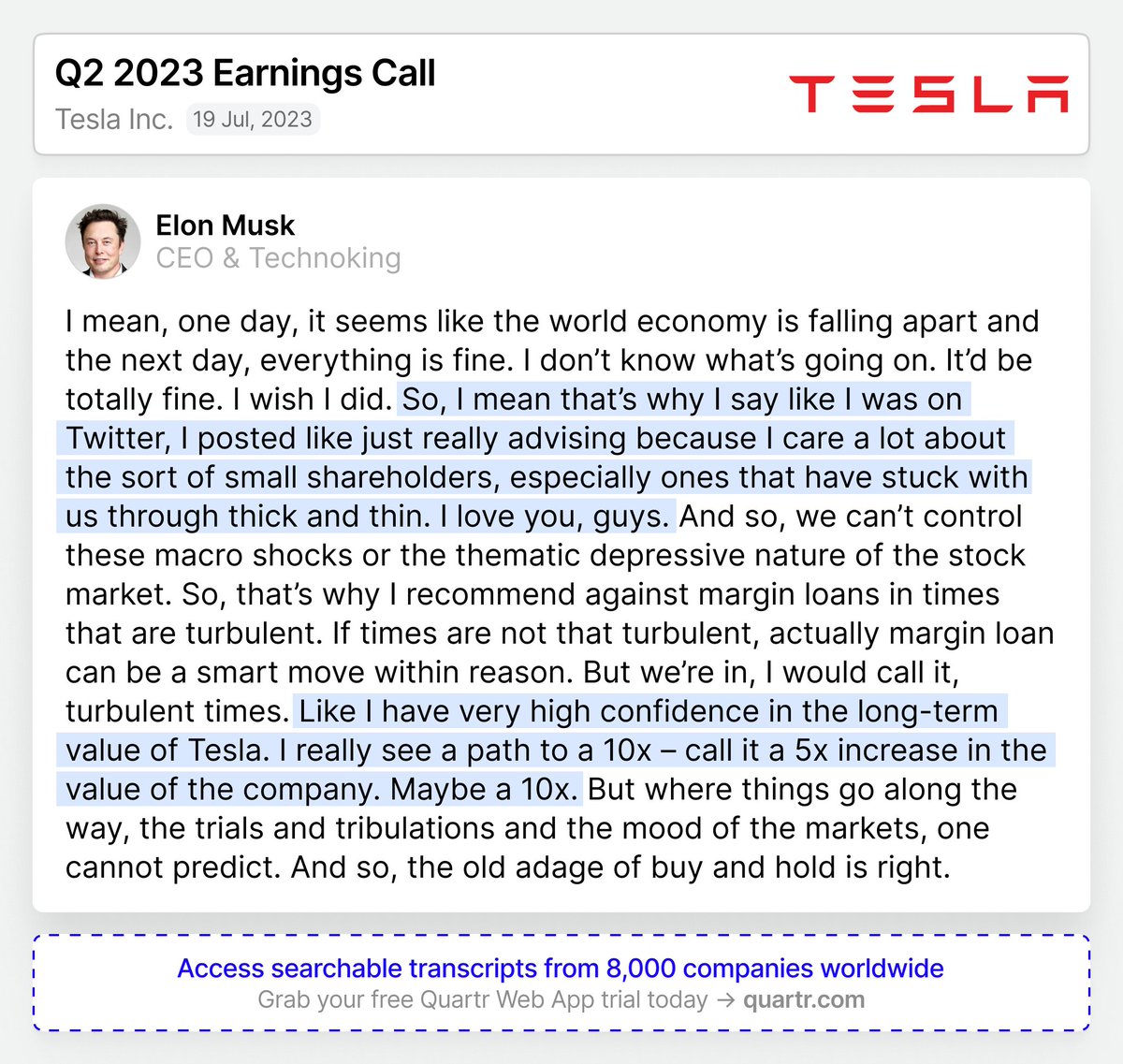

Earlier this year, Elon said he was "very confident" in a 10x (or 5x.. or maybe 10x) increase in $TSLA's market cap (this would mean ~$9.2T):

Earlier this year, Elon said he was "very confident" in a 10x (or 5x.. or maybe 10x) increase in $TSLA's market cap (this would mean ~$9.2T):

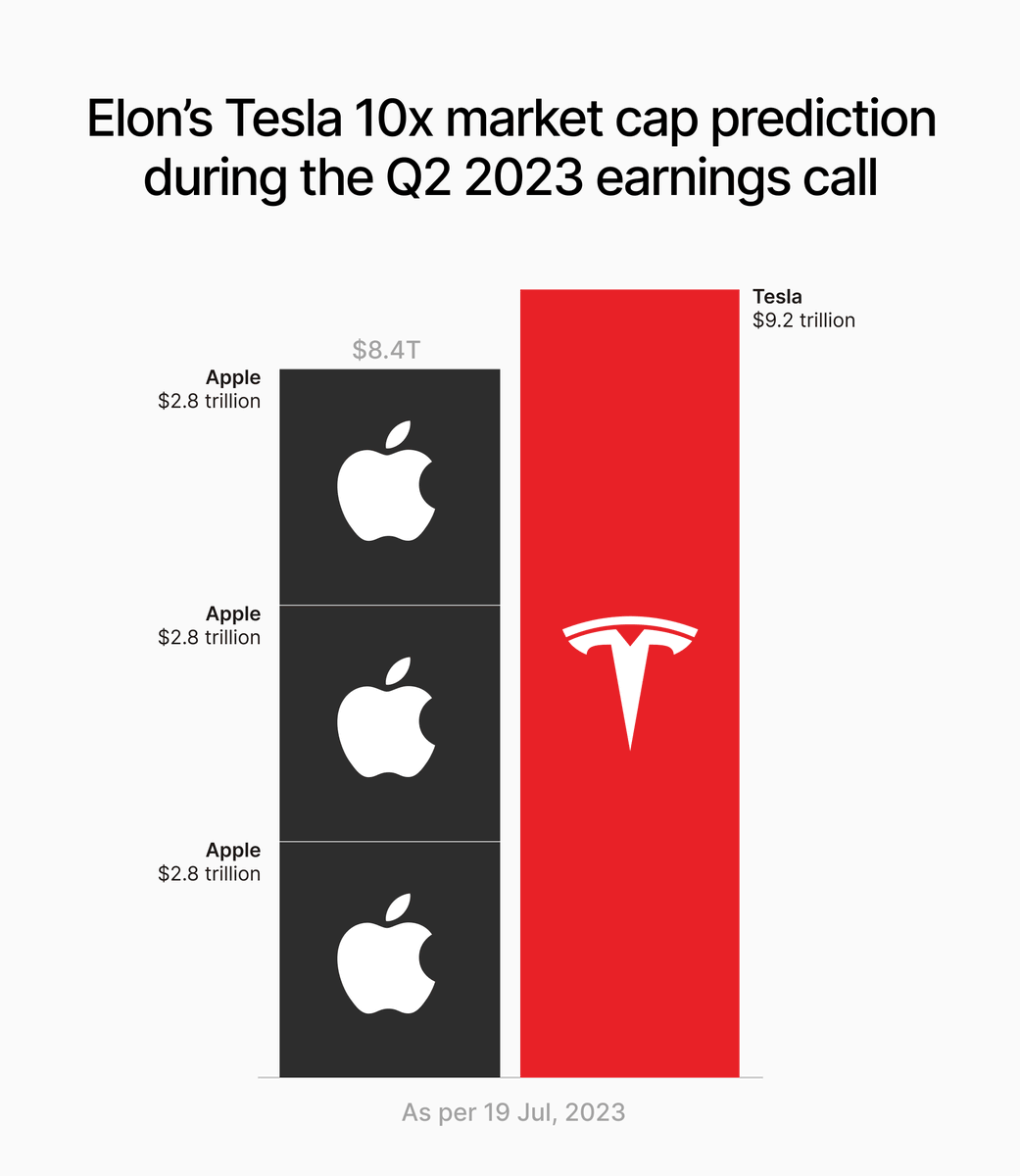

We of course visualized this, too.

Using today's $AAPL market cap of $2.8T, you could stack 3x (!) Apple and still not reach Elon's $TSLA $9.2T market cap prediction:

Using today's $AAPL market cap of $2.8T, you could stack 3x (!) Apple and still not reach Elon's $TSLA $9.2T market cap prediction:

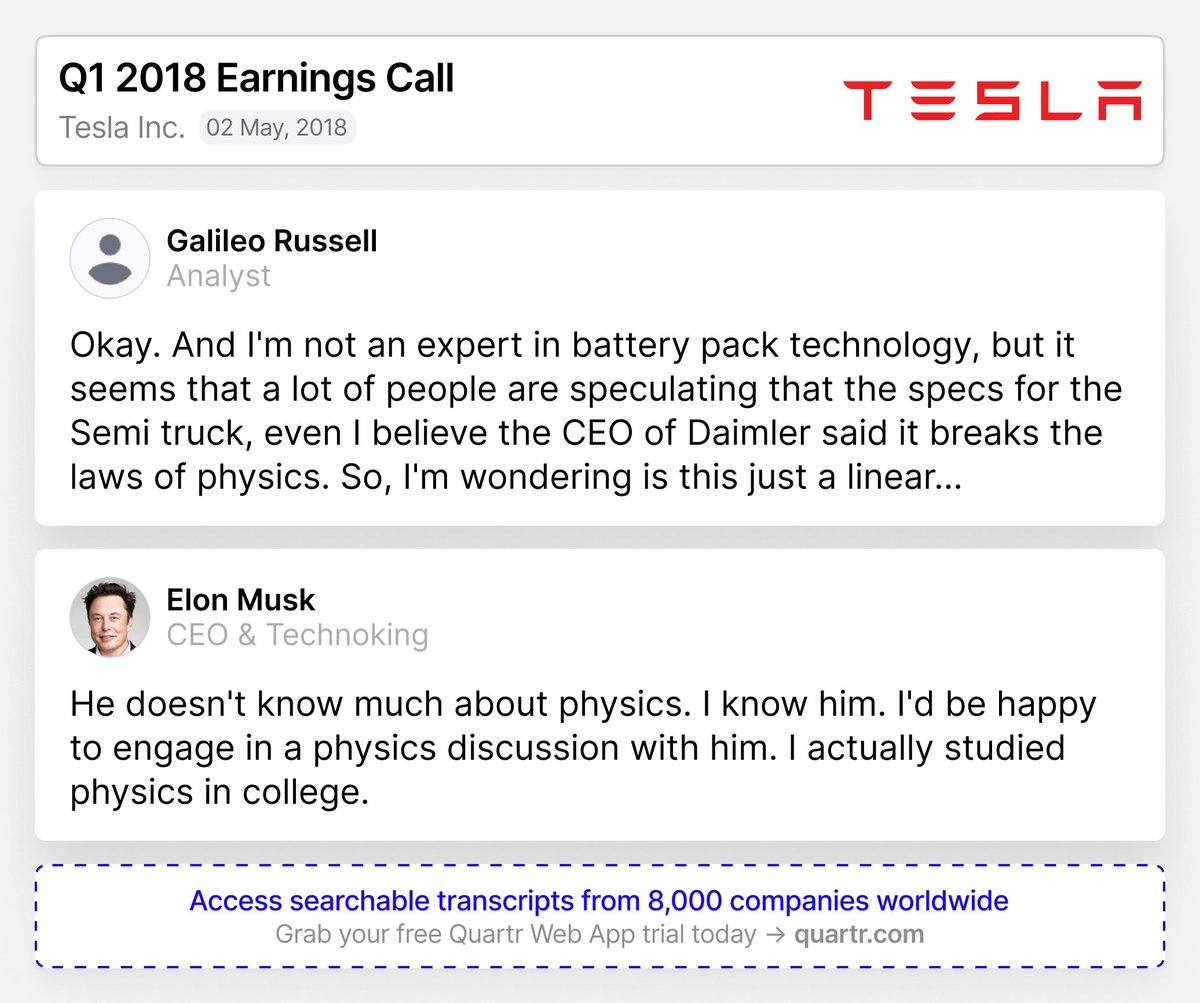

5. Here's another good one from 2018. @elonmusk says Daimler's CEO "doesn't know much about physics":

"These questions are so dry. They're killing me."

7. Here are two more funny "boring question" remarks from the Q1 2018 call:

7. Here are two more funny "boring question" remarks from the Q1 2018 call:

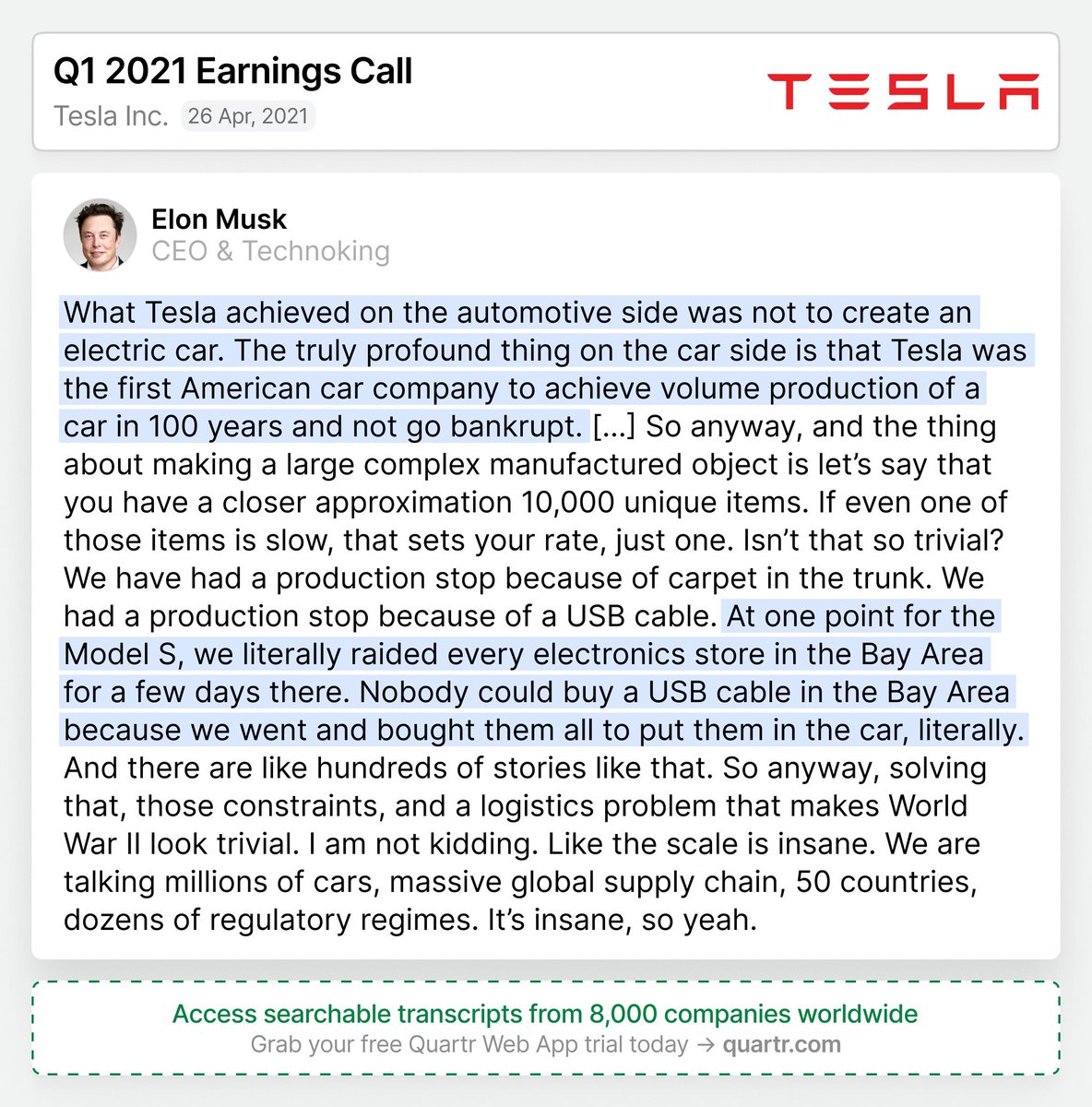

12. Elon on the fact that $TSLA was the first American car company in a 100 years to not go bankrupt while trying to achieve car volume production:

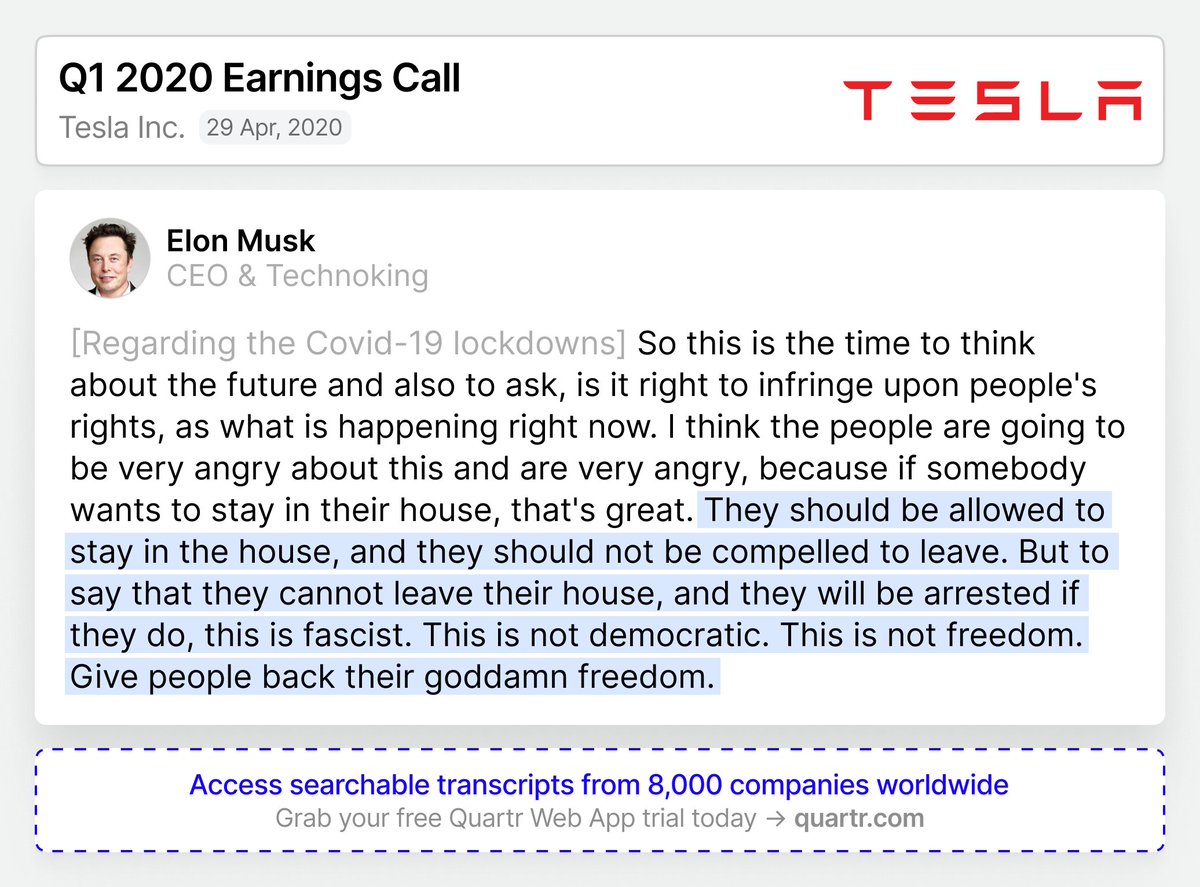

"Give people back their goddamn freedom"

13. Elon's very strong feelings about the Covid lockdowns in 2020:

13. Elon's very strong feelings about the Covid lockdowns in 2020:

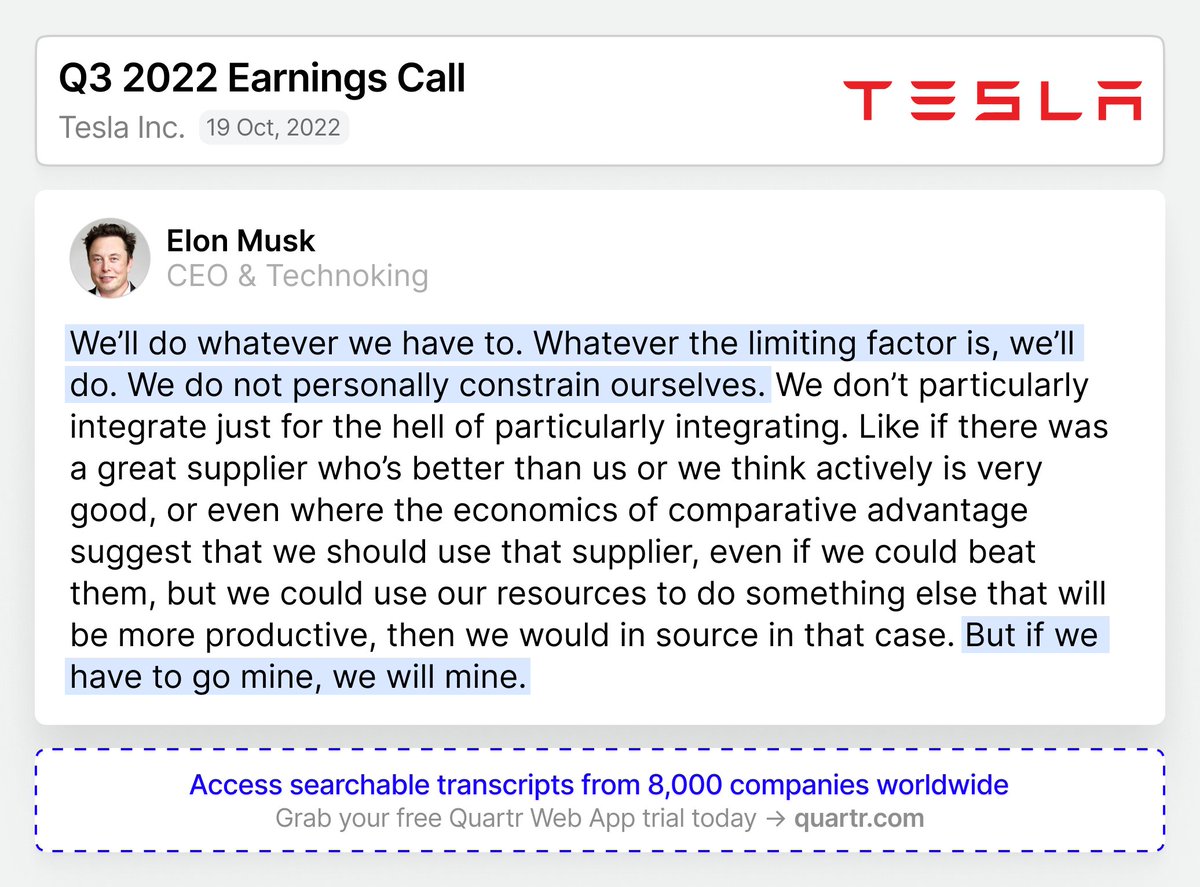

"If we have to go mine, we will mine"

15. On vertical integration – If $TSLA can't find a good enough raw materials supplier, they will start their own mine(s), says Musk:

15. On vertical integration – If $TSLA can't find a good enough raw materials supplier, they will start their own mine(s), says Musk:

• • •

Missing some Tweet in this thread? You can try to

force a refresh