🧵 1/8- If you want to be an options trader, then forecasting volatility is absolutely essential.

Without a view of volatility, your trading strategy is incomplete. But how do you forecast volatility? Here is a quick hack 👇🏾

Without a view of volatility, your trading strategy is incomplete. But how do you forecast volatility? Here is a quick hack 👇🏾

2/8 - Most trading strategies require you to have a view🔭 on Volatility. But how do you forecast volatility?

A simple Google search takes you down the GARCH rabbit hole.

What is GARCH?🤷

A simple Google search takes you down the GARCH rabbit hole.

What is GARCH?🤷

3/8 - The Generalised Autoregressive Conditional Heteroskedasticity (GARCH) process is a complex statistical approach to estimating the volatility of financial markets.

Financial institutions use the model to estimate 🧮 the return volatility of stocks, bonds, indices, etc.

Financial institutions use the model to estimate 🧮 the return volatility of stocks, bonds, indices, etc.

4/8- The GARCH is a big family of statistical models.👨👨👧👧

There are about half a dozen important ones, and they all need to be tuned to the financial instrument whose volatility you are trying to forecast.

There are about half a dozen important ones, and they all need to be tuned to the financial instrument whose volatility you are trying to forecast.

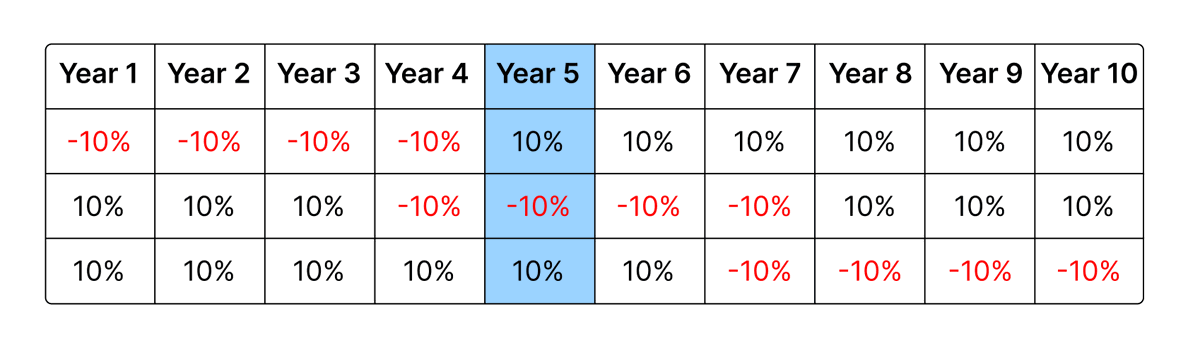

5/8- However, there is a simpler way out. We know that volatility clusters🍇. That is,

Low volatility begets low volatility, and

High volatility begets high volatility.

What if we just say that tomorrow's forecast equals today's volatility?

Low volatility begets low volatility, and

High volatility begets high volatility.

What if we just say that tomorrow's forecast equals today's volatility?

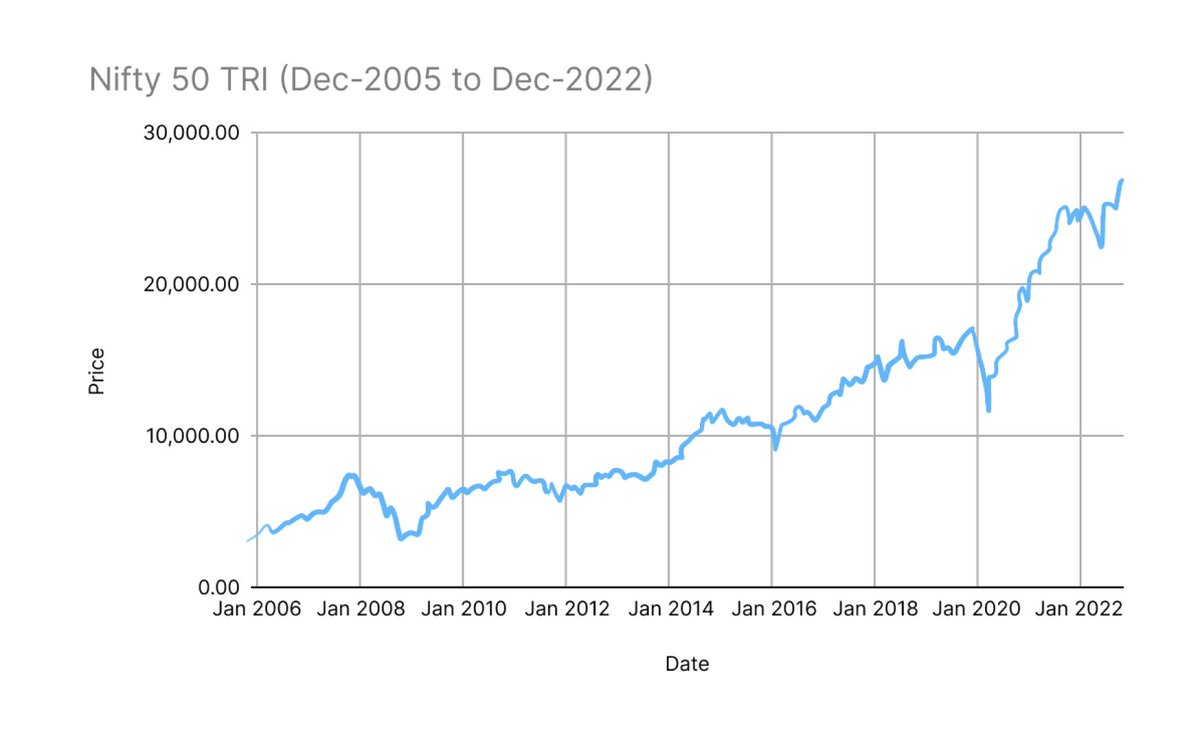

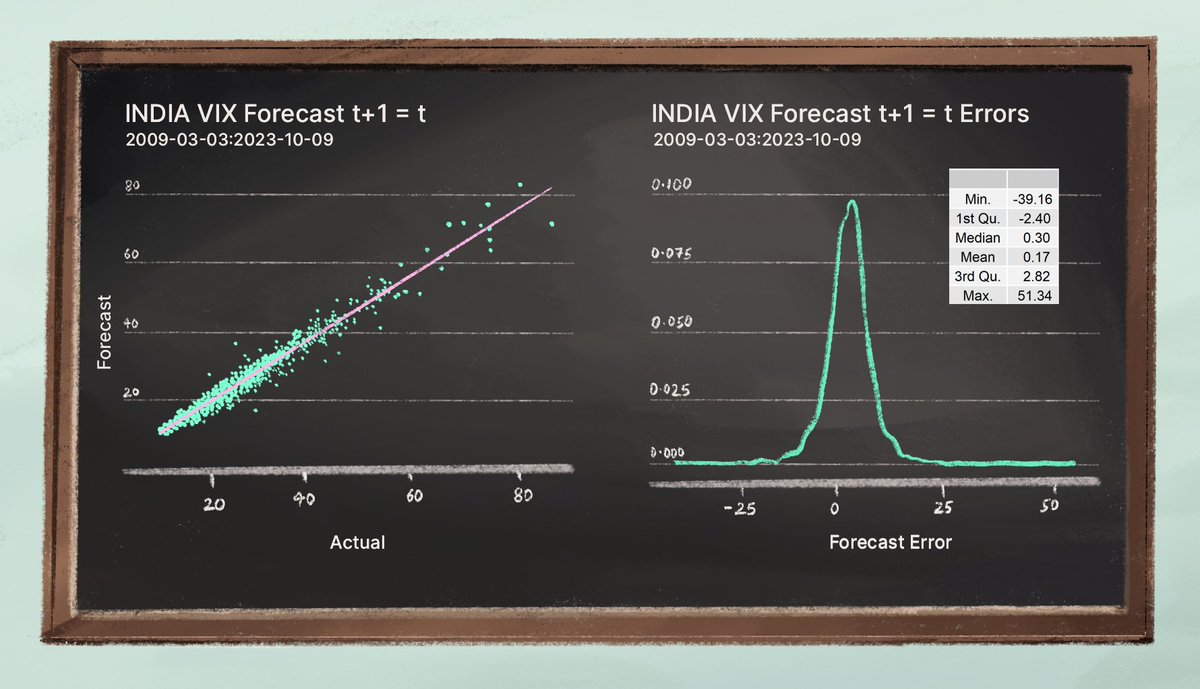

6/8 - Turns out, it is not so bad. When you apply this funda for the India VIX index, the error band is pretty narrow.

It is simple. It is fast. And most importantly, as a trader, you know what you are doing.

It is simple. It is fast. And most importantly, as a trader, you know what you are doing.

7/8- There are some instances where overnight risk makes its presence felt and trashes our forecast.🥺

However, even a super-sophisticated GARCH model will not be able to capture that either.

So why not choose KISS over GARCH any day? Keep It Simple, Silly!

However, even a super-sophisticated GARCH model will not be able to capture that either.

So why not choose KISS over GARCH any day? Keep It Simple, Silly!

9/8 - Check out the Options Theory for Professional Trading module on Varsity.

zerodha.com/varsity/module…

zerodha.com/varsity/module…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter