Dad, CFA, 'commentator'. Morningstar Research Services.

Morningstar: https://t.co/XkWvzc8k1J

Substack: https://t.co/TQT7AgQ0io

How to get URL link on X (Twitter) App

But this is what makes $ARKK a unicorn: Assets *poured* in during the run-up and, remarkably, have largely stayed put since then, despite the brutal selloff. Take the two together, and it is maybe the biggest, fastest destruction of shareholder capital in fund history.

But this is what makes $ARKK a unicorn: Assets *poured* in during the run-up and, remarkably, have largely stayed put since then, despite the brutal selloff. Take the two together, and it is maybe the biggest, fastest destruction of shareholder capital in fund history.

We often define retirement ‘success’ in arithmetic terms—future returns, spending rates, etc. But Laura reminds us that fulfillment can often boil down to very basic, tactile factors like feeling we are living with purpose or enjoying meaningful social connections...

We often define retirement ‘success’ in arithmetic terms—future returns, spending rates, etc. But Laura reminds us that fulfillment can often boil down to very basic, tactile factors like feeling we are living with purpose or enjoying meaningful social connections...

https://twitter.com/wealth/status/1425495493120036872Though the article makes some comparisons to ARK, these funds slated for conversion are nothing like ARK. The Market Expansion Enhd. Idx Fund for instance recently spread its AUM across 666 names. The other equity fund has 205 holdings, biggest weight a scant 2.7%.

2) It follows that cheaper funds survived+succeeded (ie, beat avg peer) more often than pricier funds, as shown below. (Distribution across these buckets: Cheapest 10% of funds in 5, next 22.5% in 4, middle 35% in 3, next 22.5% in 2, and costliest 10% in 1.) Again, unsurprising.

2) It follows that cheaper funds survived+succeeded (ie, beat avg peer) more often than pricier funds, as shown below. (Distribution across these buckets: Cheapest 10% of funds in 5, next 22.5% in 4, middle 35% in 3, next 22.5% in 2, and costliest 10% in 1.) Again, unsurprising.

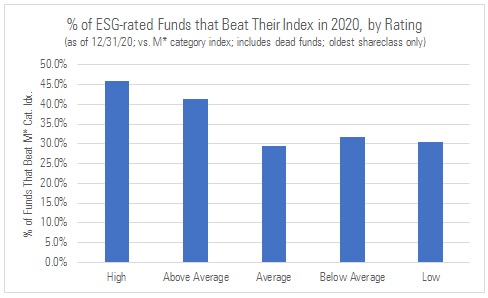

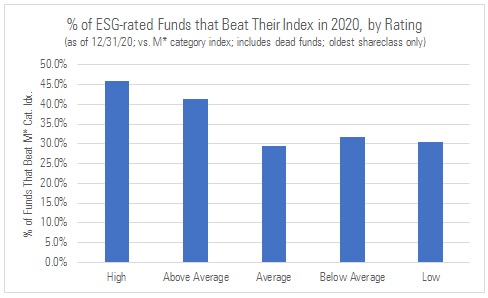

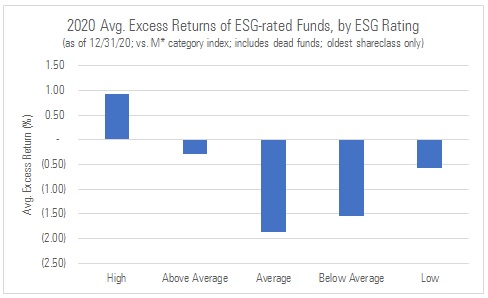

Given this, it's not too surprising that higher ESG-rated funds generated larger avg. excess returns (vs. M* cat. index) in 2020 than lower ESG-rated funds, meaning there was a better payoff to investing in funds that courted less ESG risk. That said, caveats apply...

Given this, it's not too surprising that higher ESG-rated funds generated larger avg. excess returns (vs. M* cat. index) in 2020 than lower ESG-rated funds, meaning there was a better payoff to investing in funds that courted less ESG risk. That said, caveats apply...

Does the picture improve any if we look at active fund success rates on a risk-adjusted basis (i.e., Sharpe Ratio)? No. It gets worse, with 31% of active stock and bond funds topping their M* category indexes (38% before fees). (2/6)

Does the picture improve any if we look at active fund success rates on a risk-adjusted basis (i.e., Sharpe Ratio)? No. It gets worse, with 31% of active stock and bond funds topping their M* category indexes (38% before fees). (2/6)

https://twitter.com/syouth1/status/12078304928857661442/ What's this all about? The NBER paper made 3 assertions: 1) Fund cos were overstating credit quality of their bond funds' holdings when reporting to us; 2) we misclassified funds by relying on that faulty data; 3) we assigned incorrect Star Ratings to funds we'd misclassified

2) Interestingly, that 8% avg annl. asset-wgtd rtn only slightly lagged the rtn of a blended index (orange line in chart) that mirrored the breakdown of assets across the nine style-box categories over the 20-year period. Before fees, the average dollar *beat* the benchmark. 😮

2) Interestingly, that 8% avg annl. asset-wgtd rtn only slightly lagged the rtn of a blended index (orange line in chart) that mirrored the breakdown of assets across the nine style-box categories over the 20-year period. Before fees, the average dollar *beat* the benchmark. 😮