1/ NY Attorney General vs. DCG @BarrySilbert:

FTX was worse than Madoff.

And, DCG was worse than Enron.

This thread will show how.

And why the NYAG's request will force a sale of Grayscale.

FTX was worse than Madoff.

And, DCG was worse than Enron.

This thread will show how.

And why the NYAG's request will force a sale of Grayscale.

2/ The Enron fraud involved the use of off-balance sheet special purpose entities (SPEs) to hide debt and inflate profits.

Enron executives engaged in self-dealing transactions.

The NYAG alleges DCG did both of these...and more.

Enron executives engaged in self-dealing transactions.

The NYAG alleges DCG did both of these...and more.

3/ Through complex financial structures, Enron was able to disguise its true financial state, misleading investors and analysts.

DCG did the same (later), but took it to another level

DCG did the same (later), but took it to another level

4/ While many of Enron's transactions were technically within the legal boundaries, the aggregate manipulation of these transactions was the fraud.

Enron exploitated accounting loopholes and got auditors and bankers to sign off.

Enron exploitated accounting loopholes and got auditors and bankers to sign off.

5/ The difference is DCG flat out falsified their statements, withheld material information, withheld disclosure, and lied to its own staff and customers about its cutomer health.

There were no loopholes with the DCG fraud.

There were no loopholes with the DCG fraud.

6/ DCG and Genesis knew the latter was insolvent. But both parties sought to portray 'business as usual' and a 'well capitalized status'

7/ Genesis "concealed disclosure" of financials for many months despite requests from customers and Gemini.

The CFO refused to join customer calls. Instead, the front-line was provided with talking points to perpetuate the deception

The CFO refused to join customer calls. Instead, the front-line was provided with talking points to perpetuate the deception

8/ DCG "raided the Genesis piggy bank using customer funds to finance itself.

DCG directed its subsidiary to re-finance its own loans multiple times and dictated terms.

This action deepened the Genesis negative equity hole.

DCG directed its subsidiary to re-finance its own loans multiple times and dictated terms.

This action deepened the Genesis negative equity hole.

9/ The NYAG complaint is Civil in nature. But the complaint alleges @BarrySilbert and execs broke multiple criminal laws, repeatedly.

10/ The NYAG shows thru multiple pieces of evidence that Silbert directed the fraud from DCG.

Silbert: "We can't allow people inside our outside to question Genesis solvency"

Silbert: "We can't allow people inside our outside to question Genesis solvency"

11/ Pair that note from DCG's CEO with the Genesis CEO saying: "If we're able to show our balance sheet after all of that happened and it still looks strong...people will care less about losses"

That’s not how it works.

You show the balance sheet as-is.

That’s not how it works.

You show the balance sheet as-is.

12/ Here's more evidence of Barry Silbert directing Genesis.

"We received guidance from [ Silbert ] to re-paper the $100 Loan...we will do what DCG needs us to do."

DCG also set the interest rate and terms.

"We received guidance from [ Silbert ] to re-paper the $100 Loan...we will do what DCG needs us to do."

DCG also set the interest rate and terms.

13/ DCG's Head of Communications and COO were drafting tweets for Genesis CEO (Moro) - and advising that he send it off his personal twitter

14/ On the Promissory Note

DCG never "assumed the liability" contrary to public statements.

The Promissory Note was material, self-directed and concealed the truth - it was intended to deceive and mislead.

That’s fraud.

DCG never "assumed the liability" contrary to public statements.

The Promissory Note was material, self-directed and concealed the truth - it was intended to deceive and mislead.

That’s fraud.

15\ DCG started talking about "Duration Mismatch" in its November letter to investors and 'crypto volatility' as the cause for its woes.

I called this deception out back in November after the DCG shareholder letter:

I called this deception out back in November after the DCG shareholder letter:

https://x.com/ramahluwalia/status/1596299537571774465?s=20

16/ Genesis front-line staff and account executives were kept in the dark.

Some asked good questions and suspected not all was well.

This is a story of bad leadership.

Some asked good questions and suspected not all was well.

This is a story of bad leadership.

17/ Not only did Genesis defraud Gemini and conseal statements... when Gemini put in the redemption notice Genesis threatened bankruptcy.

Pause and imagine being placed in that pickle for a moment.

Pause and imagine being placed in that pickle for a moment.

18/ Here's a sample of the human cost.

Gemini Earn : 232,000 investors and $1 Bn +

(That excludes Genesis direct creditors)

A 73 year-old grandmother and her husband, both retired, had her life savings in earn.

Gemini Earn : 232,000 investors and $1 Bn +

(That excludes Genesis direct creditors)

A 73 year-old grandmother and her husband, both retired, had her life savings in earn.

19/ What the NYAG ask?

(1) Prohibit DCG from running a securities & commodities business.

That forces DCG to spin-off Grayscale. DCG would not be able to raise VC money.

So DCG would turn into a zombie company with endless fines & settlements.

(1) Prohibit DCG from running a securities & commodities business.

That forces DCG to spin-off Grayscale. DCG would not be able to raise VC money.

So DCG would turn into a zombie company with endless fines & settlements.

20/ The NYAG requests that Defendants pay damages, and Restitution, and Disgorgement of profits.

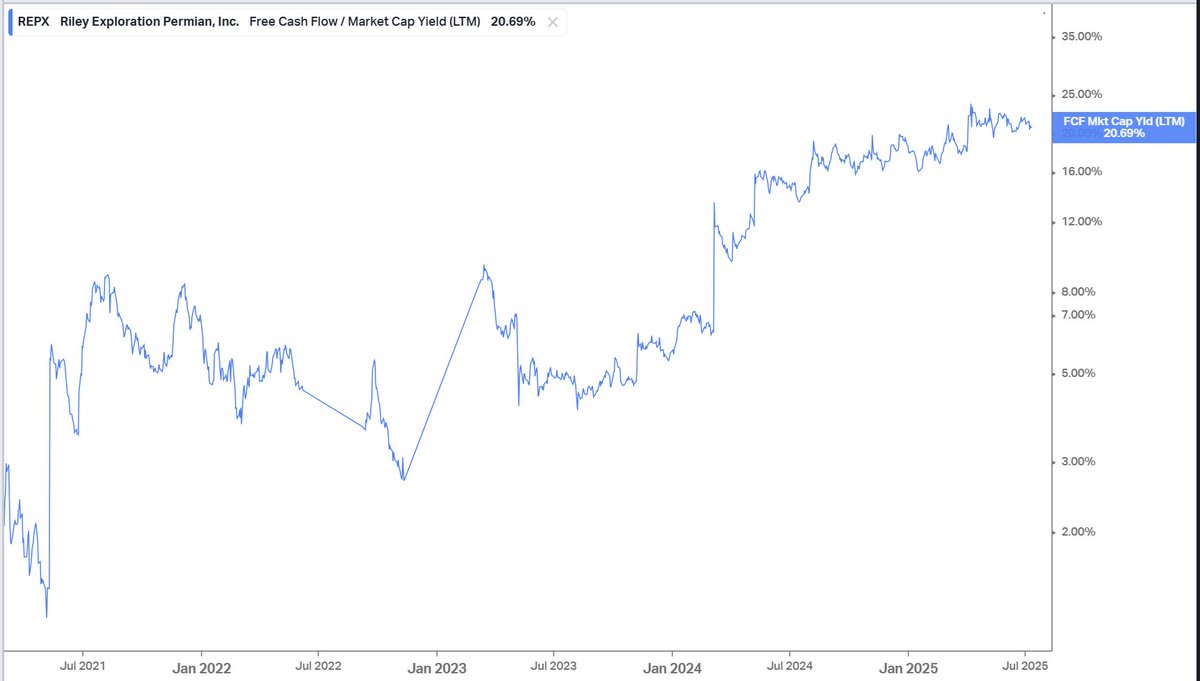

DCG doesn't have the money because of the Widowmaker trade.

So it will take years to make creditors whole.

DCG is done for. And the DCG fraud exceeded Enron.

DCG doesn't have the money because of the Widowmaker trade.

So it will take years to make creditors whole.

DCG is done for. And the DCG fraud exceeded Enron.

21/ If you want to learn more about the 'Grayscale GBTC' Widowmaker trade at the center of these issues, this is ane excellent podcast overview

h/t @TheStalwart @tracyalloway

h/t @TheStalwart @tracyalloway

https://x.com/TheStalwart/status/1616225976660140036?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh