By the age of 30, you need to know these formulas and you will be financially better off than 99% of people:

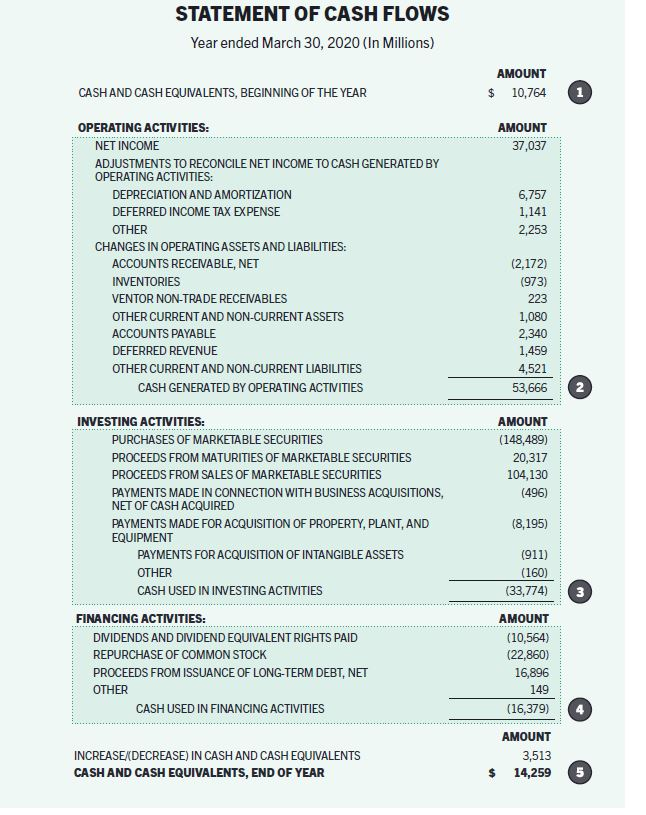

• Cash flow

It shows your savings, given the money you make and spend.

A positive cash flow indicates that you live below your means.

A negative cash flow indicates that you spend more than you earn.

It shows your savings, given the money you make and spend.

A positive cash flow indicates that you live below your means.

A negative cash flow indicates that you spend more than you earn.

• The rule of 72

It calculates how long it will take your money to double at any given rate of return.

For instance, if your investment has a return of 4%, it will take 18 years for your money to double (72/4 = 18).

It calculates how long it will take your money to double at any given rate of return.

For instance, if your investment has a return of 4%, it will take 18 years for your money to double (72/4 = 18).

• Calculate gains or losses

This helps you calculate the increase or decrease in your investment.

For example, if you bought a stock at $40 and it is now worth $120, you have made a 200% gain ($120 minus $40).

This helps you calculate the increase or decrease in your investment.

For example, if you bought a stock at $40 and it is now worth $120, you have made a 200% gain ($120 minus $40).

• Leverage ratio (equity)

It refers to borrowed money. Your ownership interest is known as "equity."

You can calculate the leverage ratio on your loans.

For example, if your house is worth $300,000 and you owe $50,000, then you have equity of $250,000 in the house.

It refers to borrowed money. Your ownership interest is known as "equity."

You can calculate the leverage ratio on your loans.

For example, if your house is worth $300,000 and you owe $50,000, then you have equity of $250,000 in the house.

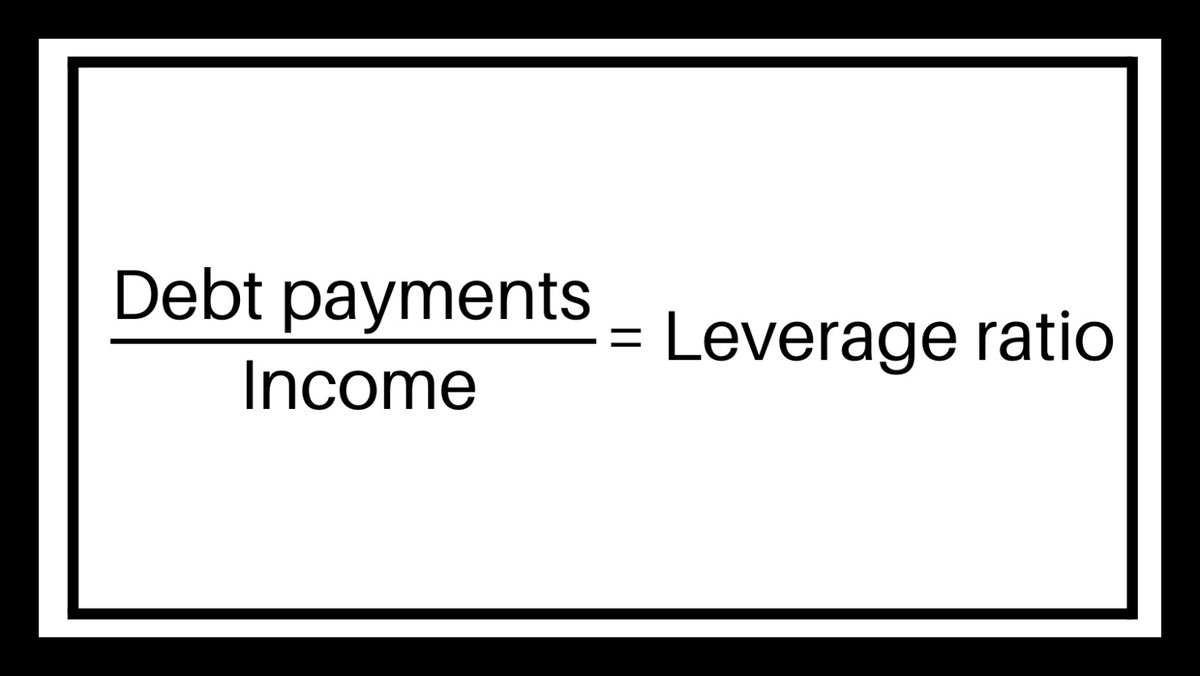

• Leverage ratio (income)

Leverage can be a bad idea when the proportion of debt is greater than income.

For example, if your monthly debt payment is $1,500 and your income is $4,500, you have three times the coverage.

The lower the debt, the better your finances will be.

Leverage can be a bad idea when the proportion of debt is greater than income.

For example, if your monthly debt payment is $1,500 and your income is $4,500, you have three times the coverage.

The lower the debt, the better your finances will be.

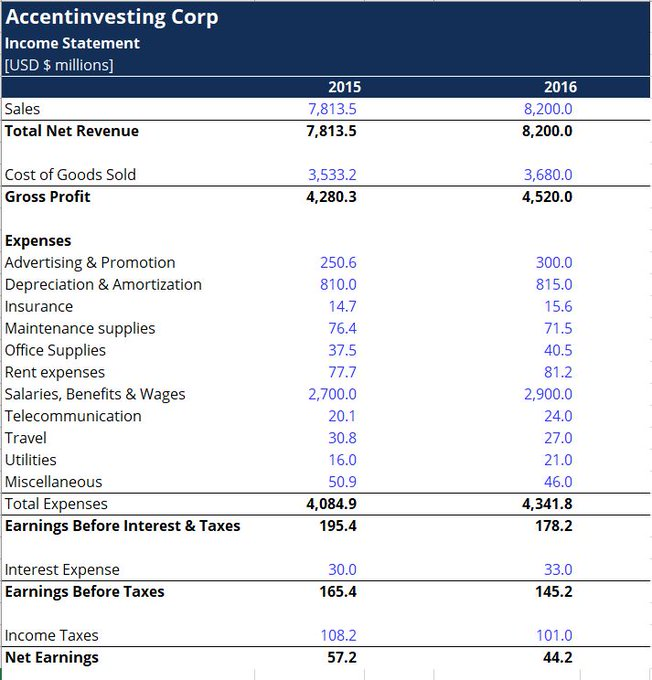

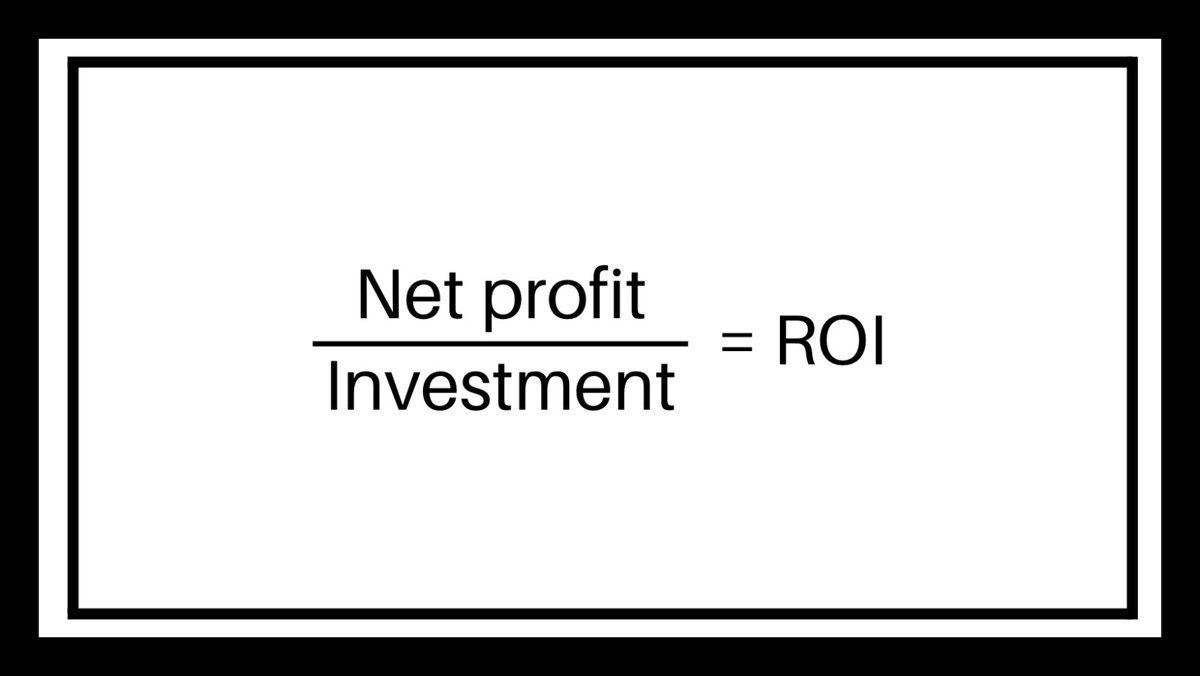

• Return on Investment (ROI)

This is a metric used to understand the profitability of an investment.

For instance, if you made a $10,000 profit from a $3,000 investment, your return on investment (ROI) would be 0.7, or 70%.

This is a metric used to understand the profitability of an investment.

For instance, if you made a $10,000 profit from a $3,000 investment, your return on investment (ROI) would be 0.7, or 70%.

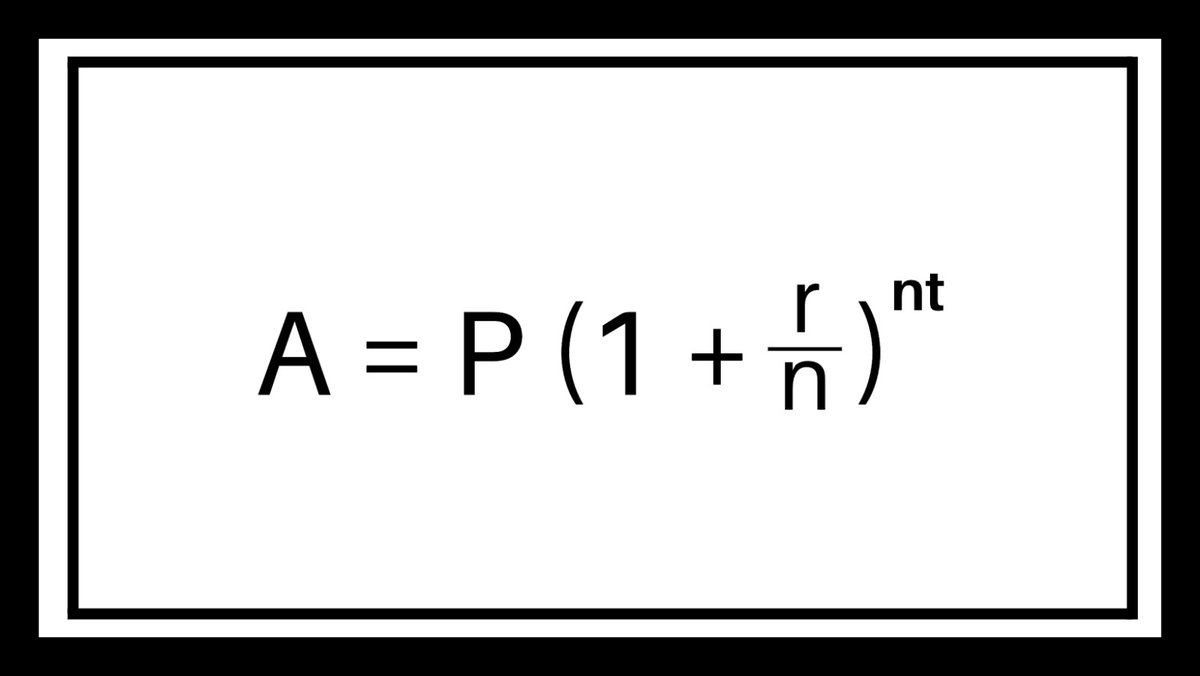

• Compound interest

Compounding is the money you earn on top of your original investment plus its earnings.

For instance, if you made a $1,000 one-time investment with a 7% return.

By year 1, you will have $1,070.

Year 2: $1,144.9.

Year 5: $1,402.55.

Year 10: $1,967.15.

Compounding is the money you earn on top of your original investment plus its earnings.

For instance, if you made a $1,000 one-time investment with a 7% return.

By year 1, you will have $1,070.

Year 2: $1,144.9.

Year 5: $1,402.55.

Year 10: $1,967.15.

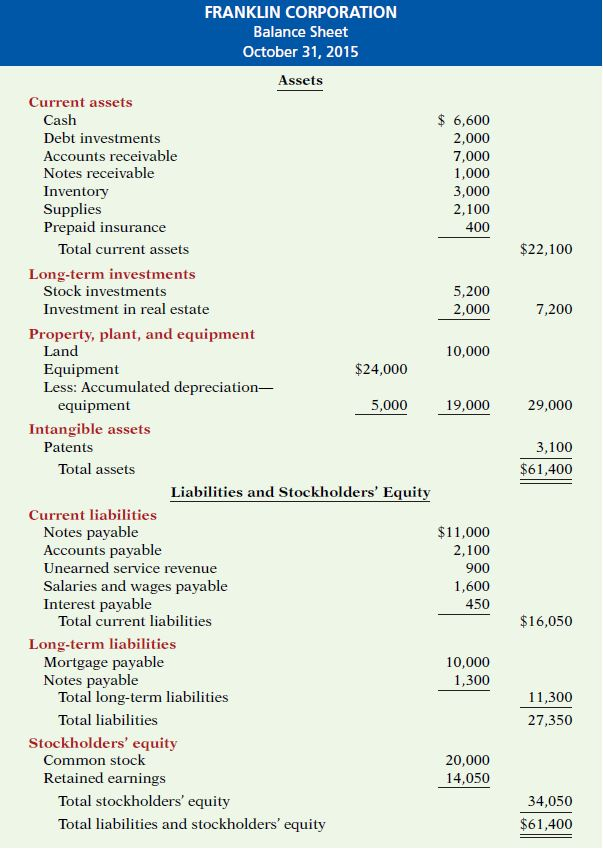

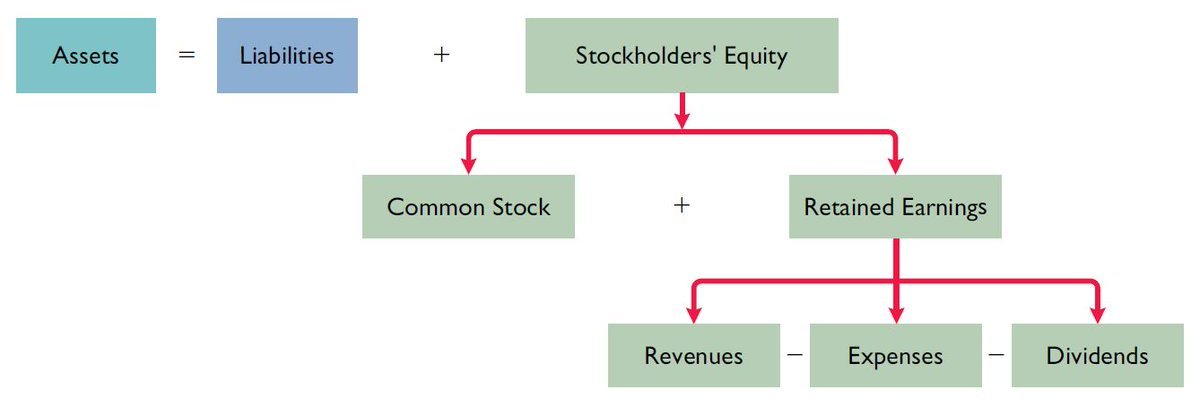

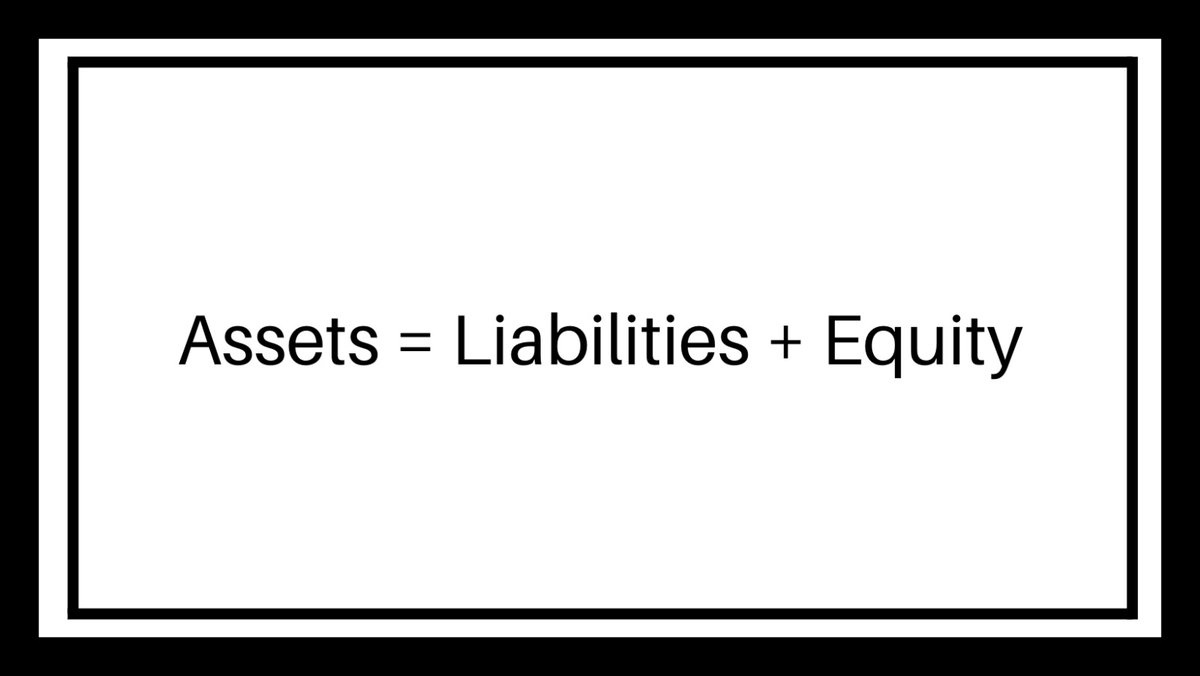

• Accounting equation: Assets = Liabilities + Equity

This formula shows how a company's total assets are funded, given its two options: borrowing (liabilities) or shareholder investment (equity).

This formula shows how a company's total assets are funded, given its two options: borrowing (liabilities) or shareholder investment (equity).

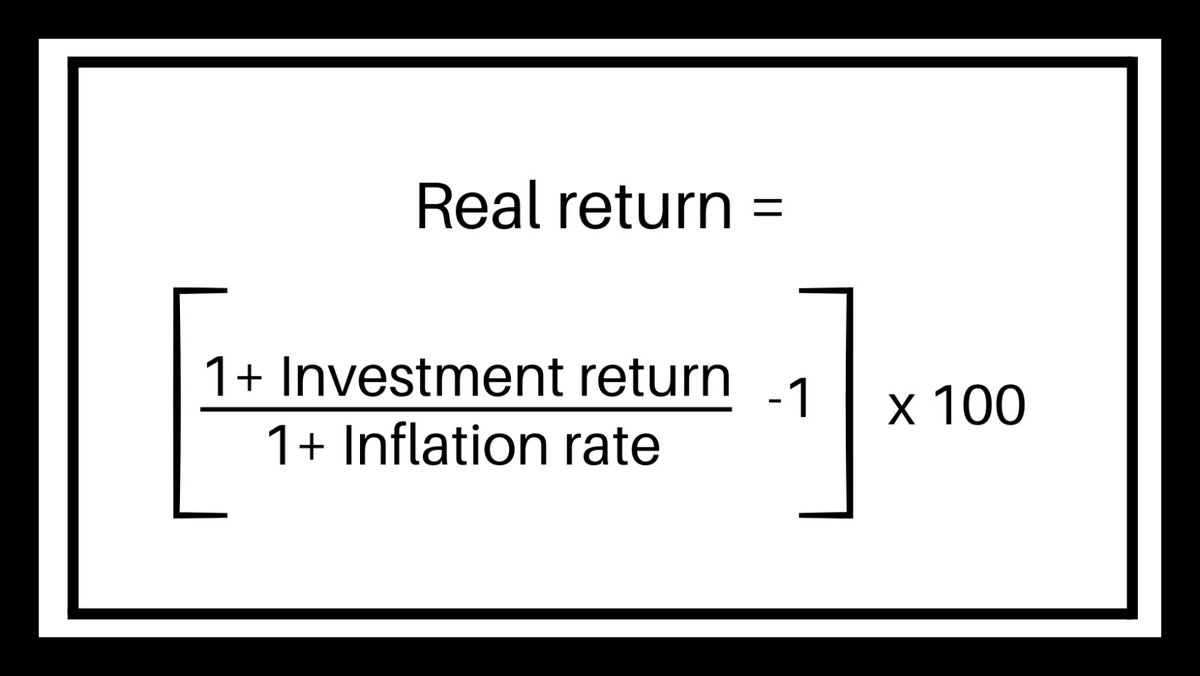

• Inflation-adjusted return

This equation helps you compute your real return, or your return adjusted for inflation.

For example, suppose an investment returns 10% and inflation is 4%.

[(1.1 ÷ 1.04) – 1] x 100 = 5.77 percent real return

This equation helps you compute your real return, or your return adjusted for inflation.

For example, suppose an investment returns 10% and inflation is 4%.

[(1.1 ÷ 1.04) – 1] x 100 = 5.77 percent real return

• Net worth

A net worth is a monetary measure that reflects your current financial situation.

It is a financial snapshot that shows the dollar value of what you own (assets) and what you owe (liabilities or debts).

A net worth is a monetary measure that reflects your current financial situation.

It is a financial snapshot that shows the dollar value of what you own (assets) and what you owe (liabilities or debts).

If you enjoyed this thread, please like, comment, and retweet the first tweet.

I write about

- Personal Finance

- Investing

- Wealth

Follow me @AccentInvesting to get more tips.

Subscribe and get a free guide on 5 ETFs to hold for life: bit.ly/AccentInvesting

I write about

- Personal Finance

- Investing

- Wealth

Follow me @AccentInvesting to get more tips.

Subscribe and get a free guide on 5 ETFs to hold for life: bit.ly/AccentInvesting

https://twitter.com/359249296/status/1719686889337135423

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter