I will teach you how to manage money and be financially literate. I share insights on finance and wealth. Level up with me. DMs open for business.

20 subscribers

How to get URL link on X (Twitter) App

• The Alchemist

• The Alchemist

🐸 Embrace the Frog

🐸 Embrace the Frog

🐸 Embrace the Frog

🐸 Embrace the Frog

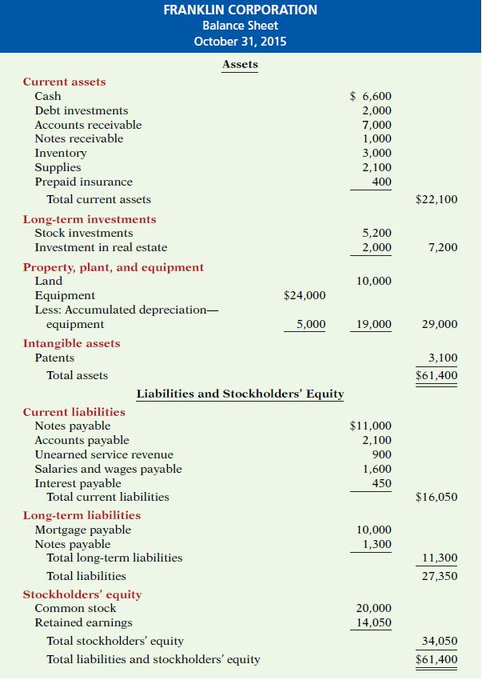

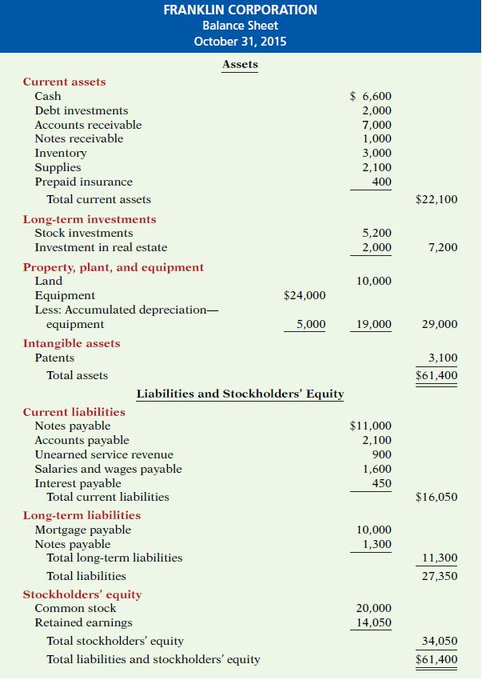

A balance sheet is a snapshot of a business at a specific point in time. It serves two purposes.

A balance sheet is a snapshot of a business at a specific point in time. It serves two purposes.

• The Power of Compounding

• The Power of Compounding

The cash flow statement summarizes the cash generated and spent over a specific period (for example, a month, quarter, or year).

The cash flow statement summarizes the cash generated and spent over a specific period (for example, a month, quarter, or year).

A balance sheet is a snapshot of a business at a specific point in time. It serves two purposes.

A balance sheet is a snapshot of a business at a specific point in time. It serves two purposes.

• No One’s Crazy

• No One’s Crazy