Some of the UK's worst libel lawyers have written to the Law Society demanding a role in shaping anti-SLAPP rules.

They say the real problem is unfair criticism of media lawyers.

Here's a very small violin, and here's a thread.

Thread:

They say the real problem is unfair criticism of media lawyers.

Here's a very small violin, and here's a thread.

Thread:

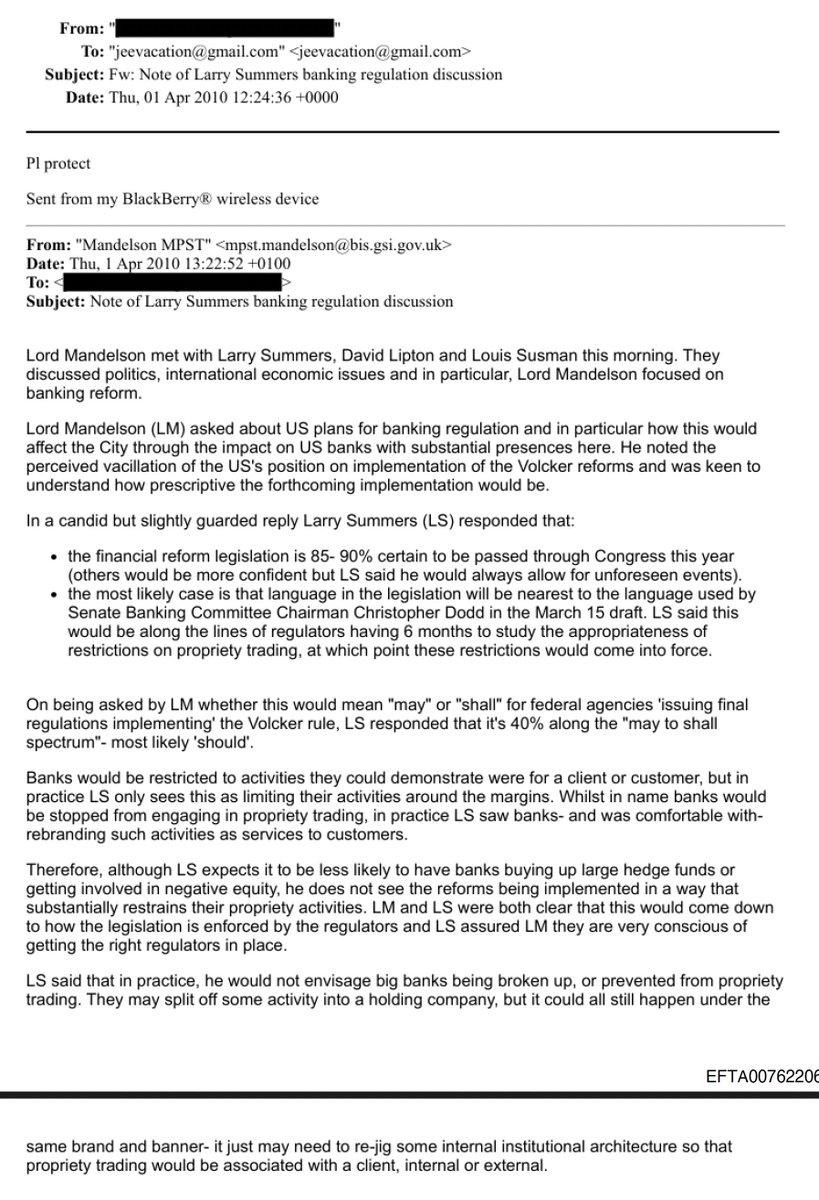

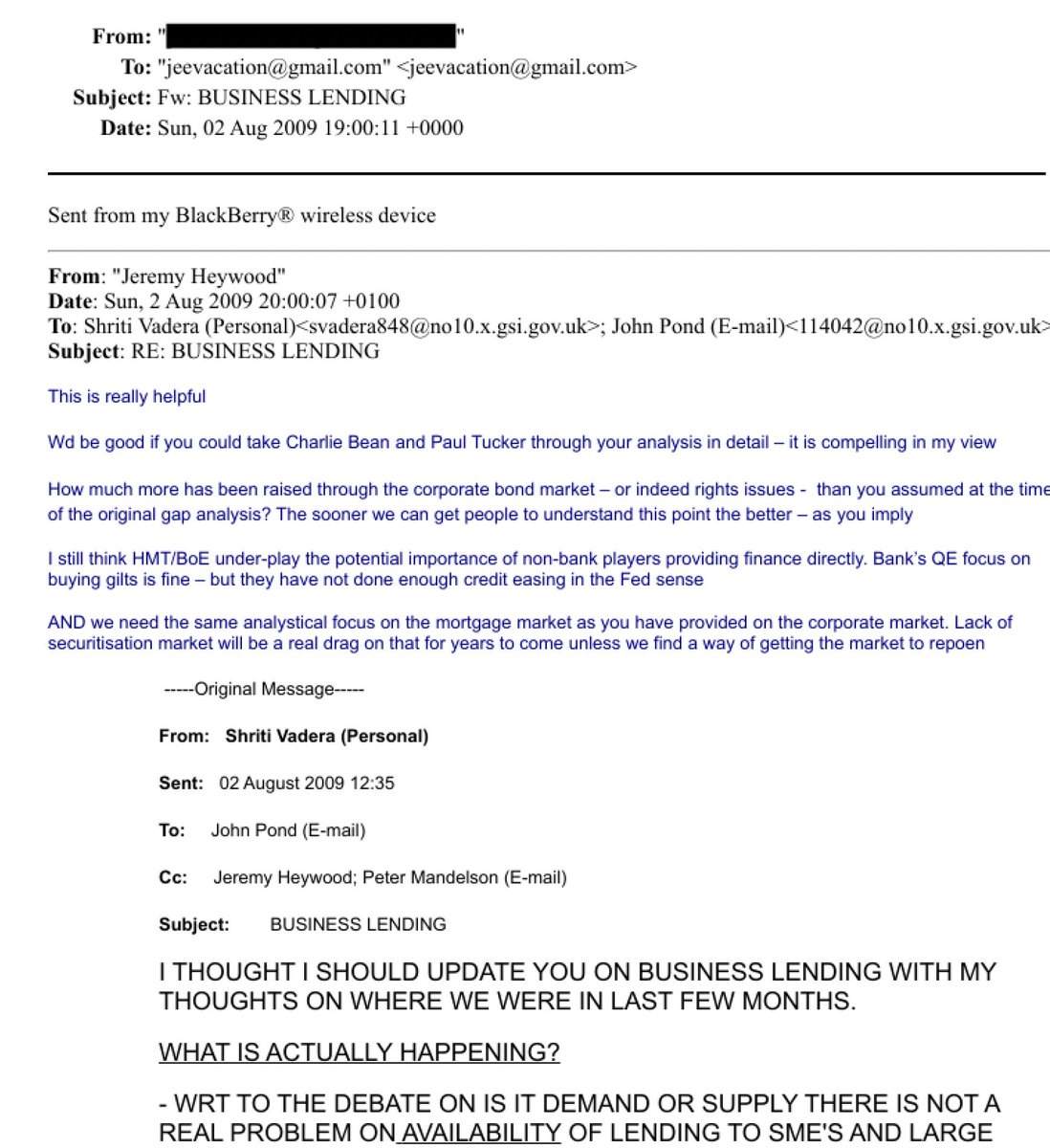

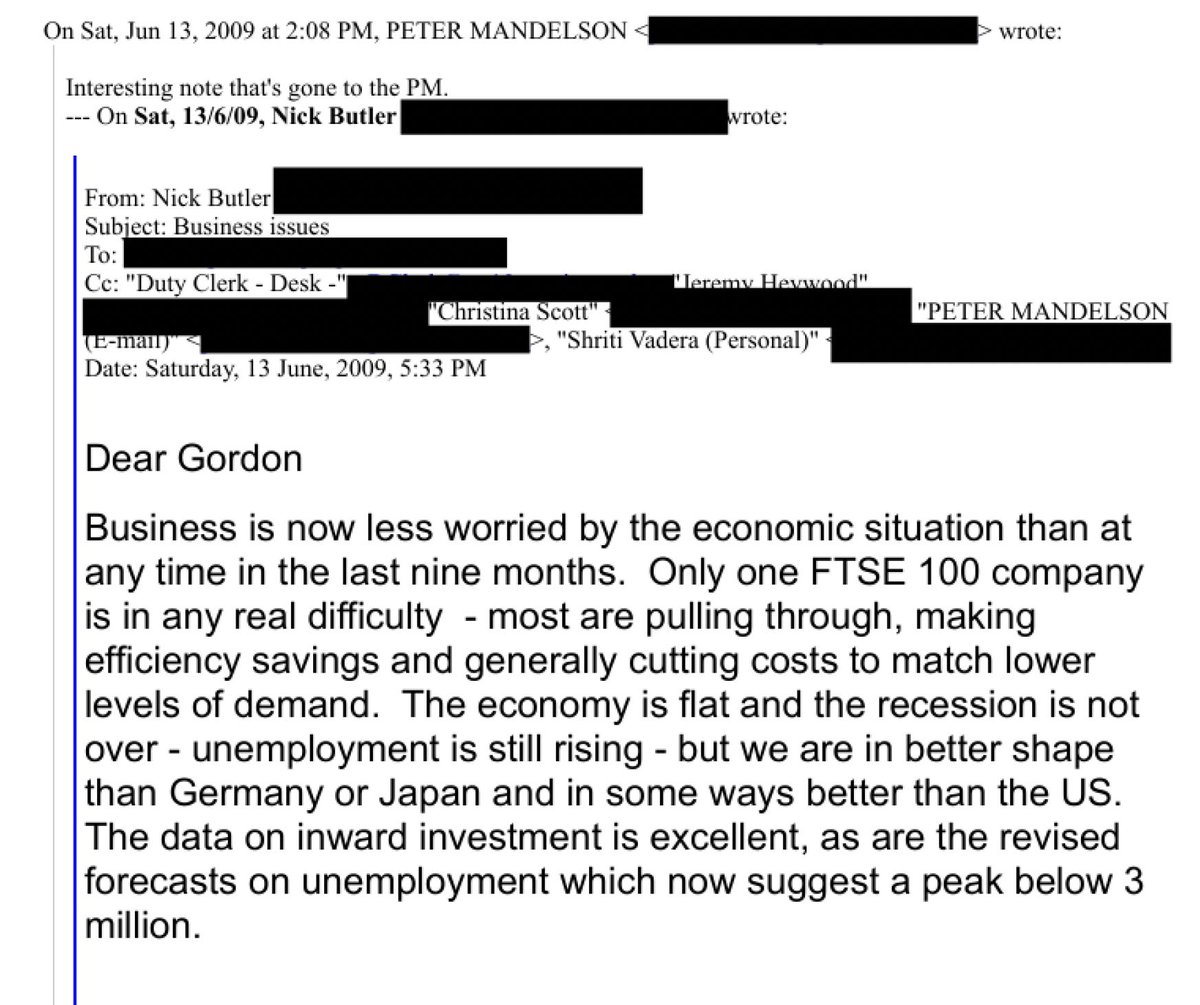

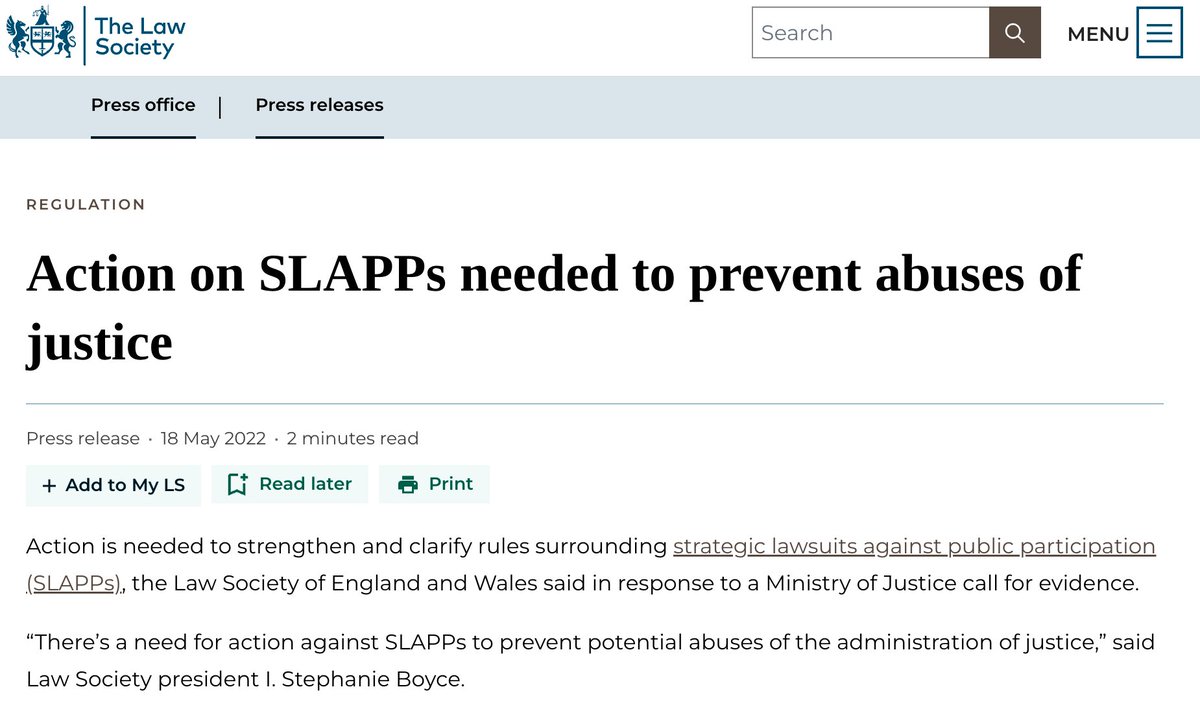

The Law Society has played an exemplary role in calling for libel law reform to prevent abusive SLAPPs – “strategic lawsuits against public participation”. In other words, the use and abuse of legal processes to silence allegations of wrongdoing.

The Society of Media Lawyers is unhappy with this. They’ve written to the President of @TheLawSociety asking the Law Society to stop advocating against SLAPP.

Indeed the Society of Media Lawyers don’t seem to accept SLAPP exists – they say there is “not a significant SLAPP problem in the UK”.

The real problem is unfair criticism of media lawyers.

The real problem is unfair criticism of media lawyers.

The letter bleats that there's no evidence of SLAPPs.

Let me help the Society of Media Lawyers identify some:

Let me help the Society of Media Lawyers identify some:

Schillings acted for Russell Brand, attempting to make the Metro newspaper retract a clearly factual report about a “joke” about sexual assault which Brand had made on live television. Asserting defamation with no legal or factual basis is characteristic of a SLAPP.

An unnamed law firm acted for Russell Brand, and sent an aggressive and intimidating email to an alleged victim of Brand’s, which included an entirely inappropriate allegation of blackmail. Making unevidenced criminal accusations in correspondence is characteristic of SLAPPs.

Archerfield Partners acted for Russell Brand in an attempt to prevent reporting of accusations of sexual assault by Szilvia Berki. This included defamation letters to newspapers and ultimately a successful application for an an anti-harassment restraining order.

If Ms Berki’s allegations were correct (which now seems at least plausible) then this was an outrageous abuse of the legal system to silence her.

Several unnamed law firms acted for PPE Medpro, Michelle Mone and Douglas Barrowman, and wrote to the Guardian saying that any claim that Mone/Barrowman were linked to PPE Medpro was defamatory.

The parties have subsequently admitted to @david_conn that Mone/Barrowman are in fact linked to PPE Medpro. Aggressive correspondence based on an untruth is a key characteristic of a SLAPP.

TT Law Ltd acted for William Hay in a defamation claim against Nina Cresswell @OhNinaC, who had alleged Hay had sexually assaulted her. Mrs Justice Williams found that Cresswell’s allegations were substantially true.

This is part of a very disturbing trend of perpetrators of sexual assault using SLAPPs to silence their victims.

An unnamed law firm acting for an individual accused of sexually assaulting Lucy and Verity Nevitt. The law of confidence was used in a successful attempt to prevent him being named. This is another very disturbing case.

Parliament has expressly not given anonymity to those accused of sexual offences, and to attempt to achieve this through secret threats of litigation is an affront to the rule of law.

An unnamed law firm acted for Wirecard against the FT in a defamation action following the FT’s reporting by @FD @danmccrum that Wirecard was engaged in fraud. The reporting was correct. Using defamation proceedings to silence true accusations is characteristic of a SLAPP.

Carter-Ruck acted for Mohamed Amersi in a defamation claim against former MP @CharlotteLeslie. Mr Justice Nicklin found for Leslie, and said he had “real cause for concern” that the litigation had an “impermissible collateral purpose”. That is a textbook definition of a SLAPP.

Discreet Law acted for Yevgeny Prigozhin in a case against journalist @EliotHiggins of investigative website Bellingcat for claiming that Prigozhin ran the mercenary Wagner Group. Which everyone at time knew he did, and he since admitted. This is possibly the SLAPPiest SLAPP.

Taylor Wessing acted for Eurasian Natural Resources Corporation Limited against journalist Tom Burgis @tomburgis. Mr Justice Nicklin found that the passages complained about in Burgis' book were not defamatory, but noted that the very serious other allegations in the book...

(that ENRCL was a "corporate front" for criminal activities) were not the subject of a defamation claim. This is a typical SLAPP technique - ignoring the core allegation made and pursuing defamation allegations on an ancillary issue.

Carter Ruck acted for the President of Malaysia’s PAS Islamic Party, Abdul Hadi Awang, in an extraordinarily far-fetched case against Clare Rewcastle Brown @RewcastleBrown with the apparent aim of preventing her reporting about corruption in Malaysia.

The case was eventually withdrawn and a settlement agreed in her favour. The far-fetched theory run by Carter Ruck, and the eventual concession, is characteristic of a SLAPP.

An unnamed law firm acted for Jeffrey Donaldson in a defamation claim against @openDemocracy for their reporting on political donations. The action eventually timed out. Commencing and then eventually withdrawing proceedings is characteristic of a SLAPP.

An unnamed law firm acted for Javanshir Feyziyev against Paul Radu @IDashboard, a Romanian reporter for the Organized Crime and Corruption Reporting Project in relation to allegations of involvement in the Azerbaijani Laundromat.

The case was settled in the reporter's favour shortly before the court date. The decision to bring a claim against an individual journalist rather than the news organisation who published the accusations is characteristic of a SLAPP.

Taylor Wessing acted for Al Wazzan, an investment advisor currently on bail in Kuwait for his role in the 1MDB scandal. Taylor Wessing attempted to prevent @RewcastleBrown from even mentioning that Al Wazzan was on bail.

Taylor Wessing abused the law of confidence in an attempt to keep their correspondence from being published.

And from my personal experience:

ACK Media Law wrote to me alleging defamation after I suggested Nadhim Zahawi was under investigation by HMRC. The firm said Nadhim Zahawi was unaware he was being investigated by HMRC. Of course Zahawi had in fact been investigated

ACK Media Law wrote to me alleging defamation after I suggested Nadhim Zahawi was under investigation by HMRC. The firm said Nadhim Zahawi was unaware he was being investigated by HMRC. Of course Zahawi had in fact been investigated

Osborne Clarke acted for Nadhim Zahawi, and accused me of defamation for allegations about Zahawi’s tax position which turned out to be correct. In the course of correspondence, Osborne Clarke stated repeatedly that Zahawi’s taxes were fully declared and paid. Not true.

Brett Wilson LLP acting for a tax avoidance boutique called Property118, accused me of defamation for stating opinions on tax law which are shared by the majority of the profession. taxpolicy.org.uk/2023/10/06/sla…

All of this presents a disturbing pattern of law firms acting for clients who are using defamation law to inappropriately stifle free discussion and, in many cases, to prevent publication of allegations that are in substance correct.

In a number of these cases the lawyers had good reason to know or suspect that the allegations were correct.

And these are likely just a small minority of cases: the intention behind most SLAPPs is that they never become public.

The stifling of debate by lawyers, through the use of abuse of pseudo-legal arguments and the making of false factual claims, represents a threat to free expression and (in my view) to the rule of law.

Many of these examples involve members of the Society of Media Lawyers. To say they have a conflict of interest would be a considerable understatement.

The idea any of these firms should be involved in the implementation of the new anti-SLAPP law, or to be appointed to the Department for Culture, Media and Sport's SLAPP taskforce, is wildly inappropriate.

I've written to the President of the Law Society making these points, and urging the Law Society to stick to its guns.

A full version of this thread, with links and references, is here: taxpolicy.org.uk/2023/11/08/wor…

A full version of this thread, with links and references, is here: taxpolicy.org.uk/2023/11/08/wor…

The Society of Media Lawyers' letter is here: inforrm.org/wp-content/upl…

Final but critical point. The SLAPP cases I've mentioned above have one unusual feature in common: we know about them. They're the SLAPPs that didn't work.

Most SLAPPs do work - or the business wouldn't exist - and we never find out about them

Most SLAPPs do work - or the business wouldn't exist - and we never find out about them

• • •

Missing some Tweet in this thread? You can try to

force a refresh