🧵1/Ω

Things I Learned From Caroline Ellison's Testimony That CoinDesk Has Declined to Mention, a Thread:

1. The billion dollars that SBF had to bribe Chinese officials to give back was held on Huobi and OKX.

Things I Learned From Caroline Ellison's Testimony That CoinDesk Has Declined to Mention, a Thread:

1. The billion dollars that SBF had to bribe Chinese officials to give back was held on Huobi and OKX.

🧵2/Ω

That bribe was for $150 million.

That bribe was for $150 million.

🧵3/Ω

Multiple people at FTX/Alameda had family ties to the Chinese government. One of those people thought the bribe was a bad idea and quit shortly thereafter. The other one was the guy who suggested the bribe.

Multiple people at FTX/Alameda had family ties to the Chinese government. One of those people thought the bribe was a bad idea and quit shortly thereafter. The other one was the guy who suggested the bribe.

🧵4/Ω

In the official spreadsheet this bribe was listed under the line item "the thing: $150 million".

In the official spreadsheet this bribe was listed under the line item "the thing: $150 million".

🧵5/Ω

Before resorting to bribing the government of China directly they had the bright idea to bribe some Thai prostitutes to let them use their IDs to open accounts on Huobi and OKX. They then attempted to trade poorly against these accounts to transfer funds out.

Before resorting to bribing the government of China directly they had the bright idea to bribe some Thai prostitutes to let them use their IDs to open accounts on Huobi and OKX. They then attempted to trade poorly against these accounts to transfer funds out.

🧵6/Ω

The balance sheet that @CoinDesk and @MikeBurgersburg reported on that blew up FTX was actually a deep fake that understated liabilities by like $4-6 billion.

(CoinDesk did actually report this)

The balance sheet that @CoinDesk and @MikeBurgersburg reported on that blew up FTX was actually a deep fake that understated liabilities by like $4-6 billion.

(CoinDesk did actually report this)

🧵7/Ω

Back to "the thing": the Alameda/FTX employee who suggested the bribe was named David Ma. The employee who thought it was a bad idea and quit was named Handy.

Back to "the thing": the Alameda/FTX employee who suggested the bribe was named David Ma. The employee who thought it was a bad idea and quit was named Handy.

🧵8/Ω

When asked to explain to the court who exactly Ryan Salame was Caroline Ellison referred to him as "an employee of FTX."

On paper Ryan Salame was the co-CEO.

When asked to explain to the court who exactly Ryan Salame was Caroline Ellison referred to him as "an employee of FTX."

On paper Ryan Salame was the co-CEO.

🧵9/Ω

Prosecutor: "Was that bribe¹ approved by the legal department at FTX?"

Ellison: "No."

¹ given that bribery was not among the charges I believe the defense insisted it be referred to in more neutral language as like "a payment" or something.

Prosecutor: "Was that bribe¹ approved by the legal department at FTX?"

Ellison: "No."

¹ given that bribery was not among the charges I believe the defense insisted it be referred to in more neutral language as like "a payment" or something.

🧵10/Ω

Courtroom drama is real and when Caroline Ellison broke down crying discussing the final days of FTX and her relief at not having to lie any more was one for the record books. The jury will not forget that.

Courtroom drama is real and when Caroline Ellison broke down crying discussing the final days of FTX and her relief at not having to lie any more was one for the record books. The jury will not forget that.

🧵11/Ω

One of the ways SBF planned to close the hole in FTX and Alameda's books was to get regulators to close down Binance, at which point FTX would get all their customers and make a bazillion dollars.

(This was on a list of strategies they drew up in an executive meeting,)

One of the ways SBF planned to close the hole in FTX and Alameda's books was to get regulators to close down Binance, at which point FTX would get all their customers and make a bazillion dollars.

(This was on a list of strategies they drew up in an executive meeting,)

🧵12/Ω

Most internal discussions among FTX / Alameda about finances were done in Signal with auto-delete turned on but they made sure to use non-deleting slack messages to talk about their philanthropic endeavors.

Most internal discussions among FTX / Alameda about finances were done in Signal with auto-delete turned on but they made sure to use non-deleting slack messages to talk about their philanthropic endeavors.

🧵13/Ω

When FTX first moved to the Bahamas SBF and Caroline Ellison both had luxury vehicles. SBF decided they should get a Toyota Corolla and a Honda Civic for the optics.

When FTX first moved to the Bahamas SBF and Caroline Ellison both had luxury vehicles. SBF decided they should get a Toyota Corolla and a Honda Civic for the optics.

🧵14/Ω

There was a crypto hedge fund called Modulo that SBF insisted on investing customer funds in that Caroline thought was a bad idea. This hedge fund was sent $50 million worth of FTX assets via a transfer on $SBNY's SigNET network.

There was a crypto hedge fund called Modulo that SBF insisted on investing customer funds in that Caroline thought was a bad idea. This hedge fund was sent $50 million worth of FTX assets via a transfer on $SBNY's SigNET network.

🧵15/Ω

In a moment many people who have dated narcissistic sociopaths will probably relate to SBF attempted to blame Caroline Ellison for the financial straits FTX was in because she had "not hedged the Nasdaq enough".

When he yelled at her about this Caroline broke down crying.

In a moment many people who have dated narcissistic sociopaths will probably relate to SBF attempted to blame Caroline Ellison for the financial straits FTX was in because she had "not hedged the Nasdaq enough".

When he yelled at her about this Caroline broke down crying.

🧵16/Ω

Not mentioned at the time (but definitely mentioned in the courtroom) was the fact that SBF had YOLOed most of the FTX customer money onto insanely risky investments well before he left Caroline in charge of a burning building with a cheery "good luck!"

Not mentioned at the time (but definitely mentioned in the courtroom) was the fact that SBF had YOLOed most of the FTX customer money onto insanely risky investments well before he left Caroline in charge of a burning building with a cheery "good luck!"

🧵17/Ω

All of Caroline's tweets about "we're willing to buy all that $FTT at $22!" etc. etc were actually first drafted by SBF. The fraud team (SBF, Ellison, Singh, Wang) decided they sounded too much like SBF's tone of voice so they decided she would rewrite them.

All of Caroline's tweets about "we're willing to buy all that $FTT at $22!" etc. etc were actually first drafted by SBF. The fraud team (SBF, Ellison, Singh, Wang) decided they sounded too much like SBF's tone of voice so they decided she would rewrite them.

🧵18/Ω

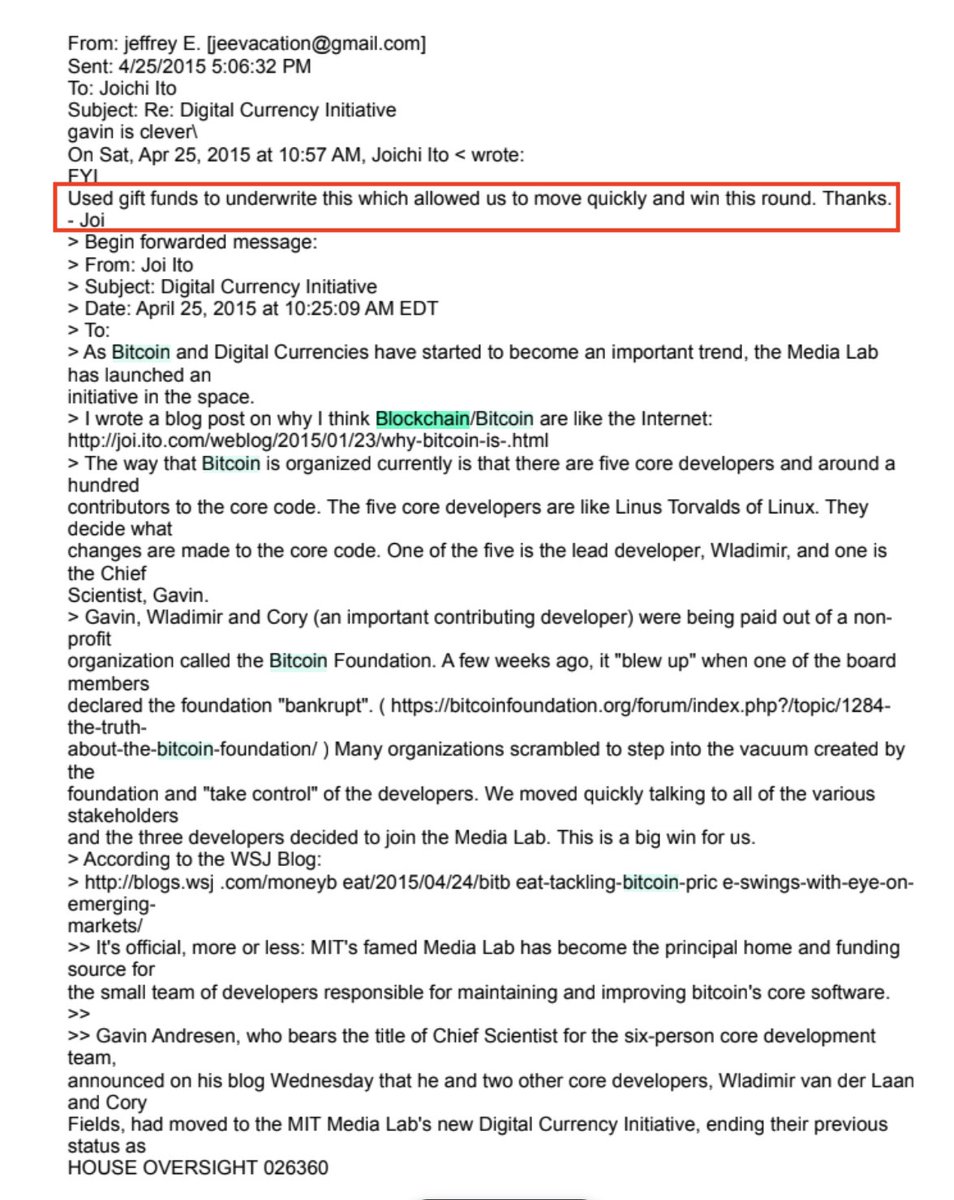

FTX intentionally kept its customer funds off of its balance sheet so that they auditor was not able to assess the situation correctly. This is how FTX scammed its way into a successful audit.

Remind you of anyone?

FTX intentionally kept its customer funds off of its balance sheet so that they auditor was not able to assess the situation correctly. This is how FTX scammed its way into a successful audit.

Remind you of anyone?

https://twitter.com/Cryptadamist/status/1709441374653669459

🧵19/Ω

Alameda burned its final deep toke of FTX customer money on defending the $22 mark for $FTT. Roughly $100 million was incinerated in this obviously futile endeavor in the final day before the collapse.

Alameda burned its final deep toke of FTX customer money on defending the $22 mark for $FTT. Roughly $100 million was incinerated in this obviously futile endeavor in the final day before the collapse.

🧵20/Ω

Way back in 2021 before Caroline Ellison and Sam Tabasco were placed in charge of Alameda there was a catastrophic trading failure where FTX lost $600-800 million in a single day mostly on $EBMX with a bit on #MobileCoin.

Way back in 2021 before Caroline Ellison and Sam Tabasco were placed in charge of Alameda there was a catastrophic trading failure where FTX lost $600-800 million in a single day mostly on $EBMX with a bit on #MobileCoin.

🧵21/Ω

It should be mentioned that the CEO of $SBNY, noted Joe Pesci impersonator Joseph DePaolo, explained *at length* on the post-FTX $SBNY earnings call that while FTX had started to setup SigNET accounts they had never actually been turned on.

Whoops.

It should be mentioned that the CEO of $SBNY, noted Joe Pesci impersonator Joseph DePaolo, explained *at length* on the post-FTX $SBNY earnings call that while FTX had started to setup SigNET accounts they had never actually been turned on.

Whoops.

https://twitter.com/Cryptadamist/status/1712224967813705916

🧵22/Ω

Back to the top. If yr not steeped in crypto you may not know what #Huobi/#OKX are or why it is notable that CoinDesk didn't mention them.

OKX is the Chinese crypto exchange of choice for fentanyl dealers.

Back to the top. If yr not steeped in crypto you may not know what #Huobi/#OKX are or why it is notable that CoinDesk didn't mention them.

OKX is the Chinese crypto exchange of choice for fentanyl dealers.

https://twitter.com/Cryptadamist/status/1712218395586732146

🧵23/Ω

Huobi is the Chinese crypto exchange currently owned by legendary (and PRC connected) scammer #JustinSun who also just so happens to be the biggest sponsor of @CoinDesk and apparently everything else in crypto these days.

Huobi is the Chinese crypto exchange currently owned by legendary (and PRC connected) scammer #JustinSun who also just so happens to be the biggest sponsor of @CoinDesk and apparently everything else in crypto these days.

https://twitter.com/Cryptadamist/status/1617938533989384192

🧵25/Ω

Is it a coincidence that @CoinDesk left that part out? I dunno. But the last time @CoinDesk published something critical of #JustinSun's relentless scamming was also one of the only times they retracted an article.

Is it a coincidence that @CoinDesk left that part out? I dunno. But the last time @CoinDesk published something critical of #JustinSun's relentless scamming was also one of the only times they retracted an article.

https://twitter.com/Cryptadamist/status/1695718561795170476

🧵26/Ω

Apparently I misspelled Handi Yang's name but apparently today's courtroom revelations have negatively impacted her career already. Though tbh i'm not sure why given that she was the one advocating *not* doing crimes and making corruptions.

Apparently I misspelled Handi Yang's name but apparently today's courtroom revelations have negatively impacted her career already. Though tbh i'm not sure why given that she was the one advocating *not* doing crimes and making corruptions.

https://twitter.com/CL207/status/1712188019078271349

🧵27/Ω

I guess to be fair not doing crimes and not making corruptions is going to severely impact your effectiveness in the cryptocurrency space. So it was probably reasonable to let her go from "eGirlCapital".

I guess to be fair not doing crimes and not making corruptions is going to severely impact your effectiveness in the cryptocurrency space. So it was probably reasonable to let her go from "eGirlCapital".

🧵28/Ω

Re: Handi Yang, the person w/family connections to the PRC who quit because she thought paying the bribe was a bad idea:

Re: Handi Yang, the person w/family connections to the PRC who quit because she thought paying the bribe was a bad idea:

https://twitter.com/innercitypress/status/1713293487611740386

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh