Here's a plain English thread on the latest GDP numbers and why this is totally unsustainable - oh yeah, and inflation's not dead...🧵

Real GDP jumped 4.9% in the third quarter, but what's fueling the rise vs. what's not growing speaks volumes about the economy's trajectory - the key driver of economy growth, real private fixed investment, is flat since Q1 '22:

The residential side is even worse, with real private investment there remaining below pre-pandemic level, signaling housing market shortages will continue:

If fixed (factories, machines, etc.) investment had almost no growth last quarter, where'd the investment surge come from? Inventories. Firms stocked up to avoid future price increases, which contributed a whopping 1.32 percentage points to GDP, or 27% of Q3 growth:

So, that adds to today's GDP but subtracts from tomorrow, and doesn't add to long-run growth - kind of like gov't spending, which accounted for almost 1/5 of economic growth last quarter and is growing faster than consumer spending, and has been last 5 quarters:

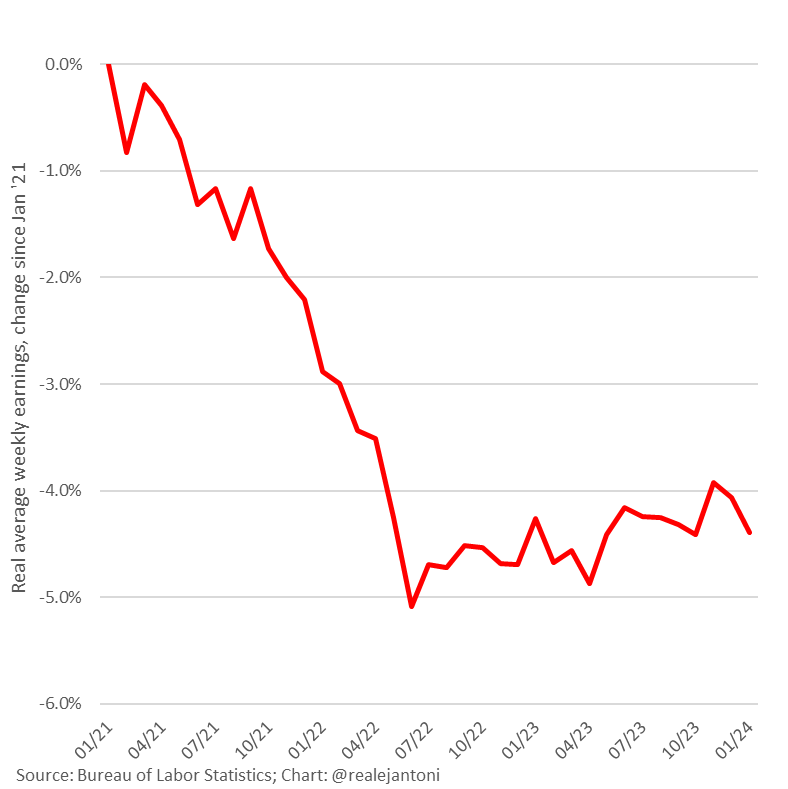

But it's good that consumer spending is growing fast, right? Not in this case, because the rise in real spending is fueled by depletion of savings and going into debt - once again, this is not sustainable; real disposable income fell again last quarter:

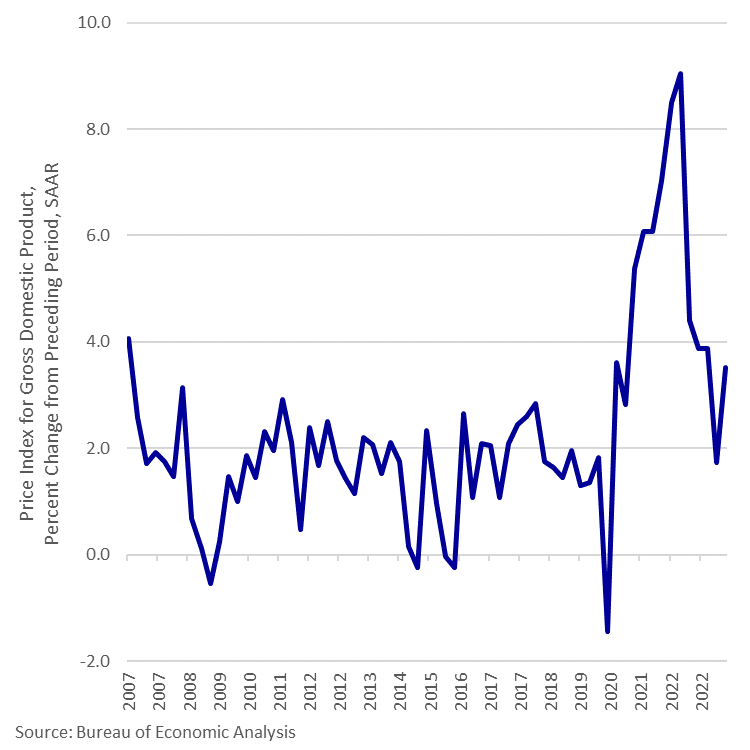

And inflation isn't dead - not by a long shot; the price index for GDP doubled from the previous quarter (3.5% vs. 1.7%); pre-pandemic, that's the highest rate since 2007:

TLDR: this GDP report is classic case of short but unsustainable burst in economic growth; indicators still pointing to downturn next year and the exploding federal deficit is going to compound the problem - Treasury already borrowed $500 billion this month alone - buckle up...

• • •

Missing some Tweet in this thread? You can try to

force a refresh