I just finished reading All Public Writings of Warren Buffett.

It took me 125 reading hours (40 pages per hour x 5,000 pages).

Here's what I learned:

It took me 125 reading hours (40 pages per hour x 5,000 pages).

Here's what I learned:

• How Warren Buffett selects companies

Every company should be one:

- They can understand (circle of competence)

- With favorable long-term prospects

- Operated by honest and competent people

- Available at very attractive prices

Every company should be one:

- They can understand (circle of competence)

- With favorable long-term prospects

- Operated by honest and competent people

- Available at very attractive prices

• Warren and Charlie's 2 main tasks

- Attract and keep outstanding managers

- Capital allocation

Berkshire wants to invest alongside managers who love what they do.

- Attract and keep outstanding managers

- Capital allocation

Berkshire wants to invest alongside managers who love what they do.

• Forecasting is a Fools Game

"I make no attempt to forecast the general market. My efforts are devoted to finding undervalued securities."

"I make no attempt to forecast the general market. My efforts are devoted to finding undervalued securities."

• You want declining stock prices

If you're a net buyer of stocks for the next 10 and 20 years, the best thing that can happen to you is declining stock prices.

If you're a net buyer of stocks for the next 10 and 20 years, the best thing that can happen to you is declining stock prices.

• Management should focus on capital allocation

"The primary test of managerial economic performance is the achievement of a high earnings rate on equity capital employed and not the achievement of consistent gains in earnings per share."

"The primary test of managerial economic performance is the achievement of a high earnings rate on equity capital employed and not the achievement of consistent gains in earnings per share."

• Phenomenal companies

"The combination of a very important and very hard-to-duplicate business advantage with extraordinary management whose skills in operations are matched by skills in capital allocation is phenomenal."

"The combination of a very important and very hard-to-duplicate business advantage with extraordinary management whose skills in operations are matched by skills in capital allocation is phenomenal."

• The importance of skin in the game

"At least four of the five, over 50% of the family net worth is represented by holdings of Berkshire. We eat our own cooking."

"At least four of the five, over 50% of the family net worth is represented by holdings of Berkshire. We eat our own cooking."

• Swing heavily when the odds are in your favor

"Good investment ideas are rare, valuable, and subject to competitive appropriation just as good product or business acquisition ideas are. When you've found, you should swing heavily."

"Good investment ideas are rare, valuable, and subject to competitive appropriation just as good product or business acquisition ideas are. When you've found, you should swing heavily."

• Invest in boring companies

"Experience, however, indicates that the best business returns are usually achieved by companies that are doing something quite similar today to what they were doing five or ten years ago."

"Experience, however, indicates that the best business returns are usually achieved by companies that are doing something quite similar today to what they were doing five or ten years ago."

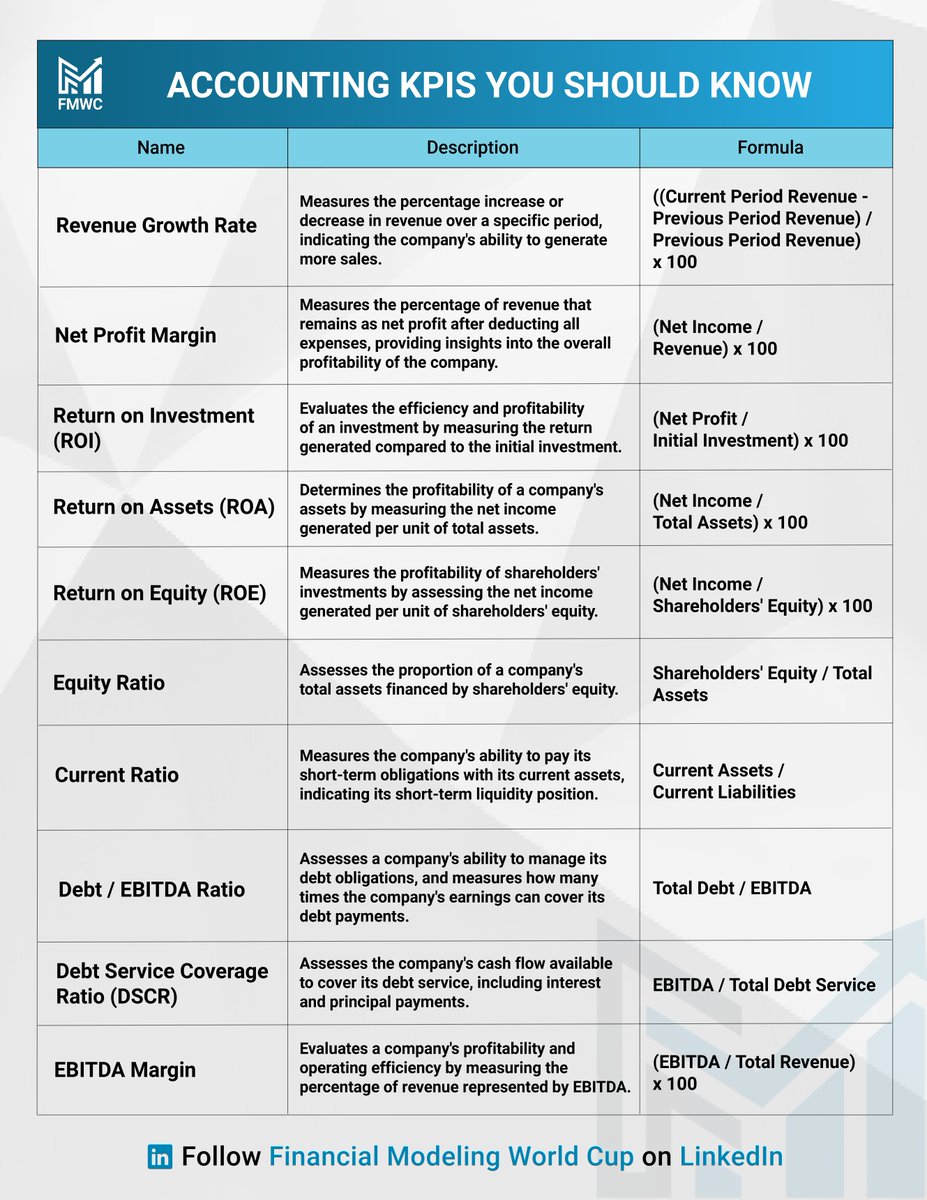

• How to measure operational excellence

"There are two tests of economic excellence

- An average return on equity of > 20% over the past decade

- No year worse than 15%.

These business superstars were also stock market superstars as 24 of the 25 outperformed the S&P 500."

"There are two tests of economic excellence

- An average return on equity of > 20% over the past decade

- No year worse than 15%.

These business superstars were also stock market superstars as 24 of the 25 outperformed the S&P 500."

• Favorite holding period is forever

"When we own outstanding businesses with outstanding management, our favorite holding period is forever."

"When we own outstanding businesses with outstanding management, our favorite holding period is forever."

• The power of reinvestment opportunities

"Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return."

"Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return."

• Buffett's acquisition criteria:

- Demonstrated consistent earnings power

- Business earning good returns on equity

- Healthy balance sheet

- Great management is already in place

- Simple businesses (so we can understand it)

- Demonstrated consistent earnings power

- Business earning good returns on equity

- Healthy balance sheet

- Great management is already in place

- Simple businesses (so we can understand it)

That's it for today.

I'm sharing the 5,000 page document for free with everyone who's interested.

Grab it for free here: eepurl.com/h9kw29

I'm sharing the 5,000 page document for free with everyone who's interested.

Grab it for free here: eepurl.com/h9kw29

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter