Thread on data lows and data highs🧵:

ICT has his own “one setup for life”

This would definitely be my “one setup for life” as it barely ever fails for me personally, but patience is required

Let’s begin👇

ICT has his own “one setup for life”

This would definitely be my “one setup for life” as it barely ever fails for me personally, but patience is required

Let’s begin👇

Before I get started, I just want to say that I’ve never seen a thread or video about this, and I only know a few others besides me who love using this setup

This can probably be combined with a few different models, but I use it with inversions.

This can probably be combined with a few different models, but I use it with inversions.

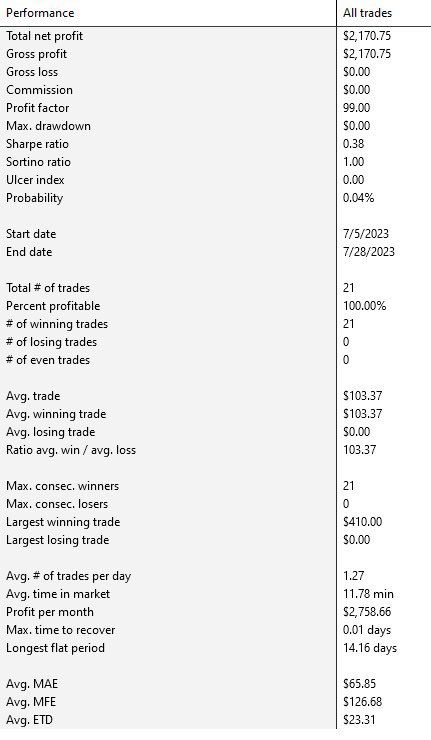

THIS is the model.

It’s a bit complicated but I’m going to show you each aspect of it in detail. You should use this for when you are done with the thread.

It’s a bit complicated but I’m going to show you each aspect of it in detail. You should use this for when you are done with the thread.

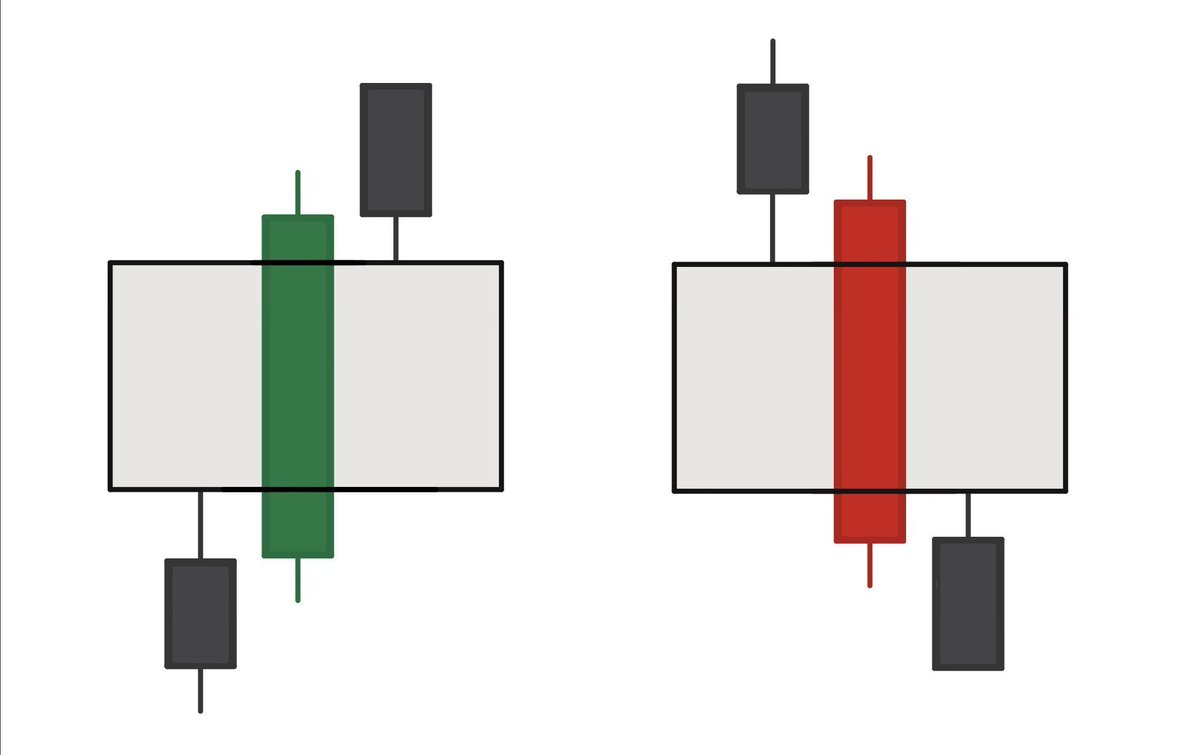

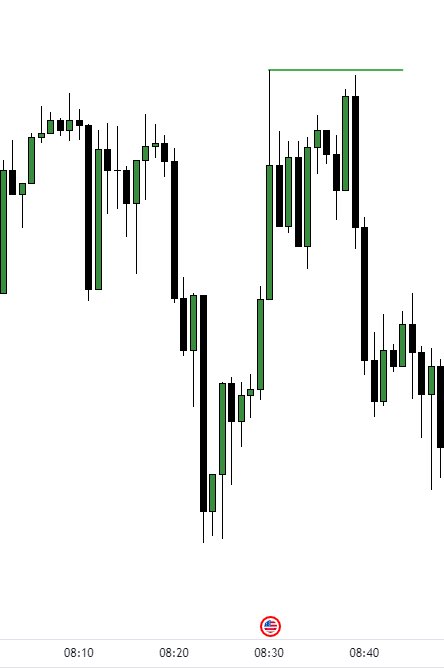

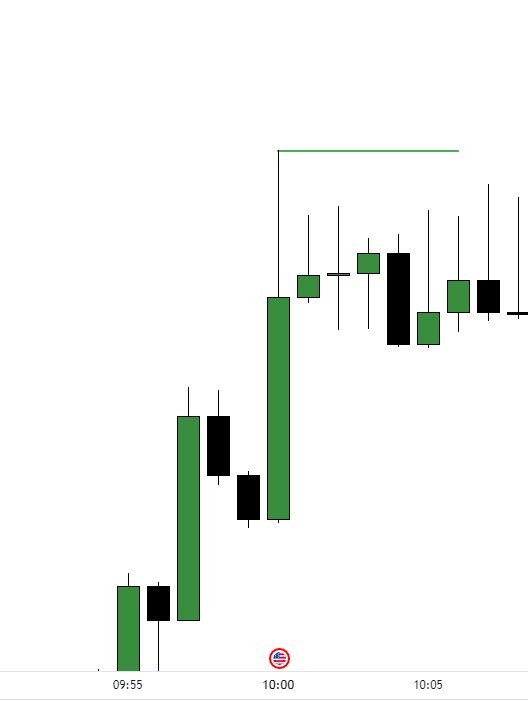

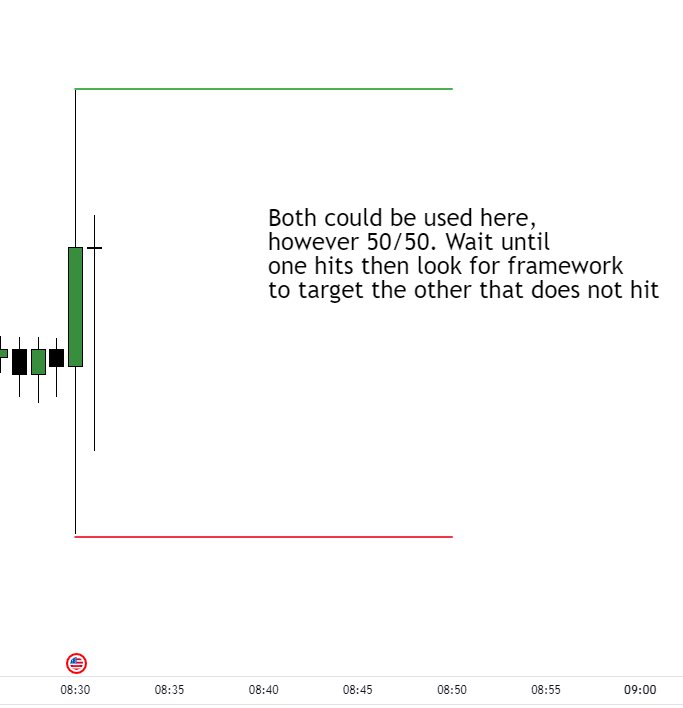

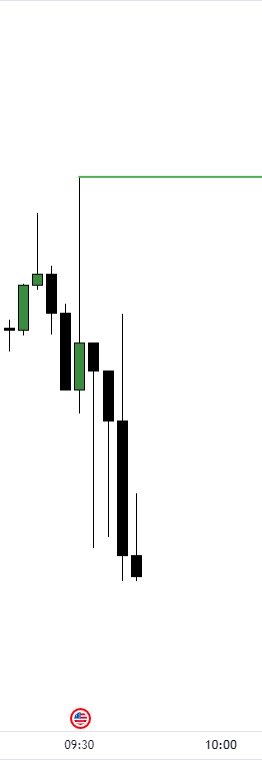

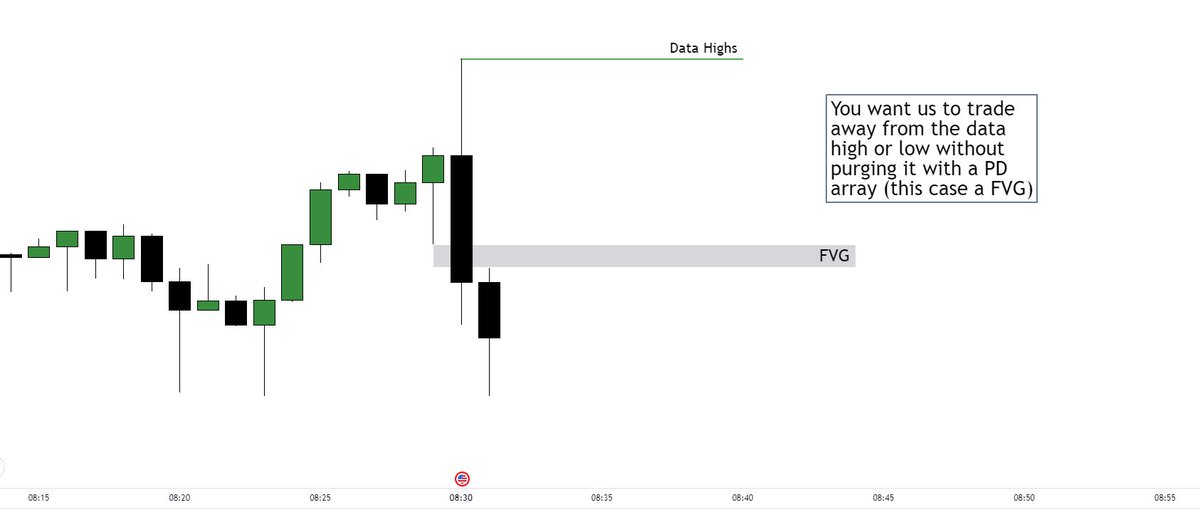

First things first, when looking for this model/framework, you want to see an abnormally large wick off of a news candle.

You want to see that wick traded away from without being purged so it can set it us up for a MMXM and the setup later.

Here are some examples:

You want to see that wick traded away from without being purged so it can set it us up for a MMXM and the setup later.

Here are some examples:

Once you have identified this wick, you do NOT want to see this purged. You want to us to go the OPPOSITE direction and form some PD arrays, like a FVG for this case.

This allows for the market maker model to setup back to the high

This allows for the market maker model to setup back to the high

Another thing I REALLY do prefer is getting a new swing low or swing high for the framework to work.

Sometimes we form a FVG or orderblock up to data highs RIGHT after they come out and half the time that PD array fails if we don’t get any new swing points created with them

Sometimes we form a FVG or orderblock up to data highs RIGHT after they come out and half the time that PD array fails if we don’t get any new swing points created with them

THREAD CONTINUED because twitter uploads it halfway

https://x.com/dodgysdd/status/1719440481451413782?s=46&t=gUYYXM7Fe_3WYUBD-HccQA

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter