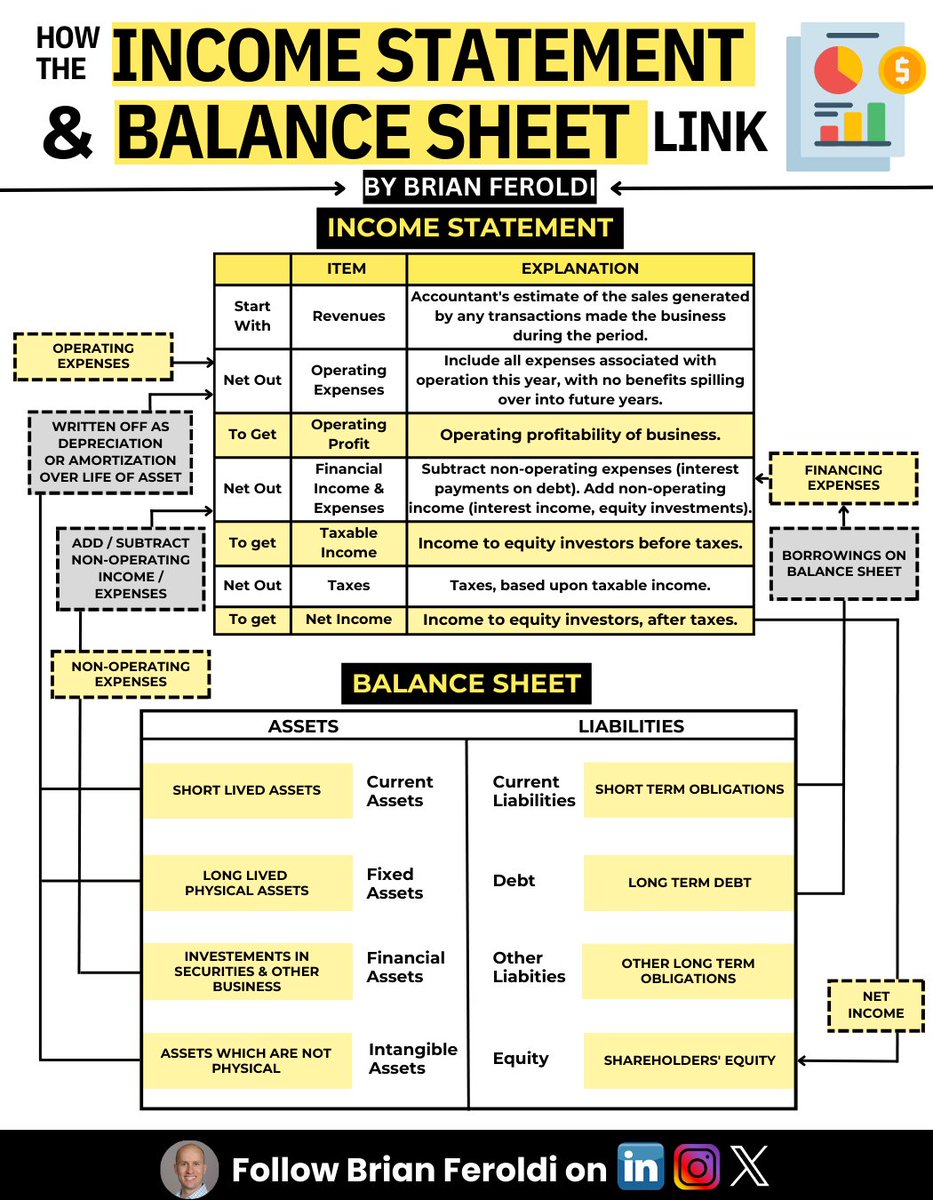

If you buy individual stocks, you MUST understand accounting.

These 7 infographics will help you master balance sheet analysis:

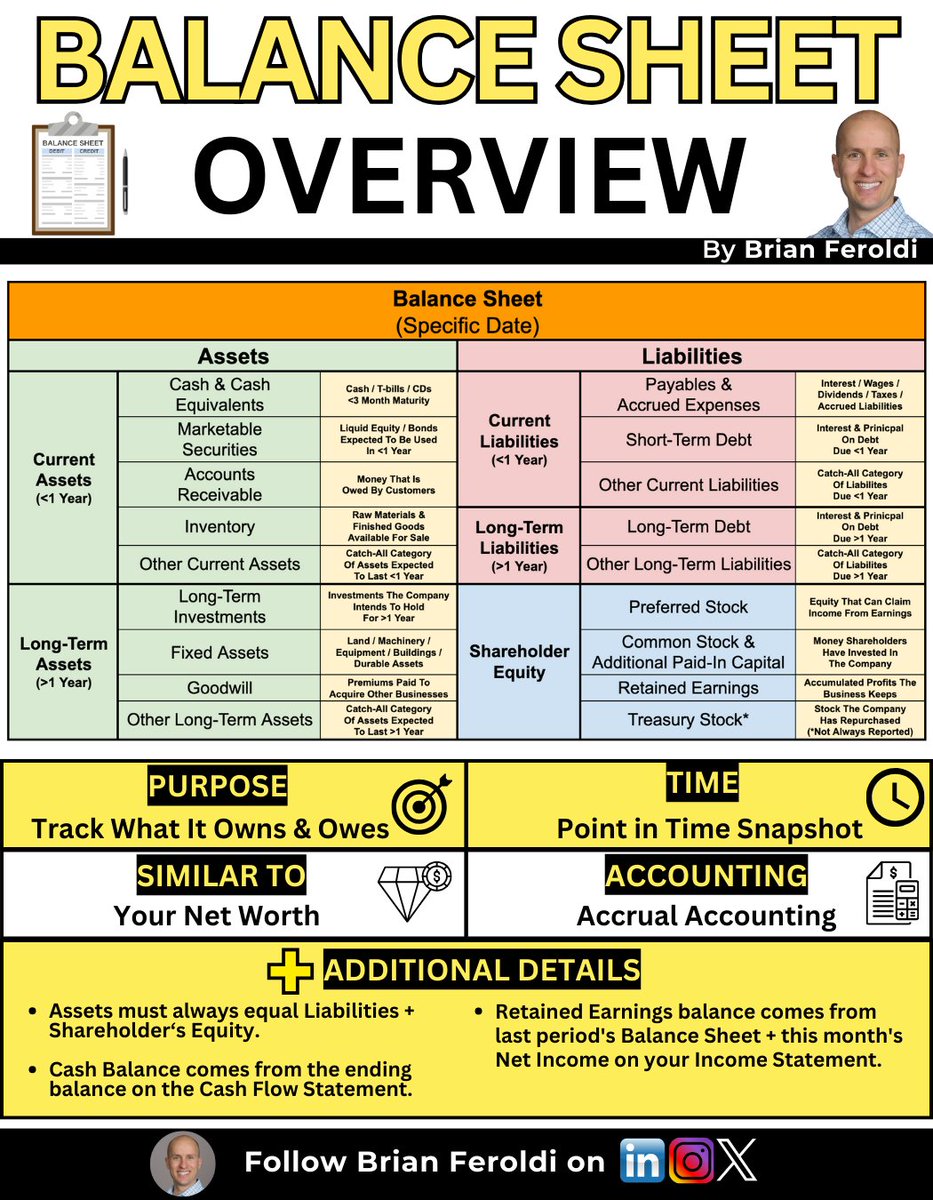

1: Balance Sheet Overview

These 7 infographics will help you master balance sheet analysis:

1: Balance Sheet Overview

Want to go deeper into accounting?

Join my upcoming cohort-based course, Advanced Financial Statements Analysis.

Details here:

Interested? DM me for a coupon code. maven.com/brian-feroldi/…

Join my upcoming cohort-based course, Advanced Financial Statements Analysis.

Details here:

Interested? DM me for a coupon code. maven.com/brian-feroldi/…

Enjoy this thread? Follow me @brianferoldi

If you want to share with your followers, retweet the first tweet below:

If you want to share with your followers, retweet the first tweet below:

• • •

Missing some Tweet in this thread? You can try to

force a refresh