By popular demand (ok maybe not popular demand but @alphaarchitect asked), here's a thread on how active US stock funds have fared against their style-specific indexes (i.e., Russell index family) *before* fees over various rolling periods (i.e., 3, 5, 10 years) since 2003...

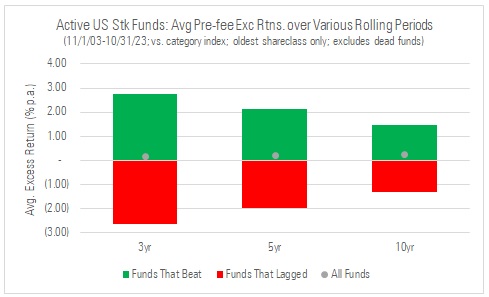

Let's start with rolling three-year periods since 2003. On average, 42% of funds beat their BM before fees (by avg margin of 2.74% p.a.), 39% lagged (by -2.62% p.a.), and 19% died before reaching the end. All told, the average fund beat its index by 0.19% p.a. before fees.

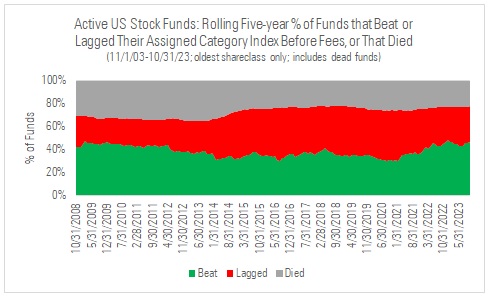

Here's the same thing but for rolling five-year periods since 2003. On average, 38% of funds beat their BM before fees (by avg margin of 2.12% p.a.), 34% lagged (by -1.99% p.a.), and 28% died before reaching the end. All told, the avg fund beat its index by 0.21% p.a. before fees

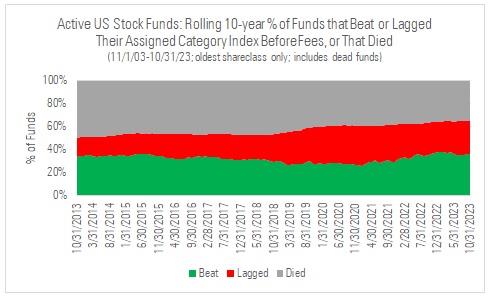

And here it is for rolling 10-year periods since 2003. On average, 32% of funds beat their BM before fees (by average margin of 1.48% p.a.), 24% lagged (by -1.32% p.a.), and 43% died before reaching the end. All told, the average fund beat its index by 0.26% p.a. before fees.

Before looking at how types of active US stock funds did before fees, here's a few charts that summarize everything (i.e., the averages I cited in the three previous tweets). Tldr, as you elongate the measurement period, fewer funds survive, fewer beat, and outperf margin shrinks

Now let's look at types of active US stock funds, focusing on large-cap funds and the rolling 10-year periods since 2003. On average, 26% of funds beat, 27% lagged, and 46% died. Remarkably, <10% of Large Growth funds beat their index *before* fees over the decade ended 10/31/23

Next, let's take a look at active mid-cap funds, again focusing on rolling 10-year periods since 2003. On average, 31% of funds beat before fees, 24% lagged, and 45% died. These success rates slightly exceeded those of active large-cap funds.

Now, active small-cap funds, focusing on rolling 10-year periods since 2003. On average, 47% beat before fees, 14% lagged, and 39% died. In other words, the avg active small-cap fund was almost 2x more likely to beat its index before fees than the avg active large cap fund.

Here's the same thing but this time focusing on value, blend, and growth styles over rolling 10-year periods, irrespective of market-cap (i.e., large, mid, small). On average, 42% of value funds beat their benchmark before fees vs. 29% of blend funds and 29% of growth funds.

These charts provide a little more detail on % of funds that beat or lagged before fees, or died, by category as well as major style (i.e., market cap, value/blend/growth). Small Value boasts highest average pre-fee success rate (57%) while Large Growth has the lowest (22%).

In summary, with only a third of active U.S. stock funds beating their index before fees over the average 10-year period and with the average fund outperforming by just 0.26% p.a. (excluding dead funds), one thing seems pretty clear: Active U.S. stock funds charge too much. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter