Non-Consensus Investing. Founder of @lumidawealth. ex-Wall St. Markets and philsophy. NYC & Exeter alum. Dad of 3. Disproving the EMH one day at a time.

3 subscribers

How to get URL link on X (Twitter) App

https://x.com/ramahluwalia/status/1860881099913629837

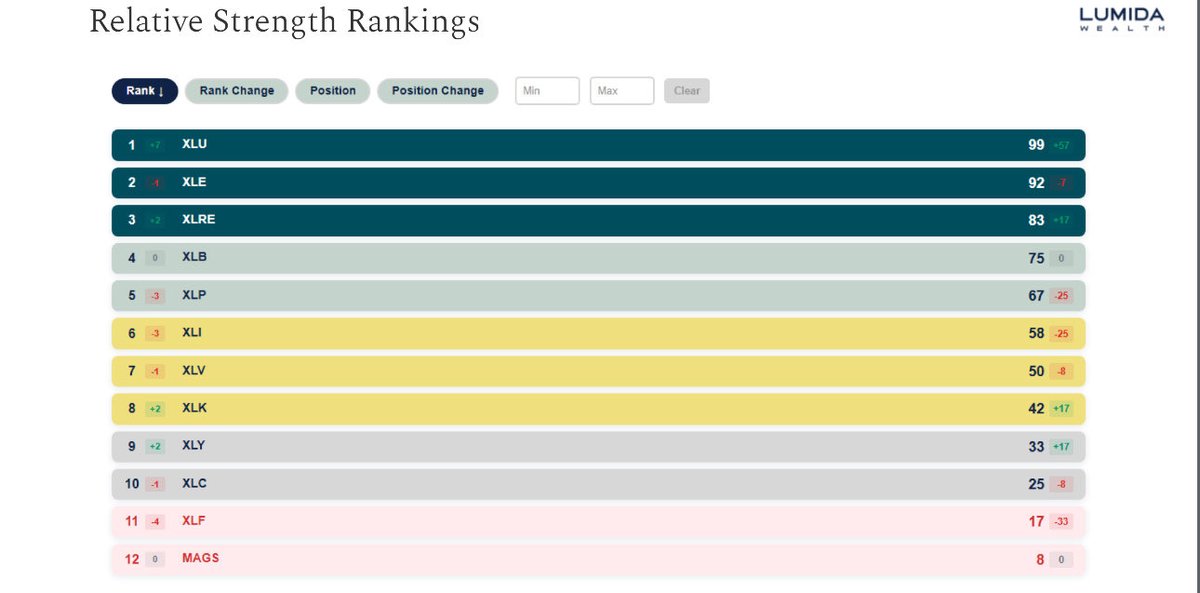

Check out what’s working…

Check out what’s working…

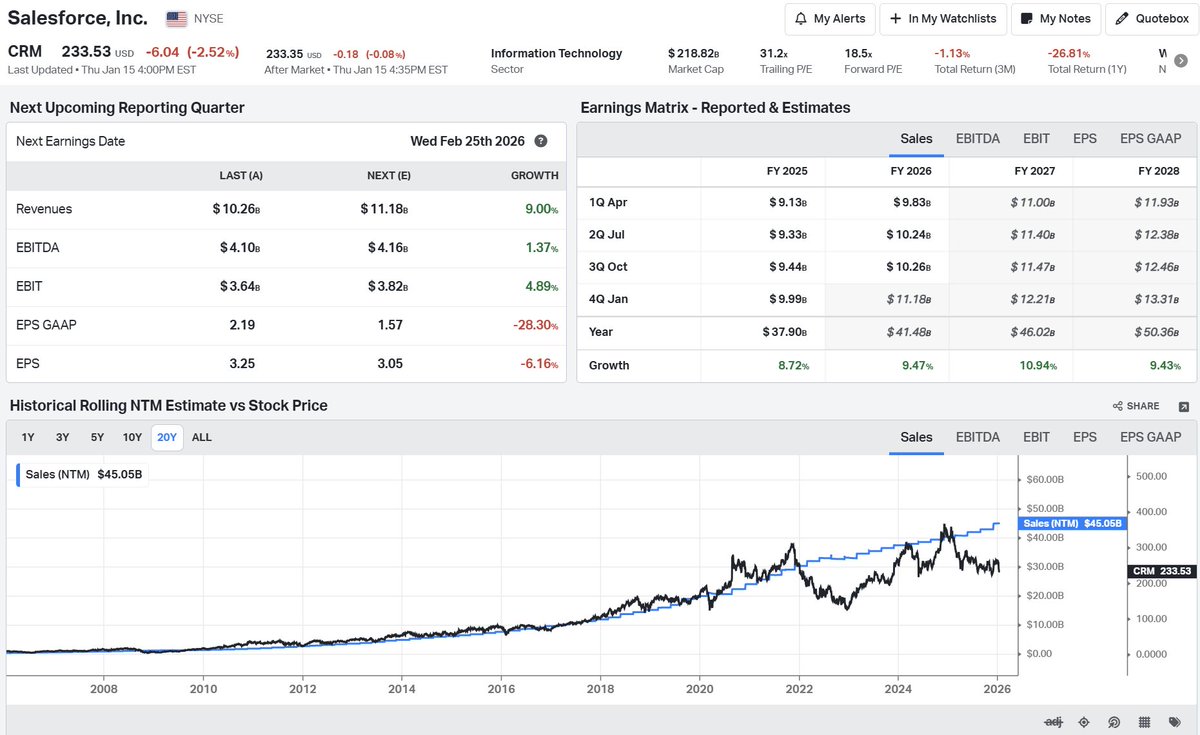

2/ Now let's look at Salesforce $CRM

2/ Now let's look at Salesforce $CRM

2/ More on how we analyzed Better

2/ More on how we analyzed Betterhttps://twitter.com/ramahluwalia/status/1970251823127609645

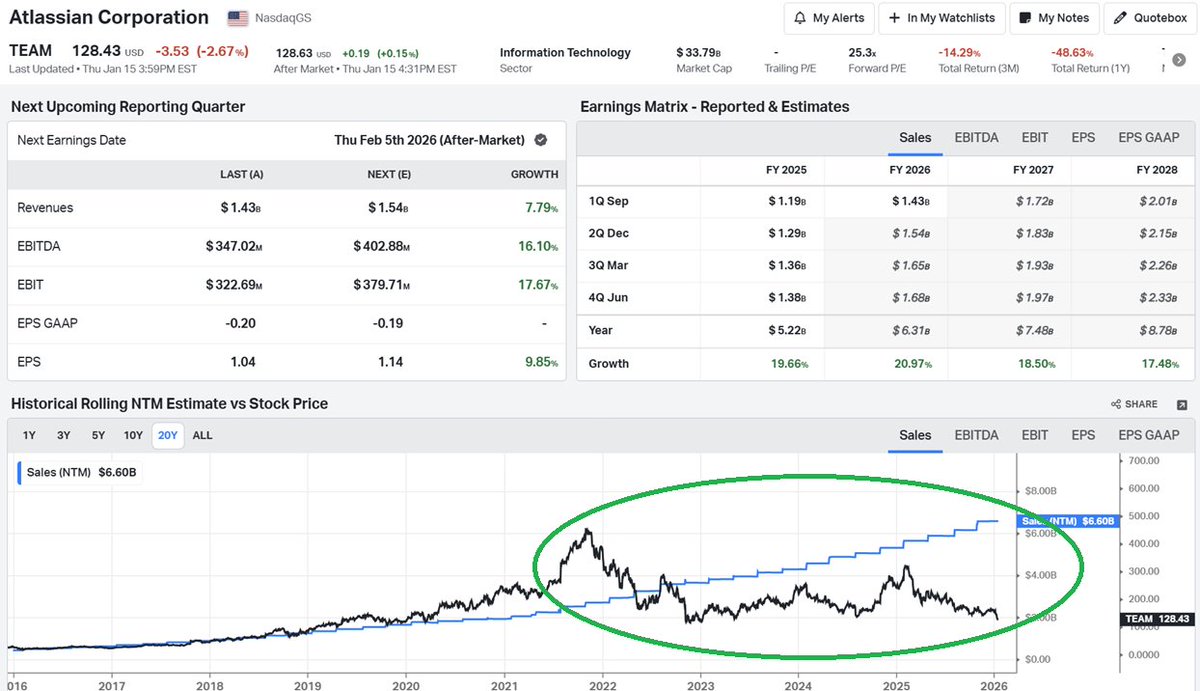

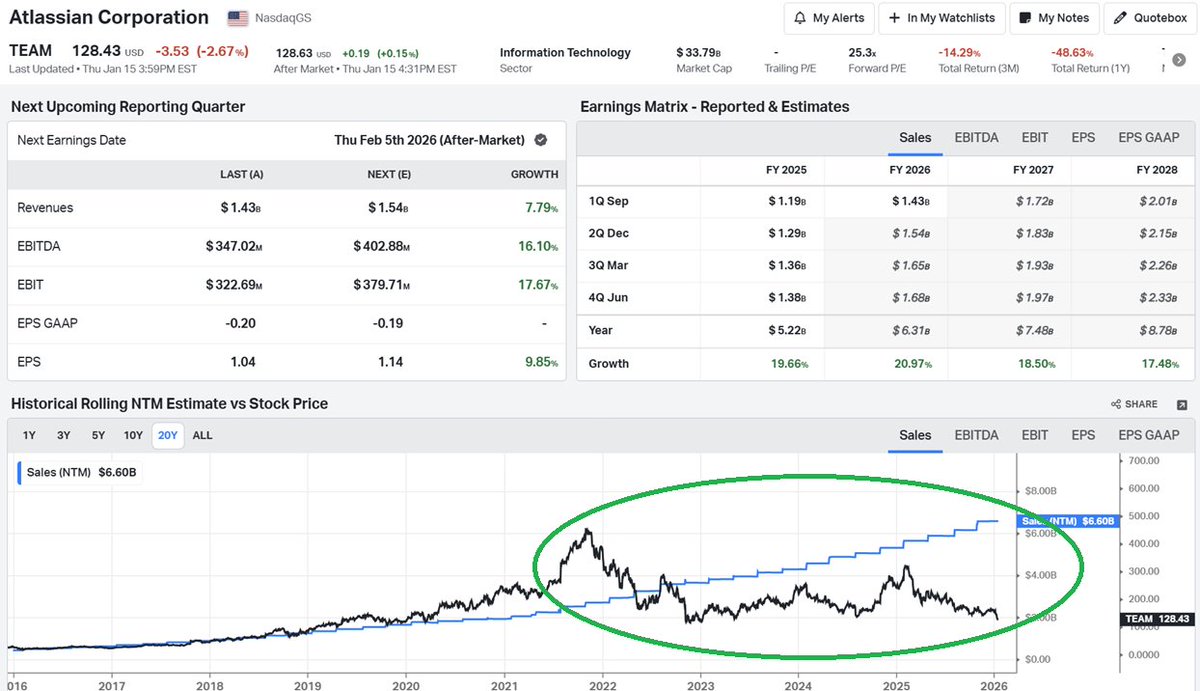

2/ AI tools don’t yet have the ability to reason this way. Partly b/c this is a straightforward concept - but the CF- curriculum and wall street research doesn’t look at asset prices this way.

2/ AI tools don’t yet have the ability to reason this way. Partly b/c this is a straightforward concept - but the CF- curriculum and wall street research doesn’t look at asset prices this way.

1/ Trump's stated goal is to bring back manufacturing to the United States via Tariffs.

1/ Trump's stated goal is to bring back manufacturing to the United States via Tariffs.

https://twitter.com/ramahluwalia/status/1859397509400899590

2/ Cost of Revenue as demand surges

2/ Cost of Revenue as demand surges

The VCs and Podcasts are talking about DeepSeek 😂

The VCs and Podcasts are talking about DeepSeek 😂 https://twitter.com/ramahluwalia/status/1883287245521907788

https://twitter.com/ramahluwalia/status/1767931489985970502

2/ Solana has been the fastest horse in the race delivering momentum.

2/ Solana has been the fastest horse in the race delivering momentum.https://x.com/joemccann/status/1769497076667404528

2/ December 25th - "I do think tech stocks are overbought - market has 2 weeks left give or take"

2/ December 25th - "I do think tech stocks are overbought - market has 2 weeks left give or take"https://x.com/ramahluwalia/status/1739481285746164093?s=20

https://twitter.com/ramahluwalia/status/1678889762747297792

2/ SoFi loses about ~$9 Bn in negative Cash Flow from Operations each year.

2/ SoFi loses about ~$9 Bn in negative Cash Flow from Operations each year.