Simplifying markets, trading, and investing. Everything you need to know to make your first investment.

How to get URL link on X (Twitter) App

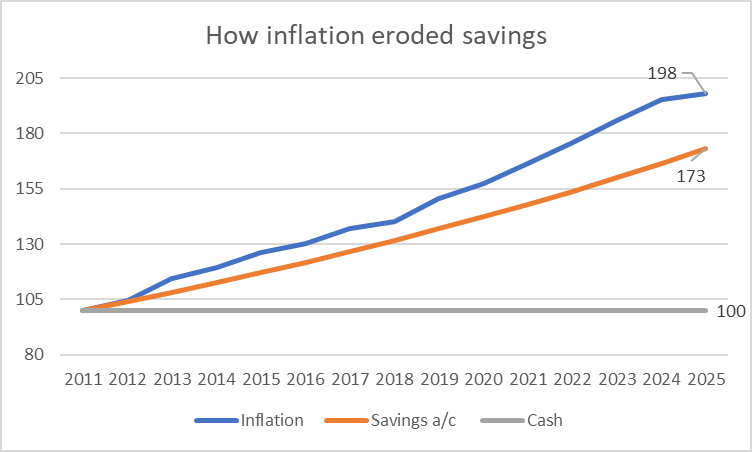

2⃣ Historical performance of various asset classes.

2⃣ Historical performance of various asset classes.

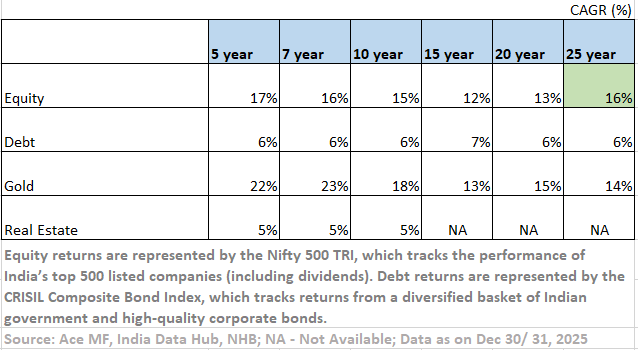

This coverage under the Vay Vandana card is in addition to any private health insurance the senior citizen may already have.

This coverage under the Vay Vandana card is in addition to any private health insurance the senior citizen may already have.

India currently has five publicly listed REITs: Embassy, Brookfield, Mindspace, Nexus Select Trust, and Knowledge Realty Trust. The REIT story in India is still fairly recent; the first public REIT, Embassy Office Parks REIT, was listed only in 2019.

India currently has five publicly listed REITs: Embassy, Brookfield, Mindspace, Nexus Select Trust, and Knowledge Realty Trust. The REIT story in India is still fairly recent; the first public REIT, Embassy Office Parks REIT, was listed only in 2019.

IMF rates data quality from A to D: A is the highest and D the lowest.

IMF rates data quality from A to D: A is the highest and D the lowest.

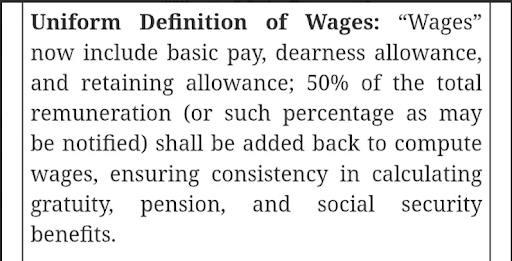

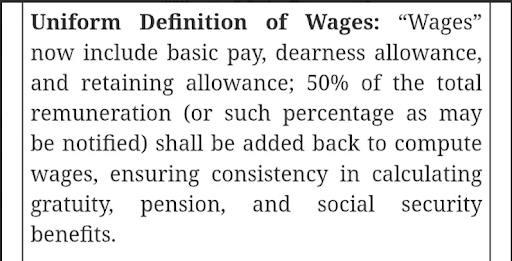

Generally, “wages” = basic pay + dearness allowance (DA).

Generally, “wages” = basic pay + dearness allowance (DA).

1⃣Besides being a precious metal, Silver’s applications in solar panels, EVs, wind turbines, semiconductors, and advanced electronics have been on the rise. But this has been known for the past few years. Perhaps, something deeper is brewing in the silver markets. (2/n)

1⃣Besides being a precious metal, Silver’s applications in solar panels, EVs, wind turbines, semiconductors, and advanced electronics have been on the rise. But this has been known for the past few years. Perhaps, something deeper is brewing in the silver markets. (2/n)

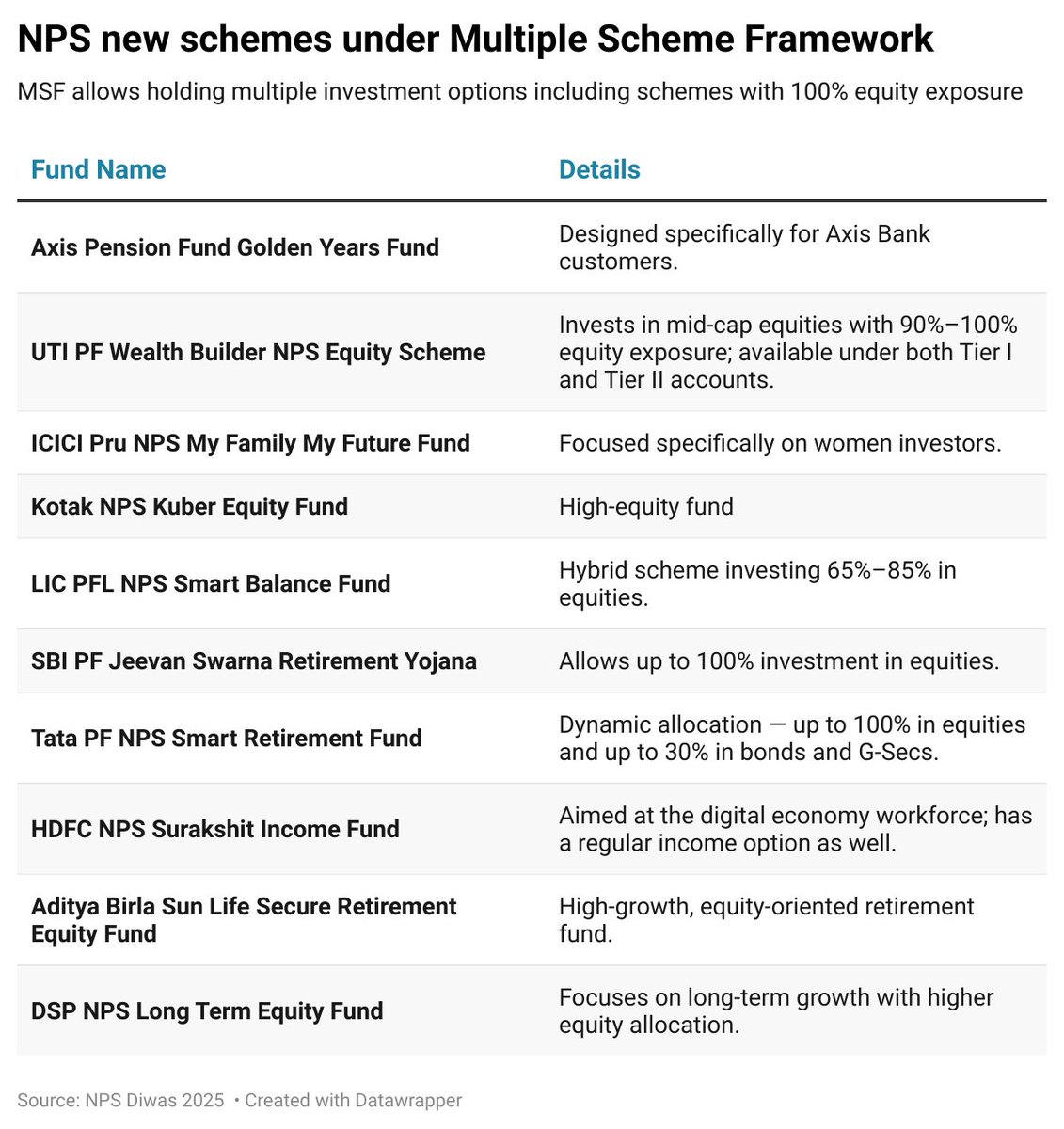

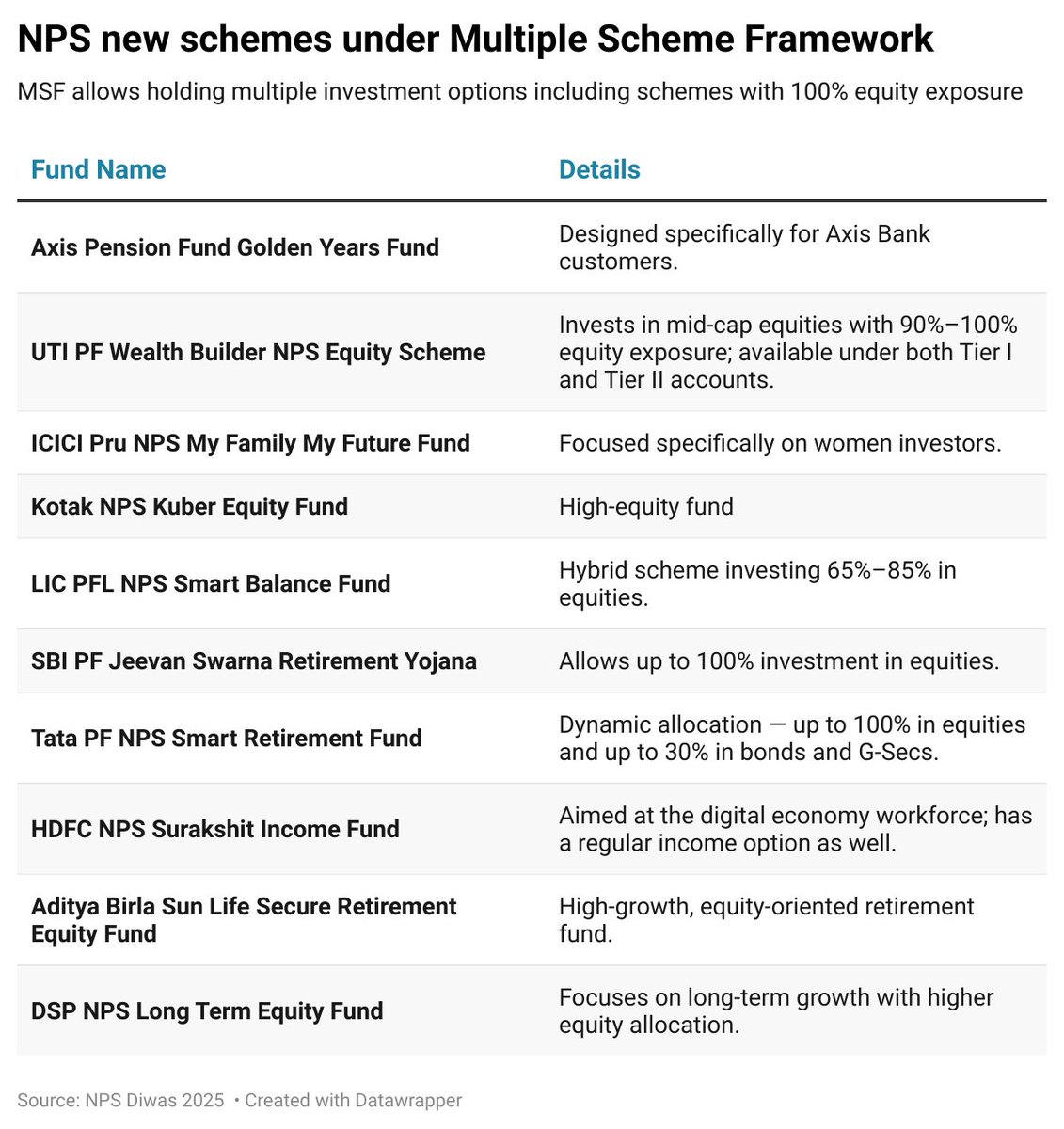

1⃣ Can you transfer your existing NPS investments into these new schemes?

1⃣ Can you transfer your existing NPS investments into these new schemes?

1⃣What are multiple schemes?

1⃣What are multiple schemes?

1⃣RERA website: a treasure of data

1⃣RERA website: a treasure of data

Budget 2024 made corporate NPS more attractive by offering tax benefits on employer contributions (up to 14% of basic+DA) under the new tax regime.

Budget 2024 made corporate NPS more attractive by offering tax benefits on employer contributions (up to 14% of basic+DA) under the new tax regime.

When a manufacturer prices a product, they factor in costs like ingredients, labor, packaging, profit, wholesaler cuts, taxes, and what customers can afford. The government doesn't dictate this initial price. (1/12)

When a manufacturer prices a product, they factor in costs like ingredients, labor, packaging, profit, wholesaler cuts, taxes, and what customers can afford. The government doesn't dictate this initial price. (1/12)

Dabba trading is an underground market where stock deals happen OUTSIDE official stock exchanges. There’s no registered broker to place trades. There’s no documentation or KYC.

Dabba trading is an underground market where stock deals happen OUTSIDE official stock exchanges. There’s no registered broker to place trades. There’s no documentation or KYC.

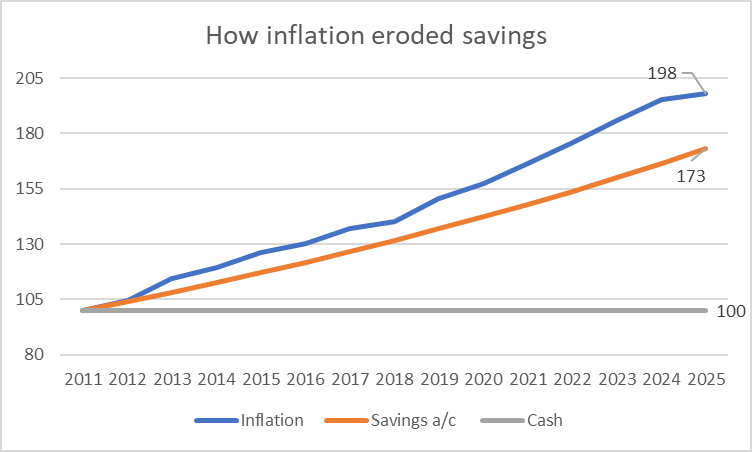

Consumer Price Index (CPI) inflation measures the price change for a basket of goods and services of regular use, such as food, fuel, housing, clothing, education, health, and transport.

Consumer Price Index (CPI) inflation measures the price change for a basket of goods and services of regular use, such as food, fuel, housing, clothing, education, health, and transport.